A Blank Statement Template for Donations provides a customizable format to document charitable contributions clearly and professionally. It helps donors receive proper acknowledgment for their gifts, ensuring transparency and compliance with tax regulations. This template is essential for organizations to maintain accurate records and foster trust with their supporters.

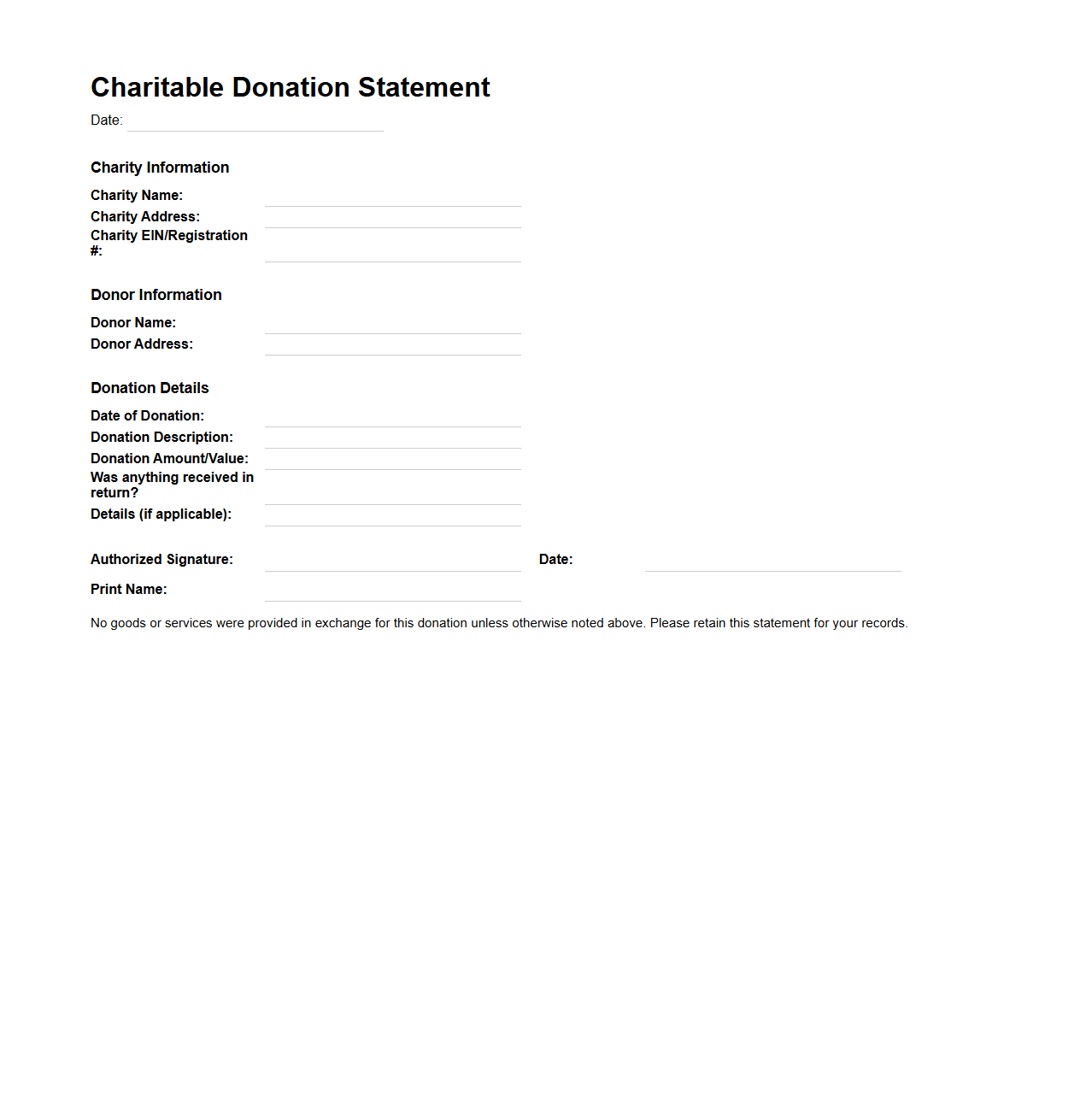

Charitable Donation Statement Template

A

Charitable Donation Statement Template document serves as a standardized form that organizations use to acknowledge and record donations made by contributors. This template ensures compliance with tax regulations by providing essential details such as donor information, donation amount, date of contribution, and the organization's tax-exempt status. Utilizing this document simplifies record-keeping for both donors and nonprofits, facilitating accurate tax reporting and fostering transparent fundraising practices.

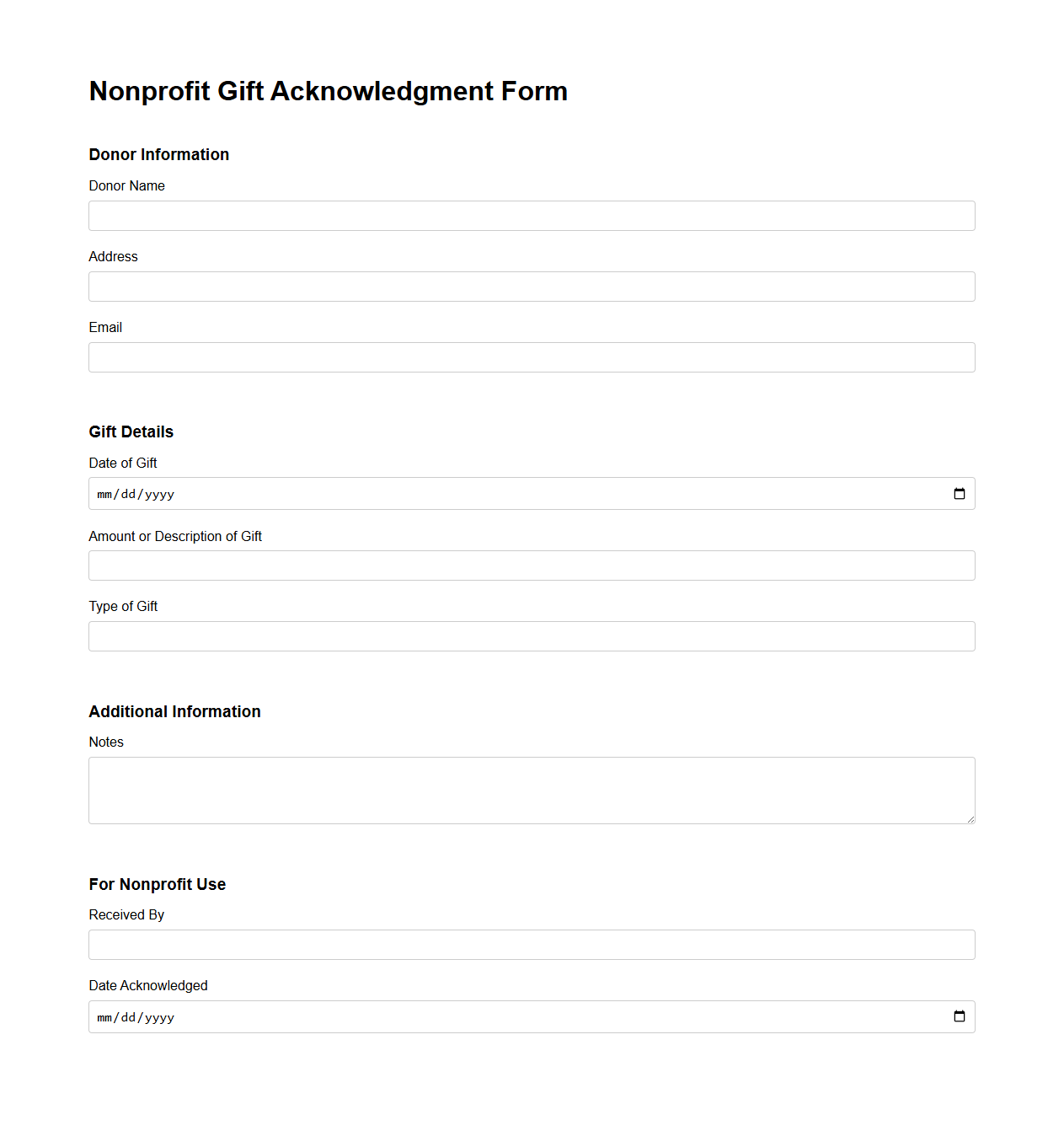

Nonprofit Gift Acknowledgment Form

A

Nonprofit Gift Acknowledgment Form is a formal document used by charitable organizations to provide donors with written confirmation of their contributions, which is essential for tax deduction purposes. This form typically includes details such as the donor's name, donation amount, date of the gift, and a statement confirming that no goods or services were exchanged for the donation. Maintaining accurate gift acknowledgment records helps nonprofits comply with IRS regulations and fosters transparency and trust with supporters.

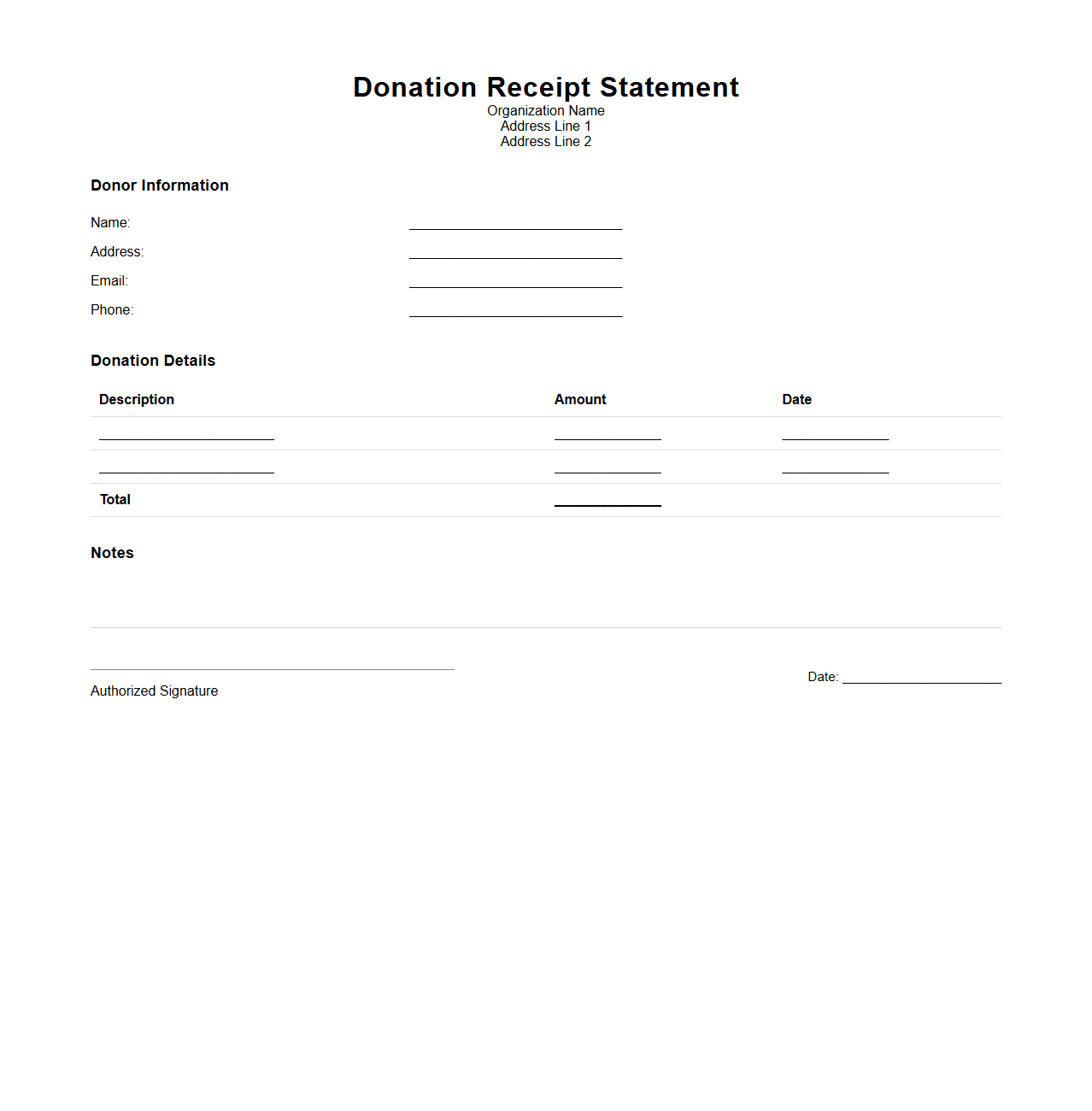

Donation Receipt Statement Layout

The

Donation Receipt Statement Layout document serves as a structured template that organizations use to provide donors with official acknowledgment of their contributions. It typically includes essential details such as the donor's name, donation amount, date of donation, and purpose or program supported, ensuring compliance with tax regulations. This document is crucial for maintaining transparency and facilitating donors' ability to claim tax deductions.

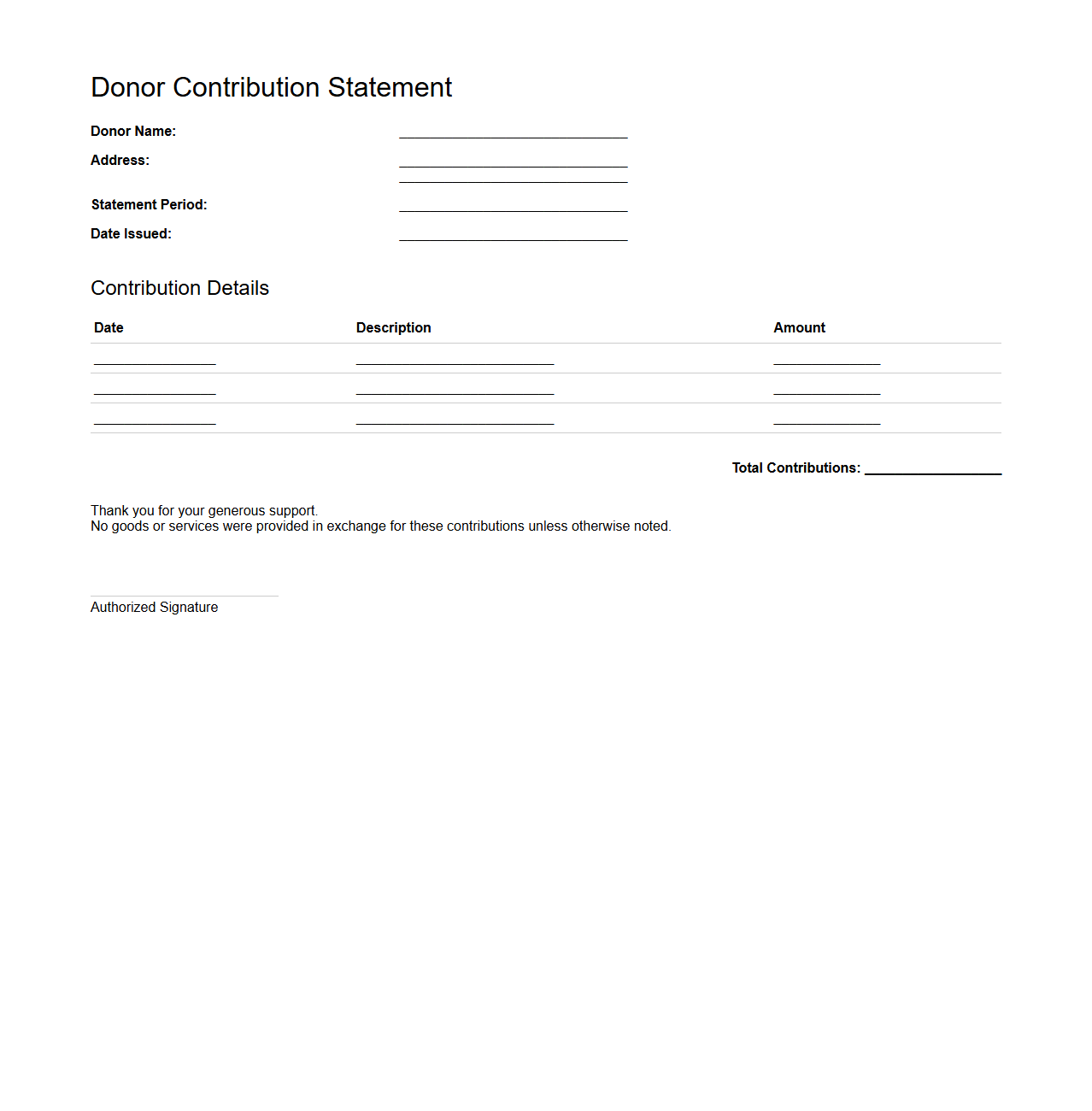

Simple Donor Contribution Statement

A

Simple Donor Contribution Statement is a concise document that summarizes the total donations made by an individual or organization within a specific period. It typically includes the donor's name, contribution dates, amounts, and the nonprofit's acknowledgment for tax deduction purposes. This statement serves as official proof of giving and helps donors maintain accurate financial records.

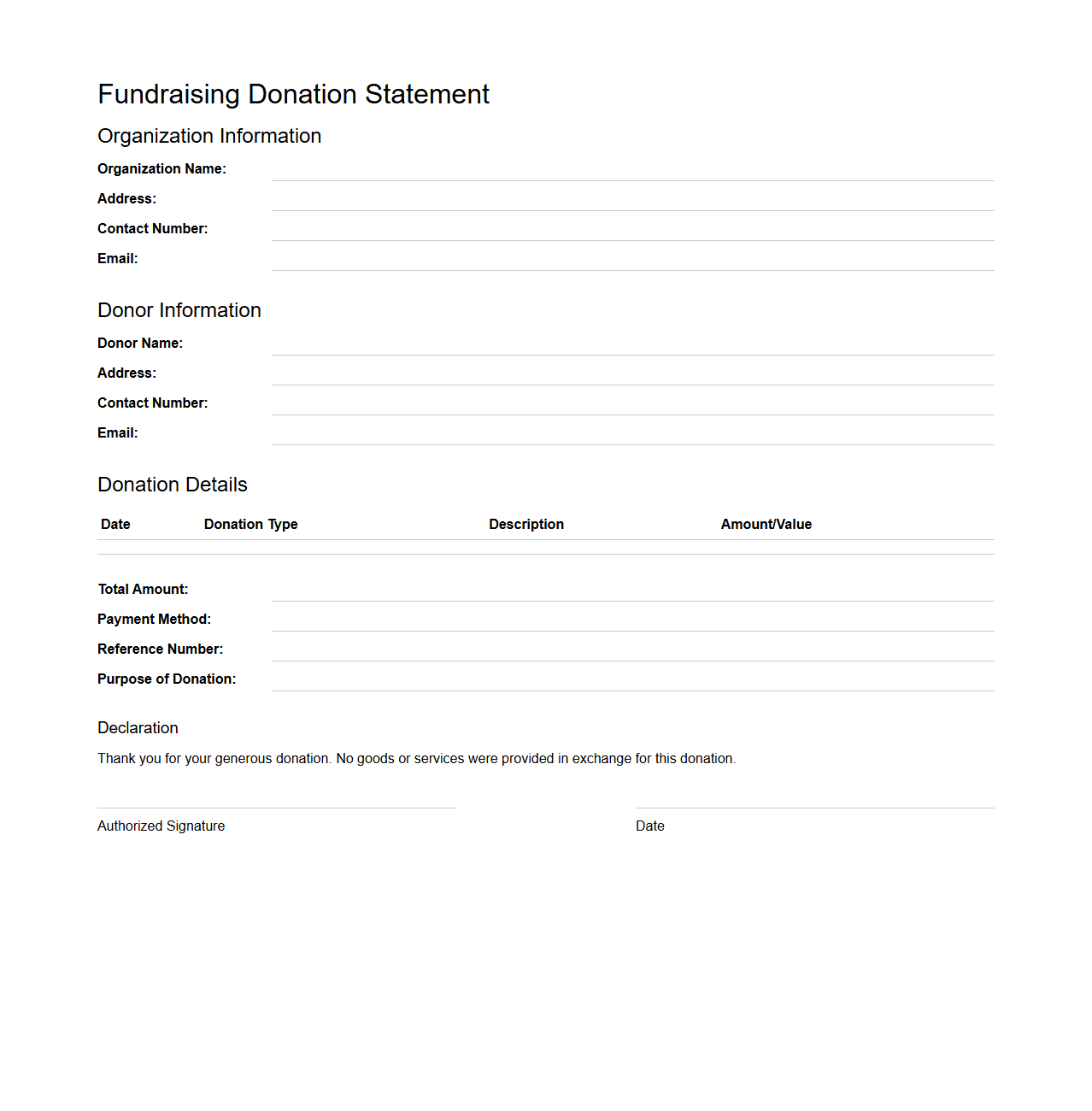

Fundraising Donation Statement Format

A

Fundraising Donation Statement Format document serves as a formal record provided by nonprofits to donors, detailing the amount and date of contributions made. It includes essential information such as donor details, donation purpose, and tax-deductible status, ensuring transparency and compliance with tax regulations. This document is crucial for both organizational accounting and donor tax reporting purposes.

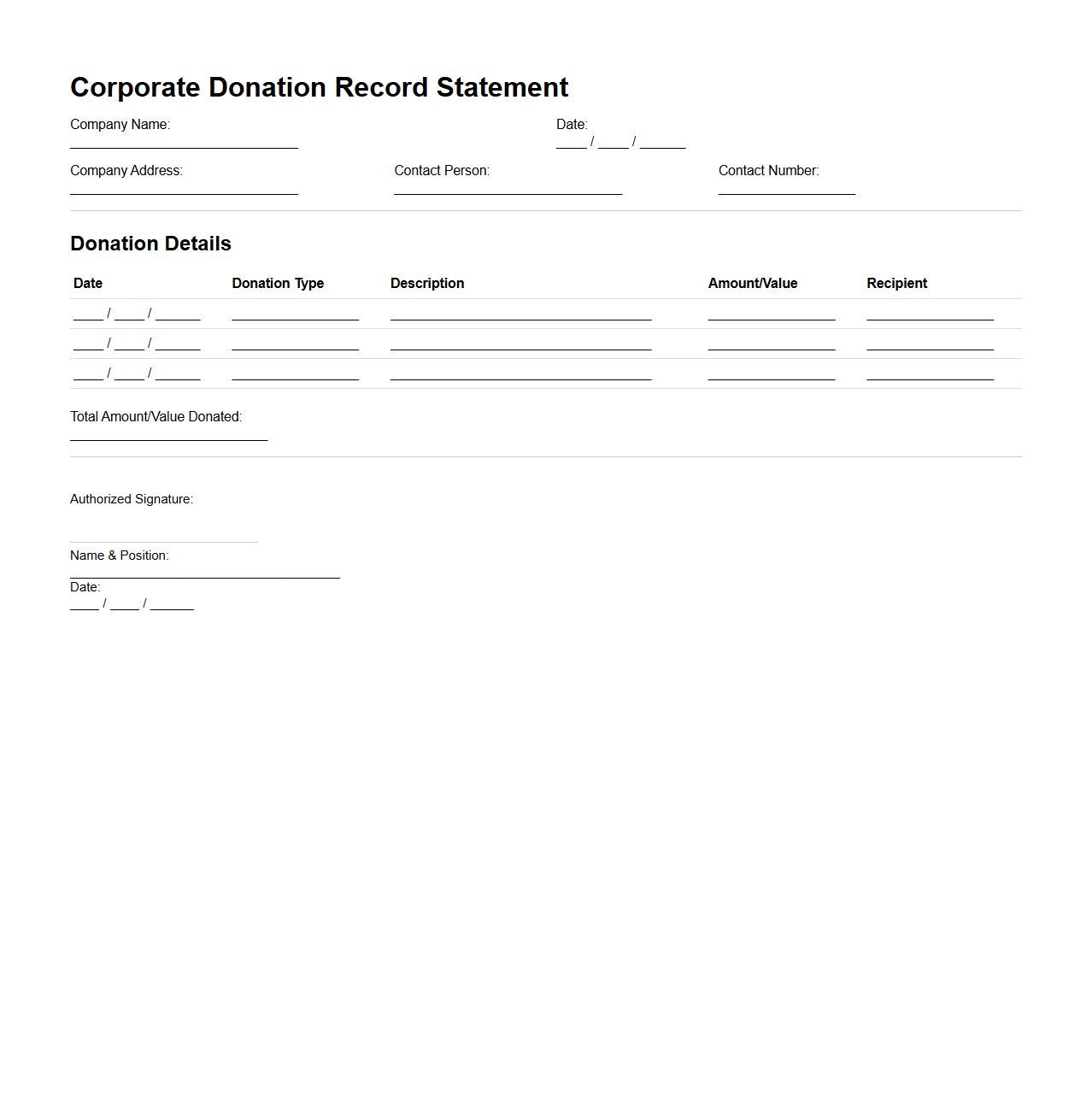

Corporate Donation Record Statement

A

Corporate Donation Record Statement document details a company's charitable contributions, including the amount, date, and recipient organization. It serves as an official record for accounting, tax reporting, and compliance purposes. This statement helps corporations track their philanthropy impact and supports transparency in financial audits.

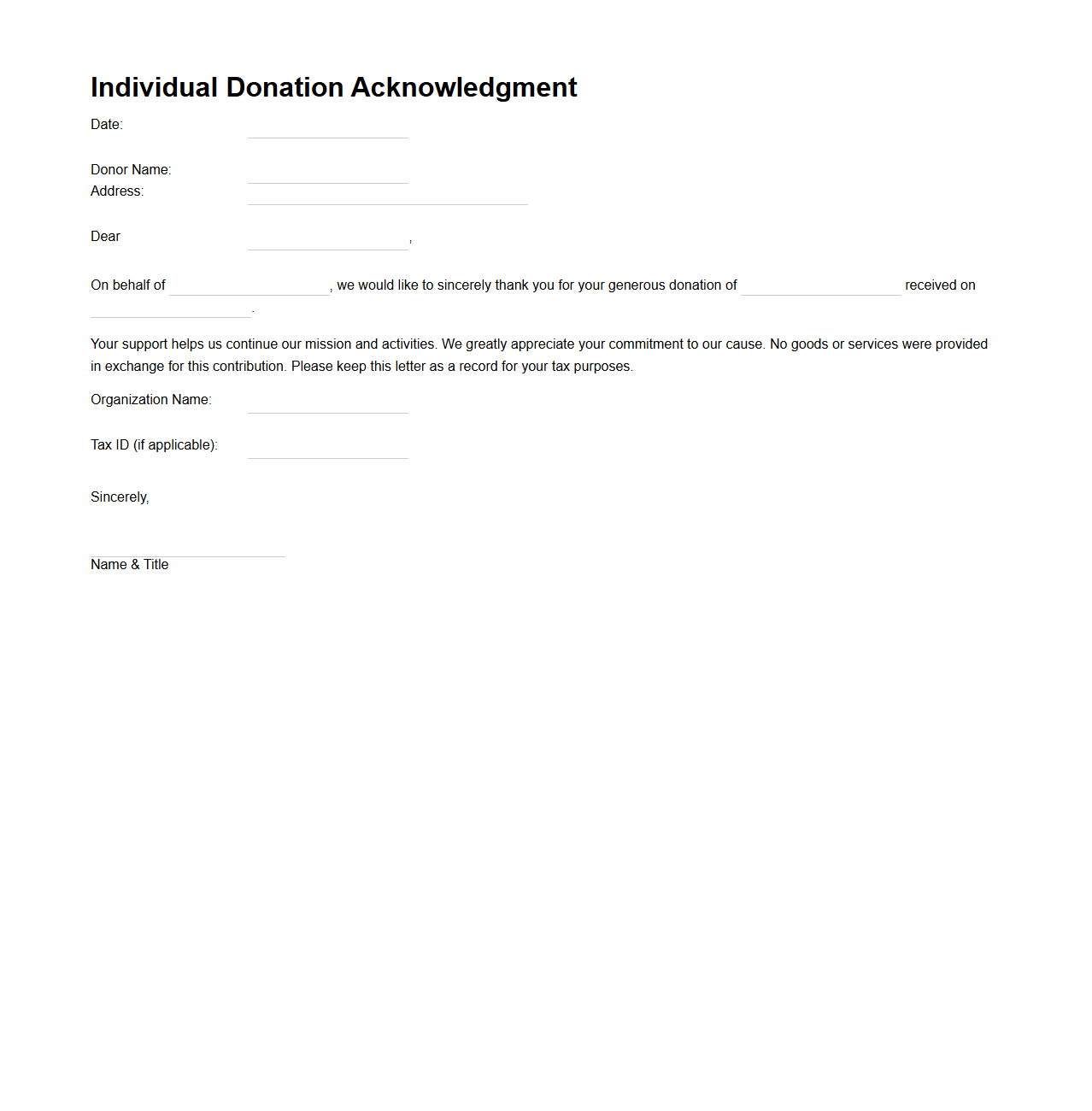

Individual Donation Acknowledgment Template

An

Individual Donation Acknowledgment Template is a standardized document used by organizations to formally recognize and thank donors for their contributions. It typically includes key details such as the donor's name, donation amount, date of donation, and a personalized message of gratitude. This template streamlines the acknowledgment process, ensuring consistency and professionalism in donor communications.

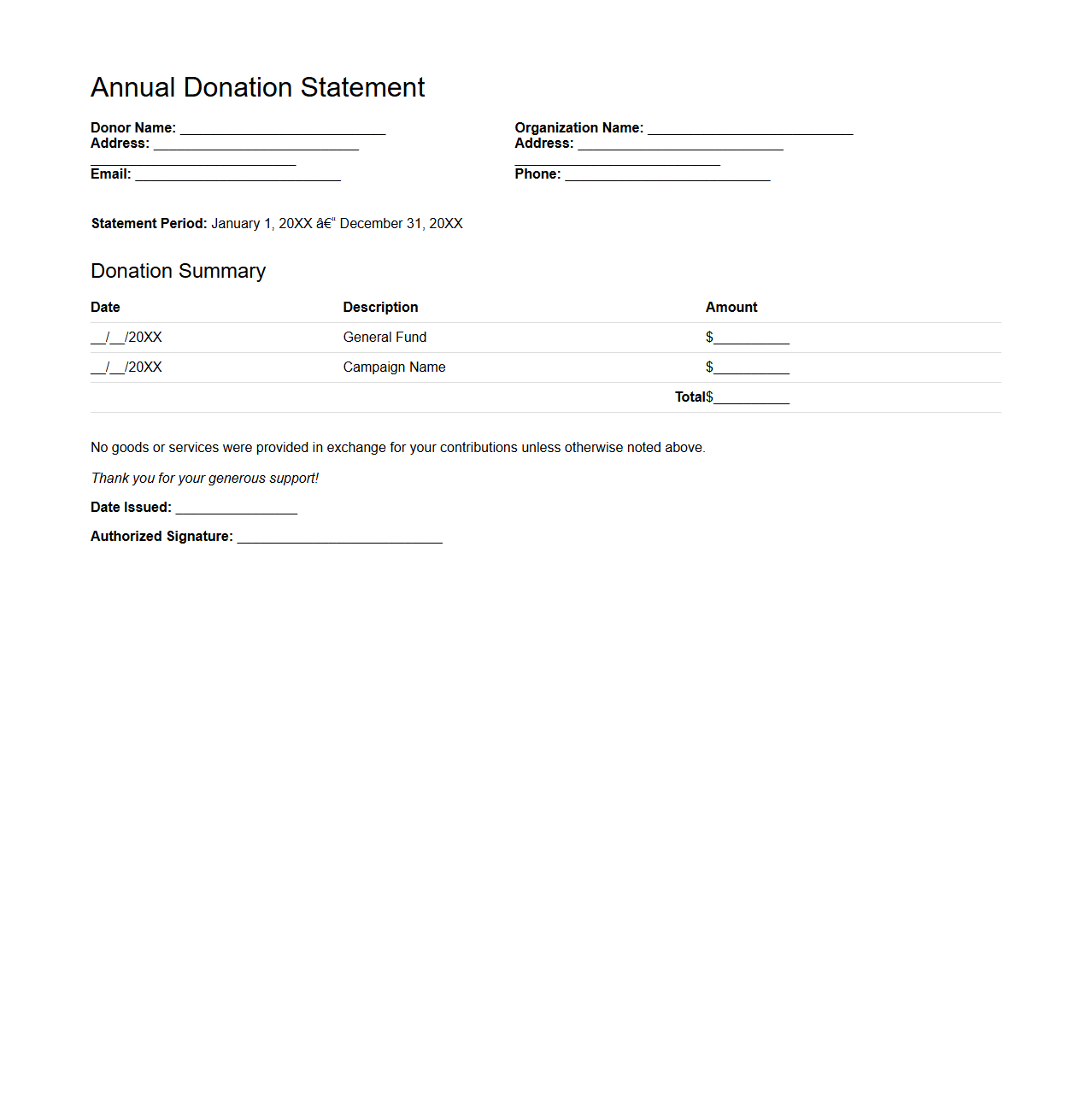

Annual Donation Statement Example

An

Annual Donation Statement Example document provides a detailed summary of all charitable contributions made by a donor within a fiscal year. It includes essential information such as the donor's name, donation dates, amounts, recipient organizations, and tax-deductible statuses. This document serves as a crucial record for both donors and nonprofit organizations to facilitate accurate tax reporting and financial transparency.

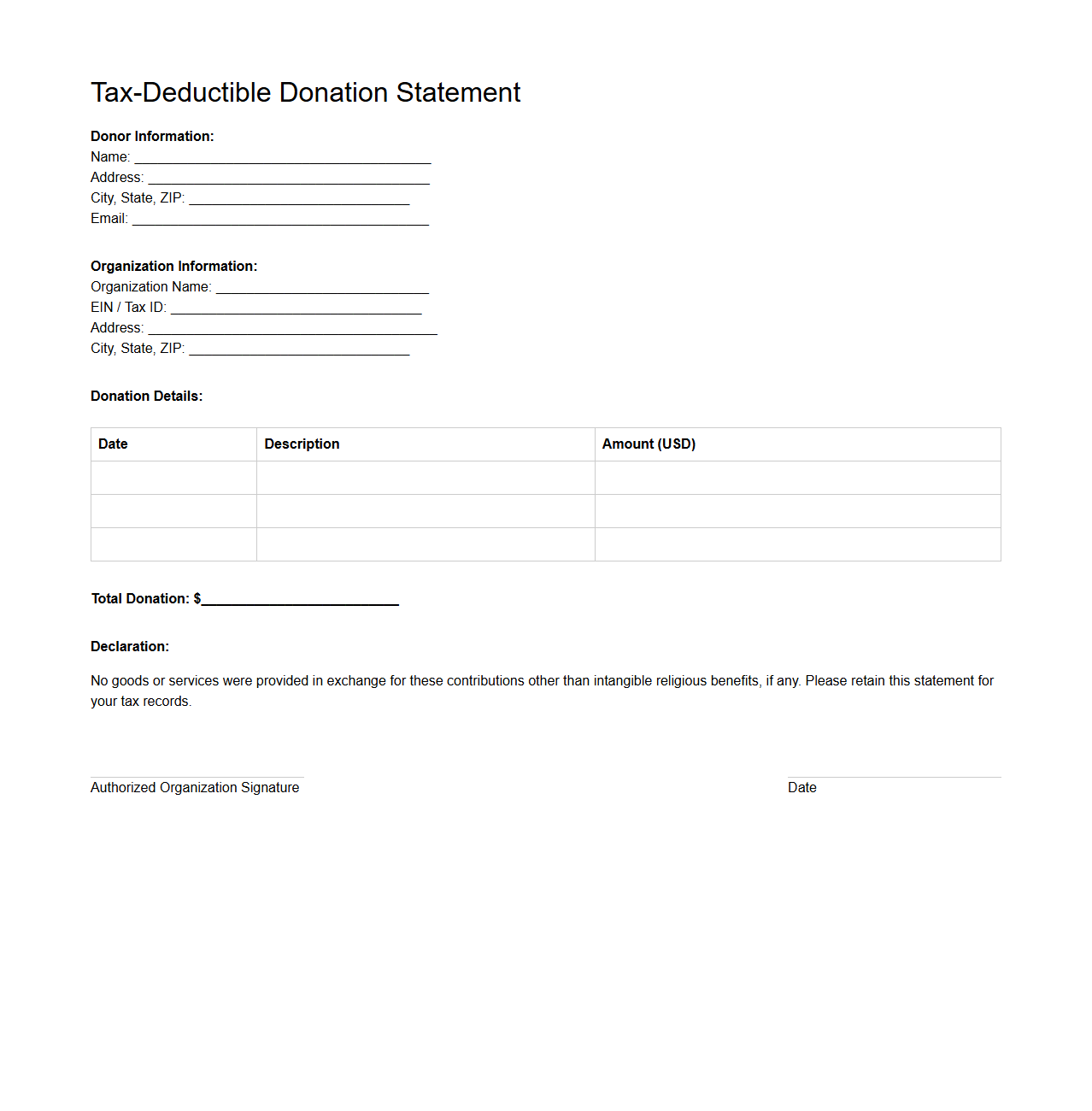

Tax-Deductible Donation Statement Sheet

A

Tax-Deductible Donation Statement Sheet is a formal document issued by nonprofits to donors, summarizing charitable contributions made within a specific tax year. It includes essential details such as donor information, donation dates, amounts, and the organization's tax-exempt status, helping donors claim eligible deductions on their tax returns. This statement ensures compliance with IRS regulations by providing accurate records required for tax deduction verification.

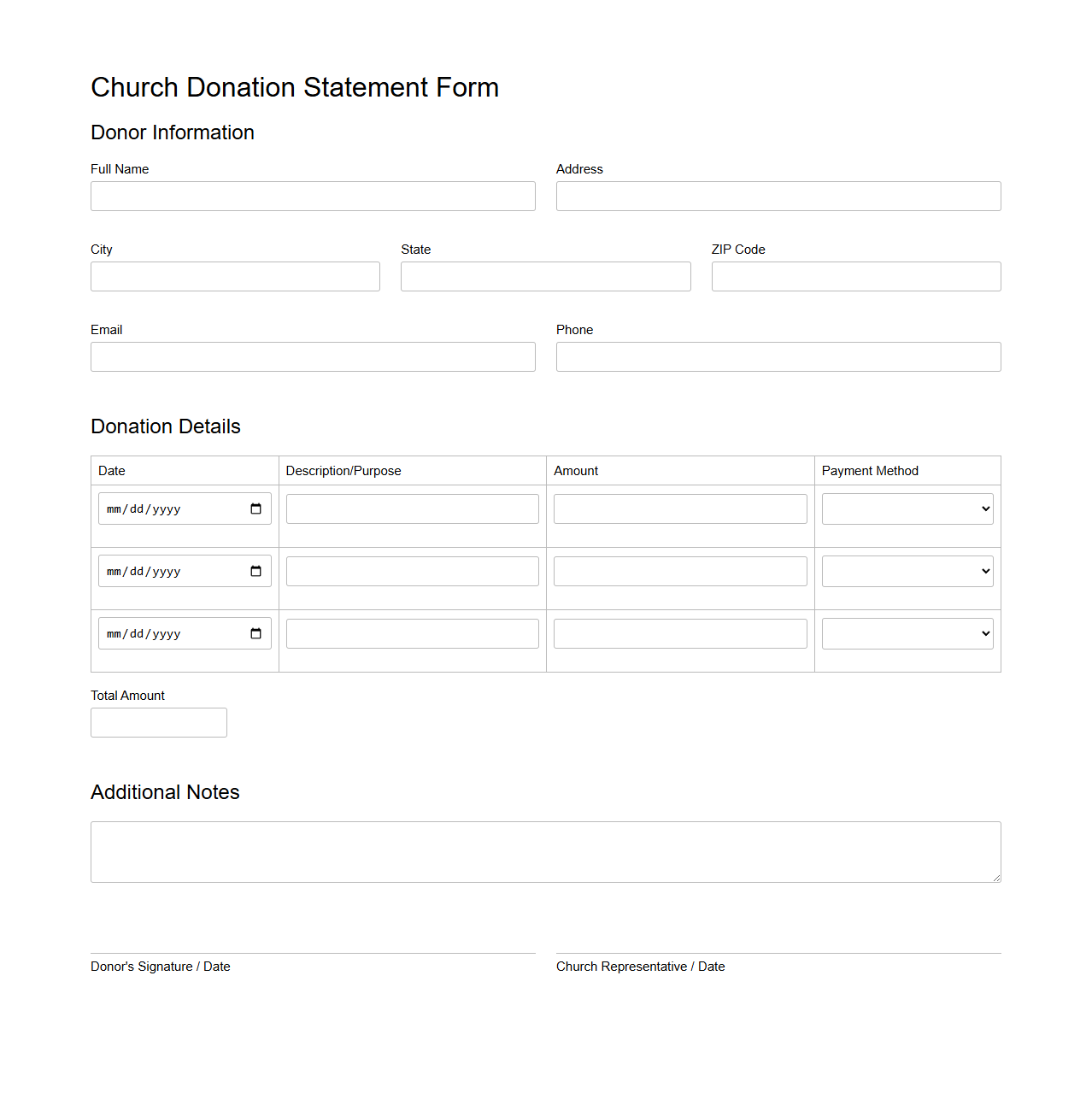

Church Donation Statement Form

The

Church Donation Statement Form serves as an official record summarizing an individual's or family's charitable contributions to a church within a fiscal year. This document facilitates transparent financial reporting, enabling donors to claim tax deductions by providing detailed information about the amount, date, and purpose of each donation. Churches use the form to maintain accurate records, ensuring compliance with tax regulations and fostering trust with their congregation.

What specific details should a blank statement for donations include for tax compliance?

A blank donation statement must outline the fundamental details necessary for tax compliance, including the organization's name, address, and tax identification number. It should also specify the type of donation accepted and the tax-deductible status of contributions. Additionally, a space for the donor's name, amount donated, and date of donation is crucial for accurate record-keeping.

How can a blank donation statement be formatted to support anonymous donor requests?

To support anonymous donor requests, the blank donation statement should provide an option to leave the donor identification fields blank or marked as "Anonymous." The design should ensure confidentiality by excluding any personal information unless voluntarily provided. Including a clear instruction or checkbox for anonymity helps donors understand their privacy options.

Which legal disclaimers must be present in a blank donation letter template?

A blank donation letter template must contain legal disclaimers about the non-refundable nature of donations and the use of funds in accordance with organizational policies. It should also mention compliance with relevant tax laws and state that the document does not constitute a legally binding contract. Furthermore, a statement about receipt acknowledgment and any conditions for tax deduction eligibility is essential.

Are there digital signature guidelines for blank donation statements in electronic submissions?

Digital signature guidelines require that electronic submissions of blank donation statements comply with national e-signature laws to ensure authenticity and integrity. The system should incorporate secure methods for capturing consent without altering the original document. Additionally, time stamps and audit trails must be maintained for verifiable electronic signatures.

What data privacy considerations are required when issuing blank donation statements?

Data privacy considerations mandate that all personal information on blank donation statements is handled according to applicable data protection regulations like GDPR or HIPAA. Organizations must implement safeguards to protect donor confidentiality and limit data access only to authorized personnel. Clear privacy notices should be provided to inform donors about how their data will be used and stored securely.