A Blank Statement Template for Tax Returns serves as a customizable form used to provide additional information required by tax authorities when filing returns. This template helps taxpayers clearly outline specific details, ensuring accurate reporting and compliance with tax regulations. Utilizing a well-structured blank statement can simplify the documentation process and reduce errors in tax submissions.

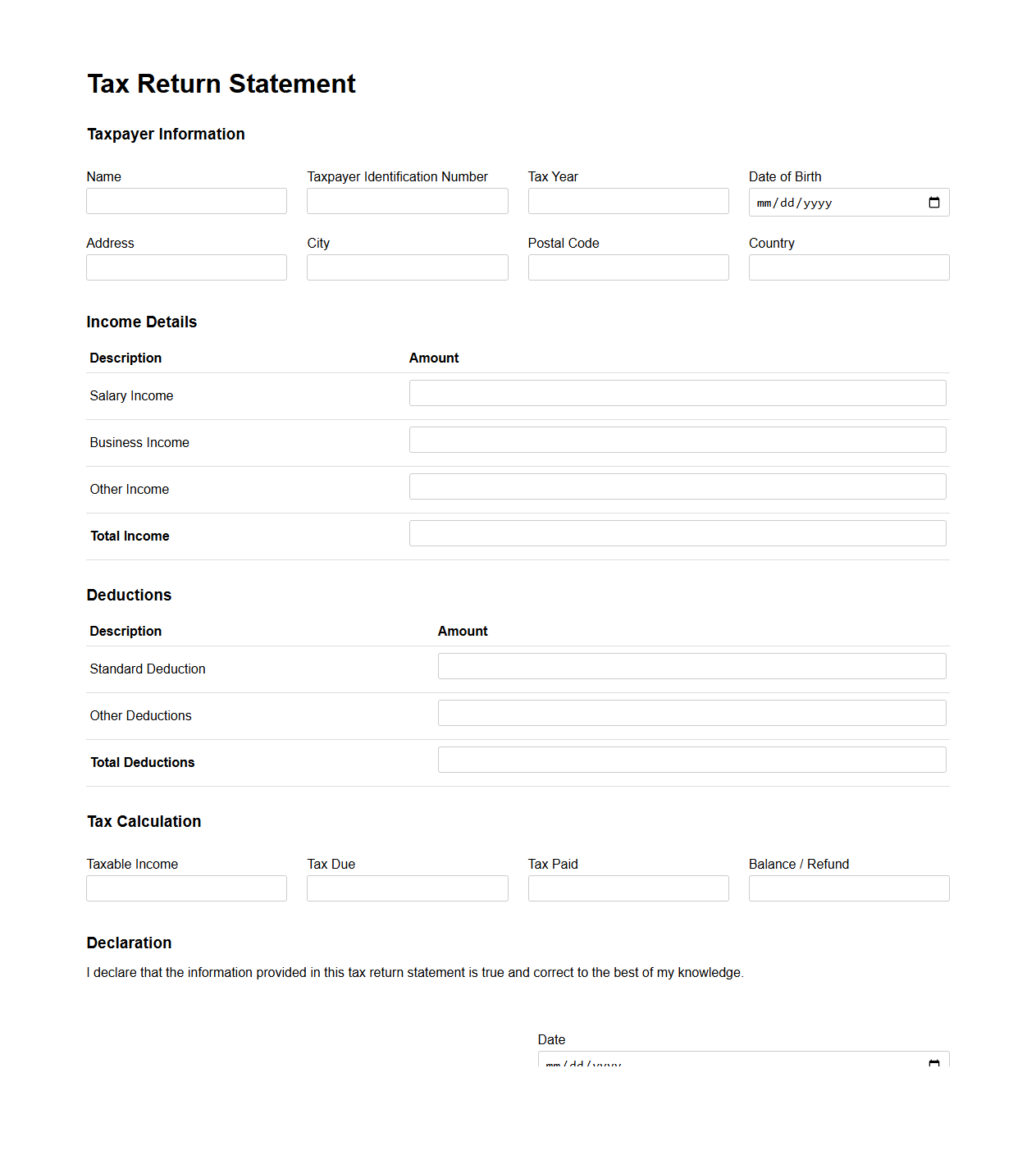

Tax Return Statement Template

A

Tax Return Statement Template document is a structured form used to accurately report income, deductions, and tax liabilities to relevant tax authorities. It simplifies the preparation process by organizing essential financial information, ensuring compliance with legal requirements, and minimizing errors. This template is vital for individuals and businesses to efficiently file their annual tax returns and maintain accurate financial records.

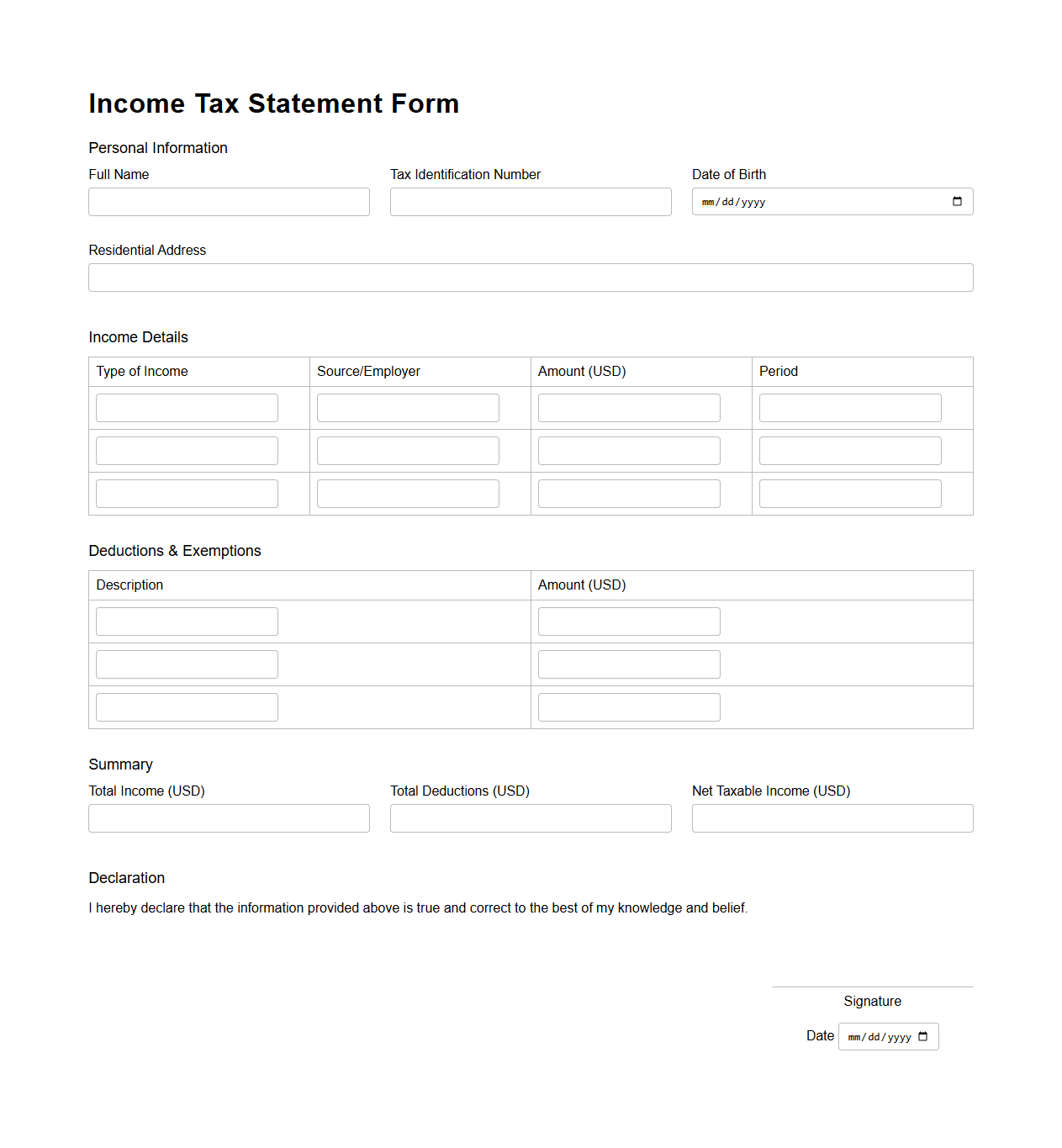

Income Tax Statement Form

An

Income Tax Statement Form is an official document that summarizes an individual's or business's earnings, taxes withheld, and tax liabilities for a specific fiscal year. This form is essential for accurately filing annual income tax returns with relevant tax authorities, ensuring compliance with tax laws. It typically includes detailed information such as salary, bonuses, deductions, and tax credits.

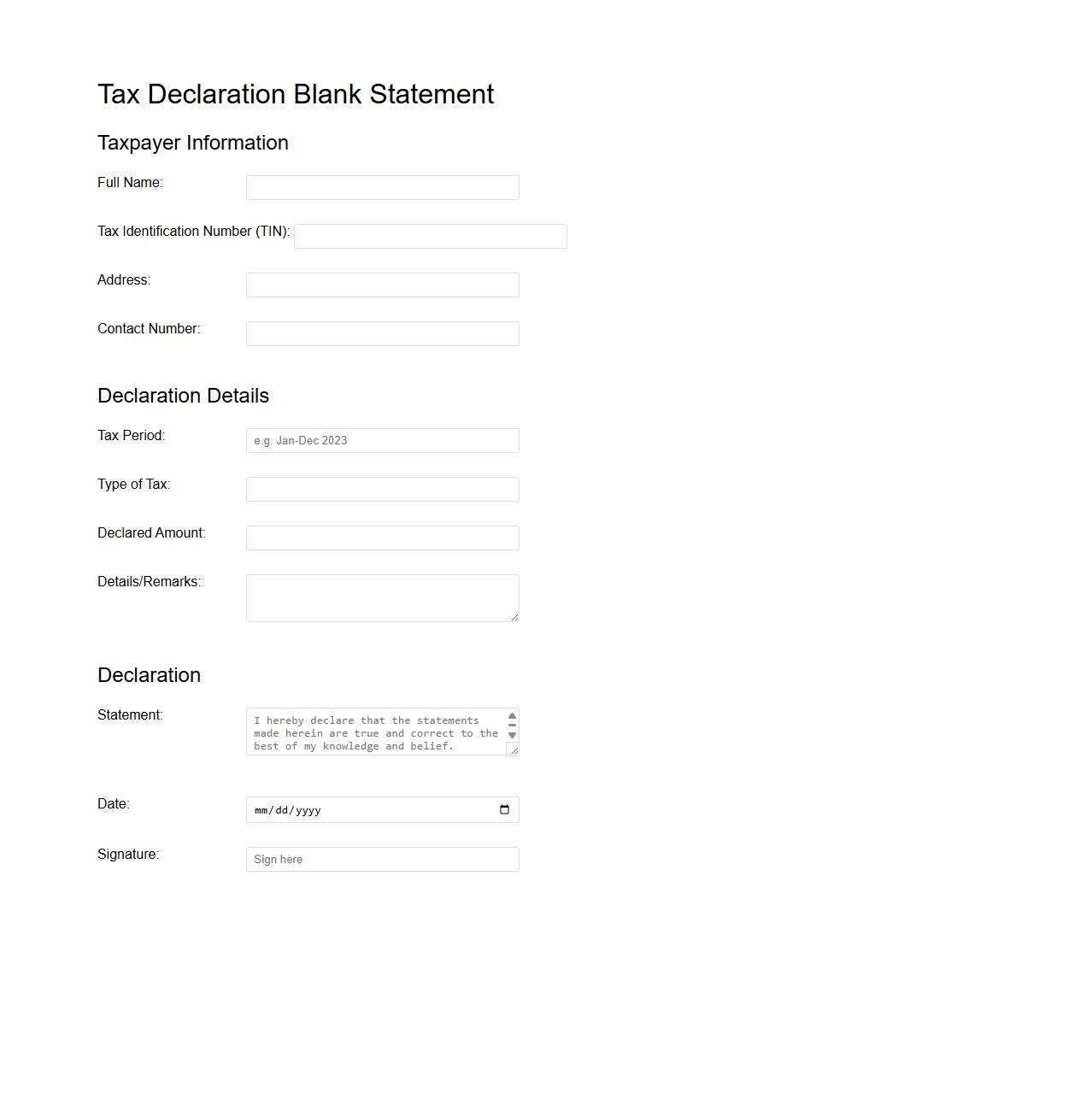

Tax Declaration Blank Statement

A

Tax Declaration Blank Statement is an official document used to report an individual's or entity's income, property, and other tax-related information to government tax authorities. It serves as a foundational form for assessing tax liabilities and ensures accurate computation of taxes owed based on declared assets and earnings. This document is essential for compliance with tax laws and helps prevent penalties arising from underreporting or non-disclosure of taxable information.

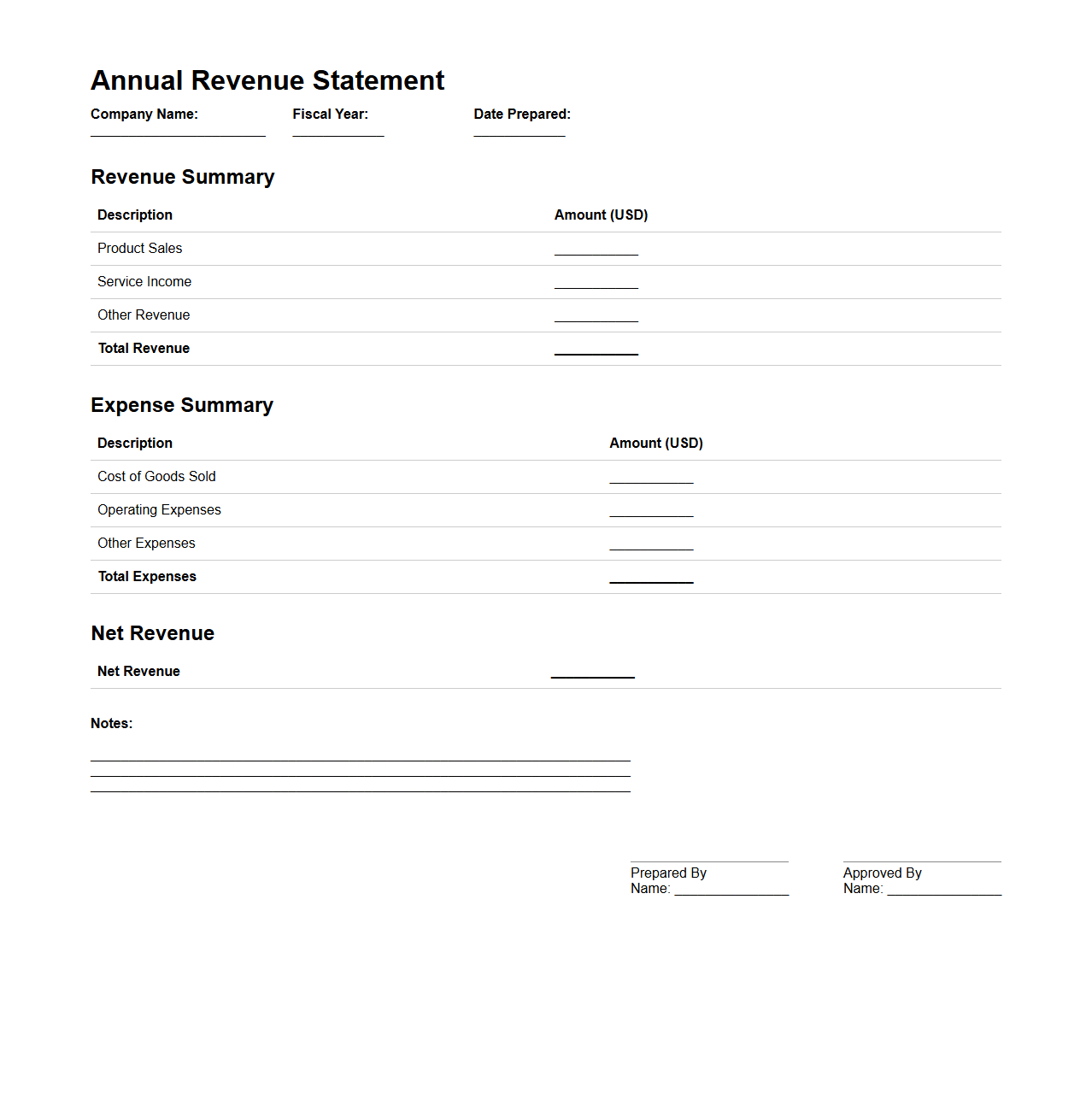

Annual Revenue Statement Template

An

Annual Revenue Statement Template is a structured document designed to systematically record and present an organization's yearly income from various sources. It provides a clear overview of financial performance, enabling businesses to track revenue trends, prepare budgets, and support strategic decision-making. This template typically includes sections for categorizing income streams, summarizing total earnings, and comparing fiscal periods for accurate financial analysis.

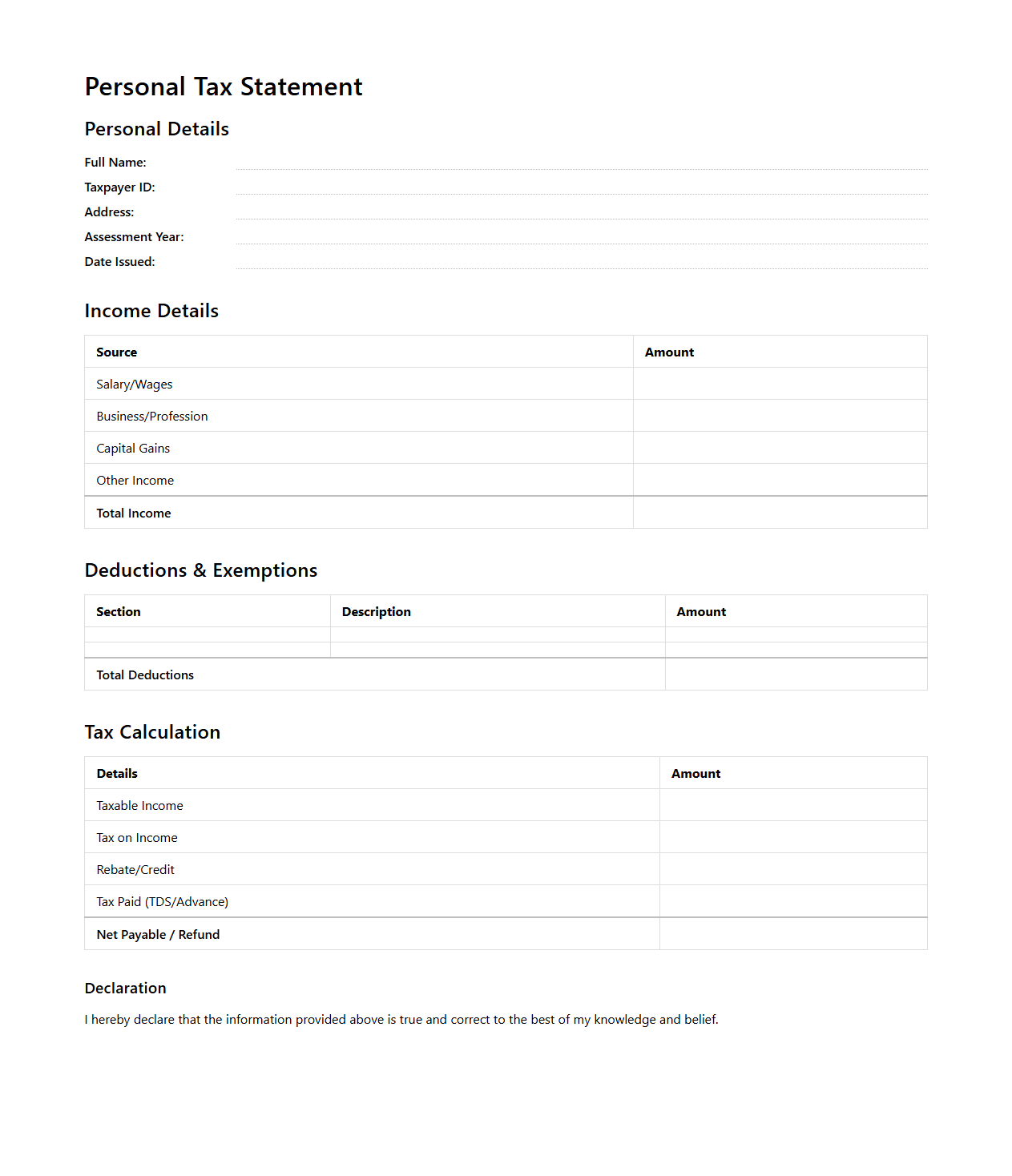

Personal Tax Statement Format

A

Personal Tax Statement Format document serves as a structured template to report an individual's income, deductions, and tax liabilities clearly and accurately. It ensures compliance with government regulations by organizing essential financial information needed for personal income tax filing. This format helps taxpayers and tax professionals efficiently track earnings, withholdings, and credits to simplify tax return preparation.

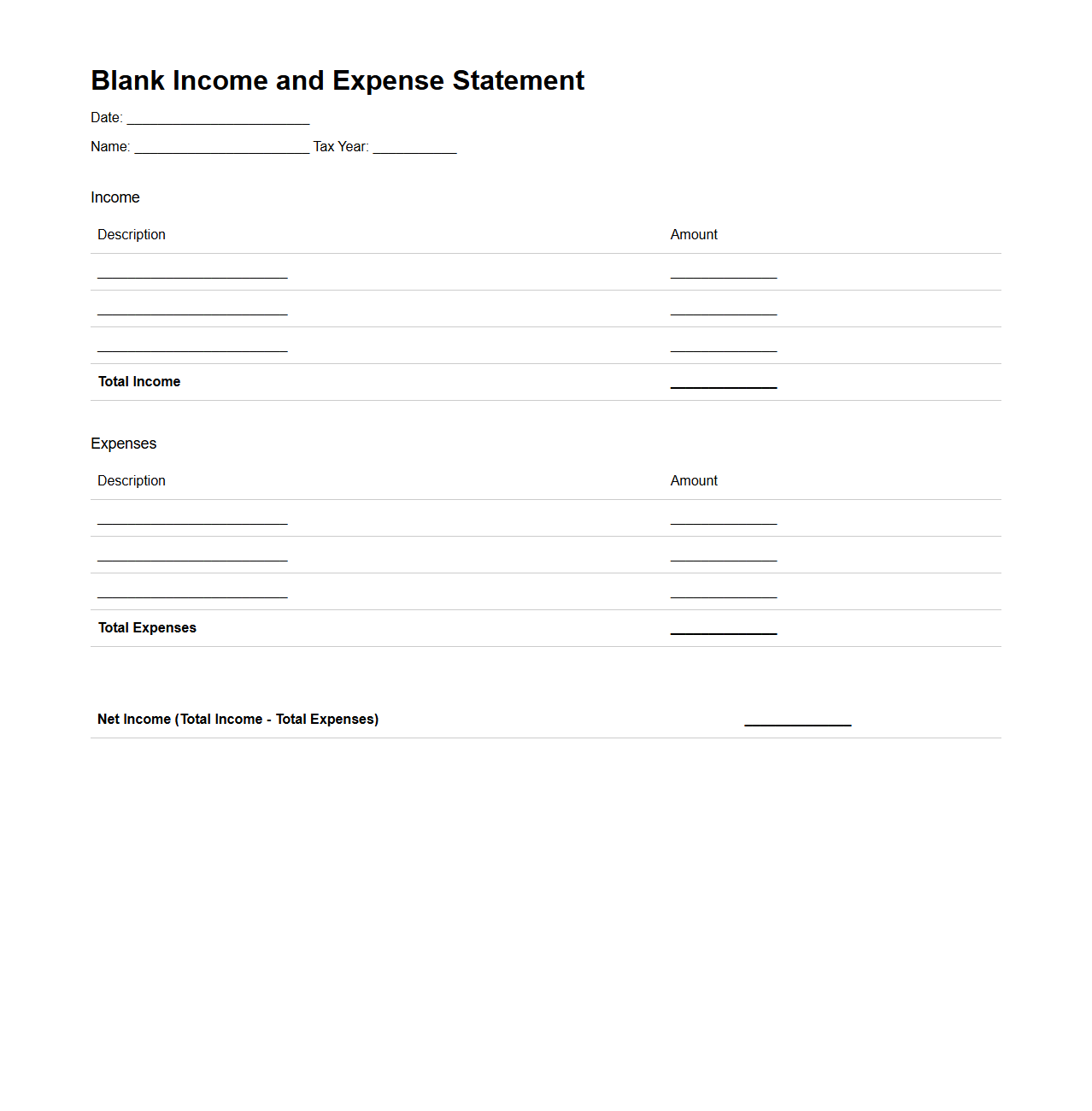

Blank Income and Expense Statement for Taxes

A

Blank Income and Expense Statement for Taxes is a financial document used to report income and deductible expenses in a standardized format for tax filing purposes. It helps individuals and businesses organize earnings and costs systematically, ensuring accurate calculation of taxable income. This statement is essential for tax compliance and audit readiness by providing clear documentation of financial activity.

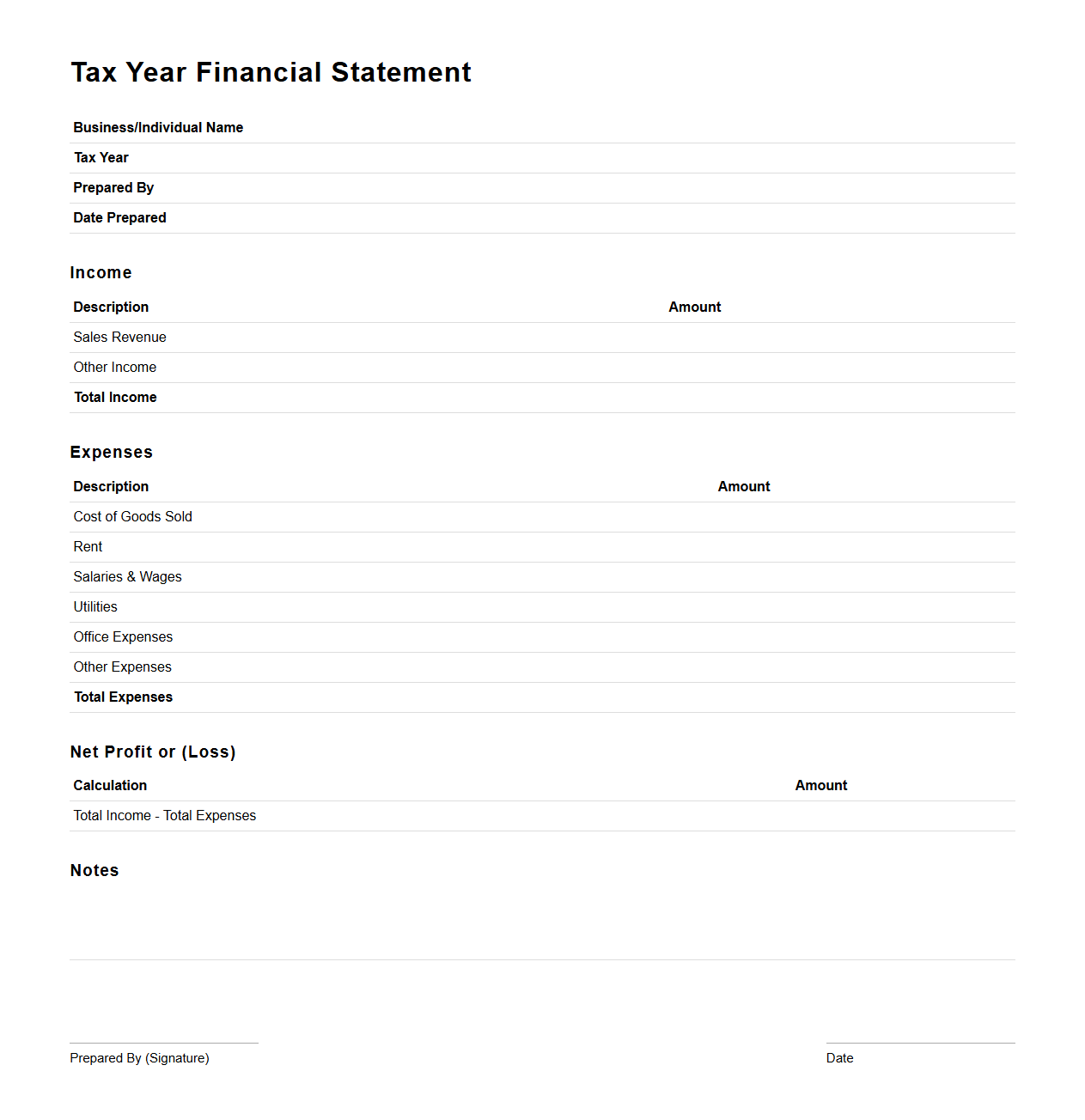

Tax Year Financial Statement Template

A

Tax Year Financial Statement Template document is designed to systematically organize and present financial data for a specific tax year, ensuring accurate reporting for tax filing purposes. This template includes sections for income, expenses, assets, liabilities, and other relevant financial information, streamlining the preparation of tax returns and compliance with tax authorities. Businesses and individuals use this document to maintain clarity and consistency in financial reporting, facilitating audits and financial analysis.

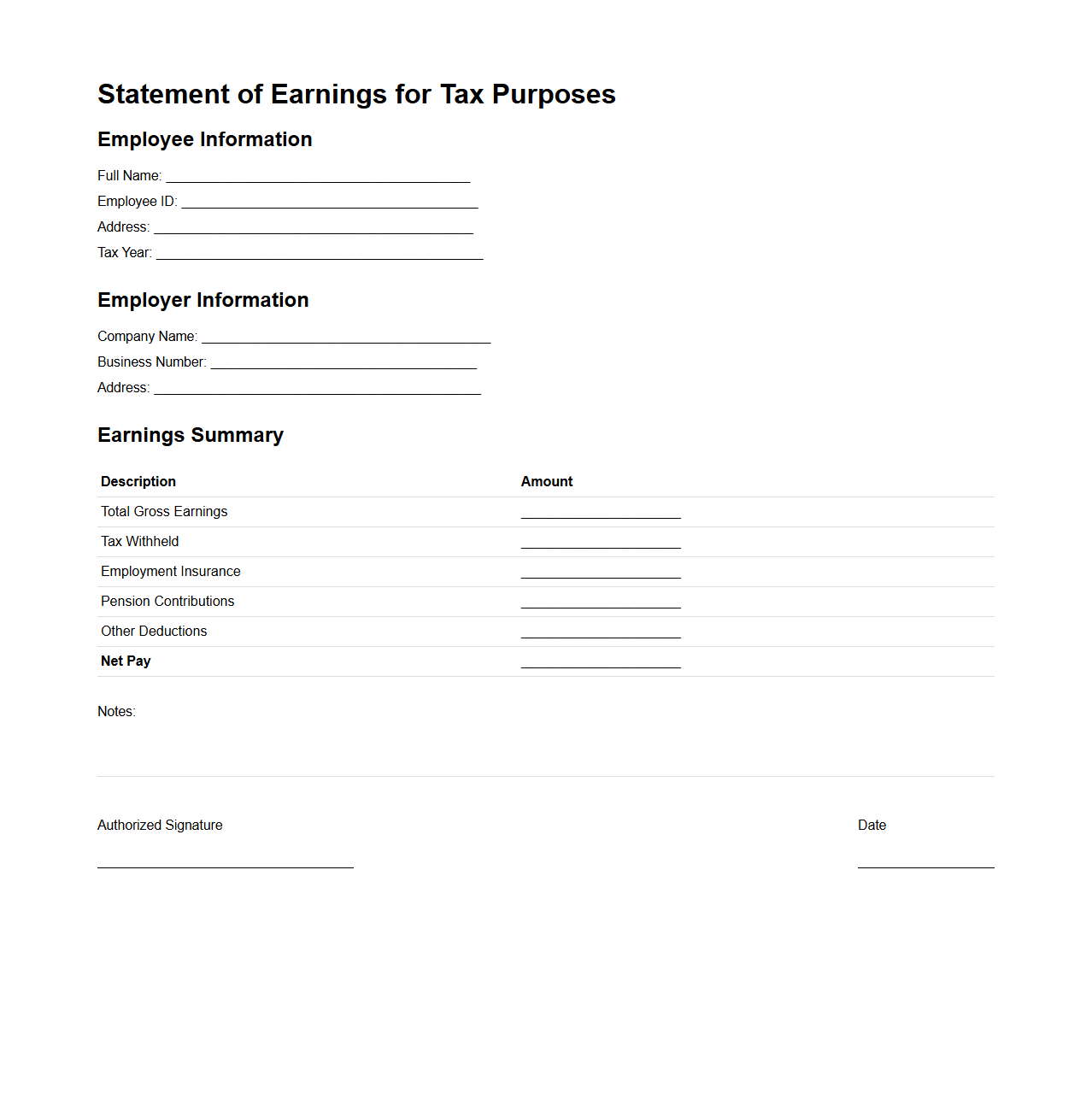

Statement of Earnings for Tax Purposes

A

Statement of Earnings for Tax Purposes is an official document outlining an individual's total income, including wages, bonuses, and taxable benefits, reported for a specific tax year. This statement is essential for accurately filing tax returns and calculating tax liabilities, ensuring compliance with tax authorities. Employers typically issue this document to employees, serving as a verified record of earnings reported to governmental tax agencies.

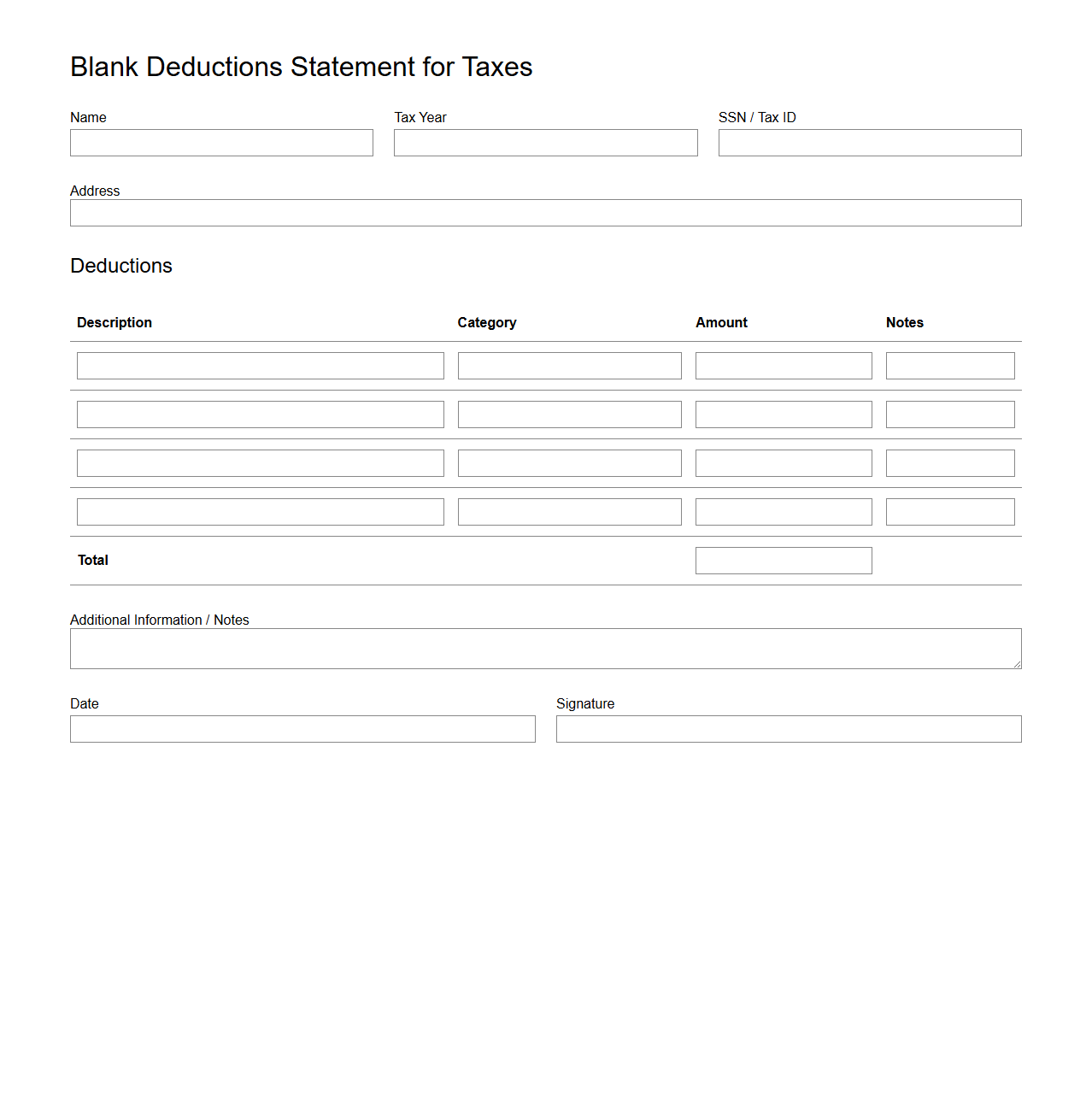

Blank Deductions Statement for Taxes

A

Blank Deductions Statement for Taxes is a document provided to taxpayers to itemize potential deductions that can reduce taxable income. It outlines various allowable expenses, such as mortgage interest, medical costs, and charitable contributions, which individuals can claim to lower their overall tax liability. This statement serves as a reference tool for accurate tax filing and ensures compliance with tax regulations.

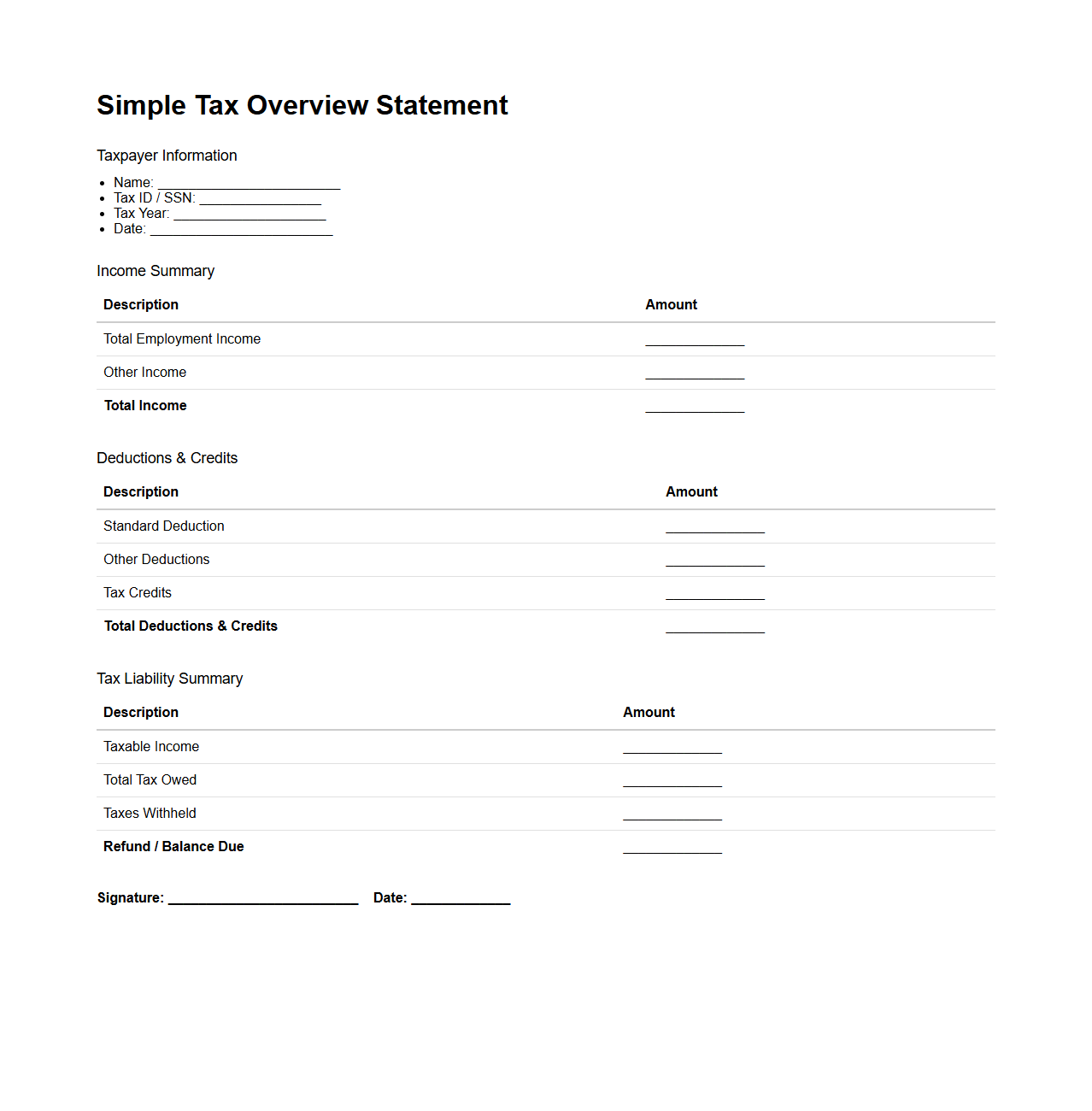

Simple Tax Overview Statement

A

Simple Tax Overview Statement document provides a clear and concise summary of an individual's or business's tax information for a specific period. It includes key details such as total income, taxable income, tax deductions, credits, and the final tax liability or refund status. This document is essential for understanding overall tax obligations and facilitating accurate tax filing or financial planning.

What information needs to be included in a blank statement for tax return documentation?

A blank statement for tax return documentation should clearly identify the taxpayer by including full name, Social Security Number (SSN), and tax year. It must state the purpose of the statement, such as explaining missing documents or income details. Additionally, a declaration that the information provided is true and accurate is essential for validation.

How do I format a blank statement for supporting evidence in tax audits?

The format of a blank statement for tax audits should start with a heading specifying it is supporting evidence for a tax audit. The body must include concise factual information and explanations relevant to the audit request. Finally, it should be signed and dated by the taxpayer or authorized representative for authenticity.

Are notarized blank statements required for specific tax return claims?

Notarization of blank statements is not generally required but may be necessary for certain claims such as affidavits or statements involving legal verification. The IRS occasionally requests notarized documents to ensure authenticity in cases of substantial claims or disputes. Taxpayers should check specific IRS guidelines or consult a tax professional for documents that require notarization.

Can a blank statement be used to declare zero income on a tax return?

A blank statement cannot replace proper income documentation but may accompany a tax return to declare zero income or explain the absence of records. It should clearly state that the taxpayer had no income during the reporting period and provide any relevant context. However, official forms and supporting schedules are required by the IRS for accurate reporting.

What are the IRS guidelines for attaching blank statements to amended tax returns?

The IRS allows attaching blank statements to amended returns (Form 1040-X) if they provide necessary explanations or supporting information. Statements must be clear, relevant, and signed to facilitate proper review of changes made. Taxpayers should ensure that any additional documents comply with IRS instructions to avoid processing delays.