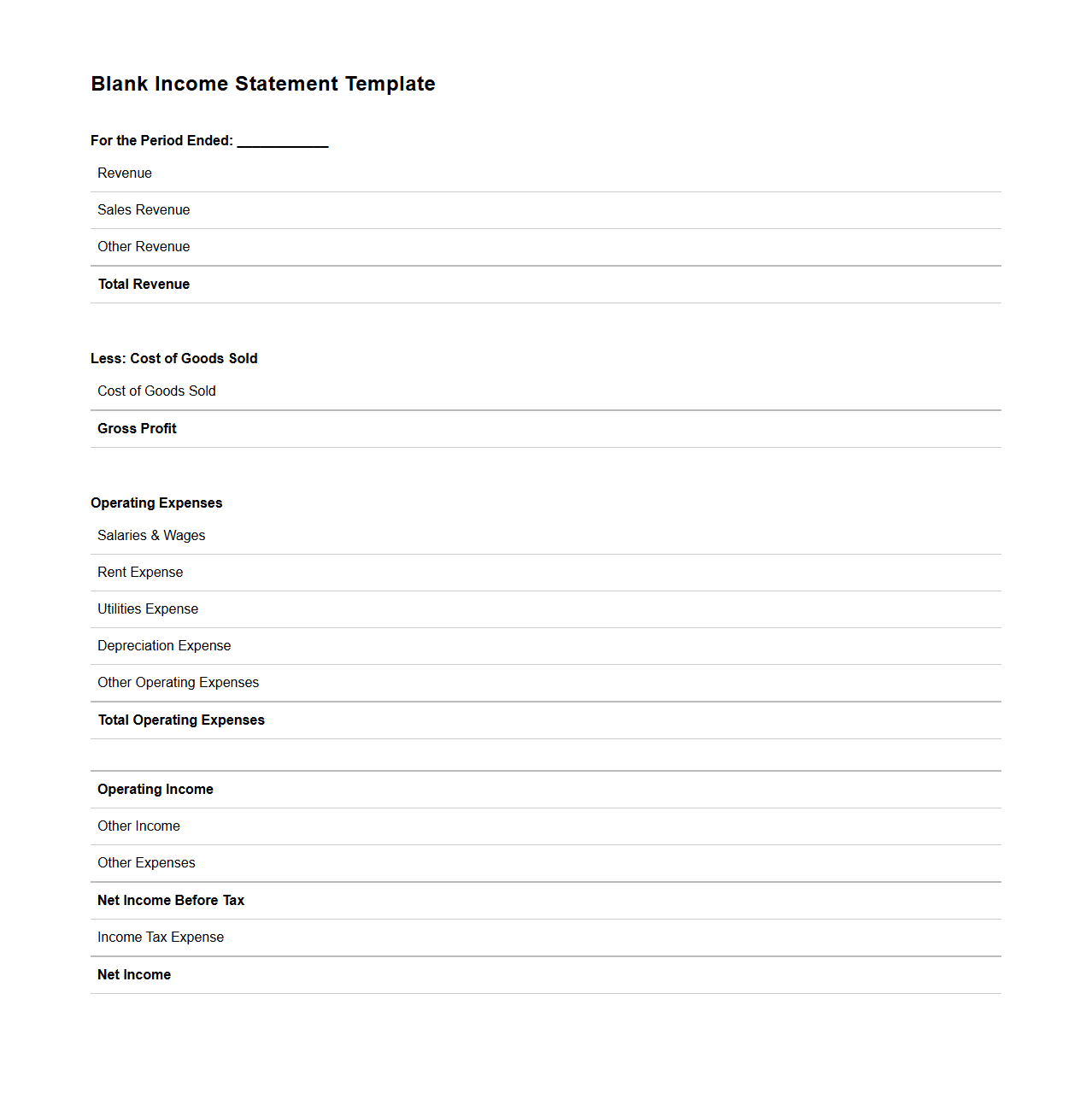

Blank Income Statement Template for Small Business Analysis

A

Blank Income Statement Template for small business analysis is a structured financial document designed to record and evaluate revenues, expenses, and net profit over a specific period. It helps small business owners and analysts systematically track operational performance, identify cost trends, and measure profitability. Using this template enables accurate financial forecasting and better decision-making for sustainable business growth.

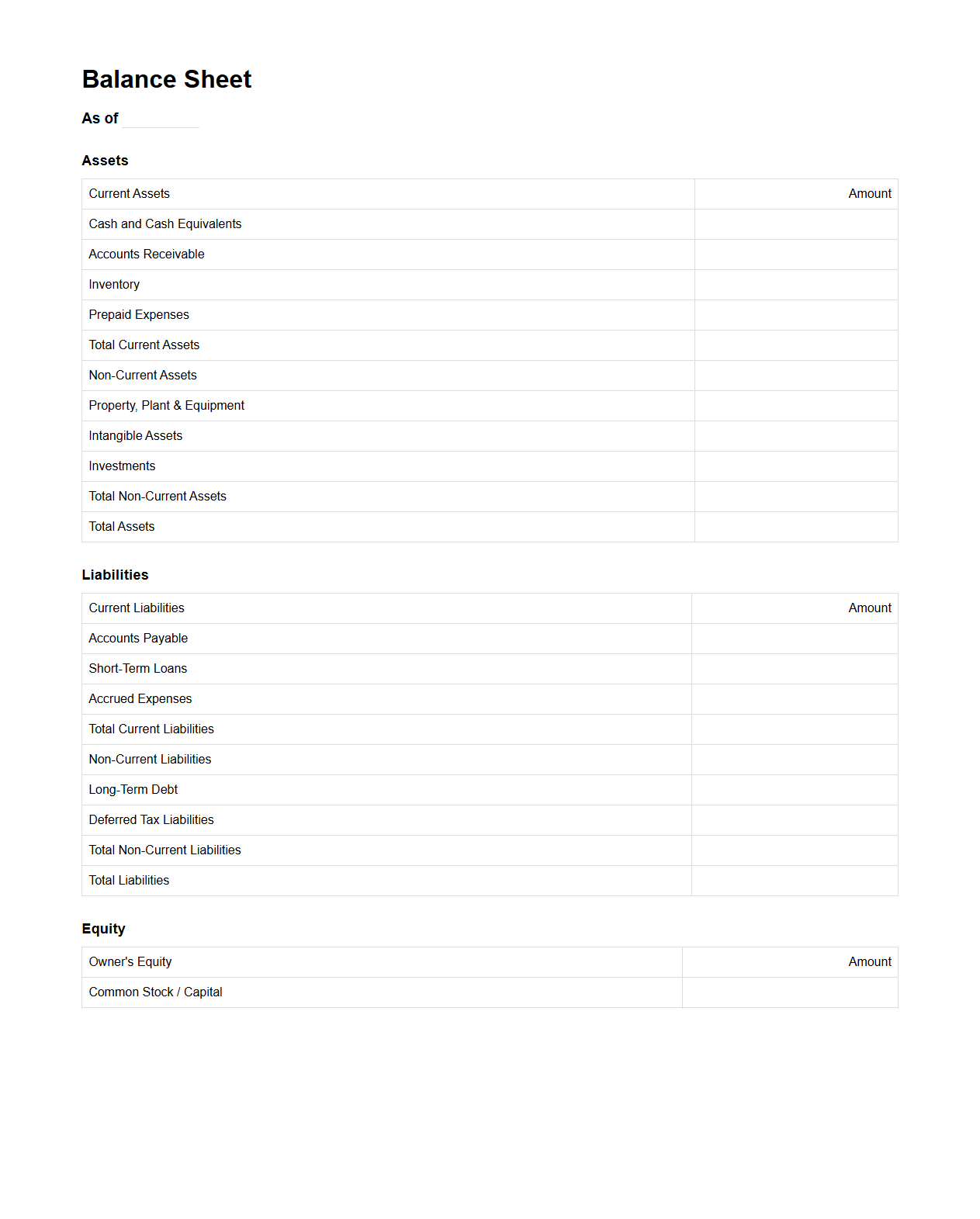

Blank Balance Sheet Format for Business Financial Review

The

Blank Balance Sheet Format is a fundamental template used to systematically organize a company's assets, liabilities, and equity at a specific point in time, providing a clear snapshot of its financial health. This format aids in conducting a comprehensive business financial review by allowing precise data entry, facilitating the identification of financial strengths and weaknesses. Utilizing a standardized blank balance sheet ensures consistency and accuracy in financial reporting and decision-making processes.

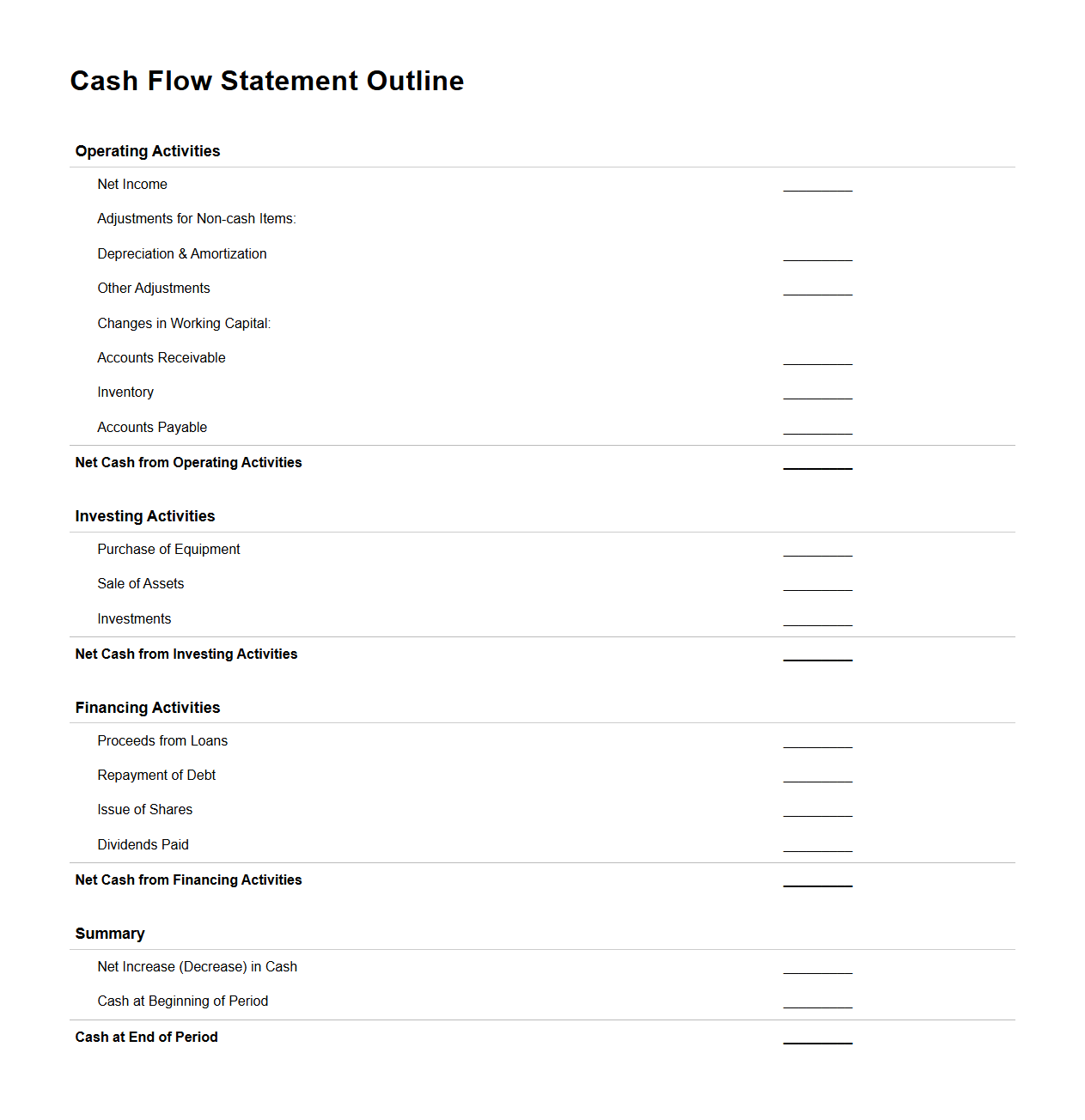

Blank Cash Flow Statement Outline for Business Assessment

A

Blank Cash Flow Statement Outline for Business Assessment is a structured template used to track and analyze the inflows and outflows of cash within a company over a specific period. It helps assess the liquidity position, operational efficiency, and financial health by categorizing cash flows into operating, investing, and financing activities. This document serves as a vital tool for stakeholders to make informed decisions, plan budgets, and evaluate the business's ability to generate sustainable cash flow.

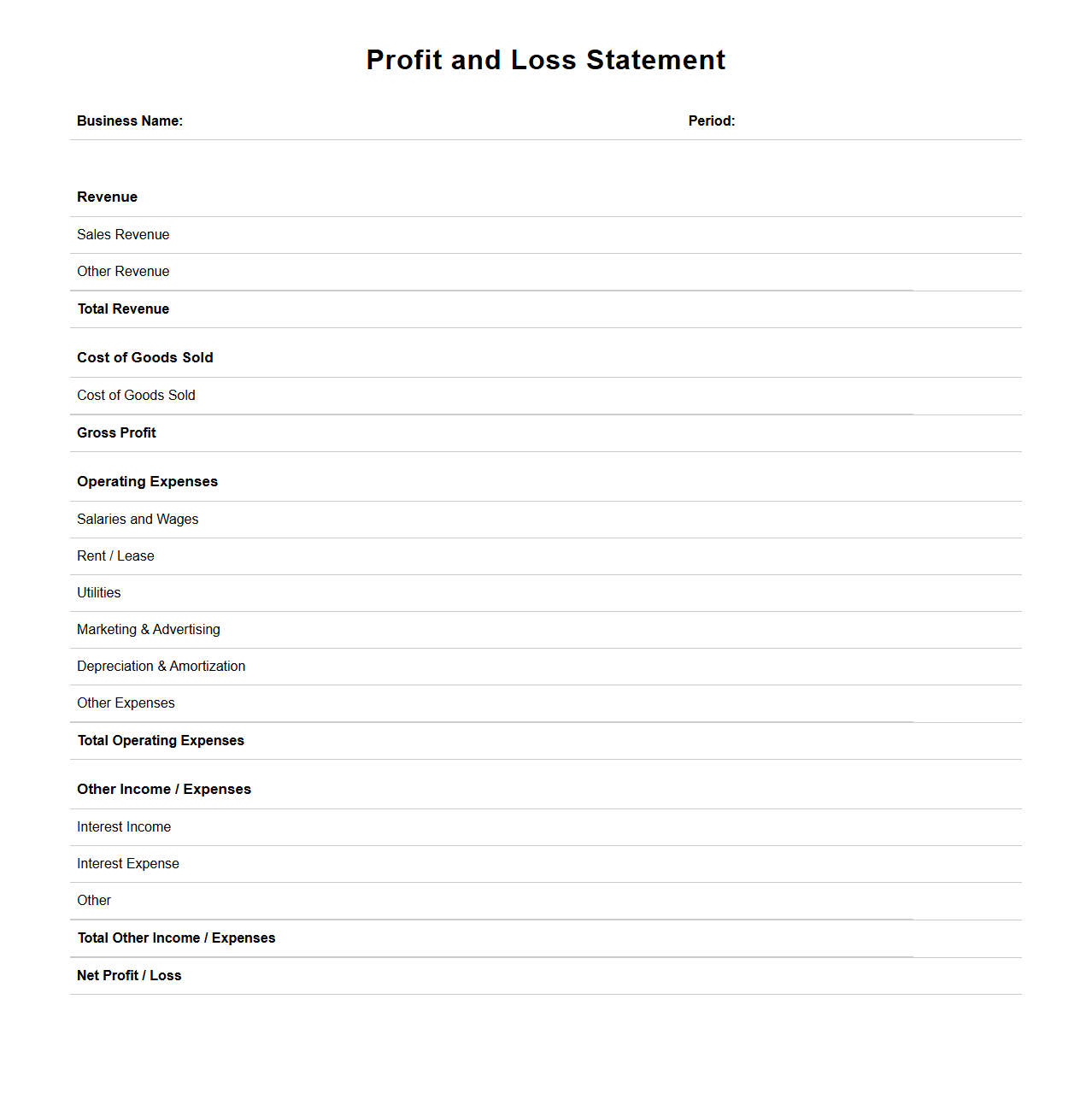

Blank Profit and Loss Statement Template for Business Analysis

A

Blank Profit and Loss Statement Template for Business Analysis is a standardized document used to record and evaluate a company's revenues, costs, and expenses over a specific period. It helps businesses track financial performance, identify profit margins, and make informed decisions based on accurate income and expense data. This template facilitates clear financial reporting and comparative analysis essential for strategic planning and budgeting.

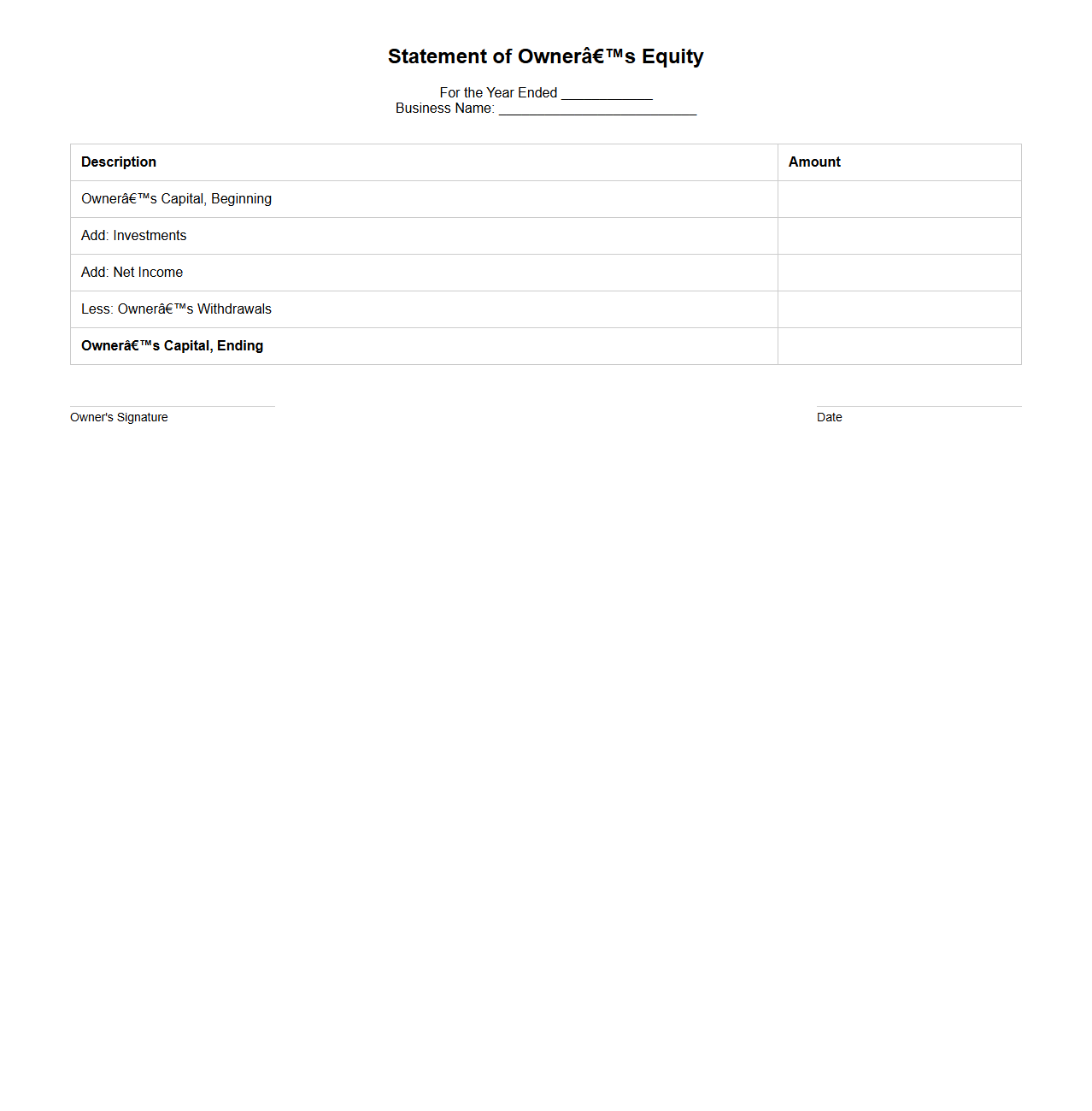

Blank Statement of Owner’s Equity for Business Reporting

The

Blank Statement of Owner's Equity for Business Reporting is a financial document template used to outline changes in the owner's equity over a specific accounting period. It captures key elements such as owner contributions, withdrawals, net income, and adjustments, offering a clear view of equity fluctuations. This blank format allows businesses to input relevant data accurately, ensuring consistent and transparent equity reporting.

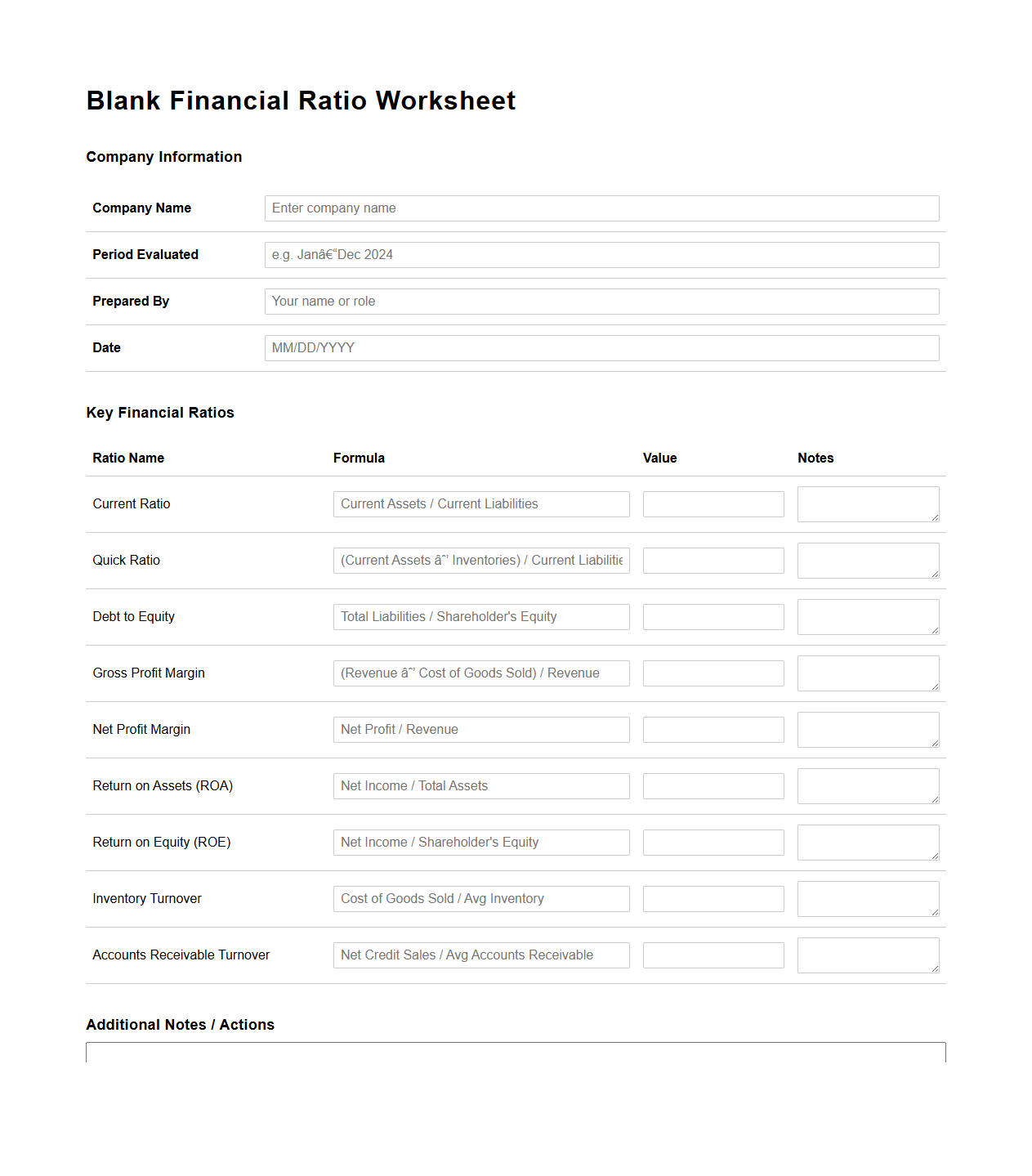

Blank Financial Ratio Worksheet for Business Evaluation

A

Blank Financial Ratio Worksheet for Business Evaluation is a structured template used by analysts and business owners to calculate and analyze key financial ratios that assess a company's performance, liquidity, profitability, and solvency. This worksheet typically includes sections for inputting financial data such as assets, liabilities, revenue, and expenses, enabling a comprehensive evaluation of operational efficiency and financial health. By organizing financial metrics in one place, it facilitates quick comparison against industry benchmarks and supports informed decision-making for strategic planning or investment analysis.

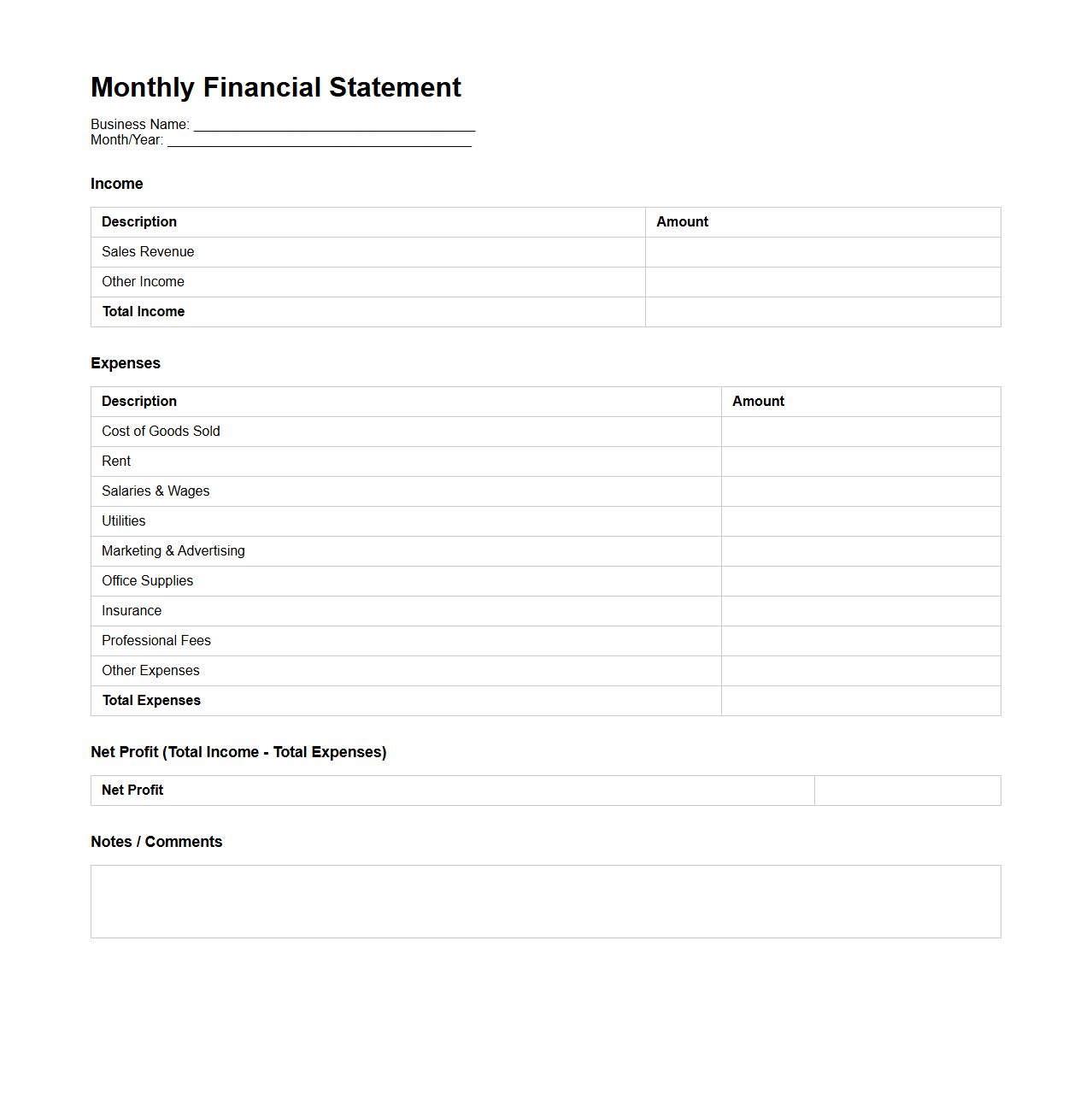

Blank Monthly Financial Statement for Business Performance

A

Blank Monthly Financial Statement for Business Performance document is a pre-formatted template designed to record and track a company's financial activities within a specific month. It typically includes sections for income, expenses, assets, liabilities, and equity, allowing business owners to analyze cash flow, profitability, and overall financial health. This document serves as a critical tool for budgeting, forecasting, and making informed strategic decisions.

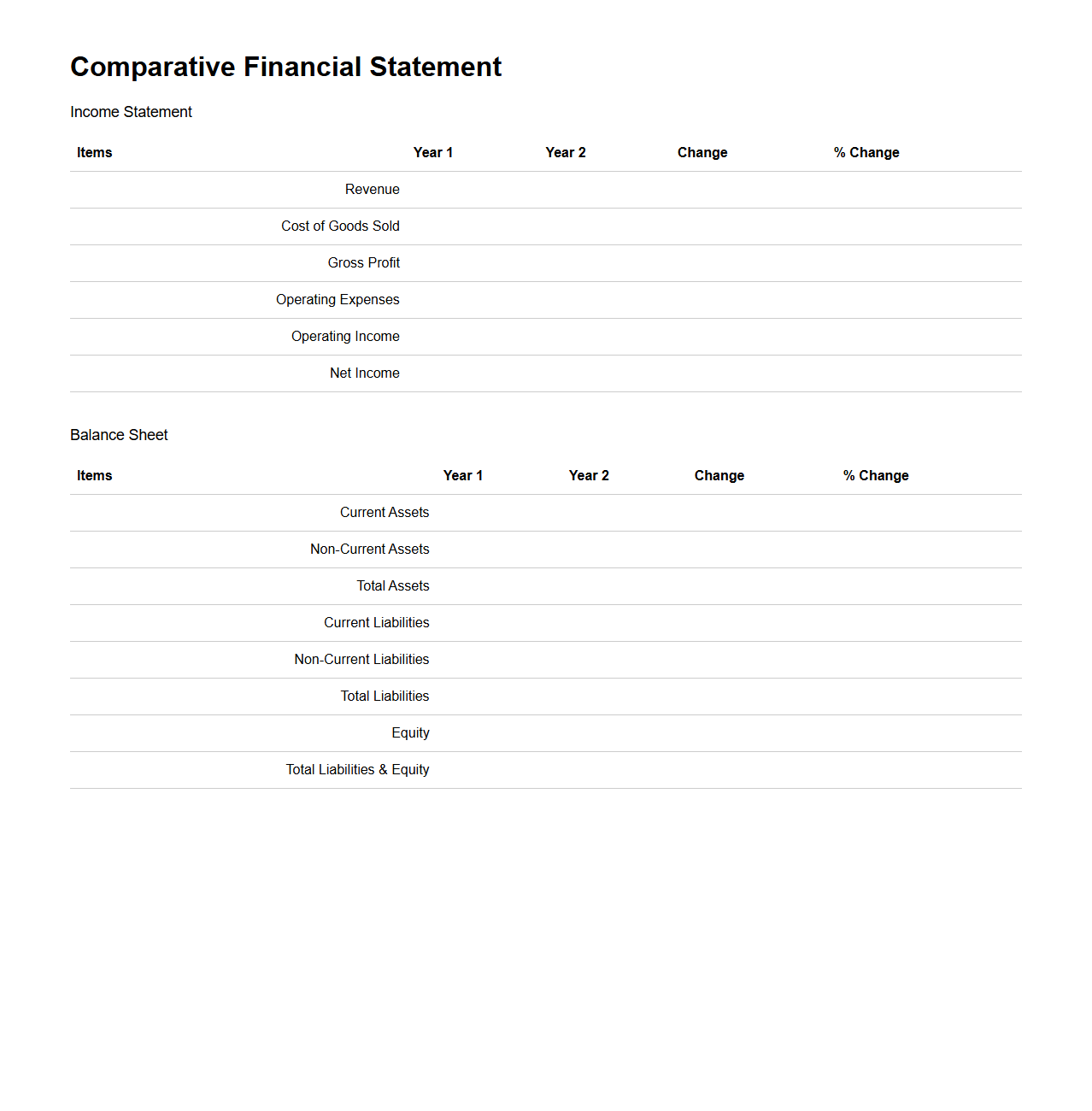

Blank Comparative Financial Statement for Business Insights

A

Blank Comparative Financial Statement is a structured template used by businesses to systematically compare financial data across multiple periods, enabling clear identification of trends, variances, and growth patterns. This document facilitates in-depth financial analysis, helping stakeholders make informed decisions by highlighting changes in assets, liabilities, revenue, and expenses over time. Its standardized format ensures consistency and accuracy, making it an essential tool for performance evaluation and strategic planning.

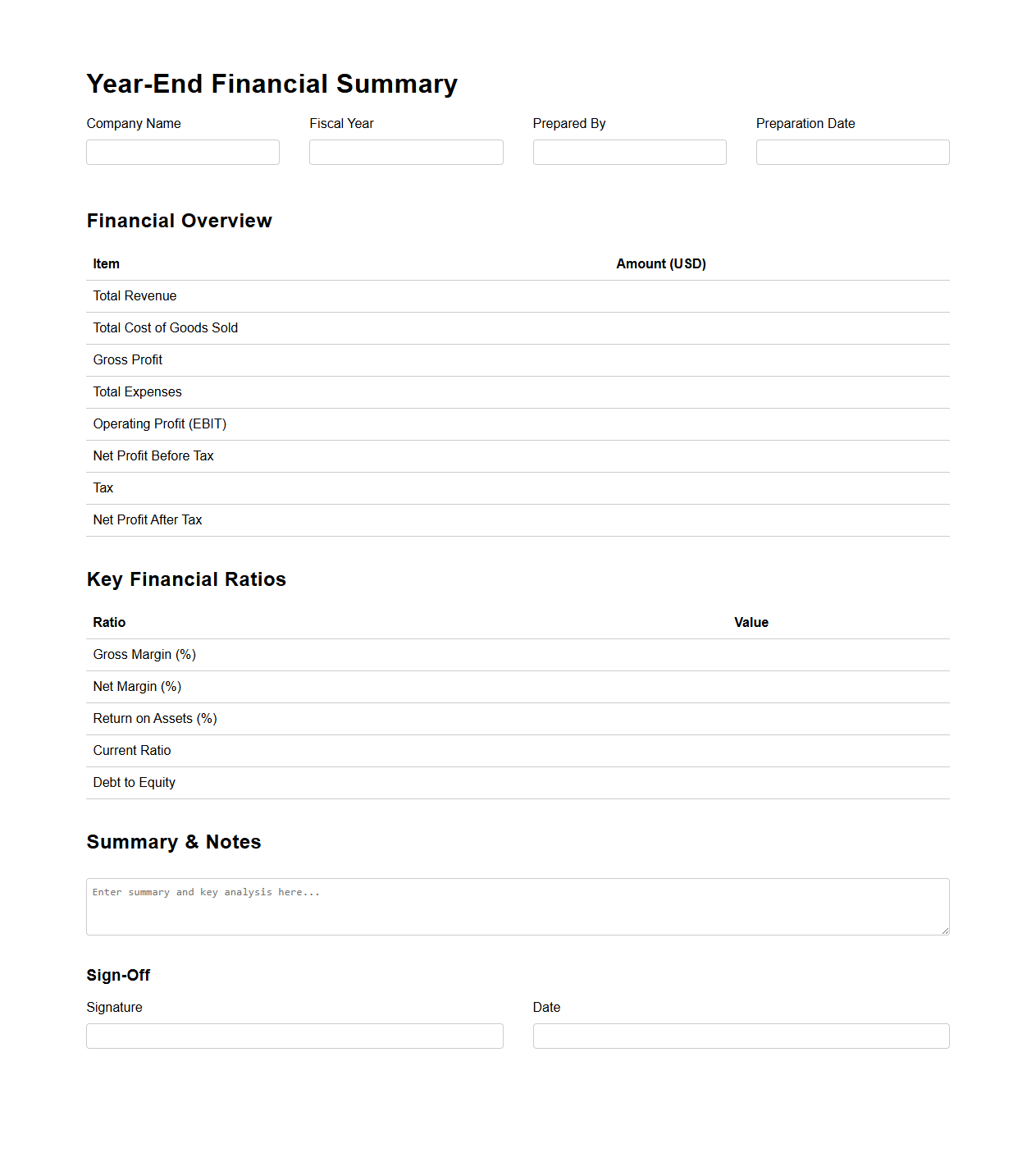

Blank Year-End Financial Summary Template for Business Analysis

A

Blank Year-End Financial Summary Template for Business Analysis document is a structured tool designed to compile and evaluate a company's financial performance over the fiscal year. It organizes key financial data such as revenues, expenses, profits, and losses in a clear, standardized format to facilitate comprehensive analysis and informed decision-making. This template aids businesses in identifying trends, assessing financial health, and planning strategies for future growth.

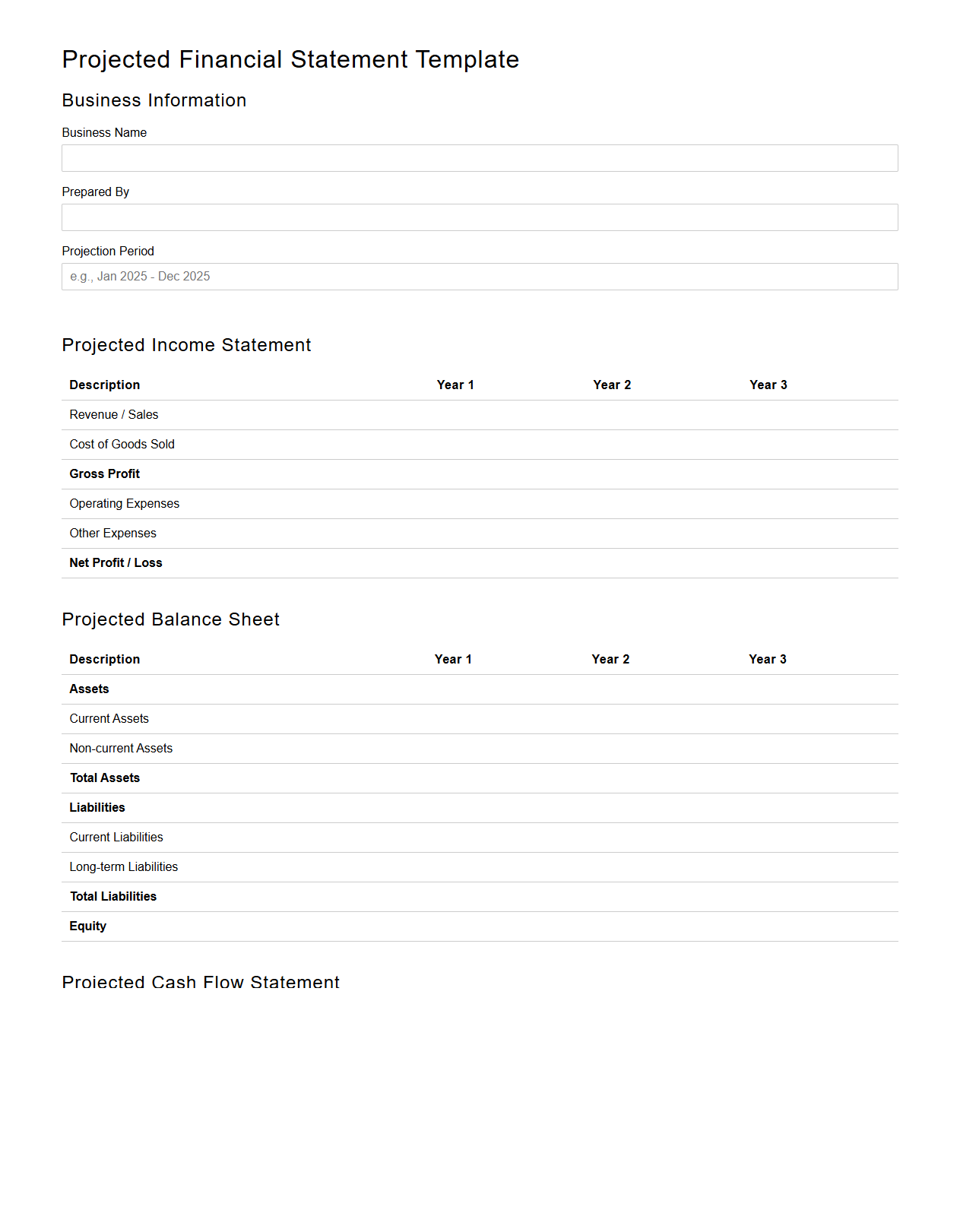

Blank Projected Financial Statement Template for Business Planning

The

Blank Projected Financial Statement Template for Business Planning is a structured financial tool designed to help businesses forecast their future financial performance. It includes sections for income statements, balance sheets, and cash flow statements, enabling entrepreneurs to estimate revenue, expenses, assets, liabilities, and cash movements over a specific period. This template is essential for making informed decisions, securing funding, and setting realistic financial goals.

Essential Fields for a Blank Financial Statement Template for Startups

Include assets, liabilities, and equity sections to capture the company's financial position. The income statement should have revenue, cost of goods sold, gross profit, expenses, and net profit fields. Additionally, a cash flow statement is critical to track operating, investing, and financing activities for startup liquidity insights.

Formatting a Blank Financial Statement for Comparative Year-Over-Year Analysis

Use clearly labeled columns for each year to facilitate side-by-side comparison of financial data. Consistent line items across years with subtotals help in identifying trends and anomalies efficiently. A clear separation between the balance sheet, income statement, and cash flow sections enhances readability and analysis.

Optional Line Items to Enhance Analytical Value of a Blank Financial Statement

Adding depreciation and amortization line items aids in understanding non-cash expenses impacting profit. Including interest expense and tax provisions provides clarity on financing costs and net profitability. Tracking dividends paid or retained earnings can highlight company payout policies and reinvestment strategies.

Impact of Regulatory Requirements on Blank Financial Statement Structure for Business Loans

Compliance with standards like GAAP or IFRS dictates specific presentation and disclosure requirements in the financial statement. Banks often require additional fields such as notes to the financial statement explaining contingencies or commitments. Transparency in liquidity and solvency ratios helps meet lender due diligence expectations.

Financial Ratios Calculated Using a Properly Designed Blank Statement

A well-structured statement enables calculation of liquidity ratios like current and quick ratios to assess short-term financial health. Profitability ratios such as net profit margin and return on equity (ROE) can be derived from the income statement and equity data. Efficiency ratios including inventory turnover and asset turnover are accessible to evaluate operational performance.