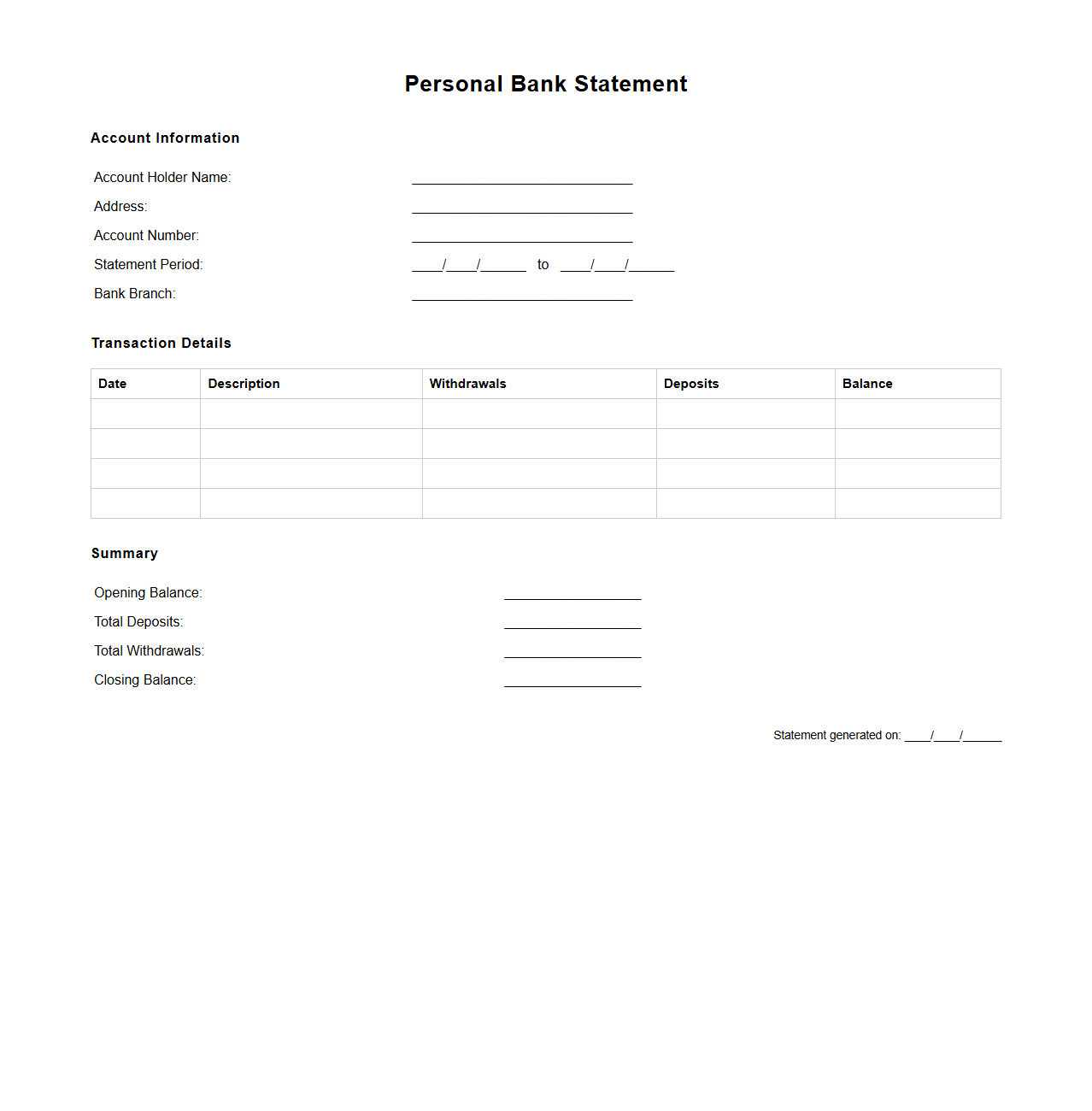

Blank Personal Bank Statement Template

A

Blank Personal Bank Statement Template document is a customizable form used to record individual financial transactions, account balances, and monthly summaries without revealing actual bank data. This template helps users organize income, expenses, and banking activities clearly for budgeting, loan applications, or financial reporting purposes. Its format typically includes sections for date, description, debit, credit, and balance to simulate a real bank statement.

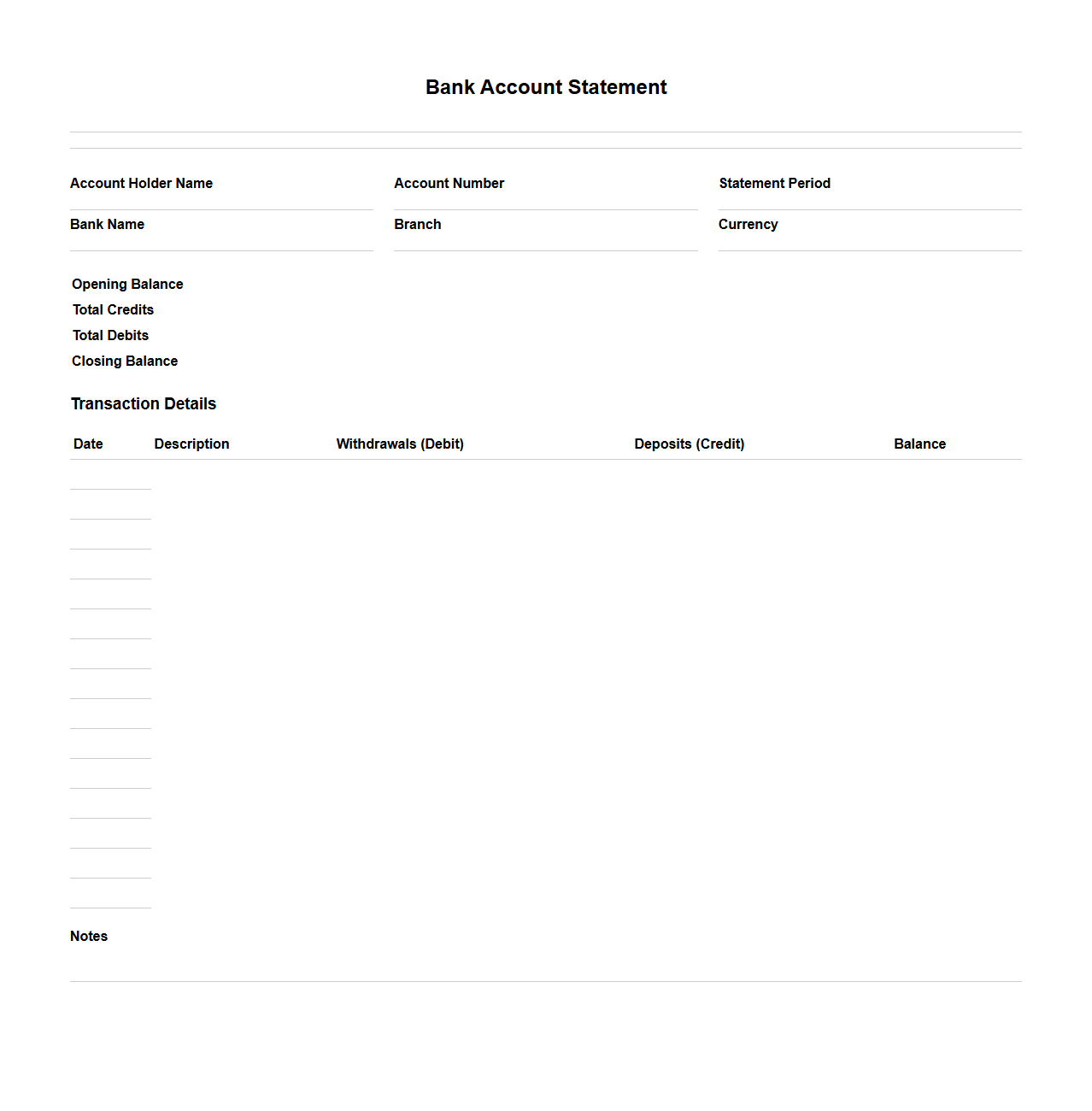

Blank Monthly Bank Account Statement Template

A

Blank Monthly Bank Account Statement Template is a pre-formatted document designed to record and summarize monthly financial transactions for a bank account. It typically includes sections for transaction dates, descriptions, debit and credit amounts, and the running balance, helping users track account activity accurately. This template is useful for personal finance management, accounting, and audit preparation.

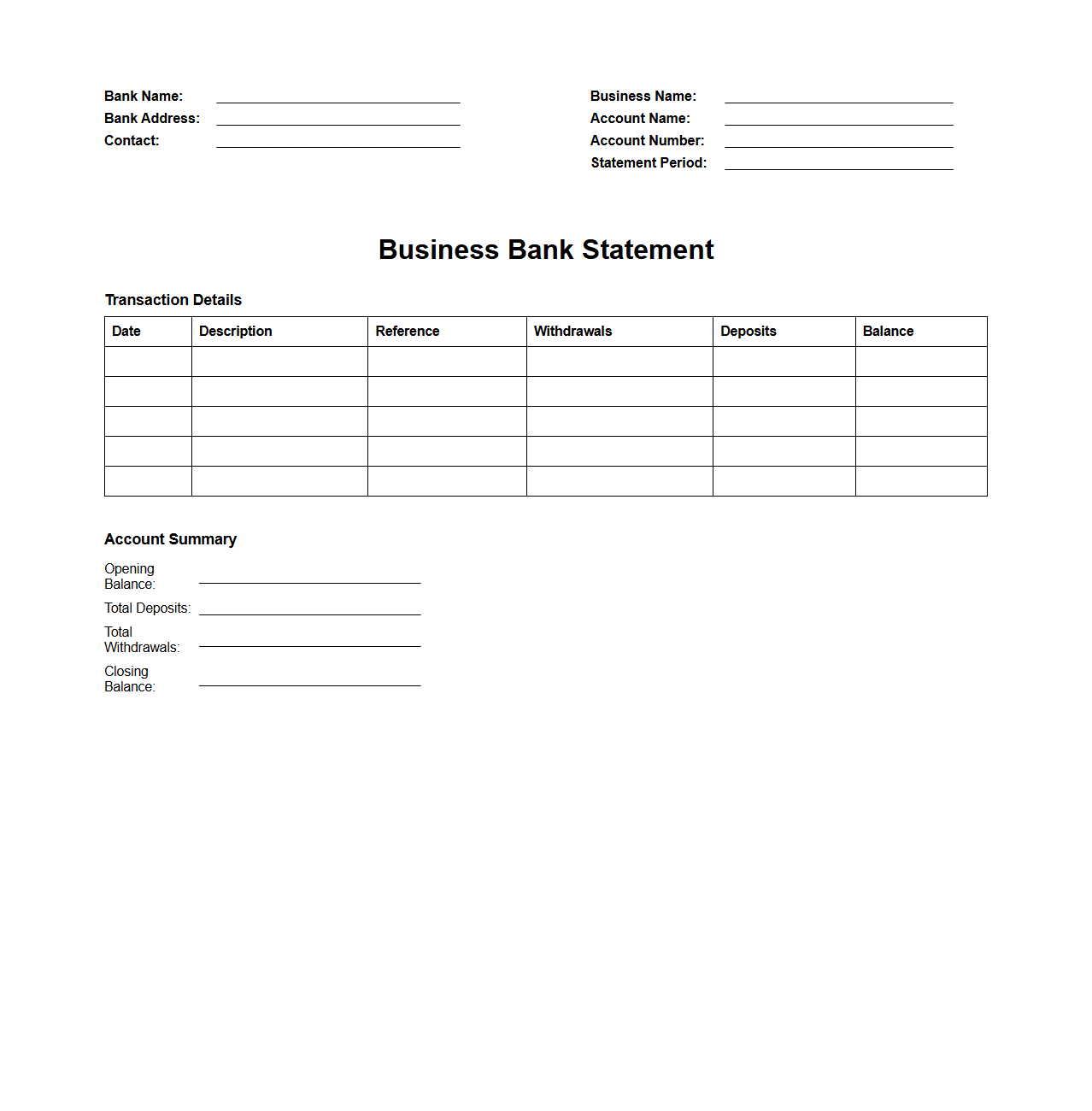

Blank Business Bank Statement Template

A

Blank Business Bank Statement Template is a customizable document used by businesses to record and organize financial transactions, including deposits, withdrawals, and balances. It serves as a crucial tool for tracking cash flow, managing accounts, and preparing for audits or tax filings. This template enhances accuracy and efficiency in financial reporting by providing a standardized format for daily business banking activities.

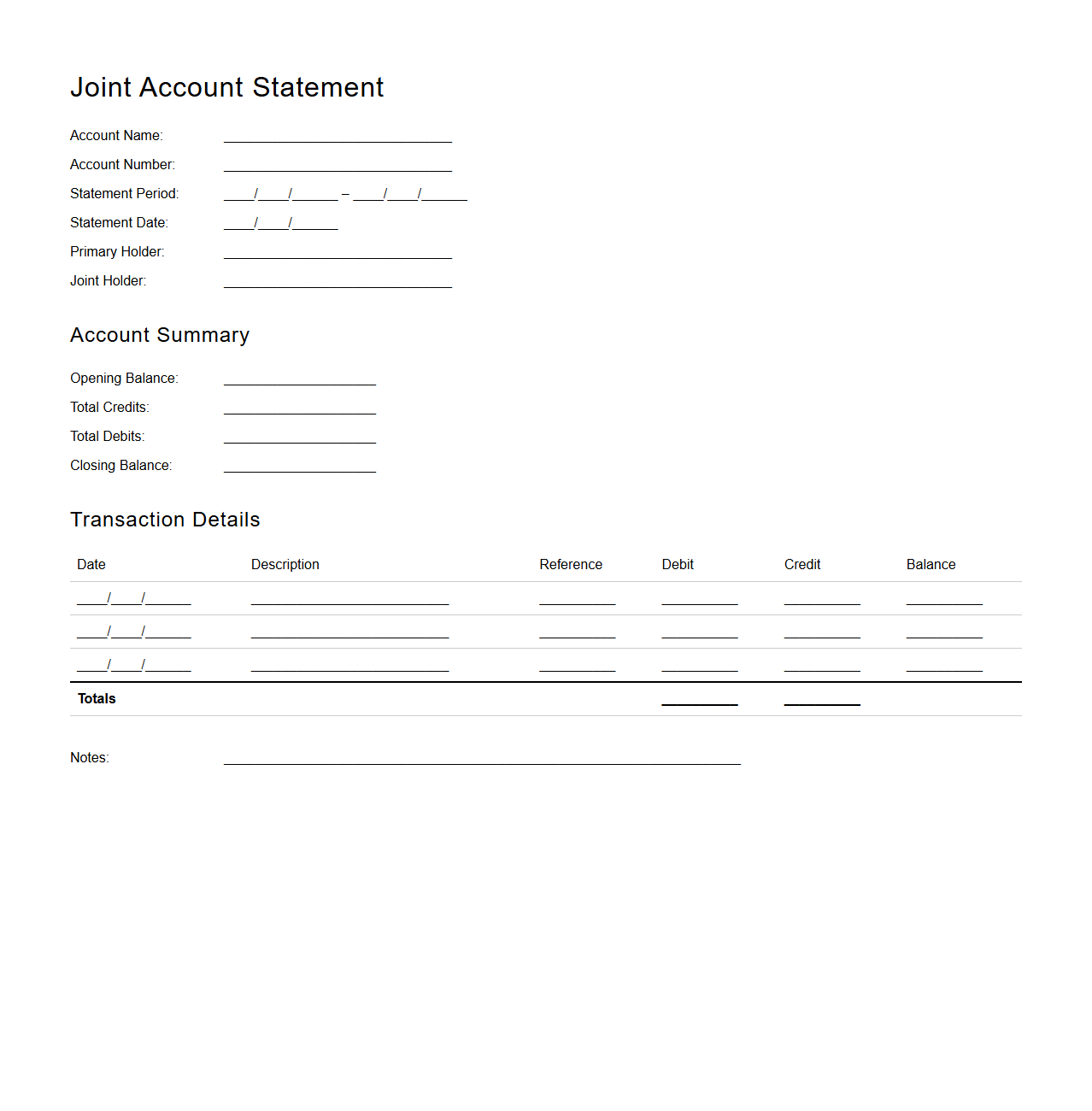

Blank Joint Account Statement Template

A

Blank Joint Account Statement Template document provides a structured format for recording and reviewing transactions, balances, and account details shared by two or more parties. This template facilitates clear financial tracking and transparency between joint account holders, ensuring accurate monitoring of deposits, withdrawals, and fees. It is commonly used for budgeting, financial planning, or auditing purposes in partnerships, family accounts, or business collaborations.

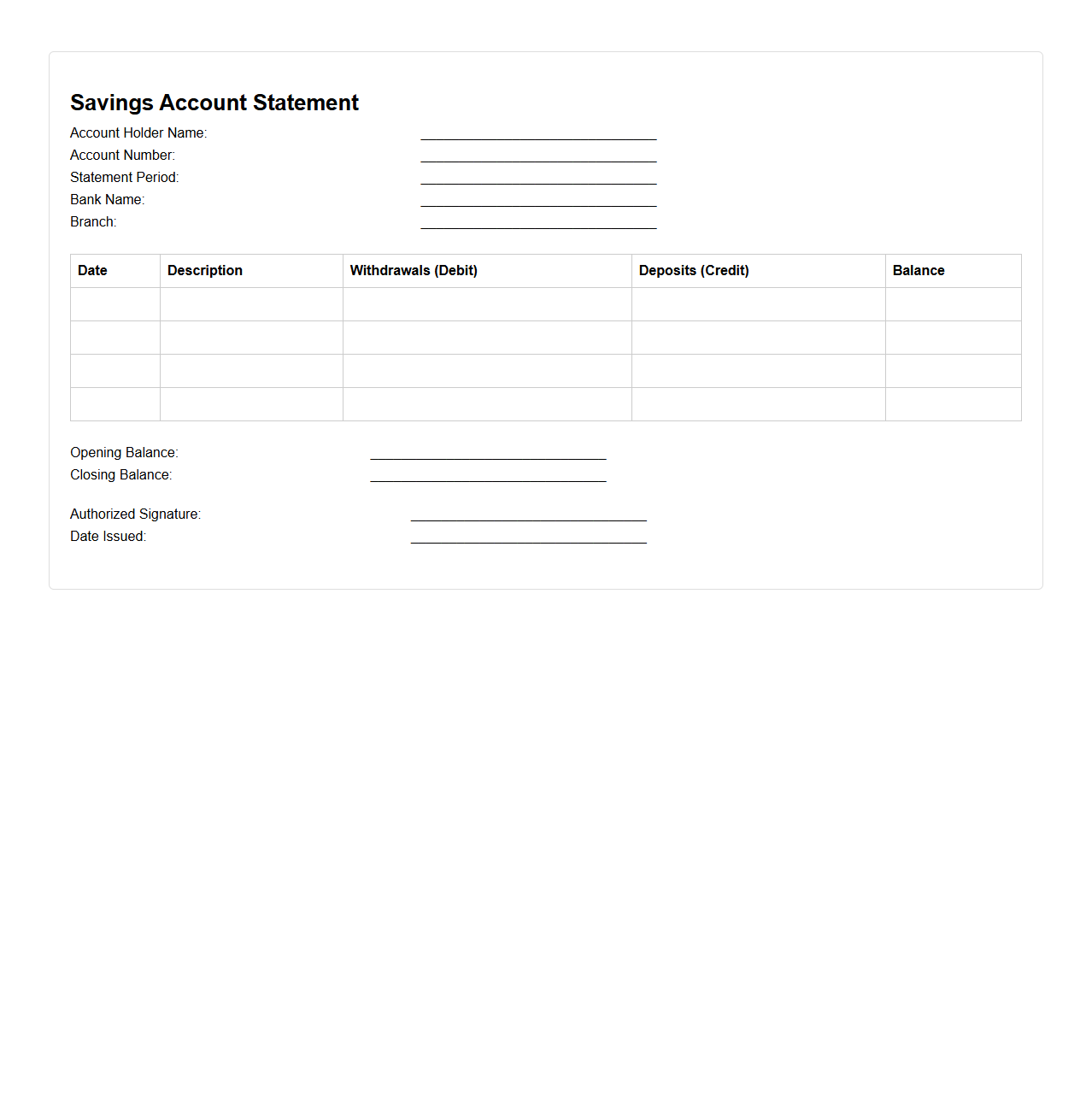

Blank Savings Account Statement Template

A

Blank Savings Account Statement Template is a pre-formatted document designed to record and summarize all transactions within a savings account over a specific period. It typically includes fields for dates, transaction descriptions, deposit and withdrawal amounts, account balances, and interest earned. This template helps account holders and financial institutions efficiently track account activity and maintain accurate financial records.

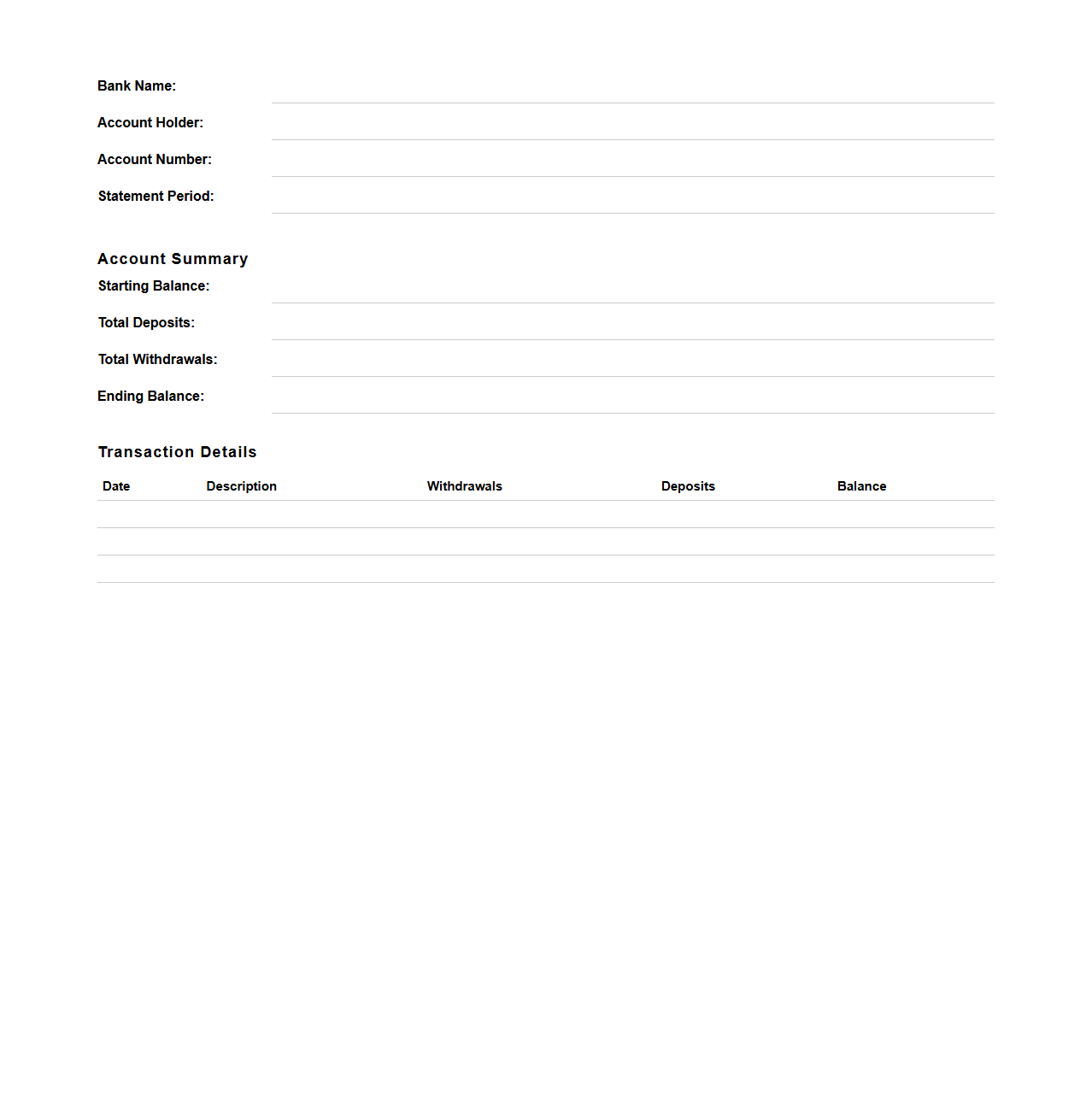

Blank Checking Account Statement Template

A

Blank Checking Account Statement Template is a pre-formatted document designed to record financial transactions for checking accounts, allowing users to input dates, descriptions, deposits, withdrawals, and balances. This template simplifies tracking monthly activity and helps reconcile accounts for accuracy and budgeting purposes. Businesses and individuals use it to maintain clear and organized financial records without relying on bank-issued statements.

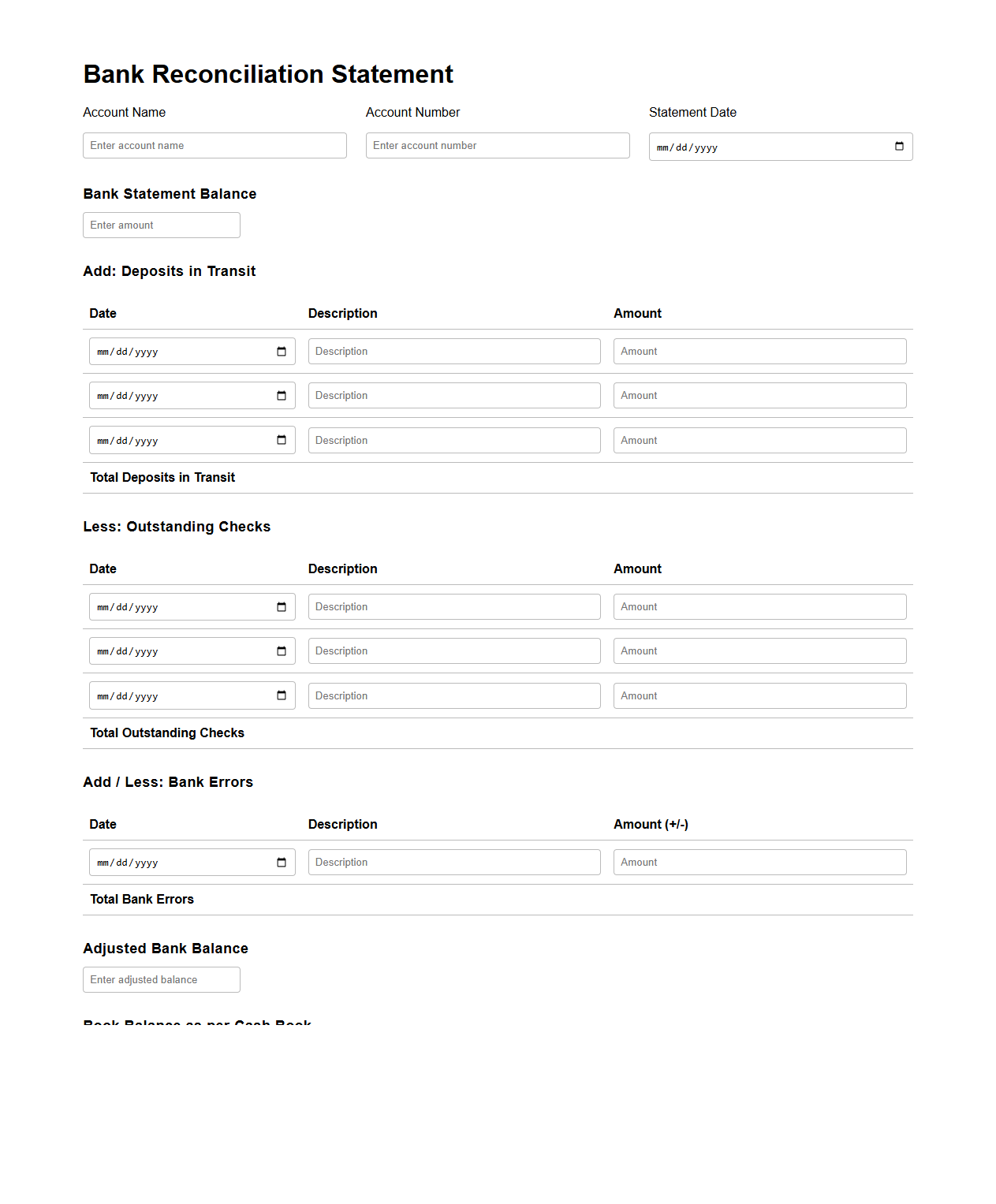

Blank Bank Reconciliation Statement Template

A

Blank Bank Reconciliation Statement Template is a standardized financial document used to compare a company's cash records with its bank statement to identify discrepancies. It helps in detecting errors, omissions, or unauthorized transactions by listing outstanding checks, deposits in transit, and bank charges. This template streamlines the reconciliation process, ensuring accurate financial reporting and effective cash flow management.

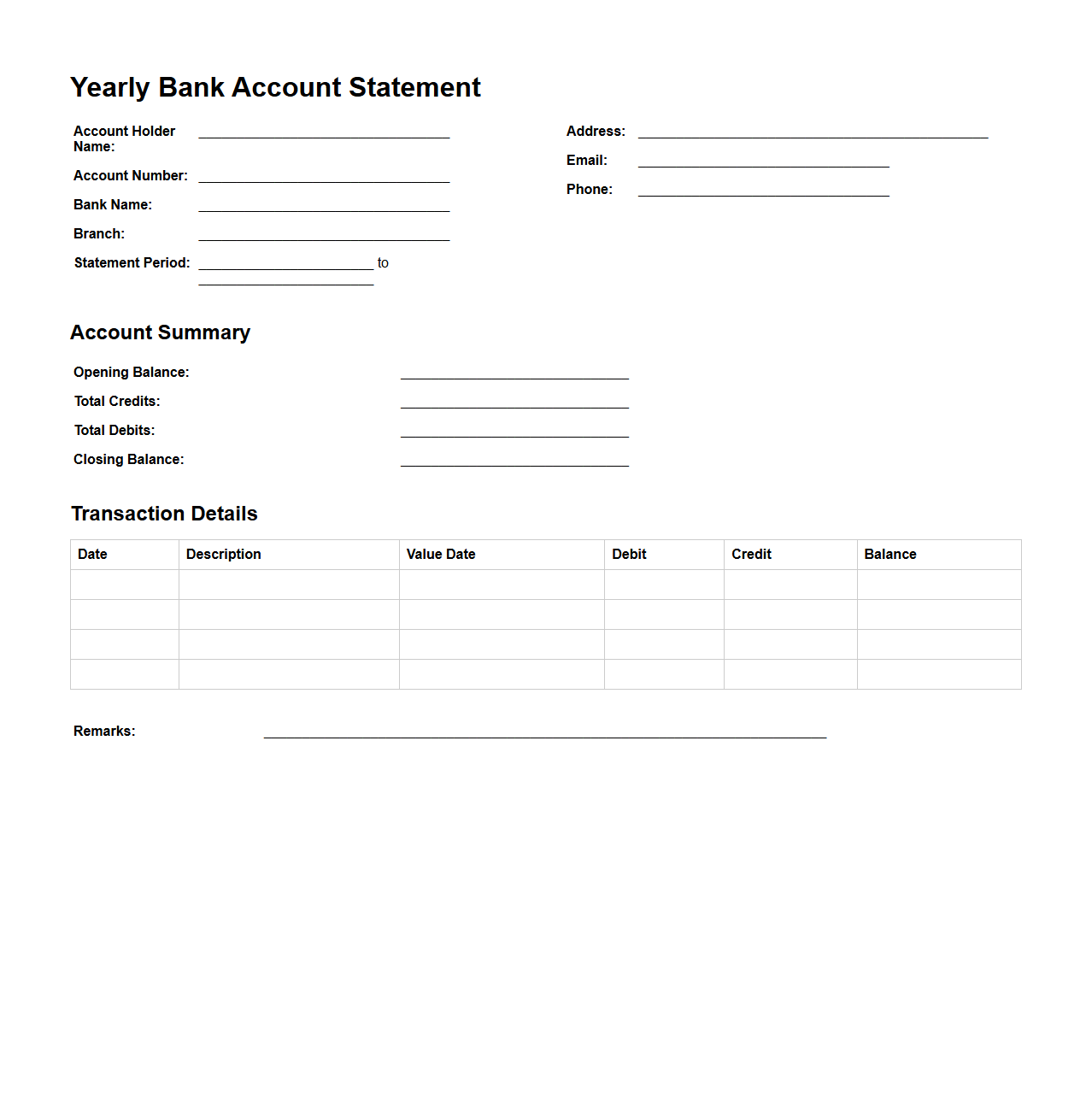

Blank Yearly Bank Account Statement Template

A

Blank Yearly Bank Account Statement Template document is a customizable form used to record and track all banking transactions over a full year. It provides a structured layout for monthly deposits, withdrawals, balances, and other account activities, allowing individuals or businesses to monitor financial health and ensure accuracy in record-keeping. This template is essential for budgeting, tax preparation, and financial analysis.

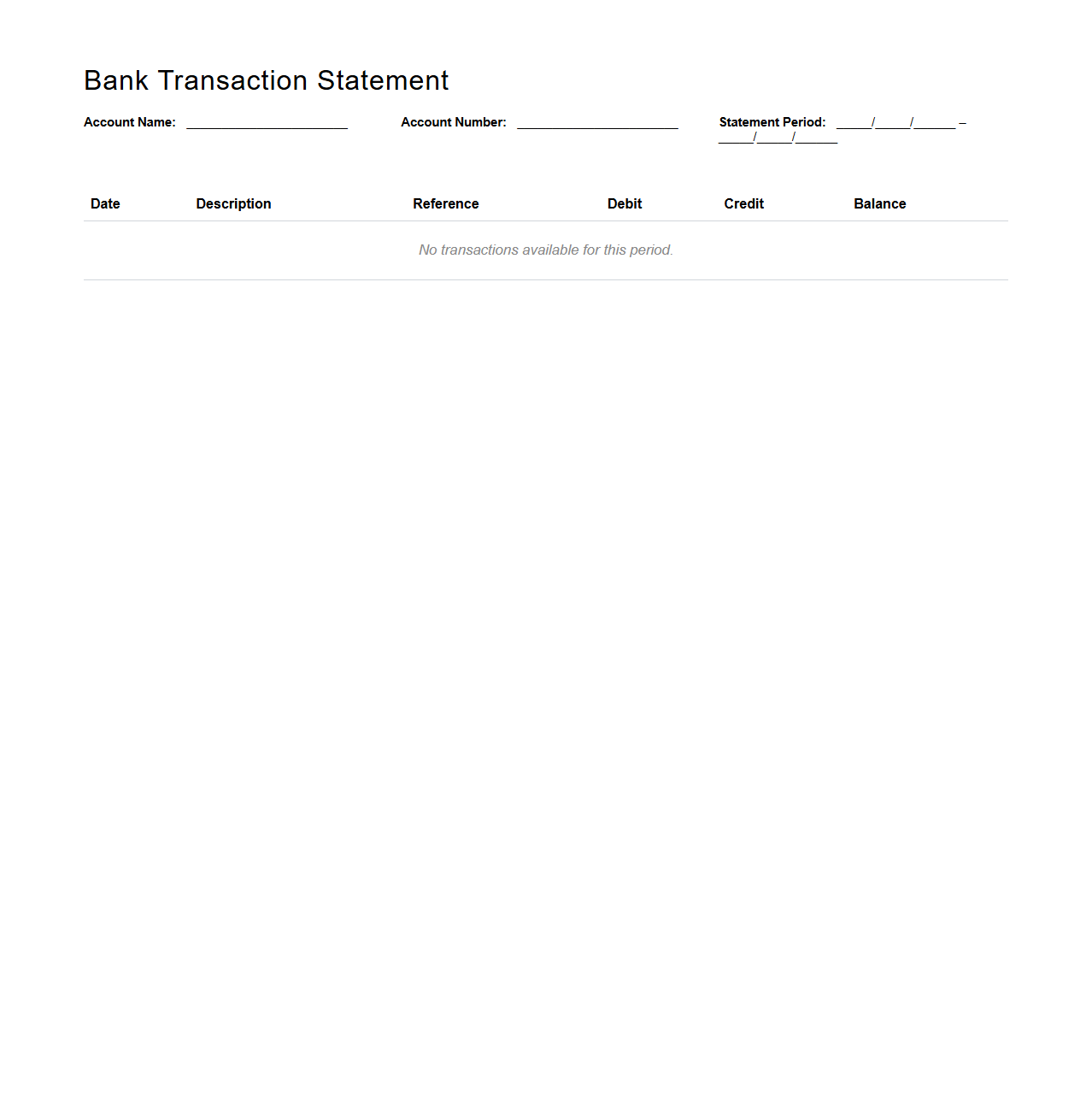

Blank Bank Transaction Statement Template

A

Blank Bank Transaction Statement Template document serves as a standardized form used to record and organize individual financial transactions within a specific period. It allows businesses and individuals to track deposits, withdrawals, transfers, and balances clearly, supporting effective financial management and reconciliation. By providing customizable columns for dates, descriptions, amounts, and balances, this template ensures accurate and transparent documentation of bank account activities.

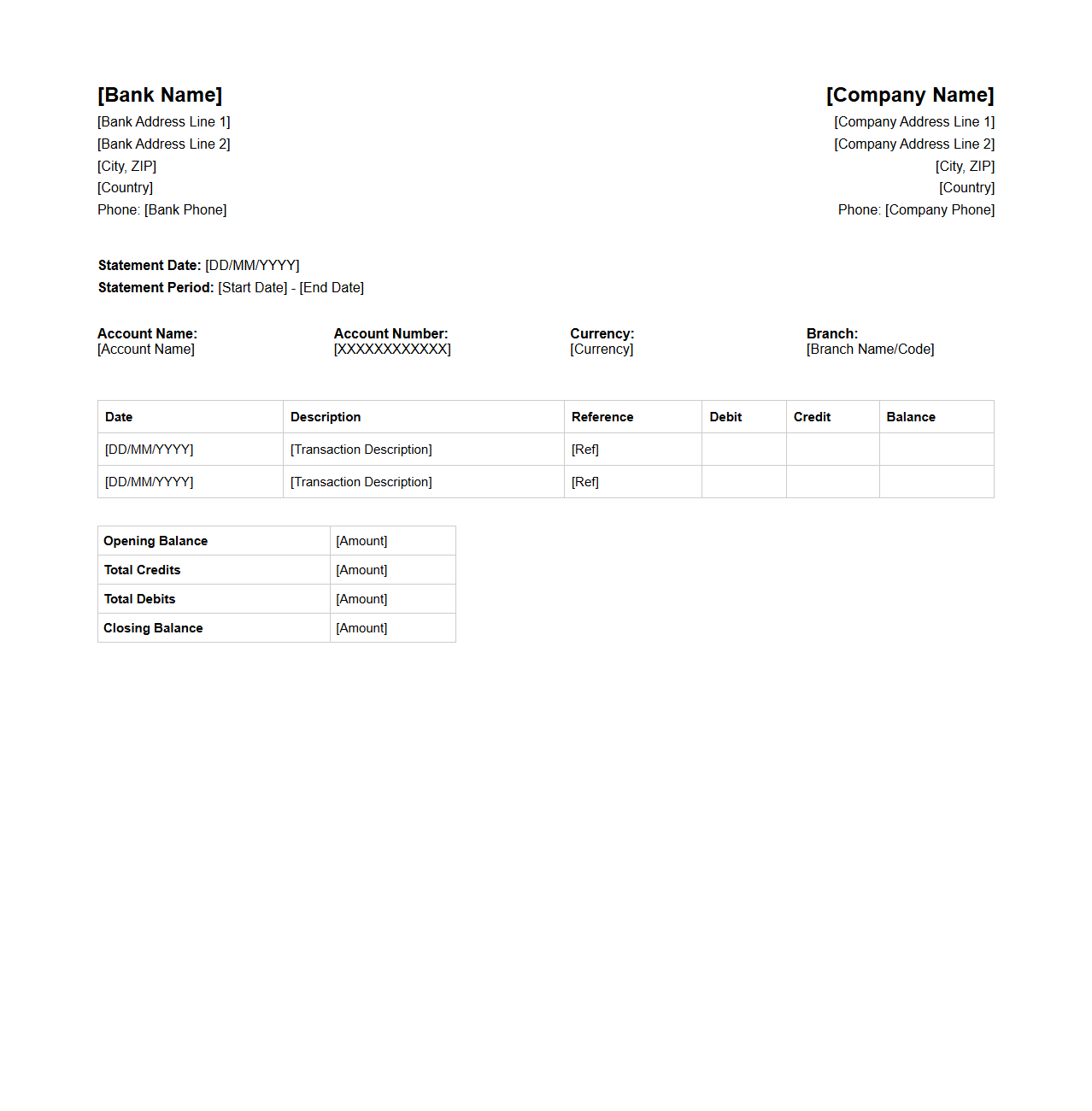

Blank Corporate Bank Statement Template

A

Blank Corporate Bank Statement Template is a pre-designed document used to record and organize a company's financial transactions over a specific period. It typically includes fields for date, description, debit, credit, and balance, making it easy for businesses to maintain clear and accurate financial records. This template helps streamline accounting processes and supports financial reporting and auditing activities.

What details are typically required in a blank statement letter for bank accounts?

A blank statement letter for bank accounts must include the account holder's full name, account number, and branch details. It should clearly state the request for a blank or transaction-less statement to be issued. Additionally, the letter must specify the period for which the statement is requested and carry the account holder's signature.

How should you format a blank statement request for multiple bank accounts?

When requesting blank statements for multiple bank accounts, list each account number and their respective account names clearly, typically in a tabular or bullet format. The letter should be concise, with a collective statement outlining the request for all accounts mentioned. Ensure each account holder's details and signatures are present if different from one another.

Are there specific bank policies for submitting blank statement letters?

Banks often have specific policies regarding the submission of blank statement letters, including mandatory identification verification and written authorization. Some banks may require the letter to be notarized or submitted in person to ensure authenticity. Always check the bank's official guidelines to comply with their procedural requirements.

What is the legal implication of signing a blank bank statement letter?

Signing a blank bank statement letter can have significant legal risks as it may authorize unintended transactions or disclosures. It is crucial to specify all terms within the letter and avoid leaving blank spaces that could be manipulated. Unauthorized use could lead to disputes or liabilities under banking and financial law.

Which supporting documents should accompany a blank statement letter request?

Supporting documents typically include a valid photo ID of the account holder, proof of address, and any relevant authorization forms. For corporate accounts, additional documents such as board resolutions or company registration certificates might be required. Providing these documents ensures smooth processing and verification by the bank.