A Blank Statement of Cash Flows Template for Finance provides a structured format to track cash inflows and outflows for businesses. It helps users categorize operating, investing, and financing activities clearly, ensuring accurate financial analysis. This template supports better cash management and informed decision-making in finance.

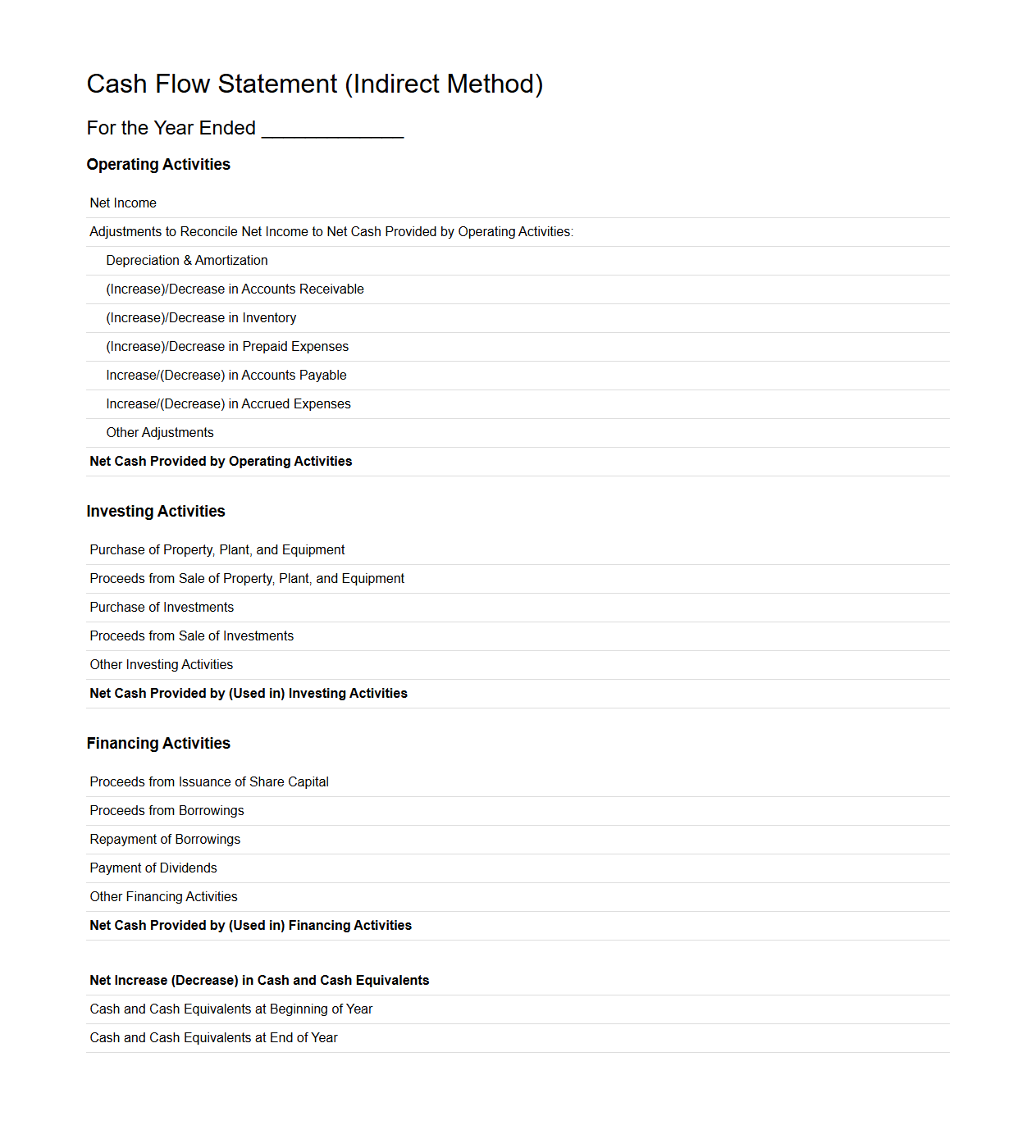

Blank Indirect Method Cash Flow Statement Template

A

Blank Indirect Method Cash Flow Statement Template document is a financial tool designed to help businesses prepare cash flow statements by adjusting net income for changes in balance sheet accounts. It enables users to systematically track operating cash flows by reconciling accrual-based income to cash-based movements without pre-filled data, promoting accuracy and customization. This template is essential for financial analysis, forecasting, and ensuring compliance with accounting standards.

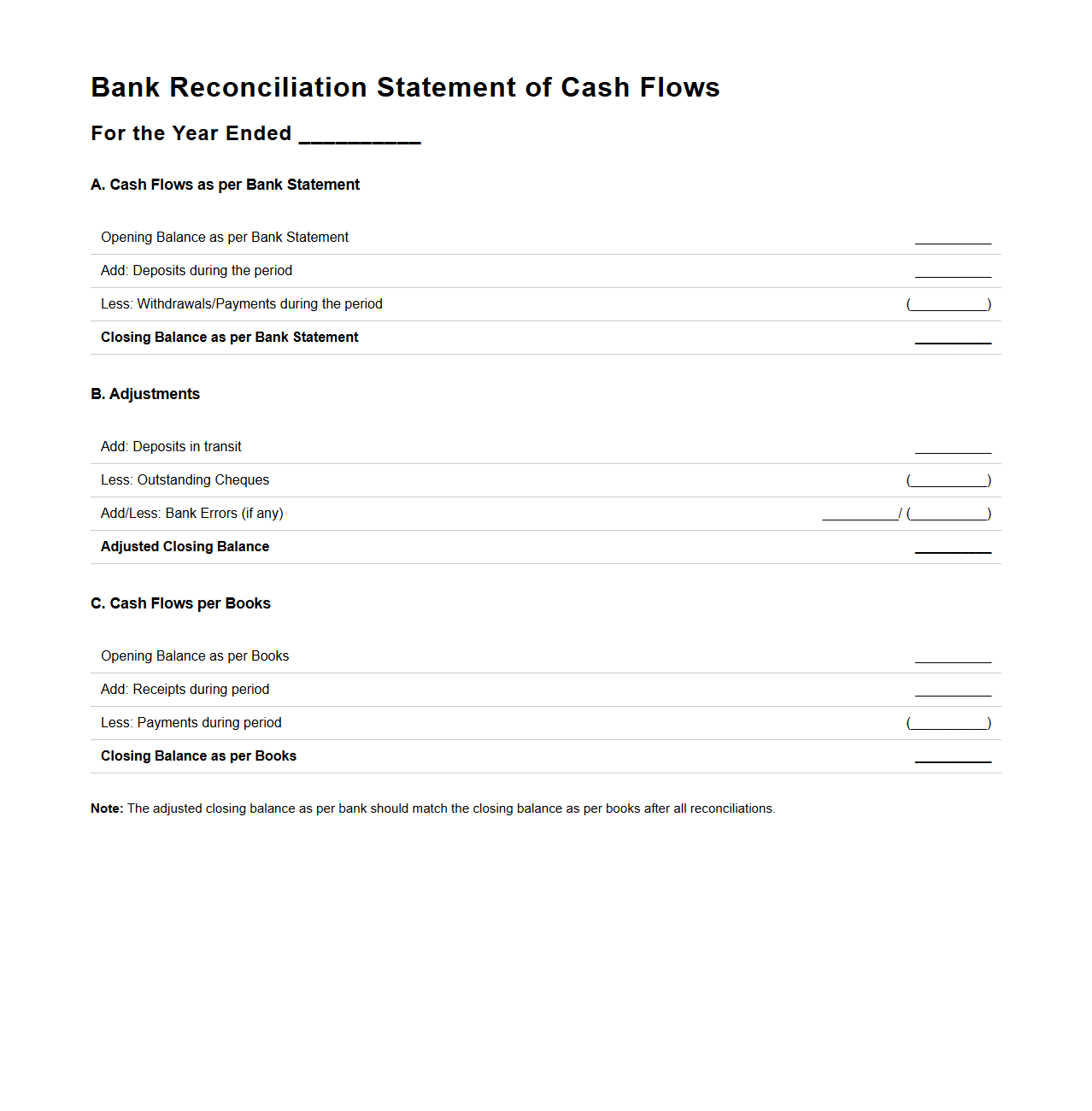

Bank Reconciliation Statement of Cash Flows Format

A

Bank Reconciliation Statement in the Cash Flows Format document is used to align the bank account balance with the company's cash flow records, ensuring accuracy in financial reporting. It identifies discrepancies between the bank statement and the cash book, such as outstanding checks or deposits in transit, to reconcile the two balances. This document is essential for verifying cash inflows and outflows and maintaining accurate cash flow statements for effective financial management.

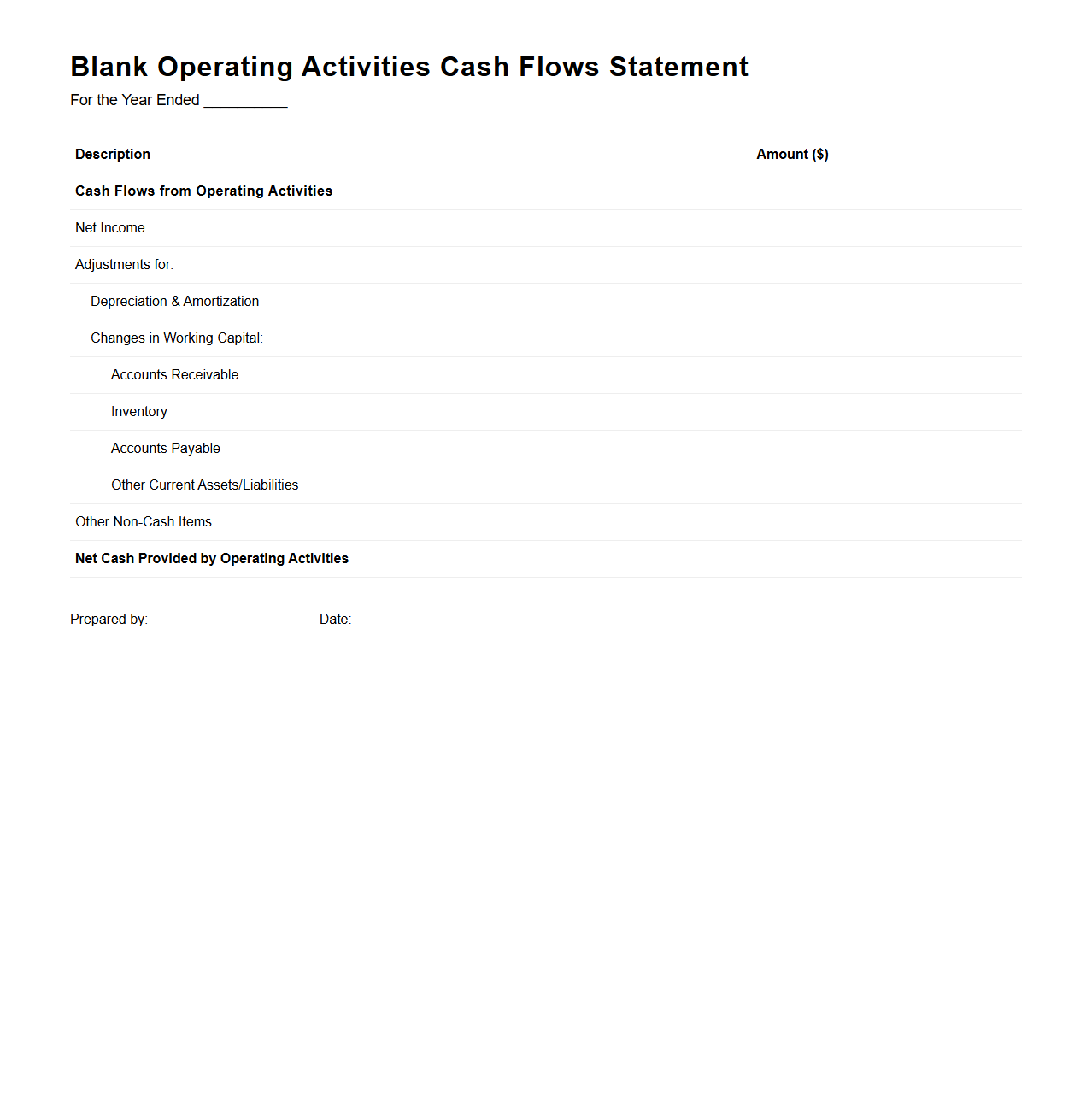

Blank Operating Activities Cash Flows Statement

The

Operating Activities Cash Flows Statement is a financial document that reports the cash generated or used by a company's core business operations during a specific period. It includes cash receipts from sales of goods or services and cash payments for expenses such as salaries, rent, and supplies, providing insight into the company's liquidity and operational efficiency. This statement helps investors and analysts assess how well the company can sustain and expand its operations through internal cash generation.

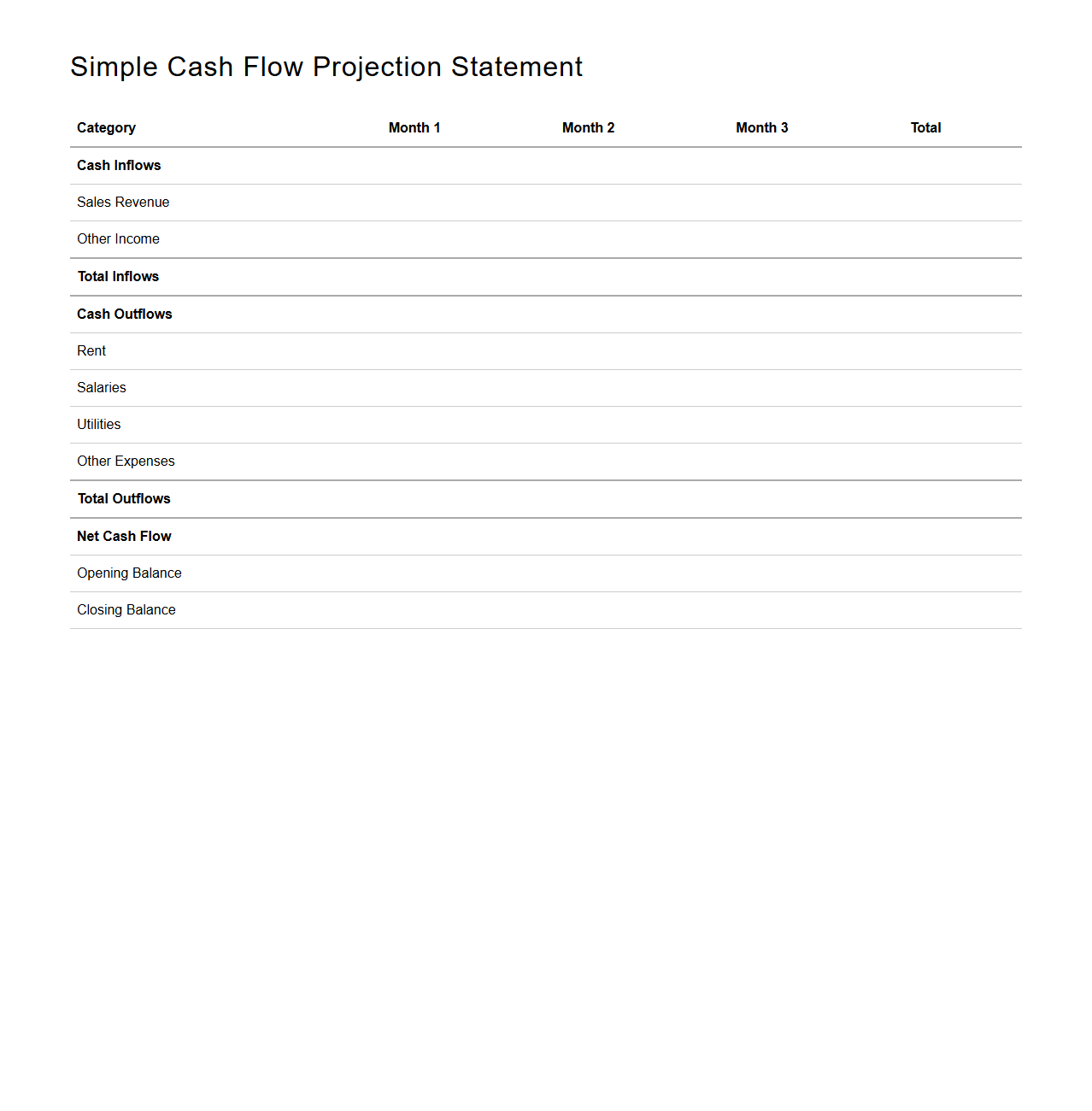

Simple Cash Flow Projection Statement Layout

A

Simple Cash Flow Projection Statement Layout document is a financial tool designed to estimate future cash inflows and outflows over a specific period, helping businesses manage liquidity effectively. It typically includes sections for operating activities, investing activities, and financing activities, clearly outlining expected receipts and payments. This layout enables accurate forecasting, ensuring that companies maintain sufficient cash reserves to meet obligations and plan for growth.

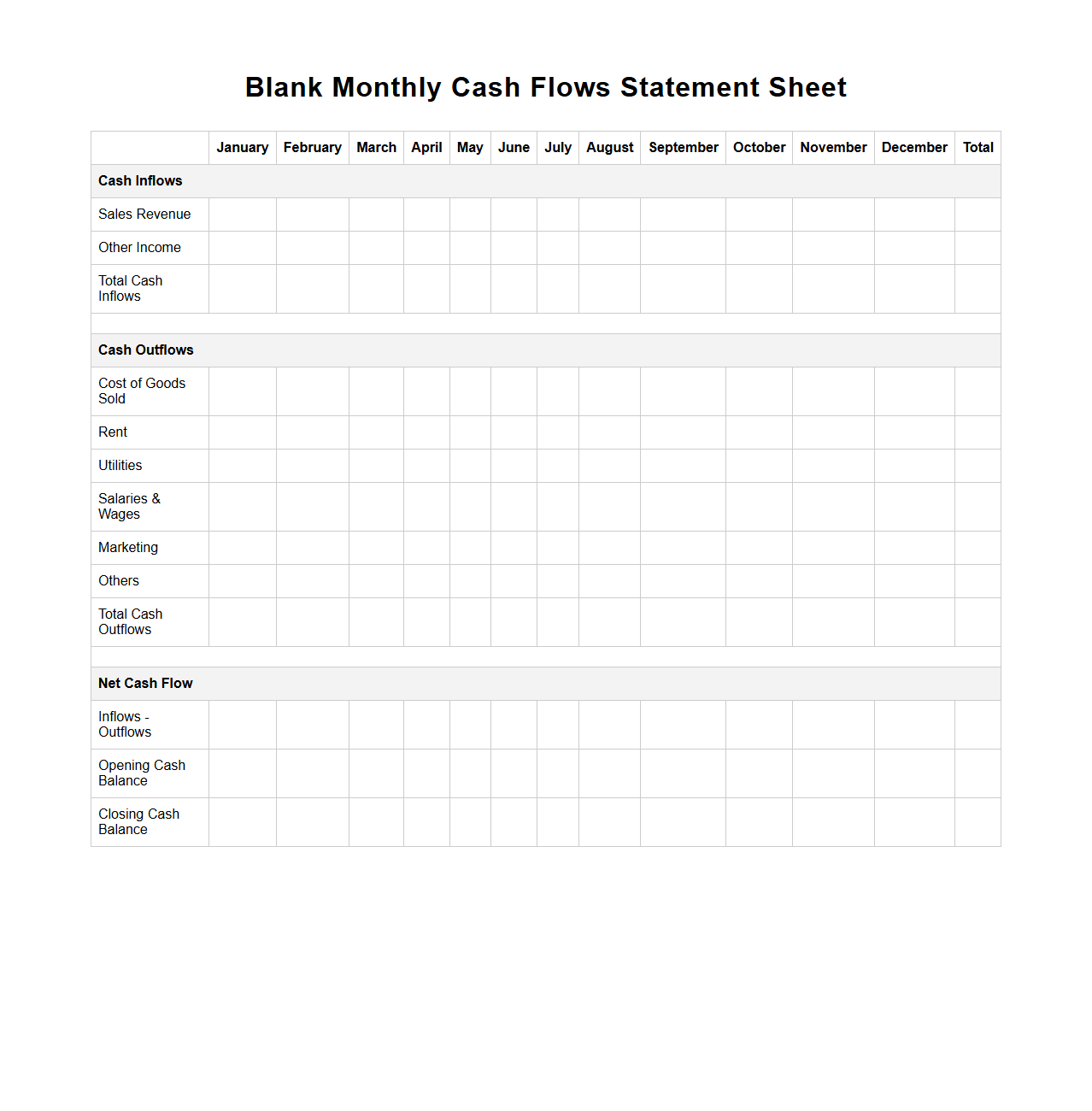

Blank Monthly Cash Flows Statement Sheet

The

Blank Monthly Cash Flows Statement Sheet is a financial document used to track and project cash inflows and outflows on a monthly basis. This sheet helps businesses and individuals monitor liquidity, plan budgets, and ensure sufficient cash availability for operational needs. It typically includes sections for operating, investing, and financing activities, allowing detailed cash movement analysis.

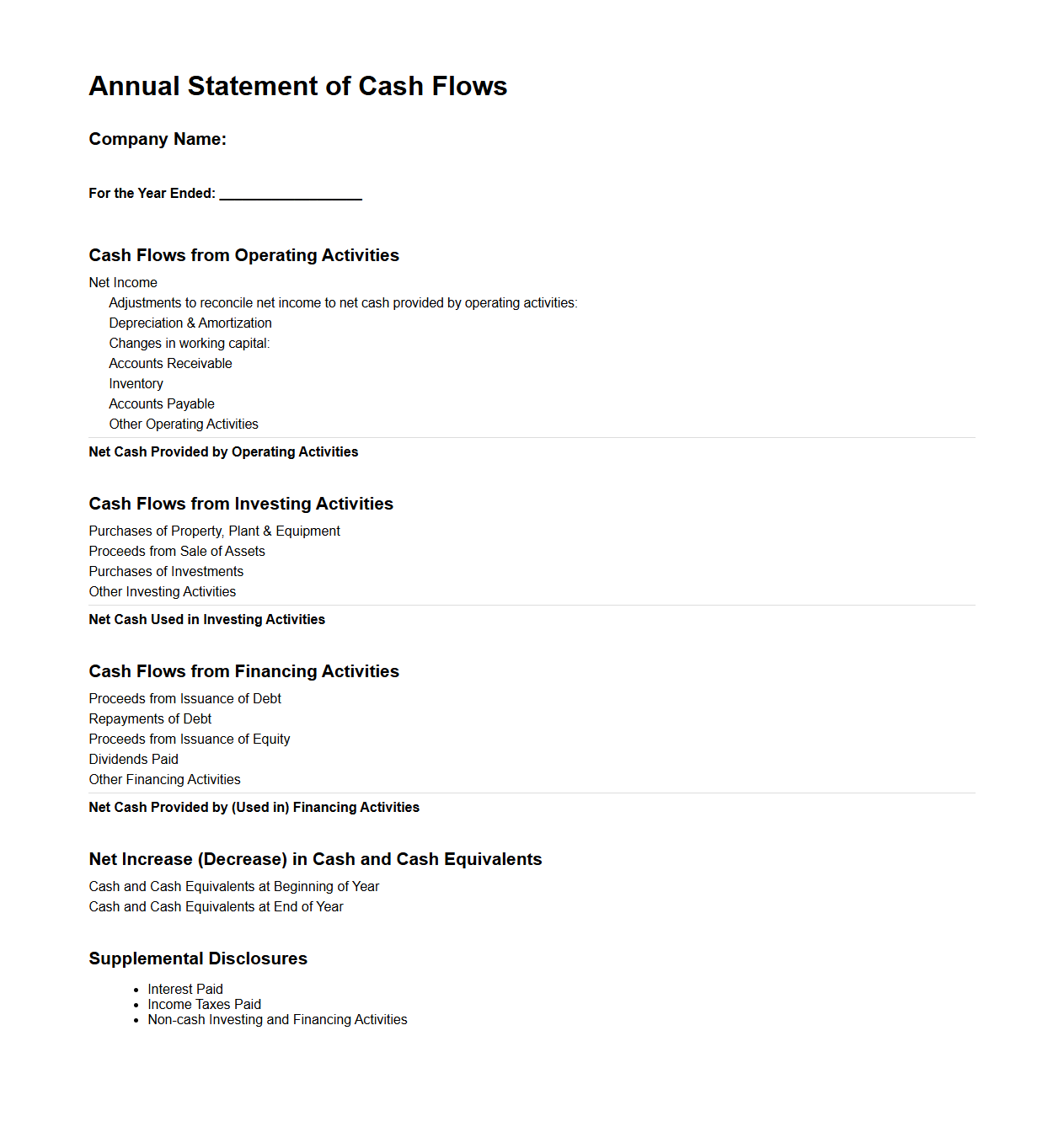

Annual Statement of Cash Flows Outline

The

Annual Statement of Cash Flows Outline document provides a structured overview of a company's cash inflows and outflows over a fiscal year, categorized into operating, investing, and financing activities. It helps stakeholders evaluate the liquidity, financial flexibility, and overall cash management strategies of the organization. This outline serves as a crucial tool for investors, analysts, and management to assess how well the business generates and utilizes cash.

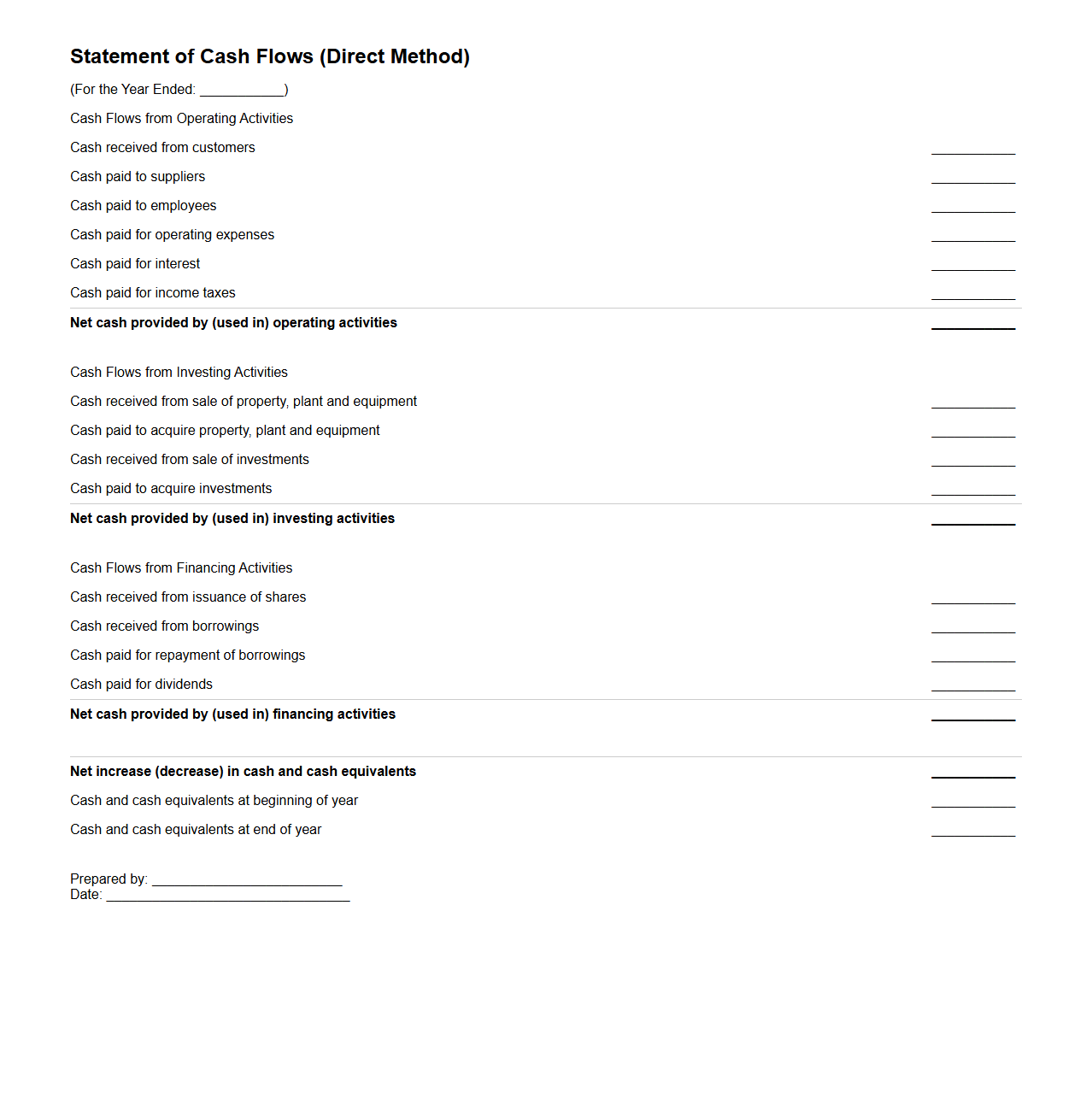

Blank Direct Method Statement of Cash Flows

The

Direct Method Statement of Cash Flows document presents a detailed report of cash receipts and payments from operating activities, showing actual cash inflows and outflows. It categorizes cash transactions such as cash received from customers and cash paid to suppliers, providing a clear and transparent view of cash movement. This method enhances financial analysis by offering insight into cash flow sources and uses, aiding effective cash management and decision-making.

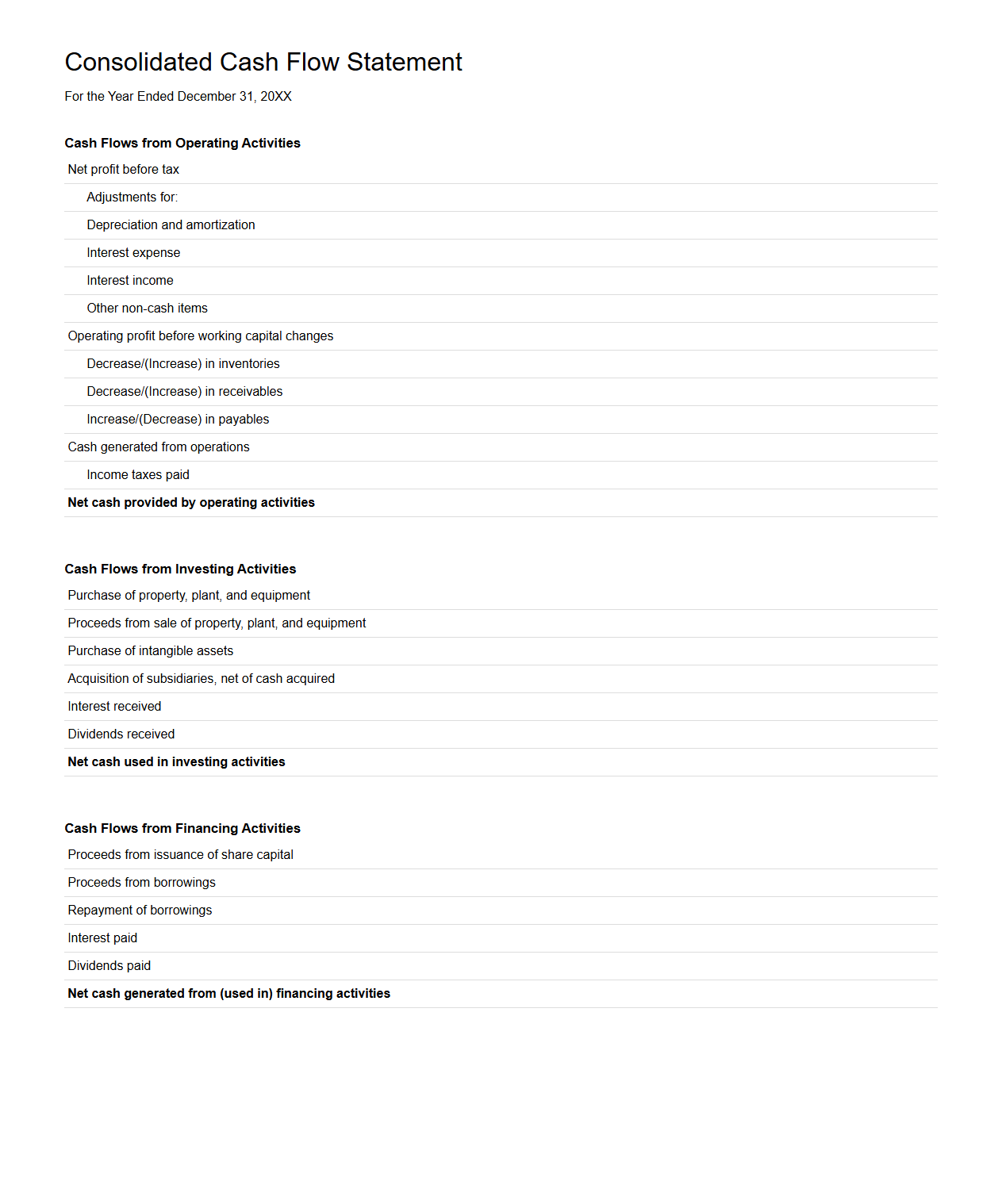

Consolidated Cash Flow Statement Structure

The

Consolidated Cash Flow Statement Structure document outlines the framework used by companies to report cash inflows and outflows from operating, investing, and financing activities on a consolidated basis. It integrates cash movements of the parent company and its subsidiaries, providing a clear view of overall liquidity and financial health. This document ensures compliance with accounting standards like IFRS or GAAP, enhancing transparency for investors and stakeholders.

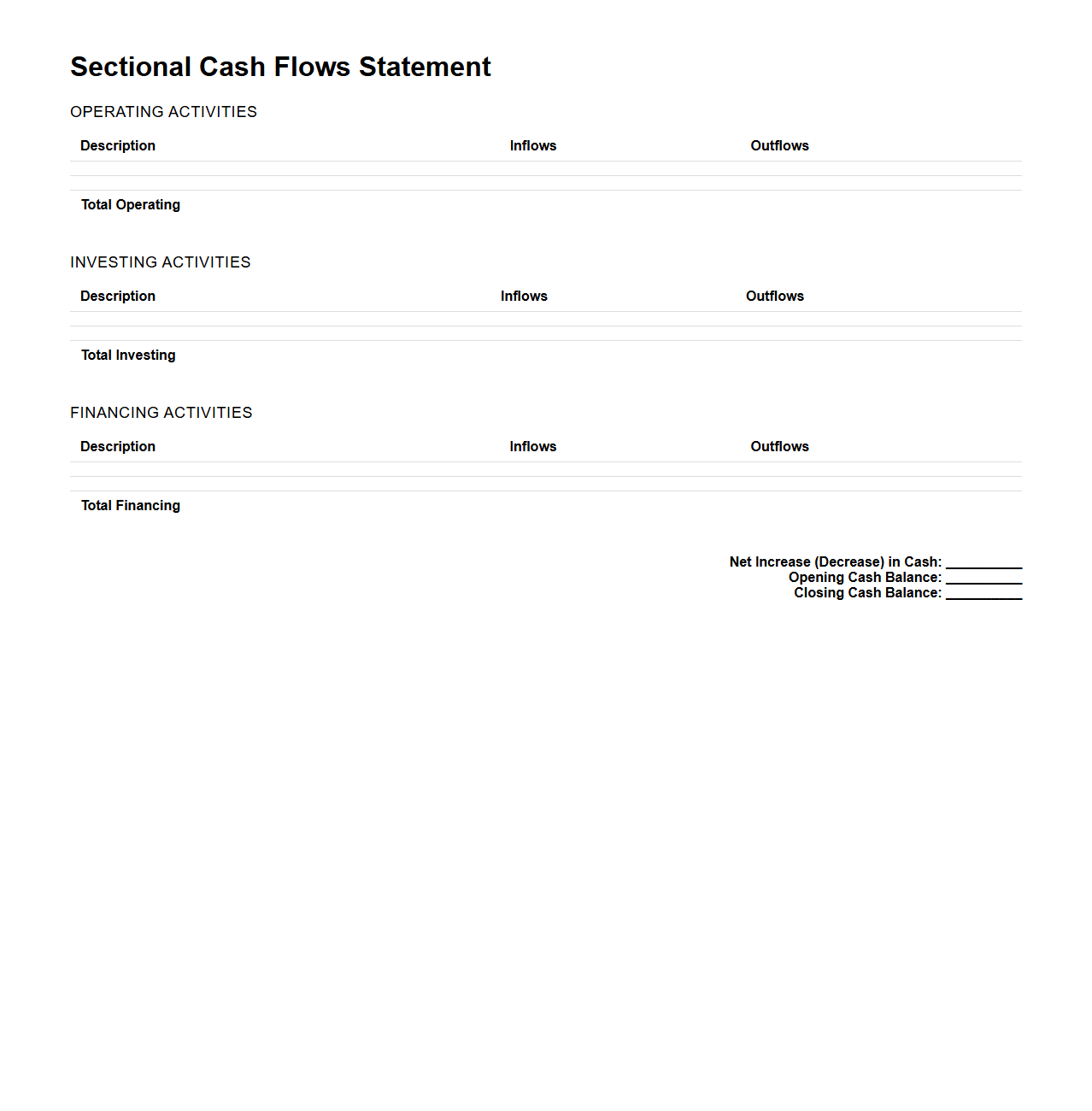

Sectional Cash Flows Statement Split Template

The

Sectional Cash Flows Statement Split Template document is designed to organize and categorize cash inflows and outflows across different sections of a business, such as operating, investing, and financing activities. It helps financial analysts and accountants break down complex cash flow data into manageable segments for clearer insight and better decision-making. This template enhances accuracy and efficiency in preparing cash flow statements aligned with standard accounting practices.

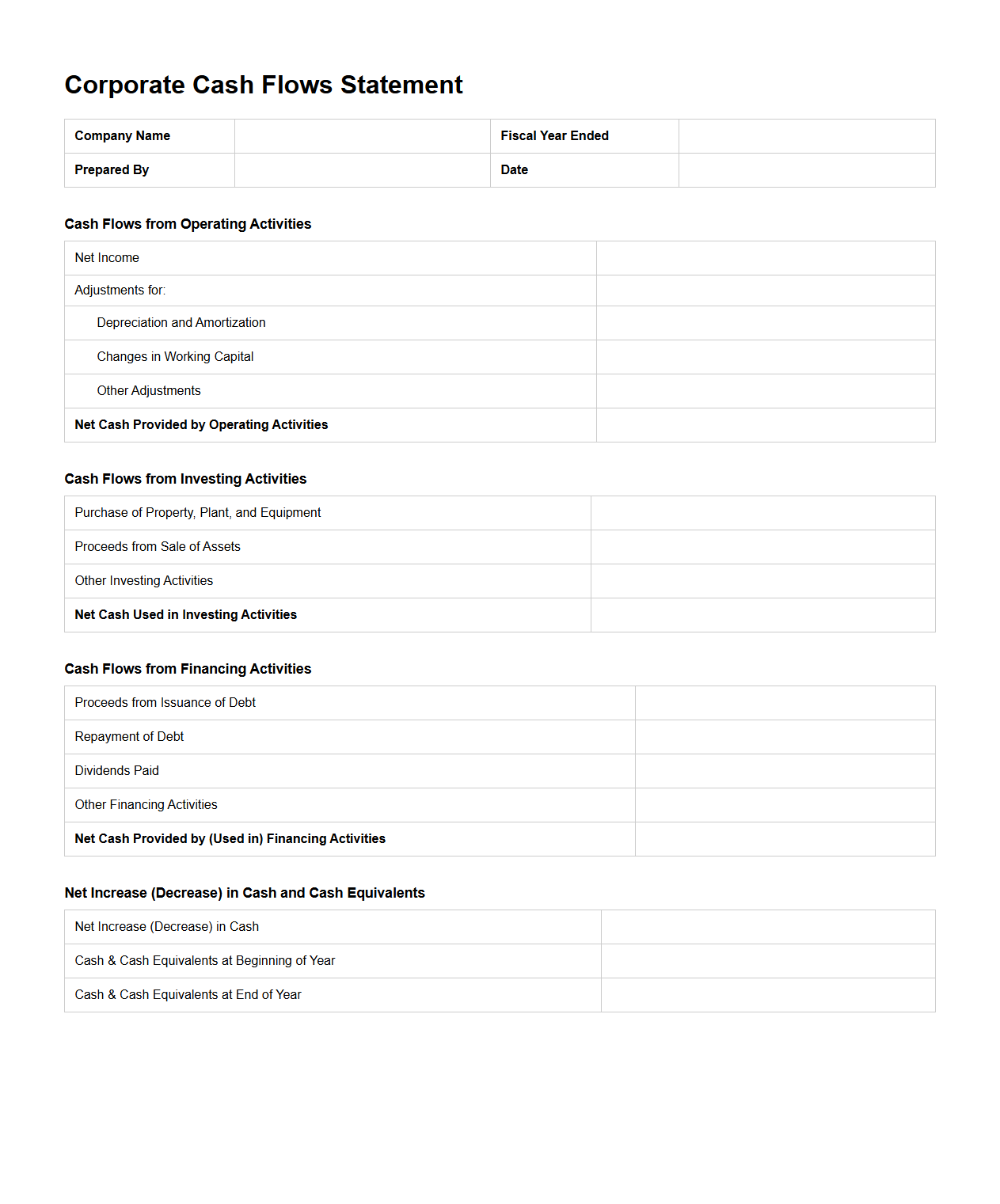

Blank Corporate Cash Flows Statement Form

The

Blank Corporate Cash Flows Statement Form is a financial document used to record and analyze the cash inflows and outflows of a company over a specific period. This form helps businesses track operating, investing, and financing activities to evaluate liquidity and cash management. Accurate completion of this statement is crucial for assessing financial health and making informed investment or budgeting decisions.

What specific items should be included in a Blank Statement of Cash Flows template for small businesses?

A Blank Statement of Cash Flows template for small businesses must include cash flows from operating, investing, and financing activities. Common items under operating activities are cash receipts from customers and cash paid to suppliers. Investing activities include purchases or sales of assets, while financing activities cover loans, equity, and dividend payments.

How can non-cash transactions be indicated on a Blank Statement of Cash Flows form?

Non-cash transactions should be clearly noted in a separate section or as a footnote within the Statement of Cash Flows template. These may include asset exchanges, depreciation, or stock issuance for debt conversion. Properly highlighting non-cash activities ensures accurate representation of cash movement and financial position.

Which section on a blank cash flow statement details financing vs. investing activities?

The Investing Activities and Financing Activities sections are distinctly separated on a cash flow statement template. Investing details the purchase and sale of long-term assets, while financing shows transactions related to debt, equity, and dividends. This separation helps users understand the sources and uses of cash specifically for growth and capital management.

What supporting documentation is required when filling out a Blank Statement of Cash Flows?

Supporting documentation includes bank statements, loan agreements, receipts, and ledgers to verify each cash flow entry. Accurate records ensure the Statement of Cash Flows is reliable and compliant with accounting standards. These documents provide proof for the inflows and outflows reflected in the report.

How should negative cash flow be formatted on a Blank Statement of Cash Flows document?

Negative cash flow should be clearly represented with parentheses or a minus sign on the Statement of Cash Flows. Formatting negative amounts distinctly ensures clarity and highlights cash deficits. Proper notation aids users in quickly identifying periods of cash outflow or shortfalls.