The Blank Statement Template for Account Activity provides a structured format to record and track financial transactions clearly. It helps users organize debits, credits, and balances systematically, ensuring accurate account management. This template is essential for maintaining transparent and detailed financial records.

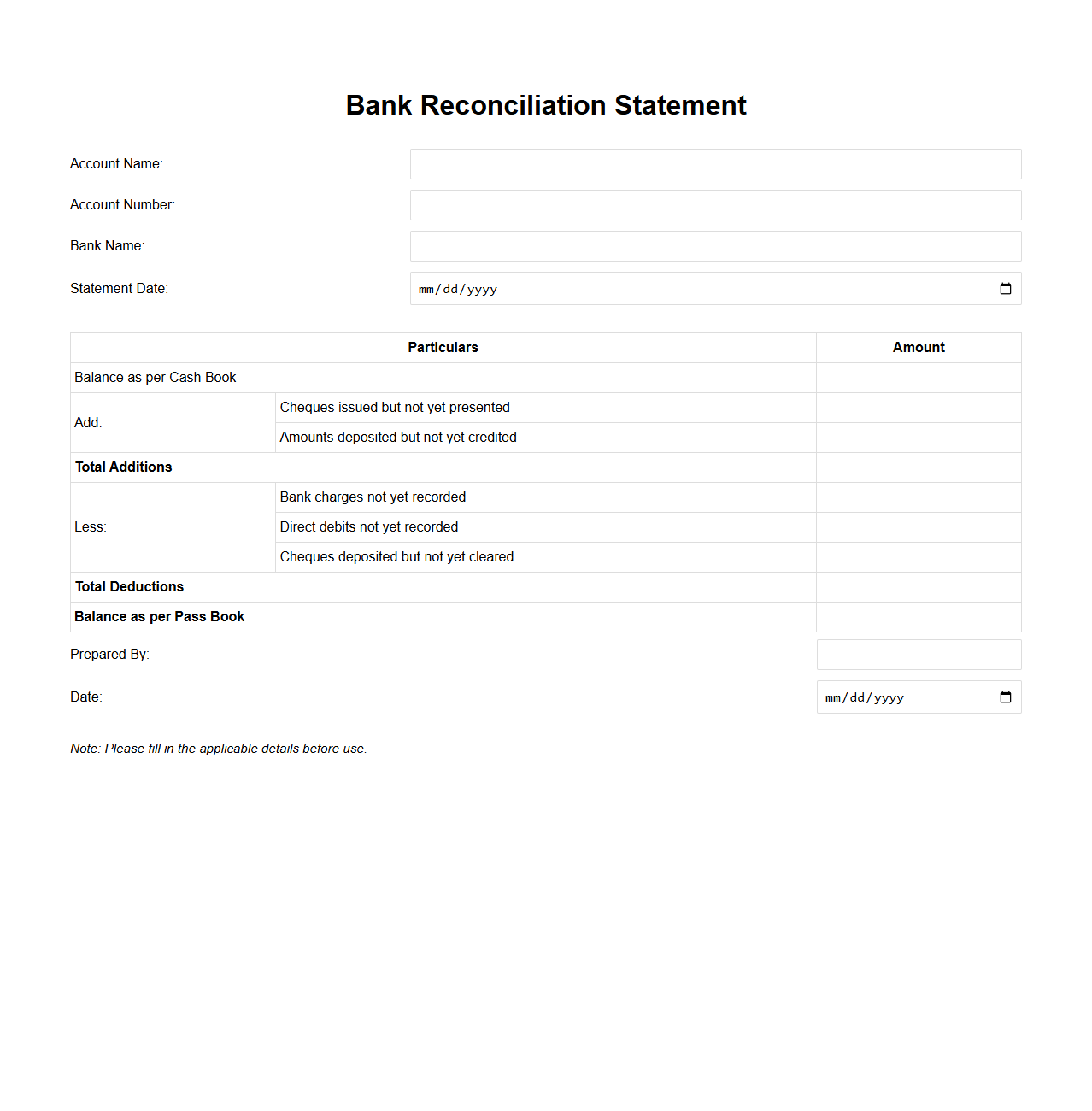

Blank Bank Reconciliation Statement Template

A

Blank Bank Reconciliation Statement Template is a structured document used to compare and match the balances between an organization's bank statement and its internal financial records. It helps identify discrepancies due to outstanding checks, deposits in transit, or errors, ensuring accurate cash flow management. This template streamlines the reconciliation process by providing a clear framework for recording and verifying transactions.

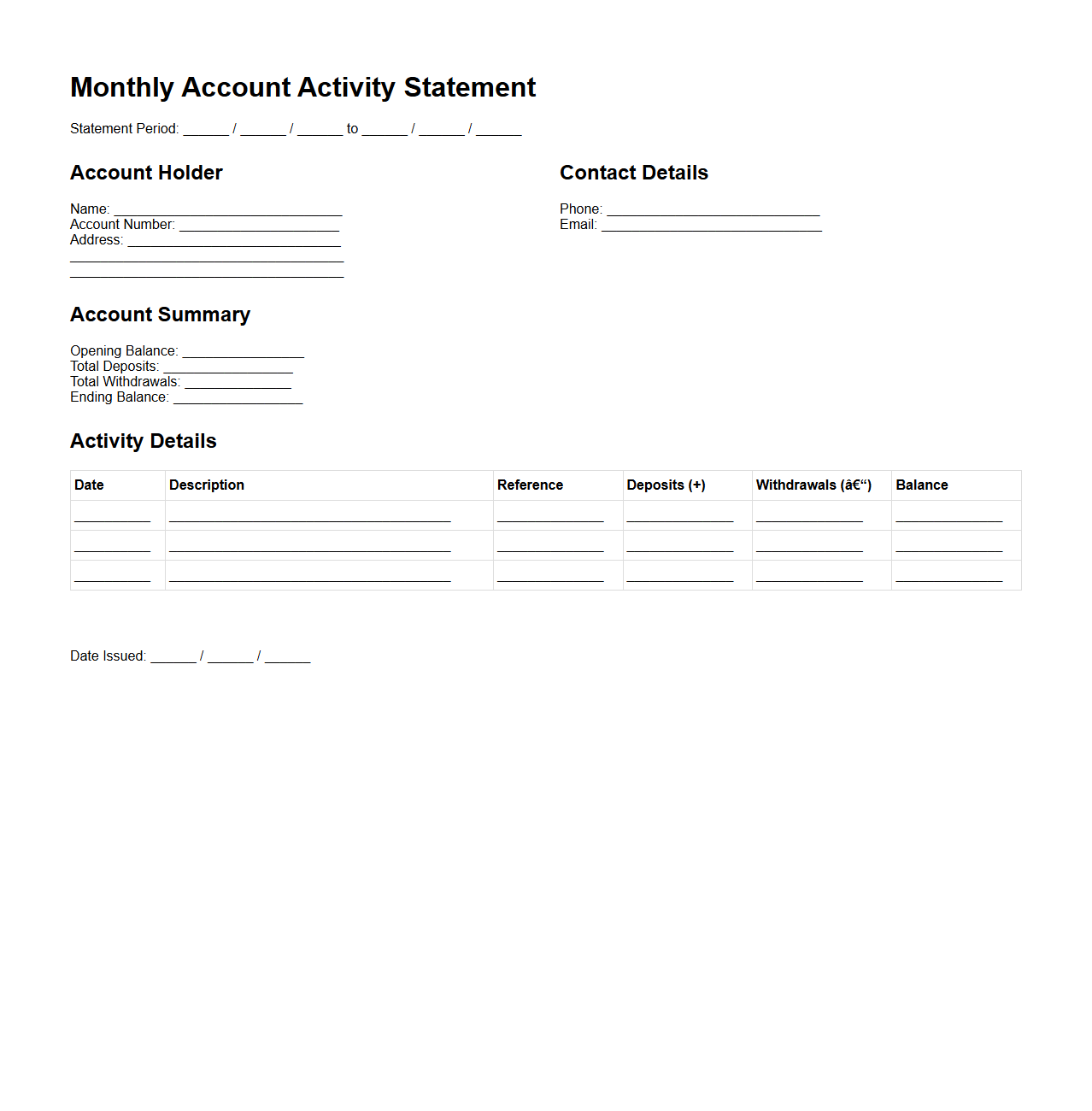

Blank Monthly Account Activity Statement

The

Blank Monthly Account Activity Statement is a financial document that provides an overview of transactions and balances in a bank or investment account for a specific month, without any pre-filled data. It serves as a customizable template enabling users to track deposits, withdrawals, fees, and interest details. This statement is essential for accurate record-keeping, financial analysis, and ensuring account activities are transparent and up-to-date.

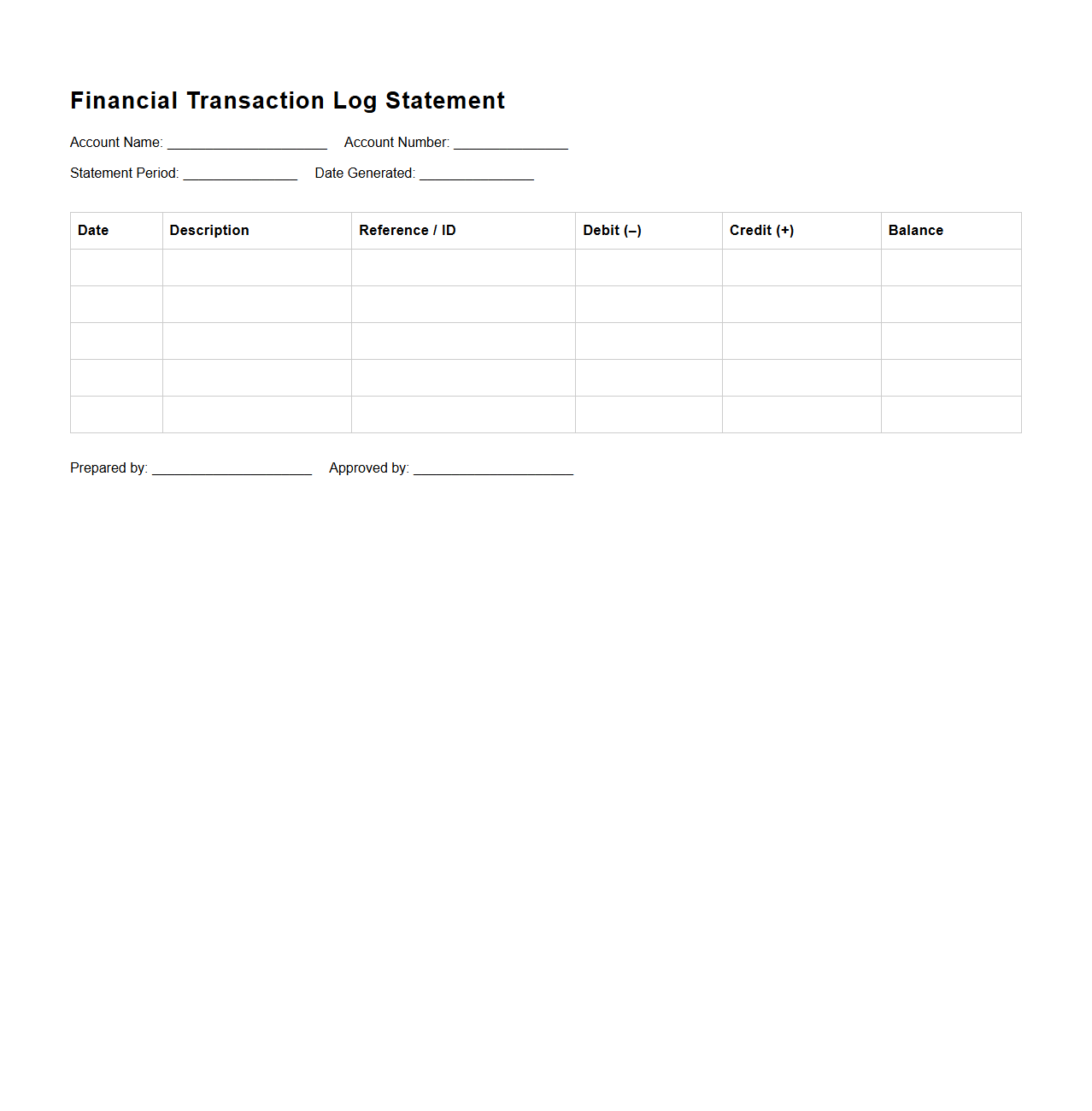

Blank Financial Transaction Log Statement

A

Blank Financial Transaction Log Statement document serves as a standardized template for recording all financial transactions in a systematic manner. It includes fields for date, description, amount, transaction type, and balance, allowing accurate tracking and auditing of financial activities. This document is essential for maintaining organized financial records and ensuring compliance with accounting standards.

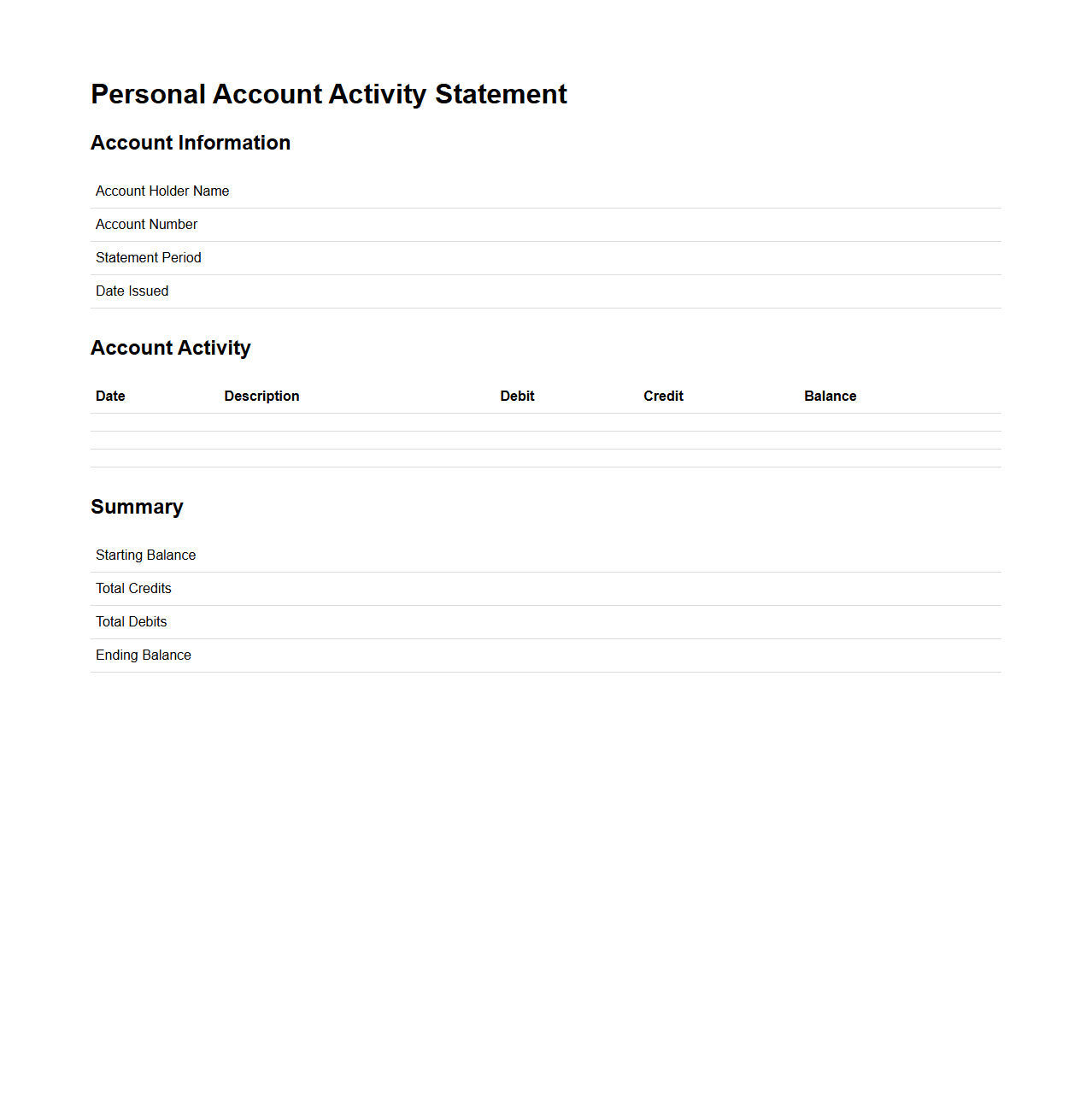

Blank Personal Account Activity Statement

A

Blank Personal Account Activity Statement is a financial document template used to record and track individual account transactions, such as deposits, withdrawals, and transfers. It provides a clear, itemized overview of account activity without prefilled data, allowing for customized input and accurate financial monitoring. This statement is essential for maintaining organized personal financial records and facilitating effective budgeting or auditing.

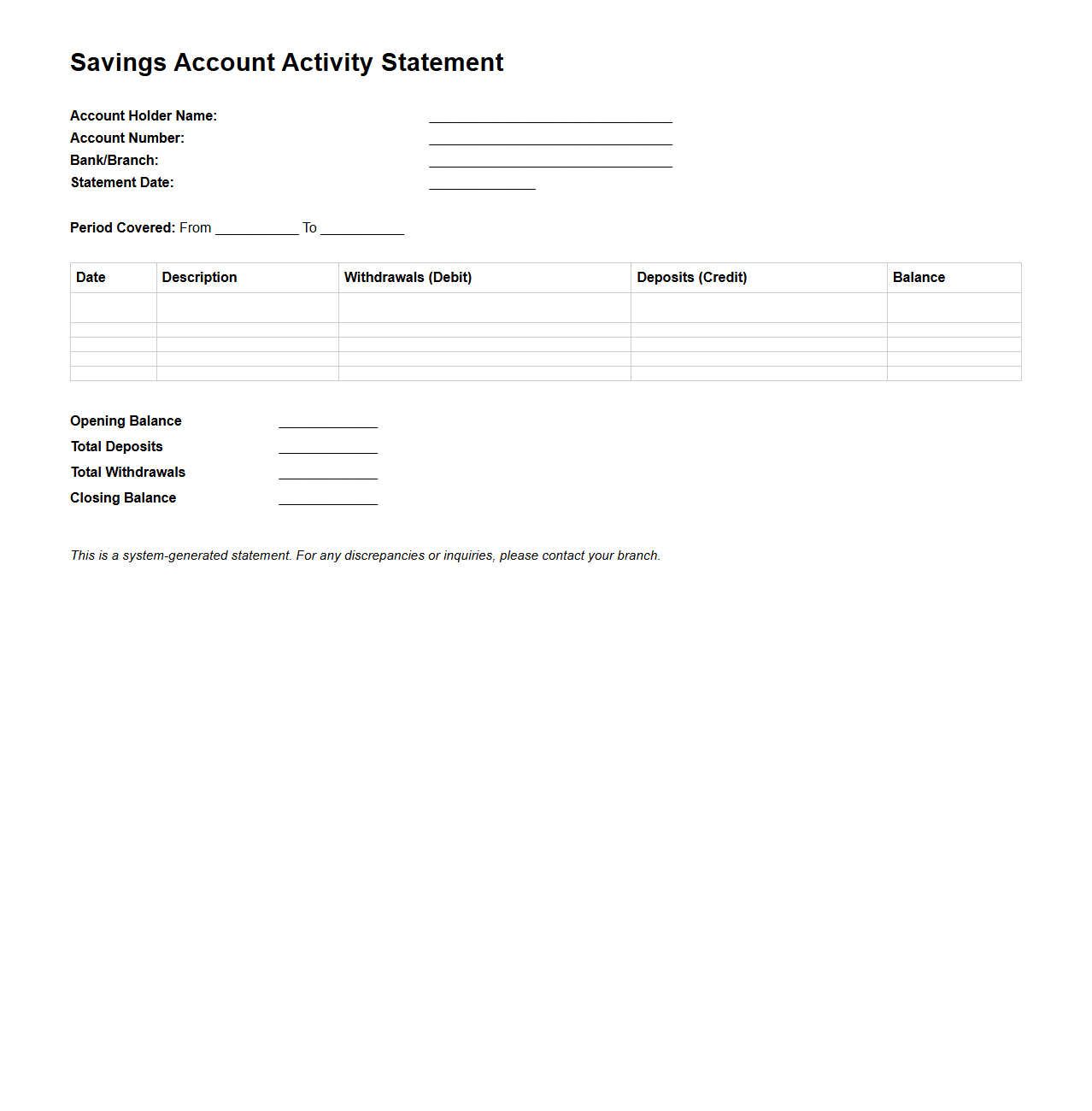

Blank Savings Account Activity Statement Template

A

Blank Savings Account Activity Statement Template is a pre-designed document used to record and track all transactions within a savings account, including deposits, withdrawals, interest earnings, and fees. This template helps account holders and financial institutions maintain organized financial records, ensuring accurate monitoring of account activity. It typically includes fields for dates, transaction descriptions, amounts, and balance updates to provide a clear summary of account movements.

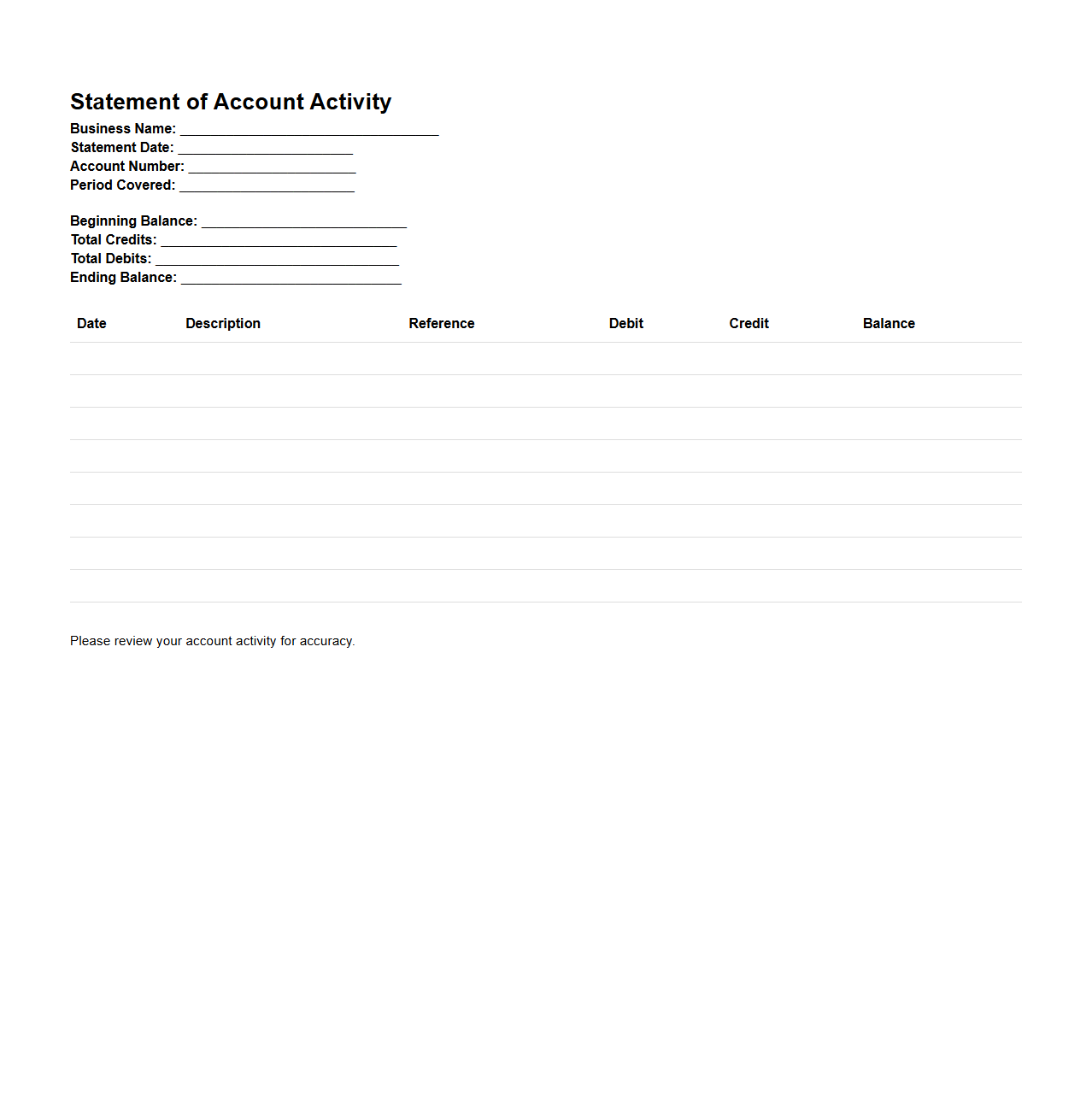

Blank Statement of Account Activity for Businesses

A

Blank Statement of Account Activity for businesses is a financial document template that outlines the chronological record of transactions without any pre-filled data, allowing companies to customize entries according to their specific account activities. It provides a clear framework for tracking debits, credits, balances, and other financial movements, ensuring accurate and organized financial reporting. This document serves as a valuable tool for auditing, budgeting, and maintaining transparent accounting records.

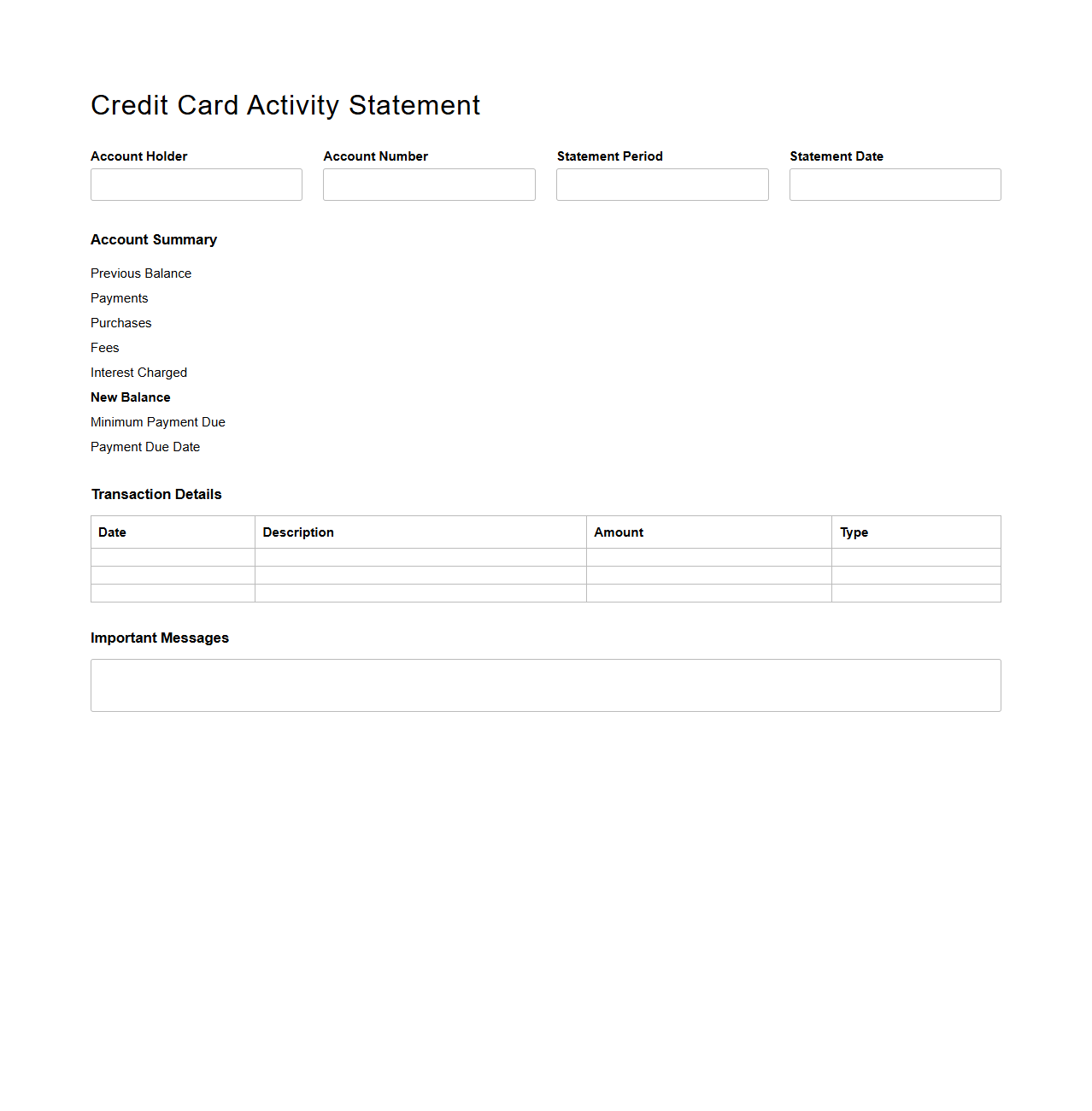

Blank Credit Card Activity Statement Template

A

Blank Credit Card Activity Statement Template is a customizable document designed to track and record all transactions made using a credit card over a specific period. It includes sections for date, description, transaction amount, and balance, allowing users to monitor expenses, identify fraudulent activities, and manage budgets effectively. This template serves as an essential tool for personal finance management and business accounting.

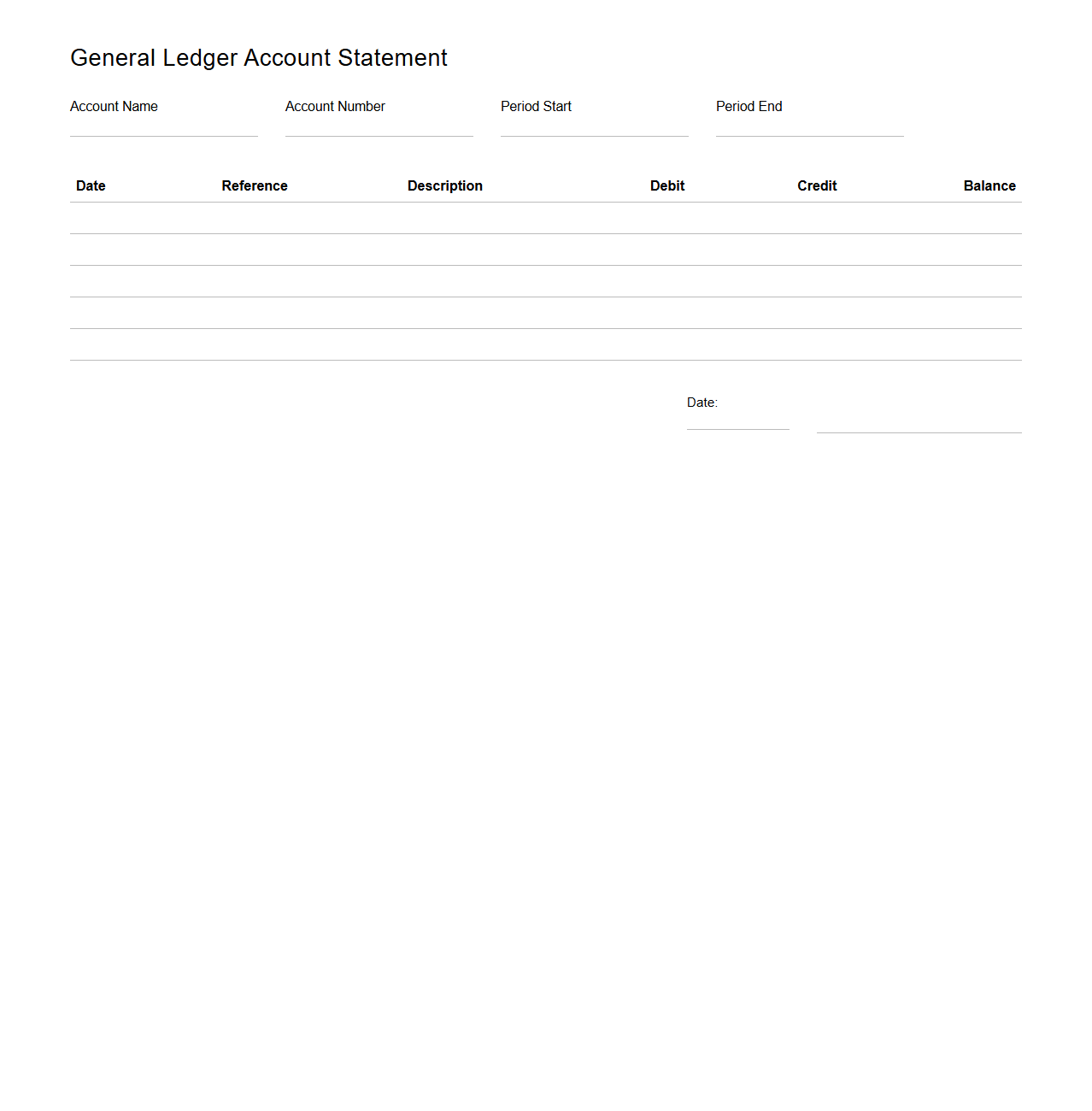

Blank General Ledger Account Statement

The

Blank General Ledger Account Statement document is a financial report template used to record and track all transactions within a specific ledger account without pre-filled data. It serves as a tool for accountants to manually input debit and credit entries, ensuring accurate financial record-keeping and facilitating detailed account analysis. This document is essential for maintaining transparency and supporting audit processes in accounting systems.

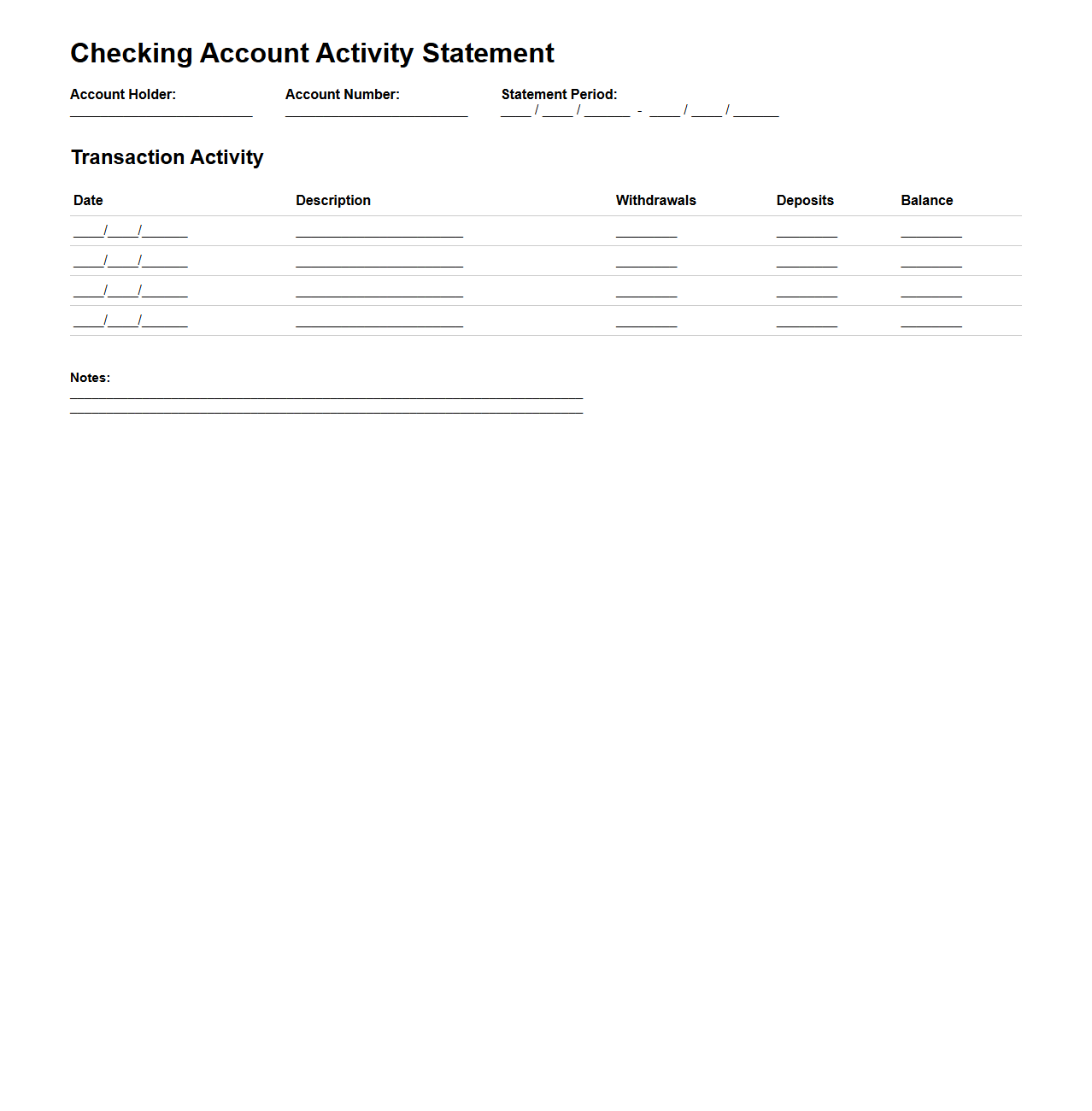

Blank Checking Account Activity Statement

A

Blank Checking Account Activity Statement is a financial document that lists all transactions in a checking account over a specified period without any pre-filled details. It typically includes spaces for transaction dates, descriptions, withdrawals, deposits, and balances, allowing account holders to manually record their account activities. This document helps in monitoring cash flow, tracking expenses, and maintaining accurate records for personal or business financial management.

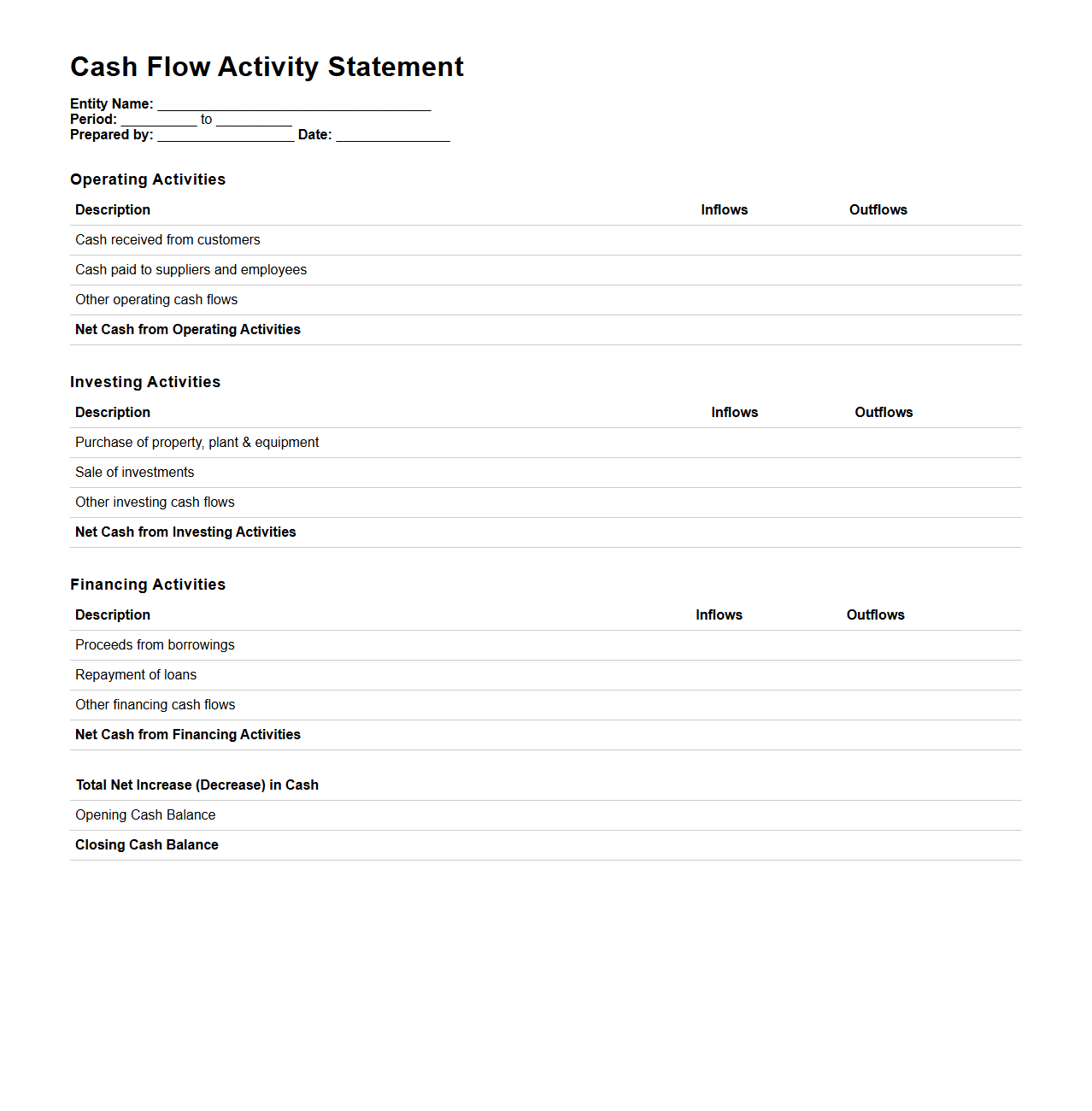

Blank Cash Flow Activity Statement Template

The

Blank Cash Flow Activity Statement Template is a structured document designed to help businesses systematically record and analyze cash inflows and outflows over a specific period. It facilitates accurate tracking of operating, investing, and financing activities, ensuring a clear understanding of liquidity positions and financial health. This template supports decision-making by providing a transparent overview of cash movements essential for budgeting and forecasting.

What key elements are required in a blank statement for account activity?

A blank statement for account activity must include essential fields such as date, transaction description, amount, and balance. It should provide clear headers and designated spaces for all transaction details to ensure comprehensive documentation. Additionally, the format should be standardized to accommodate diverse account types accurately.

How can a blank account activity statement comply with financial audit standards?

To comply with financial audit standards, a blank account activity statement should maintain integrity through unalterable formats and clear slates for data entry. It must incorporate audit trails that allow for verification of all entered transactions, ensuring transparency and accountability. Moreover, the document should adhere to regulatory requirements regarding data accuracy and completeness.

What security measures should be applied to distribute blank account activity statements?

Distributing blank account activity statements requires robust security measures such as encryption to protect sensitive information during transmission. Access control protocols should be implemented to restrict unauthorized usage and ensure that only certified individuals can handle the documents. Additionally, secure digital platforms or physically sealed envelopes should be used to prevent tampering or data breaches.

Which industries most frequently request blank account activity statements for documentation purposes?

The financial services industry, including banking and investment firms, frequently requests blank account activity statements for internal audits and client records. Insurance companies also utilize these statements to verify payment histories and claims processing. Moreover, legal and compliance sectors often rely on such documentation for regulatory and investigative procedures.

How should discrepancies be documented when filling out a blank statement for account activity?

Discrepancies in a blank statement for account activity should be clearly highlighted and annotated with explanations beside the affected entries. It is vital to maintain an audit trail that records any corrections or adjustments along with dates and authorized personnel signatures. Proper documentation helps uphold accuracy and ensures that all inconsistencies are traceable and resolvable during audits.