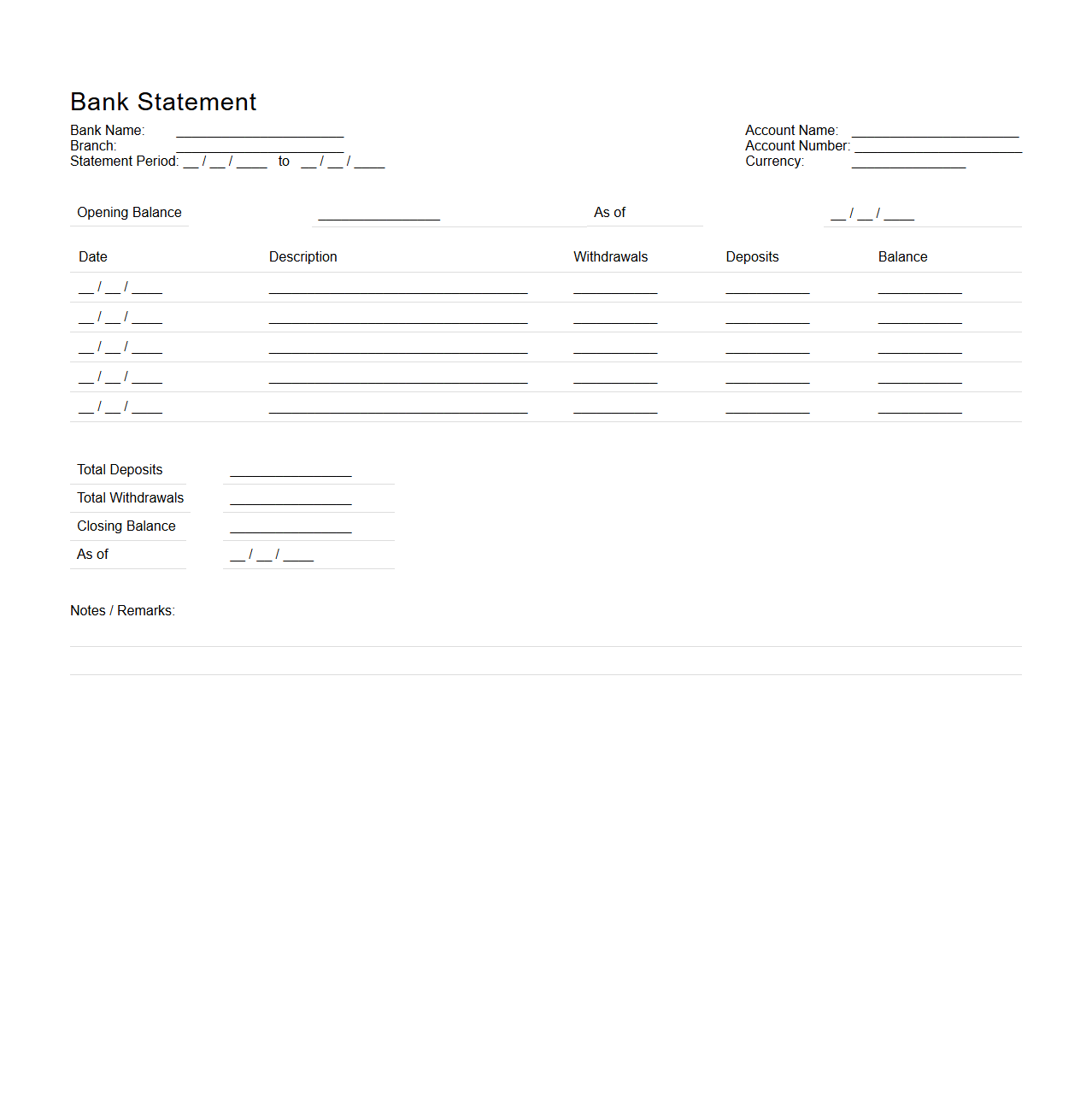

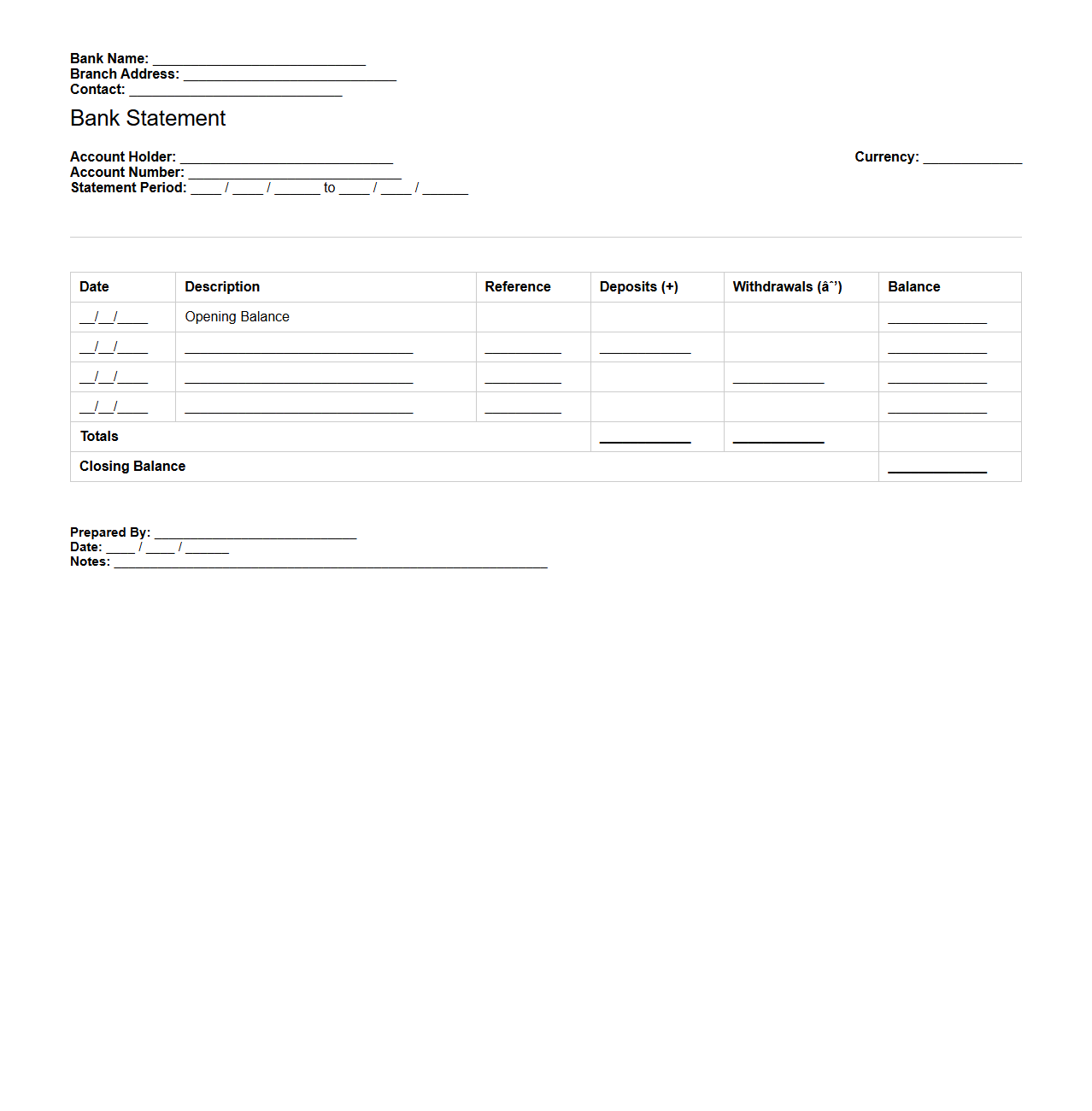

Blank Bank Statement Template for Financial Reconciliation

A

Blank Bank Statement Template for Financial Reconciliation is a standardized form designed to record and compare bank transactions systematically. This document helps businesses and individuals verify account balances, identify discrepancies, and ensure accurate financial reporting. It typically includes columns for dates, transaction descriptions, debits, credits, and running balances to facilitate comprehensive reconciliation.

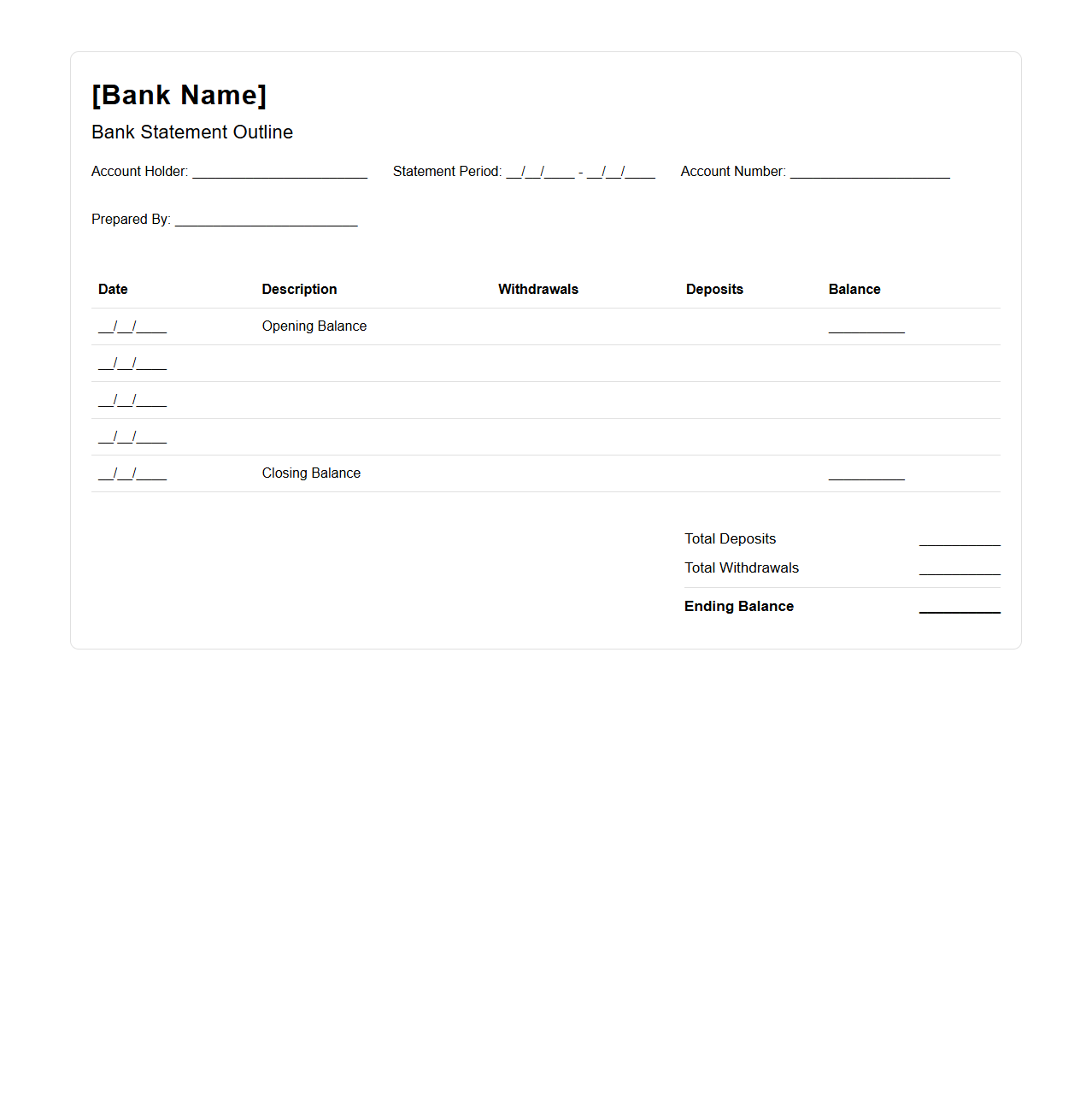

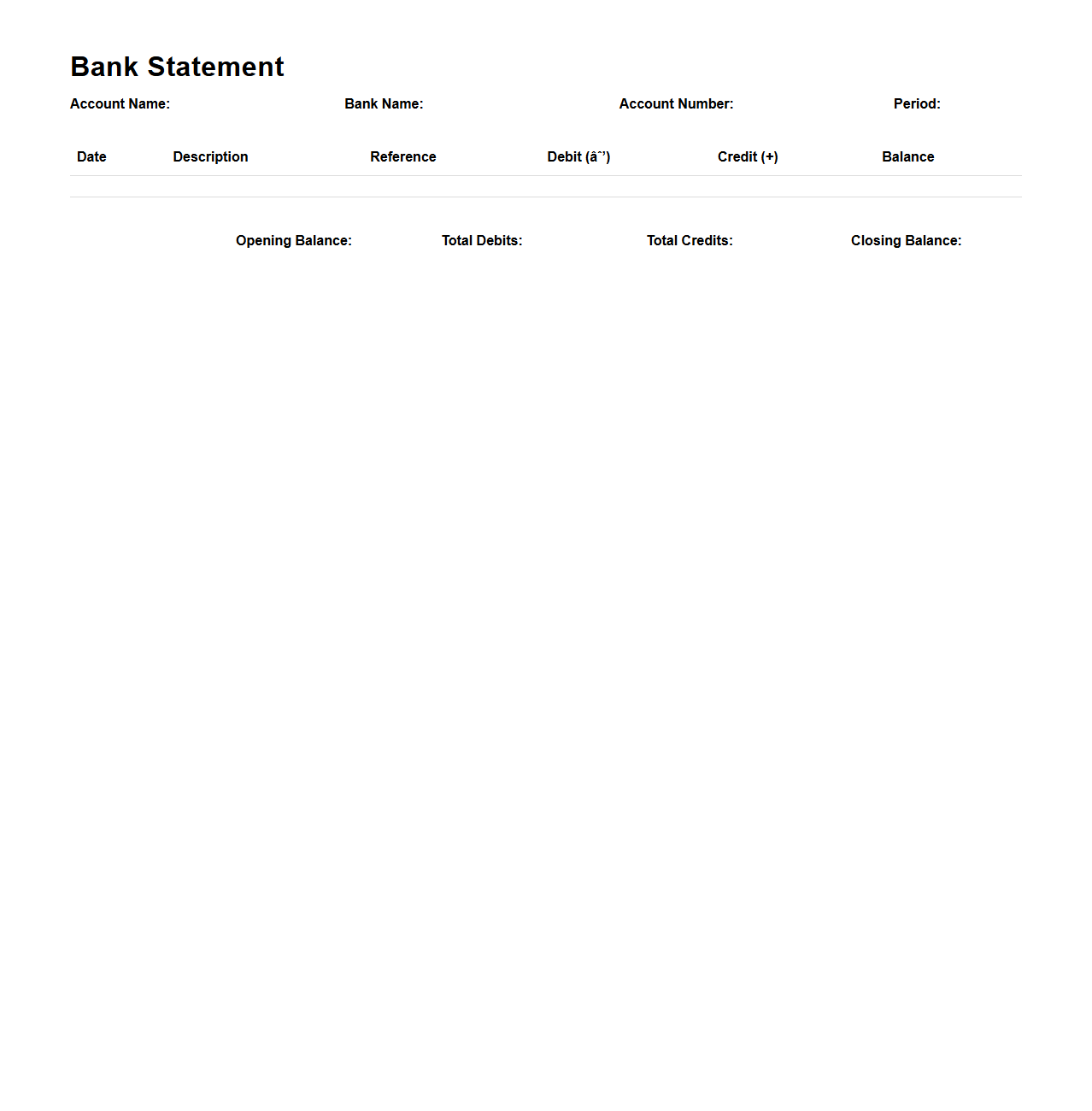

Clean Bank Statement Outline for Account Balancing

A

Clean Bank Statement Outline for Account Balancing is a structured document that clearly organizes bank statement data to facilitate accurate account reconciliation. It highlights key financial transactions, dates, and amounts in a simplified format, making it easier to identify discrepancies and ensure the ledger matches the bank records. This outline is essential for maintaining transparent financial records and effective cash flow management.

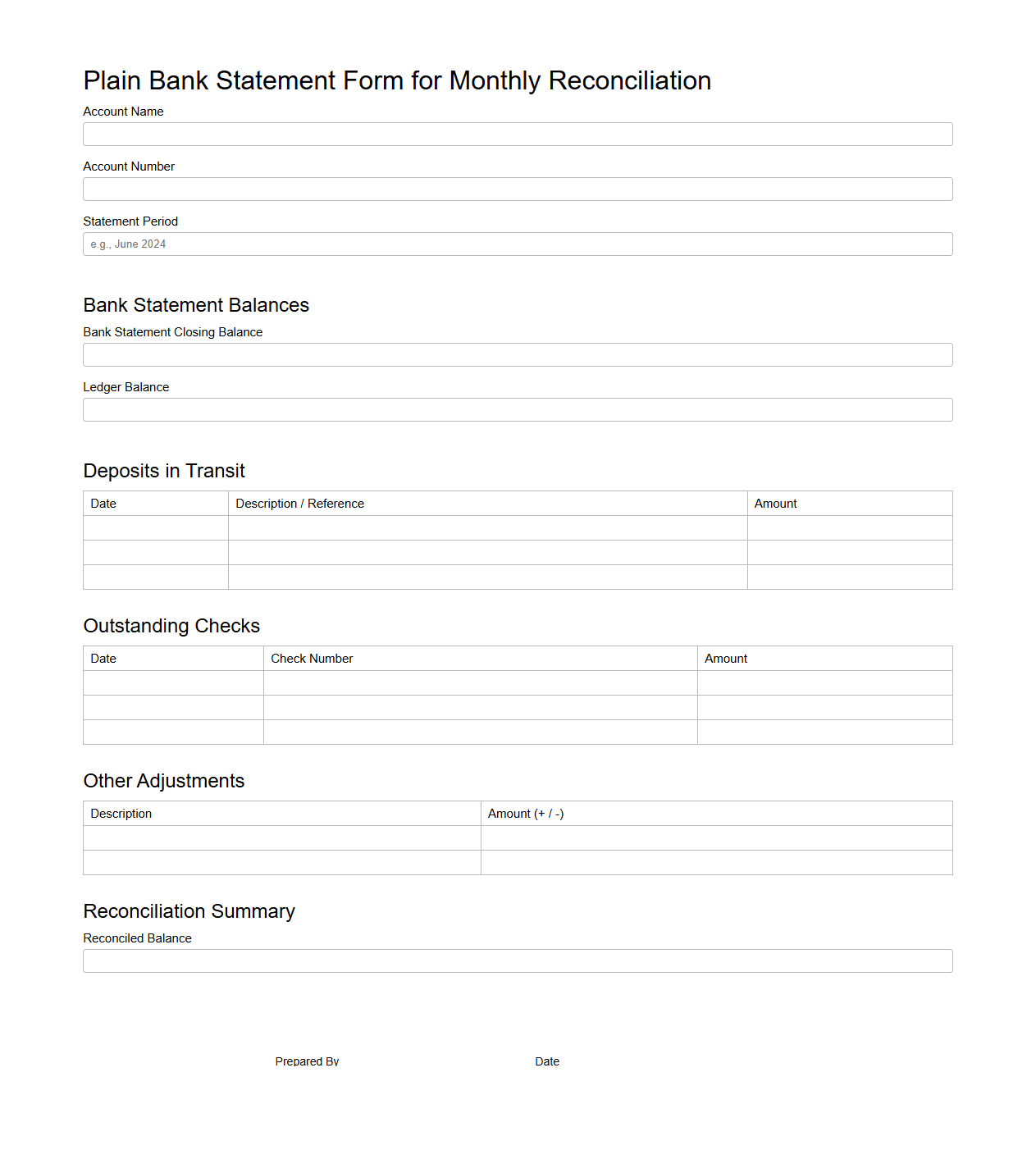

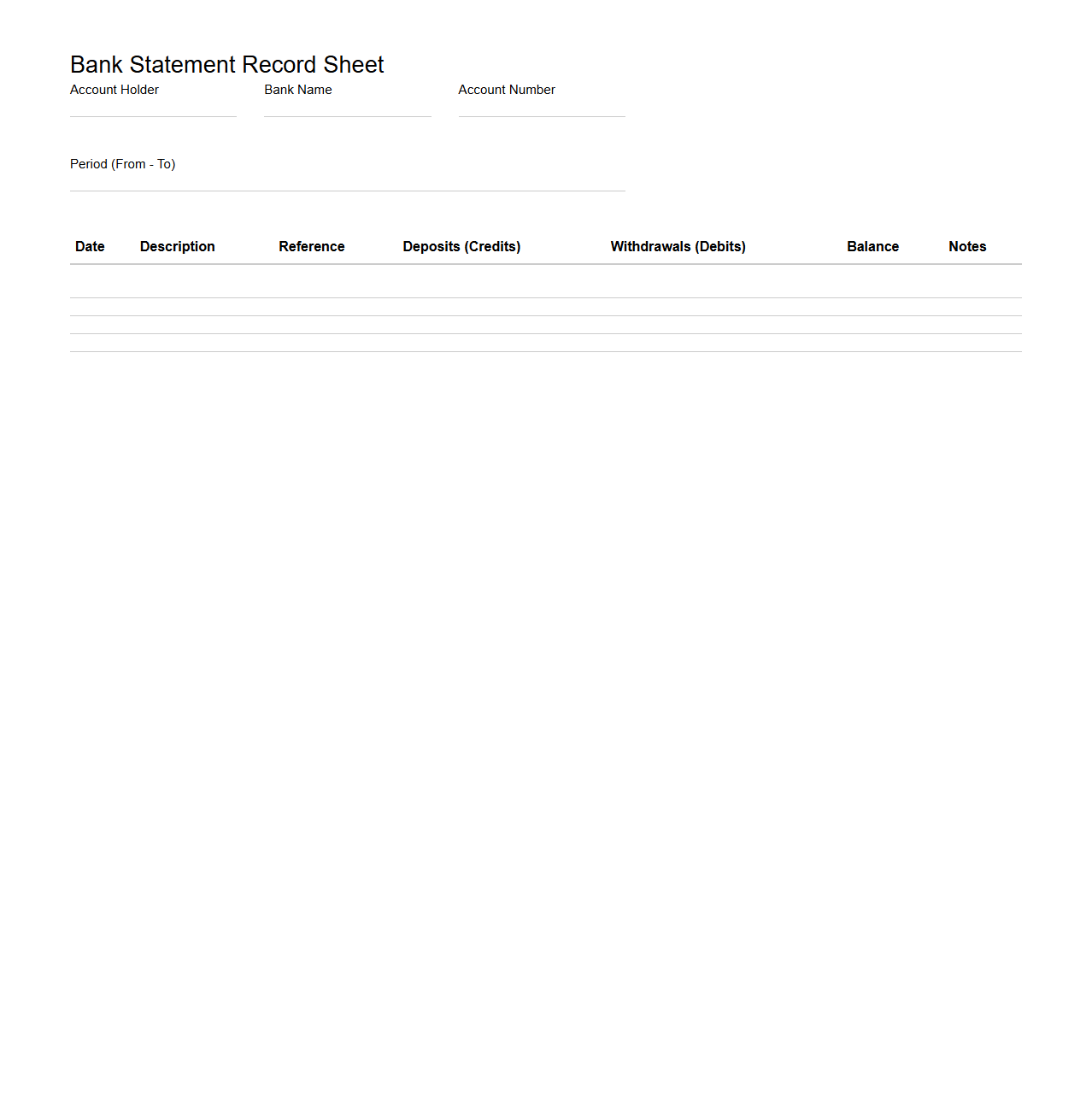

Plain Bank Statement Form for Monthly Reconciliation

A

Plain Bank Statement Form for Monthly Reconciliation is a standardized document that summarizes all banking transactions within a given month, including deposits, withdrawals, and balances. It serves as a critical tool for comparing and verifying the bank's records against a company's internal financial ledger to ensure accuracy and detect discrepancies. This form facilitates streamlined financial auditing, budgeting, and cash flow management processes.

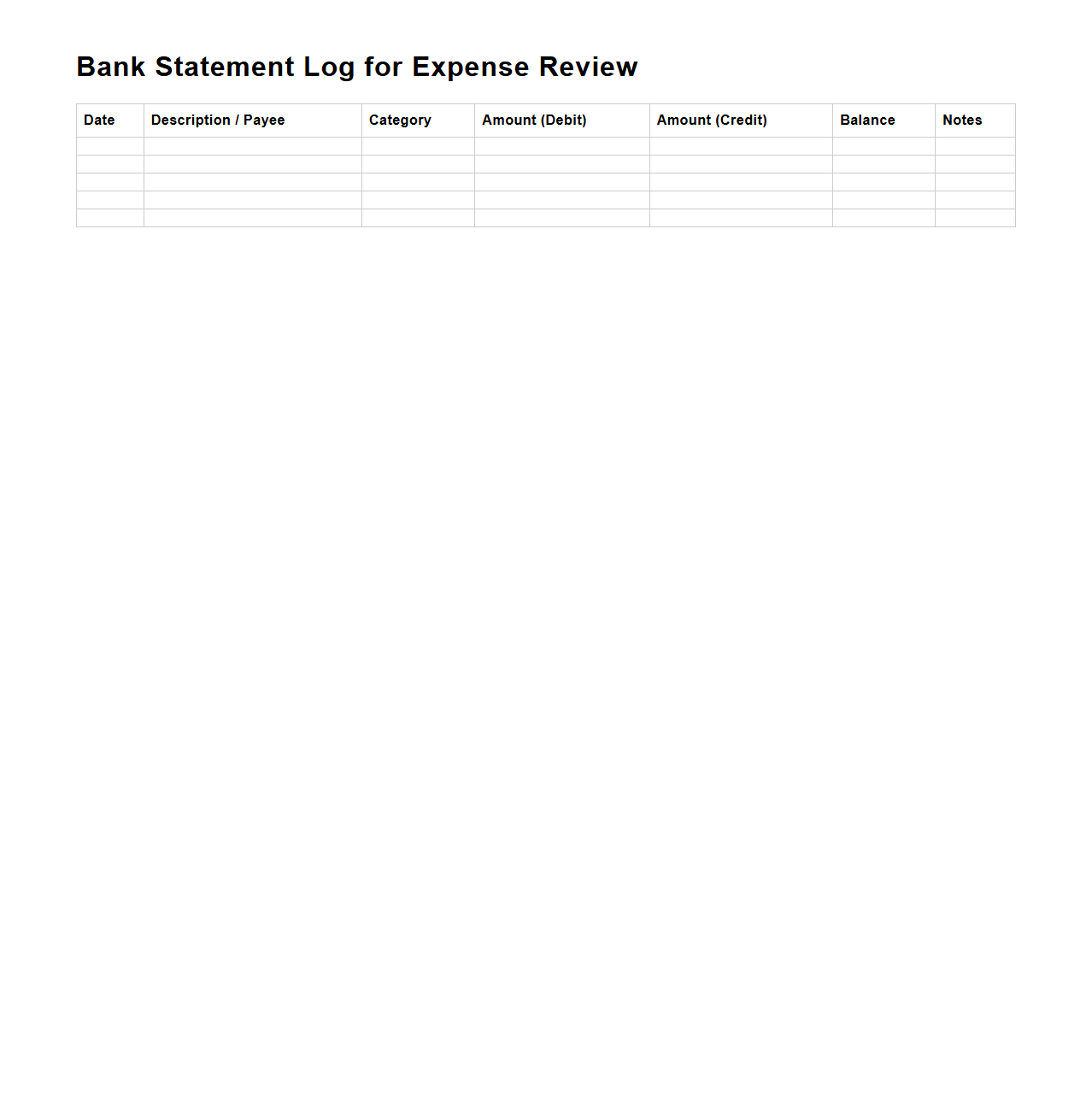

Unfilled Bank Statement Log for Expense Review

The

Unfilled Bank Statement Log for Expense Review document is used to track missing or incomplete bank statement information necessary for thorough financial analysis. This log helps identify transactions requiring verification or additional documentation to ensure accurate expense reporting. Maintaining this record enhances audit readiness and supports compliance with financial regulations.

Basic Bank Statement Layout for Audit Preparation

A

Basic Bank Statement Layout for Audit Preparation document outlines the essential structure and key components of a bank statement used during financial audits. It typically includes sections such as beginning and ending balances, transaction dates, descriptions, amounts credited or debited, and running balance to provide clear financial activity overview. This standardized format ensures auditors can efficiently verify transactions, identify discrepancies, and assess the accuracy of financial records.

Simple Bank Statement Framework for Bookkeeping

The

Simple Bank Statement Framework for bookkeeping documents standardizes transactional data to streamline financial record-keeping and reconciliation processes. It organizes debit and credit entries, dates, amounts, and descriptions in a clear format, making it easier for accountants to track cash flows and verify account accuracy. This framework enhances efficiency by reducing errors and simplifying audits through consistent documentation.

Bank Account Statement Worksheet for Transaction Tracking

A

Bank Account Statement Worksheet for Transaction Tracking is a detailed document used to systematically record, categorize, and monitor all financial transactions within a bank account. It helps in reconciling account balances, identifying discrepancies, and ensuring accurate financial reporting by tracking deposits, withdrawals, fees, and interest. This worksheet serves as a critical tool for personal finance management, accounting, and auditing purposes.

Bank Statement Record Sheet for Cash Flow Analysis

The

Bank Statement Record Sheet for Cash Flow Analysis is a financial document that compiles detailed transaction data from bank statements to track income, expenses, and cash movements. This sheet helps businesses or individuals monitor liquidity, identify spending patterns, and forecast future cash flow needs accurately. By organizing bank statement entries systematically, it facilitates effective cash management and financial decision-making.

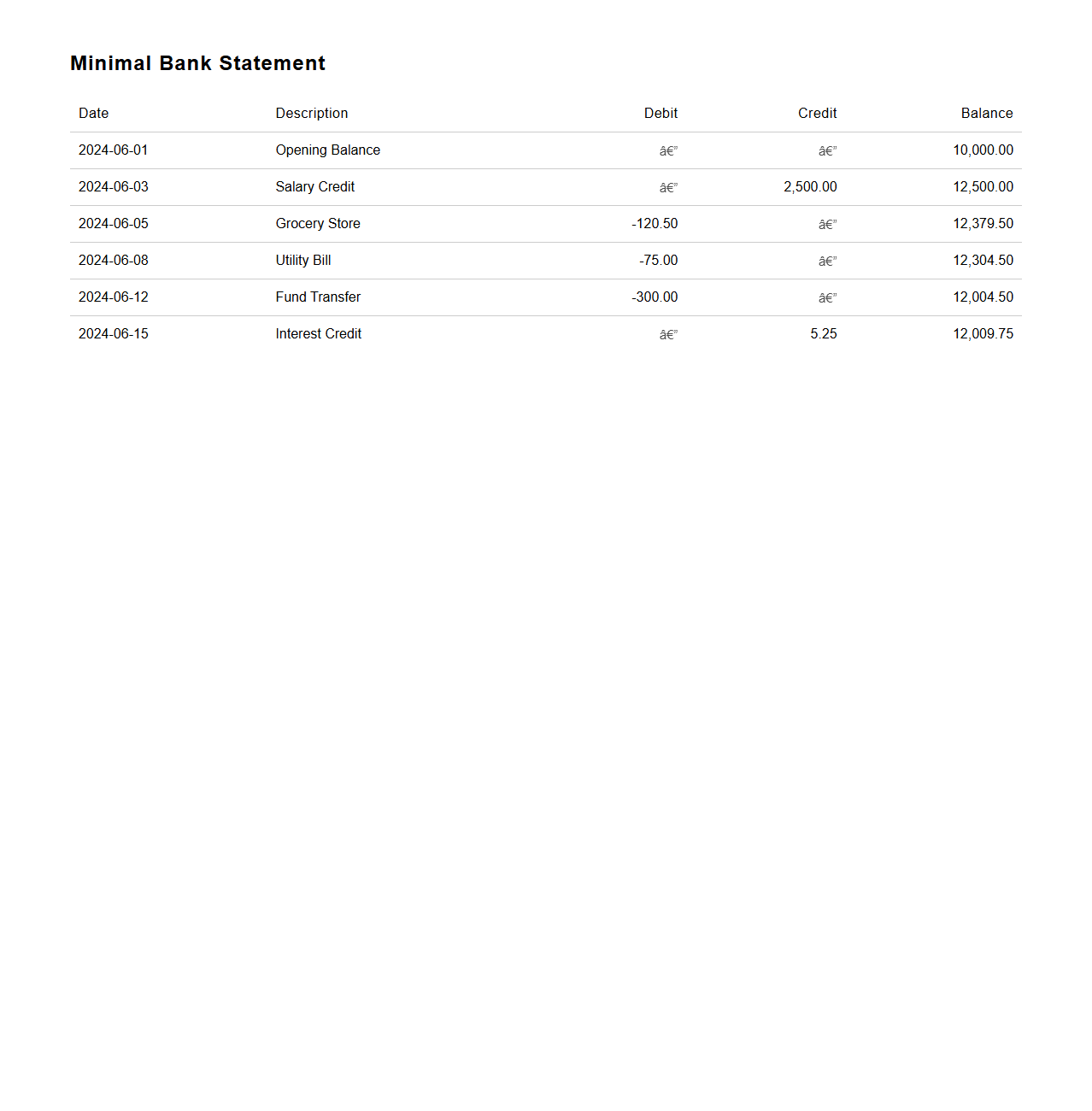

Minimal Bank Statement Grid for Financial Reporting

A

Minimal Bank Statement Grid for Financial Reporting is a streamlined table format that consolidates essential bank transaction details for clear and concise analysis. It typically includes key data points such as transaction date, description, debit and credit amounts, and running balance, enabling efficient reconciliation and auditing processes. This grid simplifies complex bank data, enhancing accuracy and speed in financial reporting workflows.

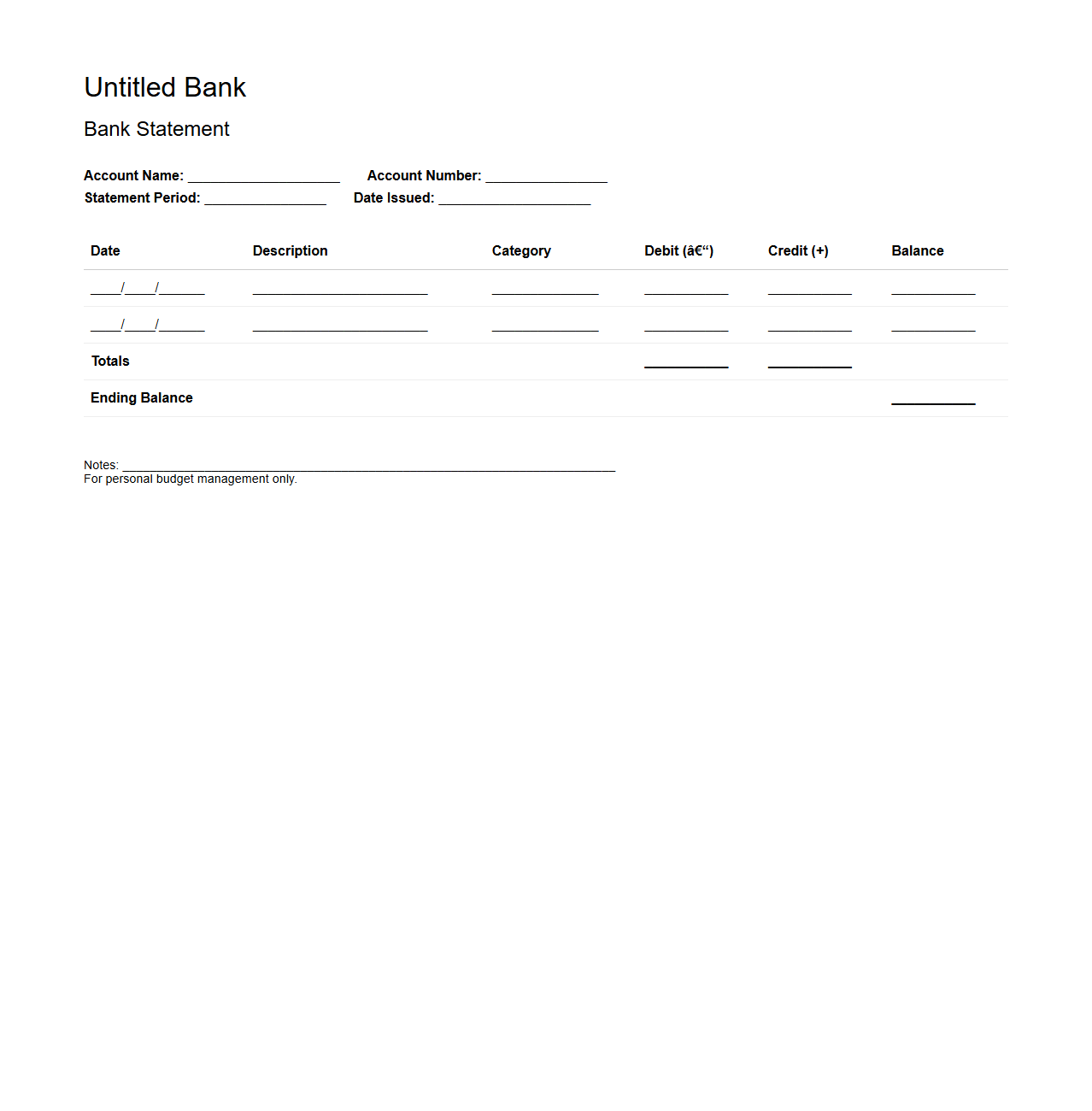

Untitled Bank Statement Format for Budget Management

The

Untitled Bank Statement Format for Budget Management is a streamlined financial document used to track and organize bank transactions without predefined headings, allowing for flexible categorization. This format enables users to efficiently monitor income, expenses, and account balances while tailoring the layout to specific budgeting needs. It supports improved financial planning by providing a clear overview of cash flow and facilitating accurate budget adjustments.

What specific details must a blank bank statement include for accurate reconciliation audits?

A blank bank statement must include transaction date, description, and amount columns to ensure accurate reconciliation audits. It should also have clearly defined opening and closing balances to verify account integrity. Including unique transaction reference numbers helps auditors trace and validate financial activities.

How can a generated blank bank statement template prevent manual reconciliation errors?

A generated blank bank statement template reduces manual errors by providing a standardized and consistent format for entering data. It minimizes the risk of omitting key details and supports automated checks for balance accuracy. This structured approach enhances data integrity during the reconciliation process.

Are there legal implications of using blank bank statements for internal financial reconciliation?

Using blank bank statements internally for reconciliation typically complies with financial regulations if they are used accurately and transparently. Misrepresentation or forgery of bank statements can lead to serious legal consequences. Organizations must maintain compliance with auditing standards to avoid regulatory violations.

Which bank statement layout formats are most compatible with accounting software for reconciliation?

CSV and Excel formats are the most compatible layouts for bank statements in accounting software reconciliation. These formats allow easy import of data and support automated matching of transactions. PDF formats are less ideal unless they are converted into editable formats for data extraction.

What data privacy protocols should be observed when handling blank bank statement templates?

When handling blank bank statement templates, it is crucial to implement encryption and secure storage to protect sensitive financial information. Access should be restricted to authorized personnel following strict data privacy policies. Compliance with regulations such as GDPR ensures confidentiality and data protection.