A Blank Income Statement Template for Small Business provides a simple and organized format to track revenue, expenses, and net profit. It helps small businesses monitor financial performance and make informed decisions without complex accounting knowledge. Using this template ensures accurate record-keeping and supports effective budgeting and planning.

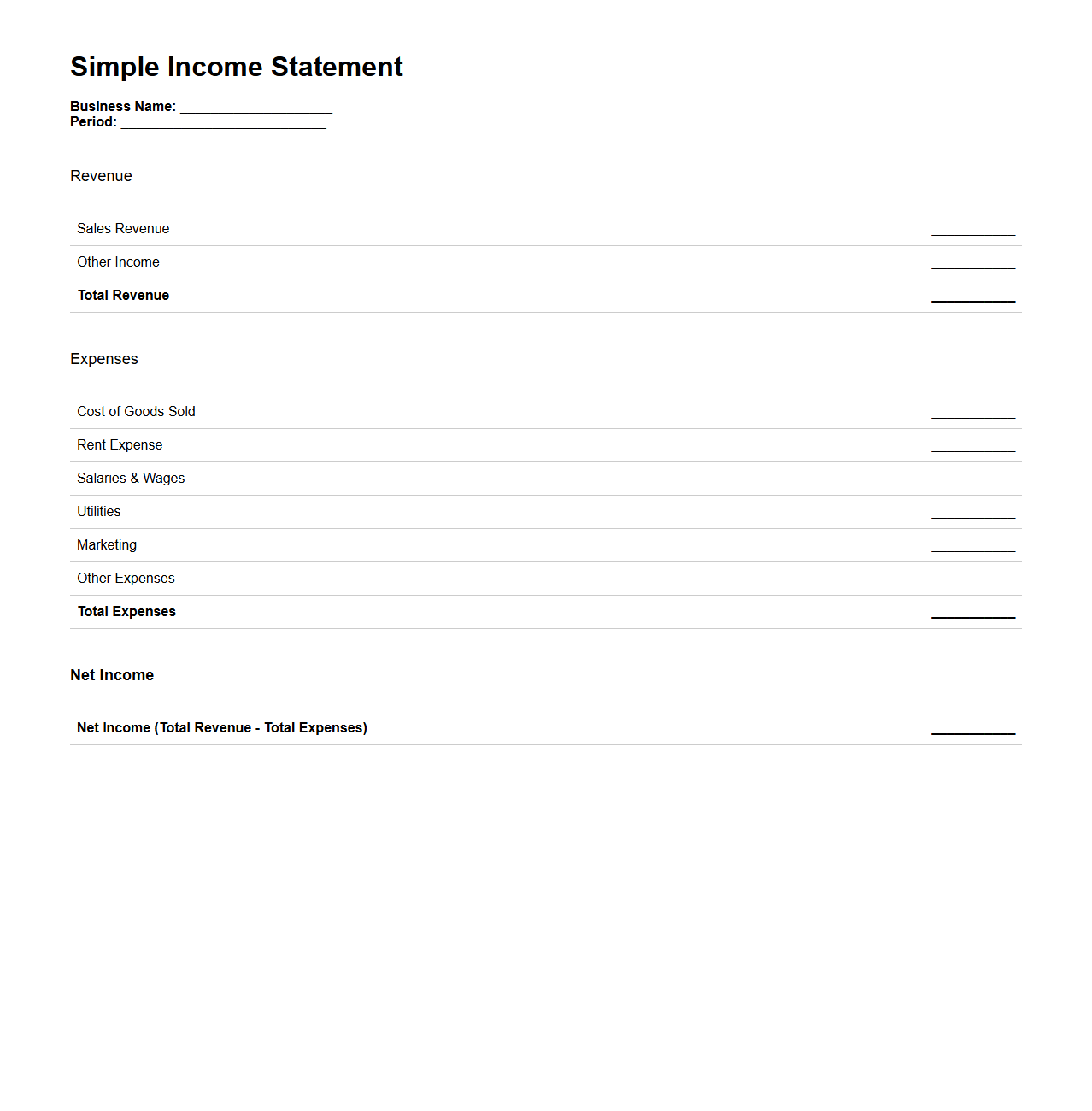

Simple Income Statement Template for Small Business

A

Simple Income Statement Template for Small Business is a streamlined financial document designed to summarize revenues, expenses, and net profit over a specific period. It helps small business owners track financial performance, identify profitability trends, and make informed budgeting decisions. The template typically includes essential categories like sales, cost of goods sold, operating expenses, and net income, enabling clear and concise financial reporting.

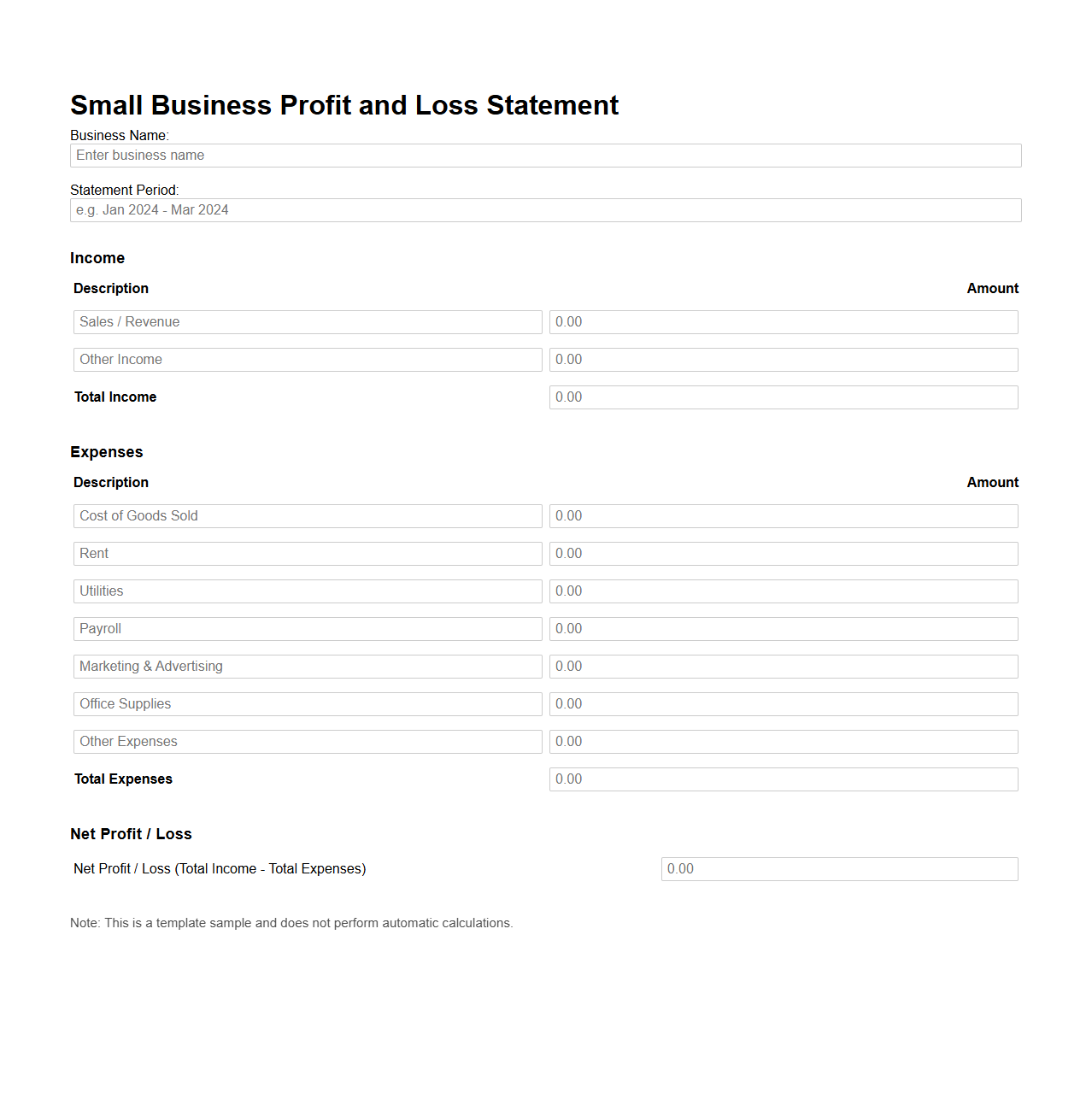

Small Business Profit and Loss Statement Template

A

Small Business Profit and Loss Statement Template is a financial document used to track revenue, expenses, and net profit over a specific period. This template helps small business owners analyze their financial performance, identify cost-saving opportunities, and make informed budgeting decisions. It typically includes sections for sales, cost of goods sold, operating expenses, and gross and net profit calculations.

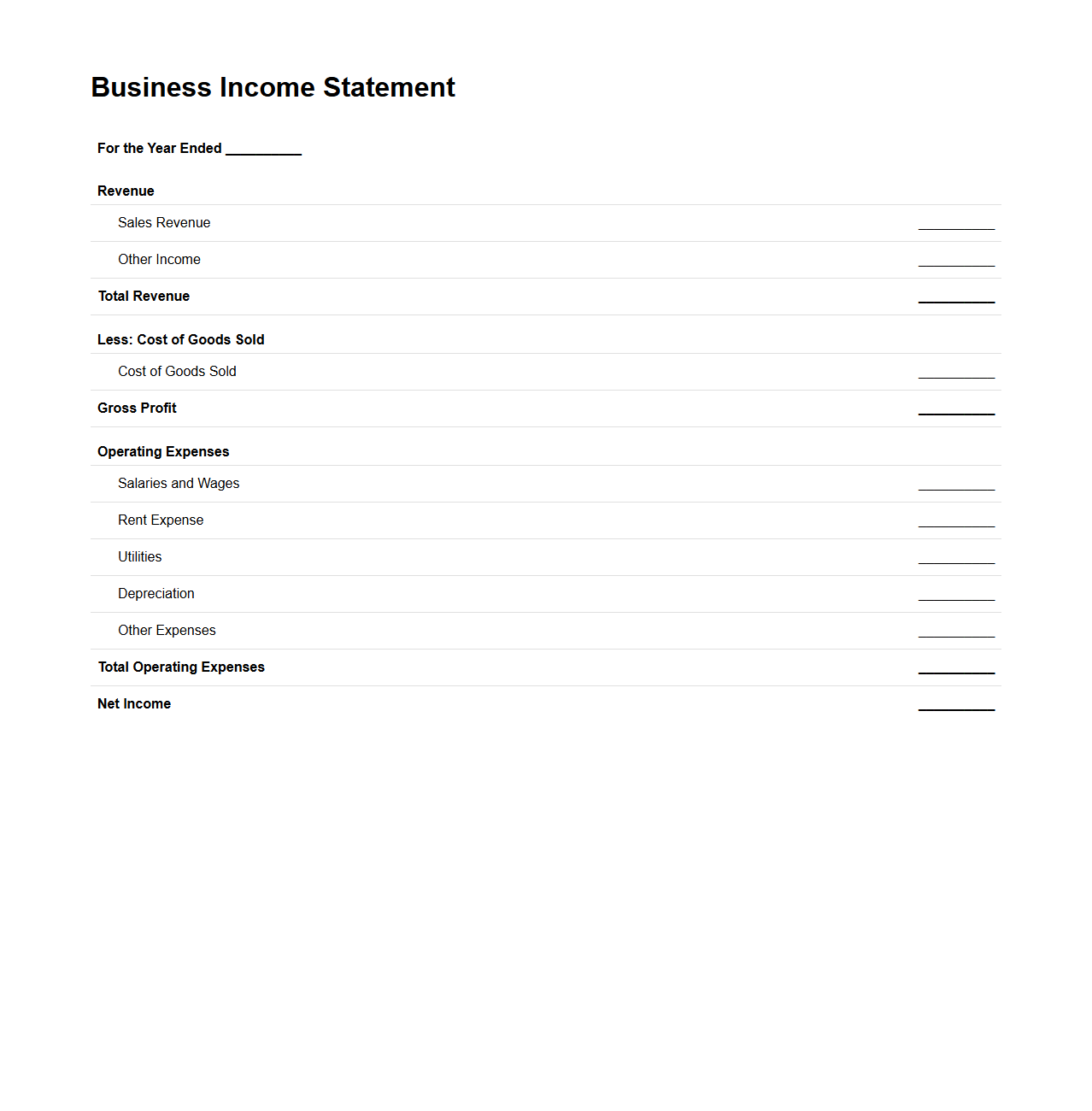

Basic Business Income Statement Format

The

Basic Business Income Statement Format document outlines the structure used to report a company's revenues, expenses, and net profit or loss over a specific period. This format typically includes sections for gross sales, cost of goods sold, operating expenses, and net income, providing a clear summary of financial performance. It serves as a crucial tool for stakeholders to assess profitability and make informed business decisions.

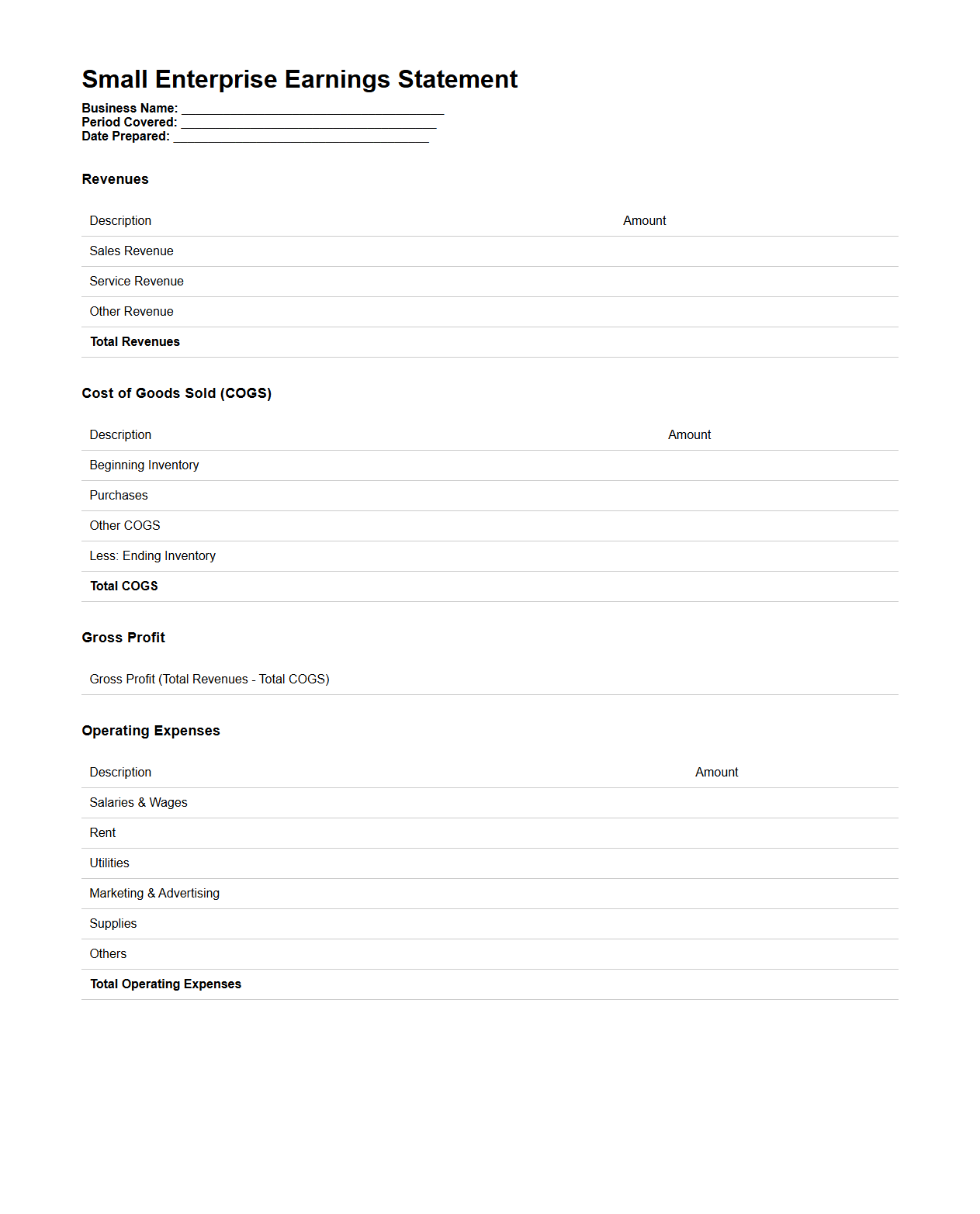

Small Enterprise Earnings Statement Template

A

Small Enterprise Earnings Statement Template is a financial document designed to systematically record and summarize the revenue, expenses, and net profit of a small business over a specific period. It helps business owners track income sources, control costs, and evaluate overall financial performance. Utilizing this template ensures accurate, organized financial data essential for decision-making and tax reporting.

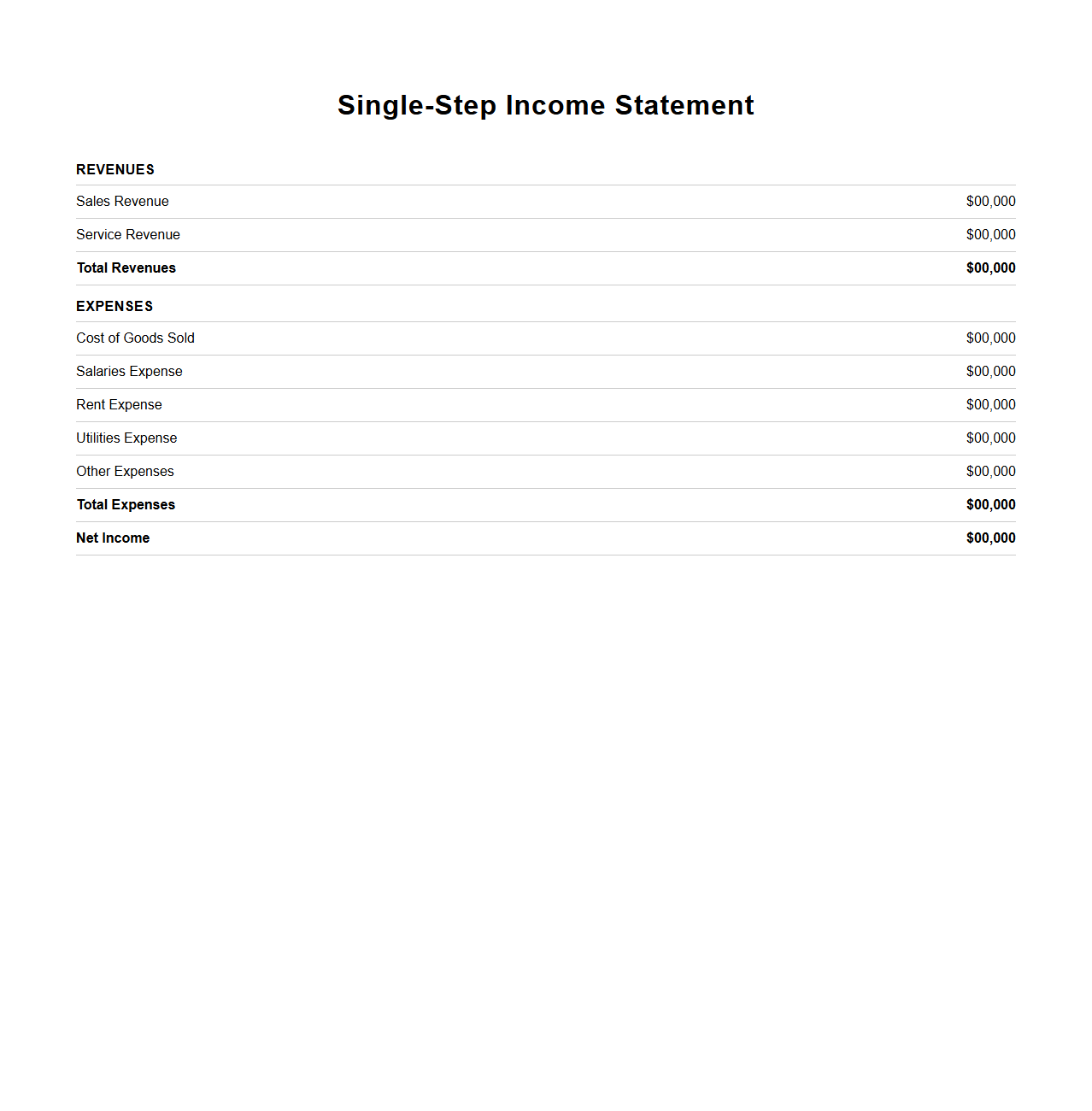

Single-Step Income Statement for Small Business

The

Single-Step Income Statement for small businesses is a simplified financial document that summarizes revenues and expenses to calculate net income in one straightforward step. It consolidates all income sources and deducts total expenses without categorizing operating and non-operating items separately, making it ideal for smaller enterprises with straightforward financial activities. This format provides a clear snapshot of profitability, aiding business owners in quick decision-making and basic financial analysis.

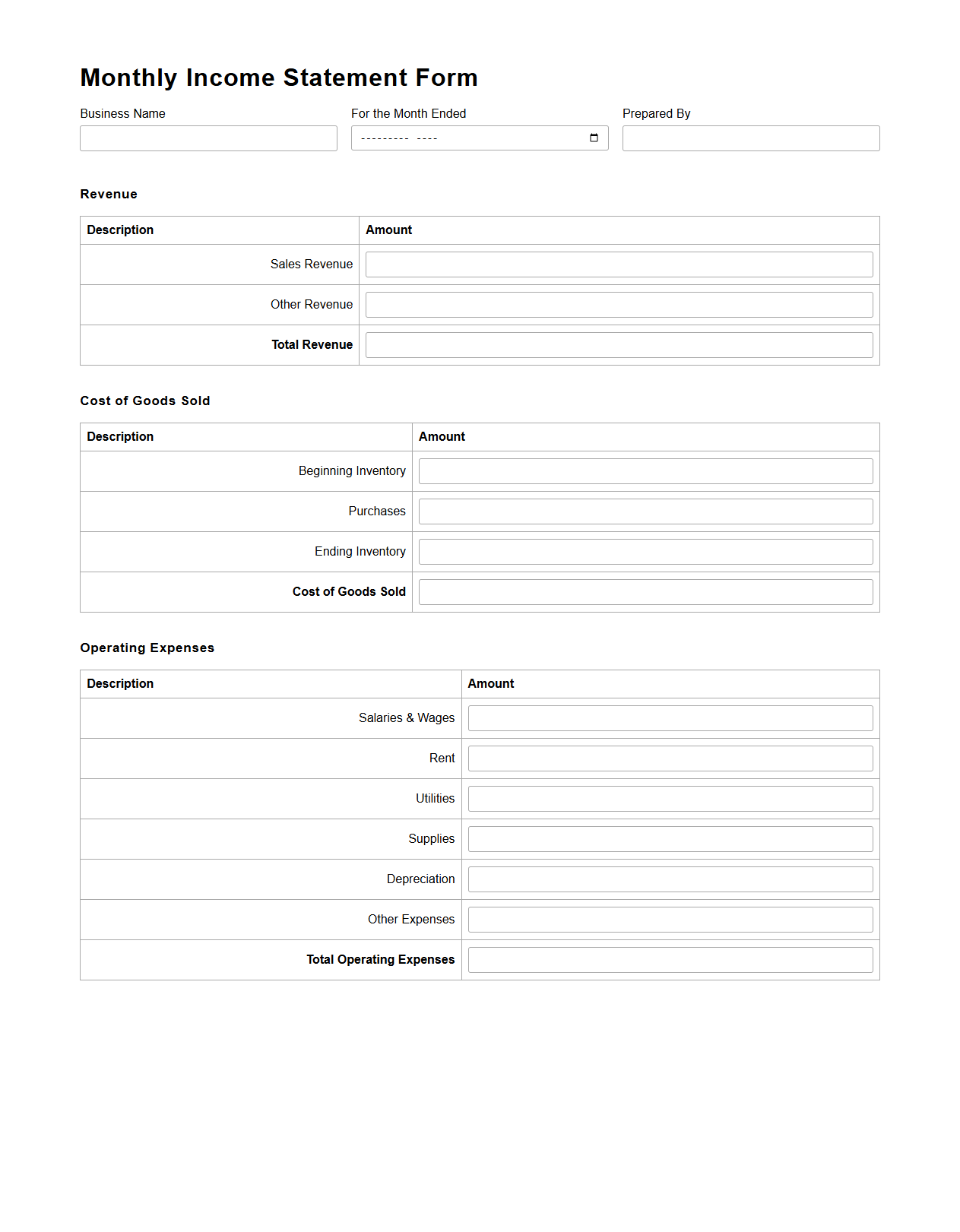

Monthly Income Statement Form for Small Business

A

Monthly Income Statement Form for Small Business is a financial document that summarizes the business's revenues, expenses, and profits over a specific month. It helps business owners track financial performance, identify trends, and make informed decisions to improve profitability. This form typically includes detailed categories such as sales, cost of goods sold, operating expenses, and net income.

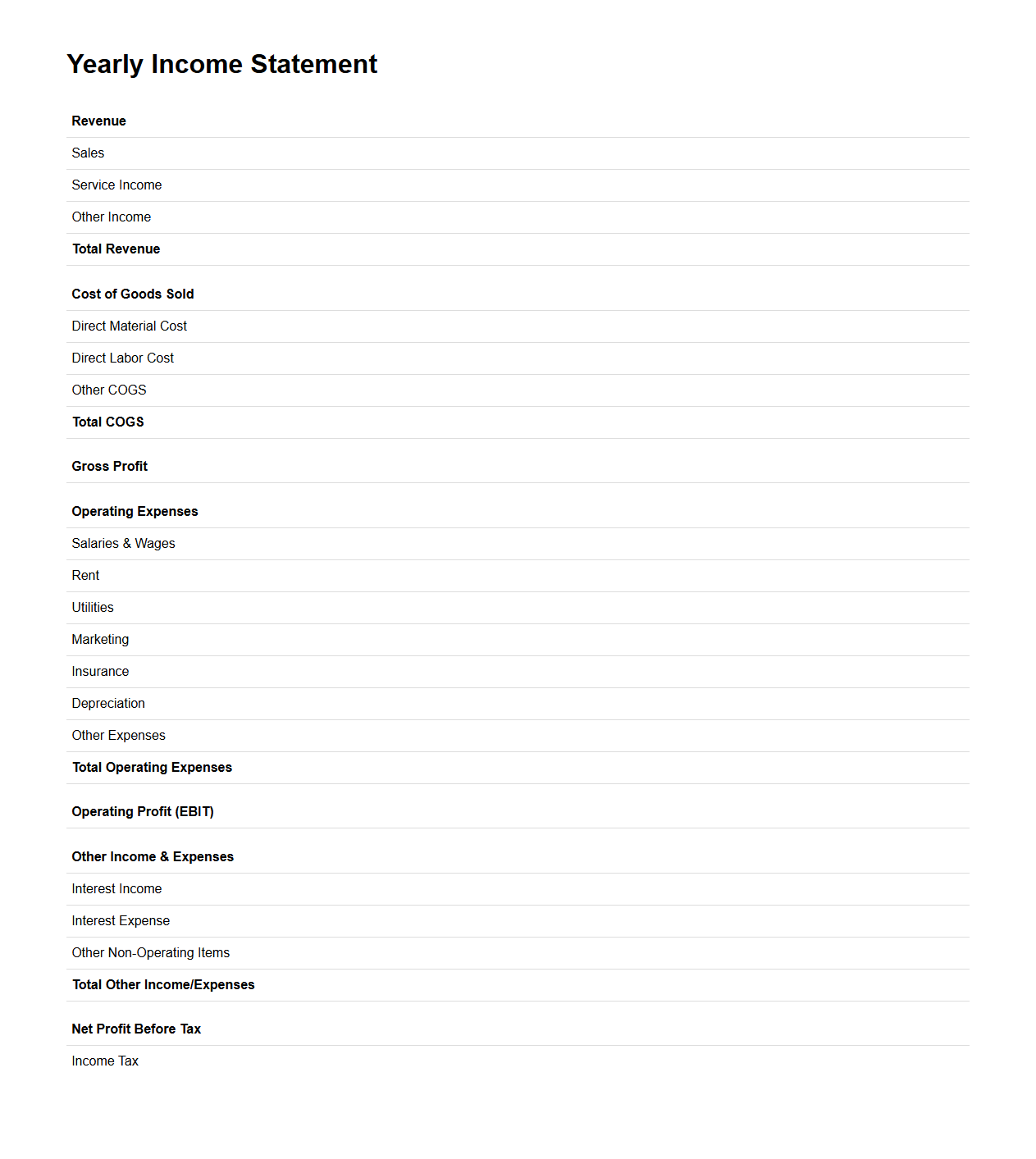

Yearly Small Business Income Statement Layout

The

Yearly Small Business Income Statement Layout document organizes financial data into categories such as revenue, cost of goods sold, gross profit, operating expenses, and net income over a twelve-month period. It provides a clear overview of a business's profitability and financial performance, helping owners track income and expenses effectively. This layout is essential for tax preparation, budgeting, and strategic financial planning.

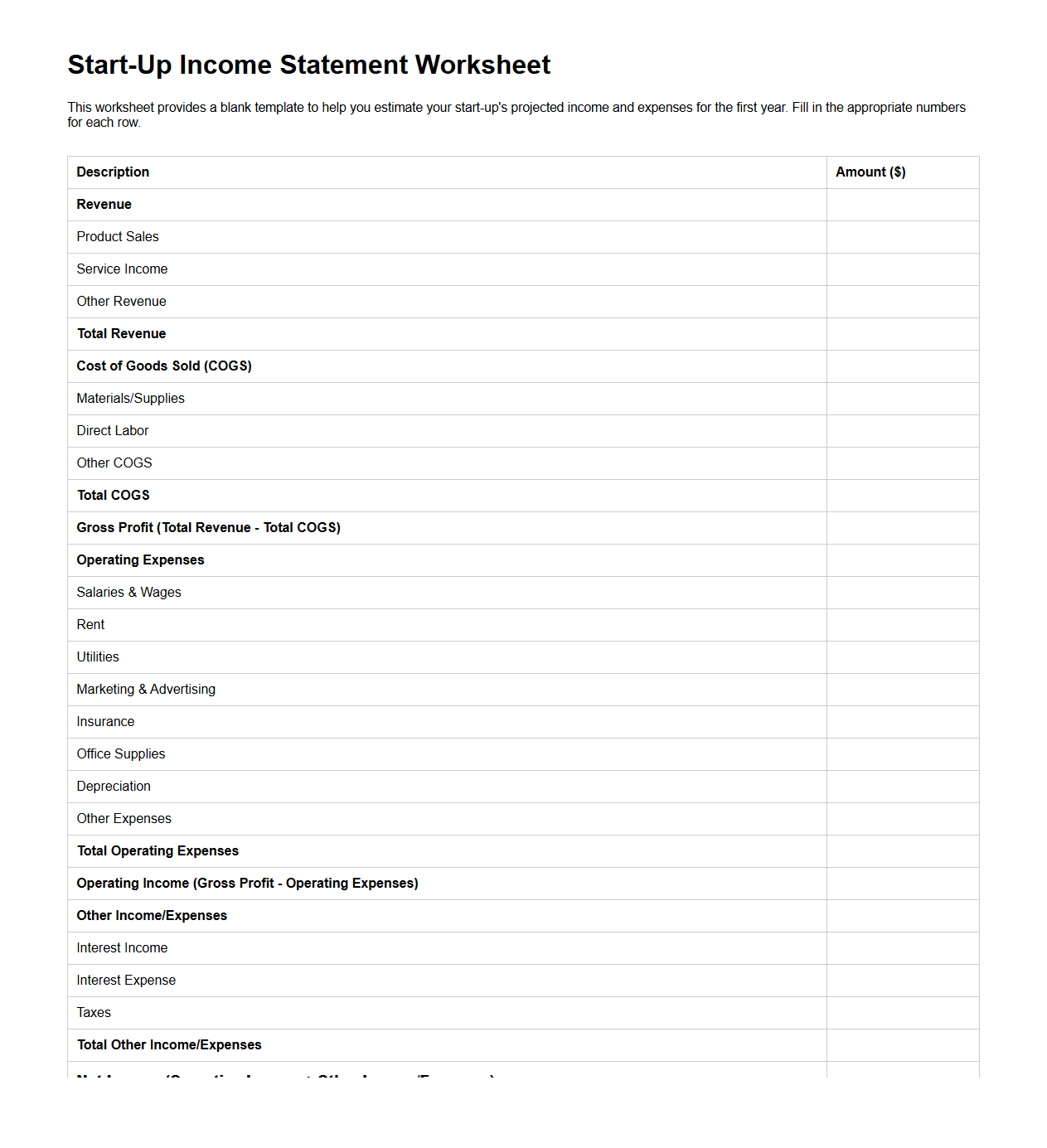

Start-Up Income Statement Worksheet

A

Start-Up Income Statement Worksheet is a financial document used by new businesses to project revenues, expenses, and net profit over a specific period. It helps entrepreneurs estimate profitability and make informed decisions by organizing key financial data such as sales, cost of goods sold, operating expenses, and taxes. This worksheet is essential for budgeting, securing funding, and tracking financial performance during the early stages of business development.

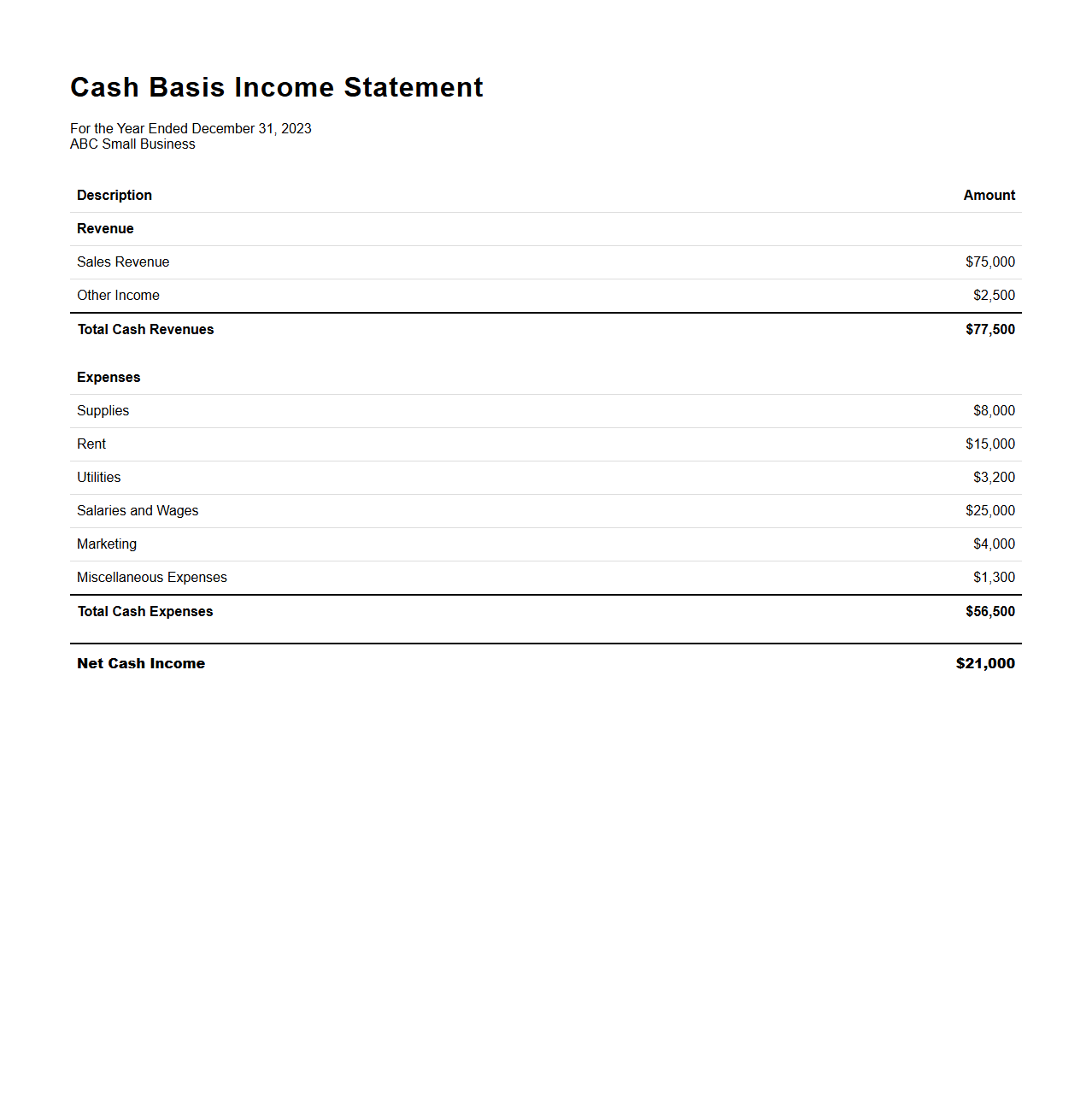

Cash Basis Income Statement Example for Small Business

A

Cash Basis Income Statement example for small businesses illustrates financial performance by recording revenues and expenses only when cash is received or paid. This document helps small business owners track actual cash flow, providing a clear view of liquidity without accounting complexities. It is particularly useful for simple accounting needs and tax reporting where cash transactions dominate.

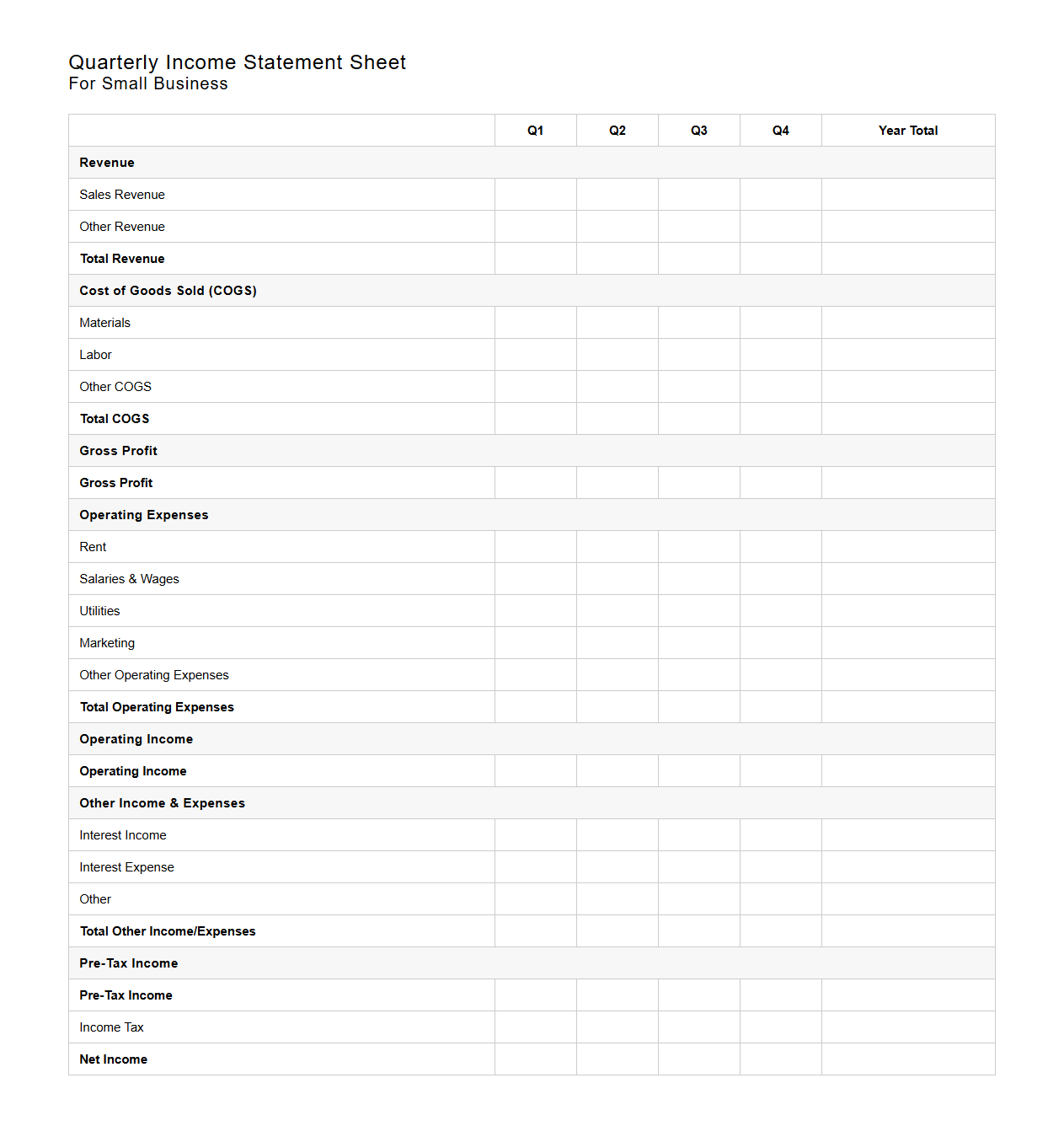

Quarterly Income Statement Sheet for Small Business

The

Quarterly Income Statement Sheet for small business is a financial document summarizing revenues, expenses, and profits over a three-month period. It enables business owners to track performance, assess profitability, and make informed decisions based on detailed income and cost data. This report is essential for managing cash flow, budgeting, and preparing for tax filings.

What sections should be included in a blank income statement template for a small business?

A blank income statement template should include key sections such as revenues, cost of goods sold (COGS), gross profit, operating expenses, and net income. Each section helps to clearly categorize income and expenses for accurate financial analysis. Including subtotals for gross profit and operating income is essential for effective financial tracking.

How can a blank income statement help small businesses track quarterly profitability?

A blank income statement allows small businesses to systematically record and compare revenue and expenses over each quarter. This periodic tracking highlights trends in profitability and areas that need improvement. It serves as an essential tool for making informed financial decisions and planning future budgets.

Which financial metrics are essential to customize on a small business income statement form?

Customizing key financial metrics such as gross profit margin, operating expenses ratio, and net profit margin is critical for small businesses. These metrics provide insights into operational efficiency and cost management effectiveness. Tailoring these figures to reflect specific business activities enhances the statement's usefulness.

How should non-operating income be presented on a blank small business income statement?

Non-operating income should be listed separately from operating revenues within a distinct section on the income statement. This distinction helps stakeholders understand the core profitability of the business apart from incidental gains. Proper classification ensures clarity and accuracy in financial reporting.

What are common mistakes small businesses make when filling out a blank income statement?

Common mistakes include misclassifying expenses, omitting non-operating income, and failing to update the income statement regularly. Small businesses often overlook the importance of accuracy in each financial entry, leading to misleading profitability results. Ensuring detailed and consistent record-keeping is vital to avoid these errors.