A Blank Statement of Changes in Equity Template for Financial Reporting provides a structured format to record and present changes in a company's equity over a specific period. It highlights adjustments such as retained earnings, share capital, and other comprehensive income, ensuring transparency and compliance with accounting standards. This template is essential for accurate financial analysis and stakeholder communication.

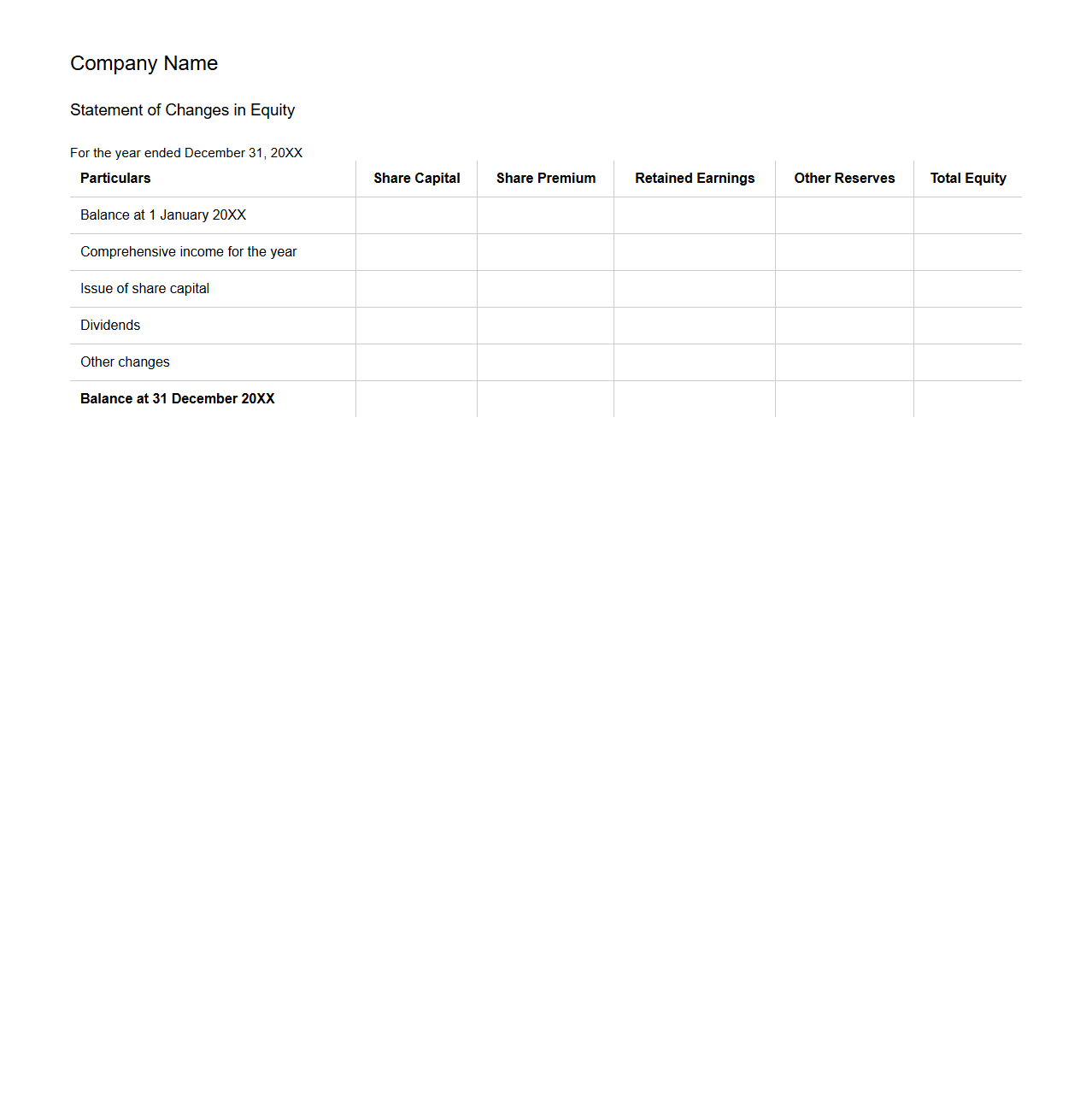

Standard Statement of Changes in Equity Template

The

Standard Statement of Changes in Equity Template document is a financial statement format used to summarize the changes in a company's equity during a specific accounting period. It details transactions such as retained earnings, share capital adjustments, dividends, and other comprehensive income components. This template helps maintain transparent record-keeping and facilitates accurate financial analysis for stakeholders.

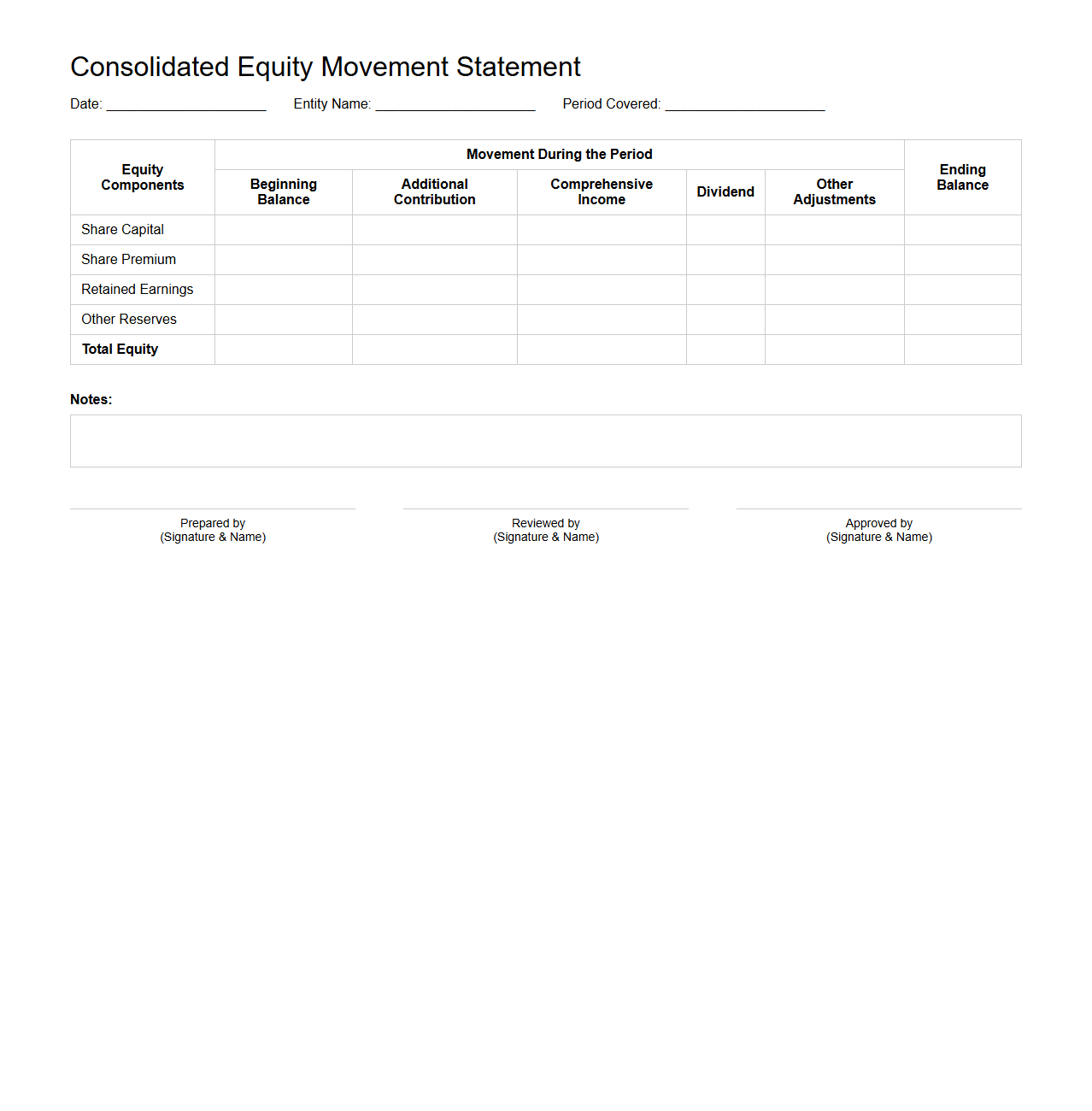

Consolidated Equity Movement Statement Form

A

Consolidated Equity Movement Statement Form document provides a detailed record of changes in shareholders' equity across multiple subsidiaries or business units within a parent company. It captures transactions such as share issuances, dividends, retained earnings adjustments, and other equity movements consolidated at the group level. This form is essential for accurately reflecting the overall financial position and equity structure in consolidated financial statements.

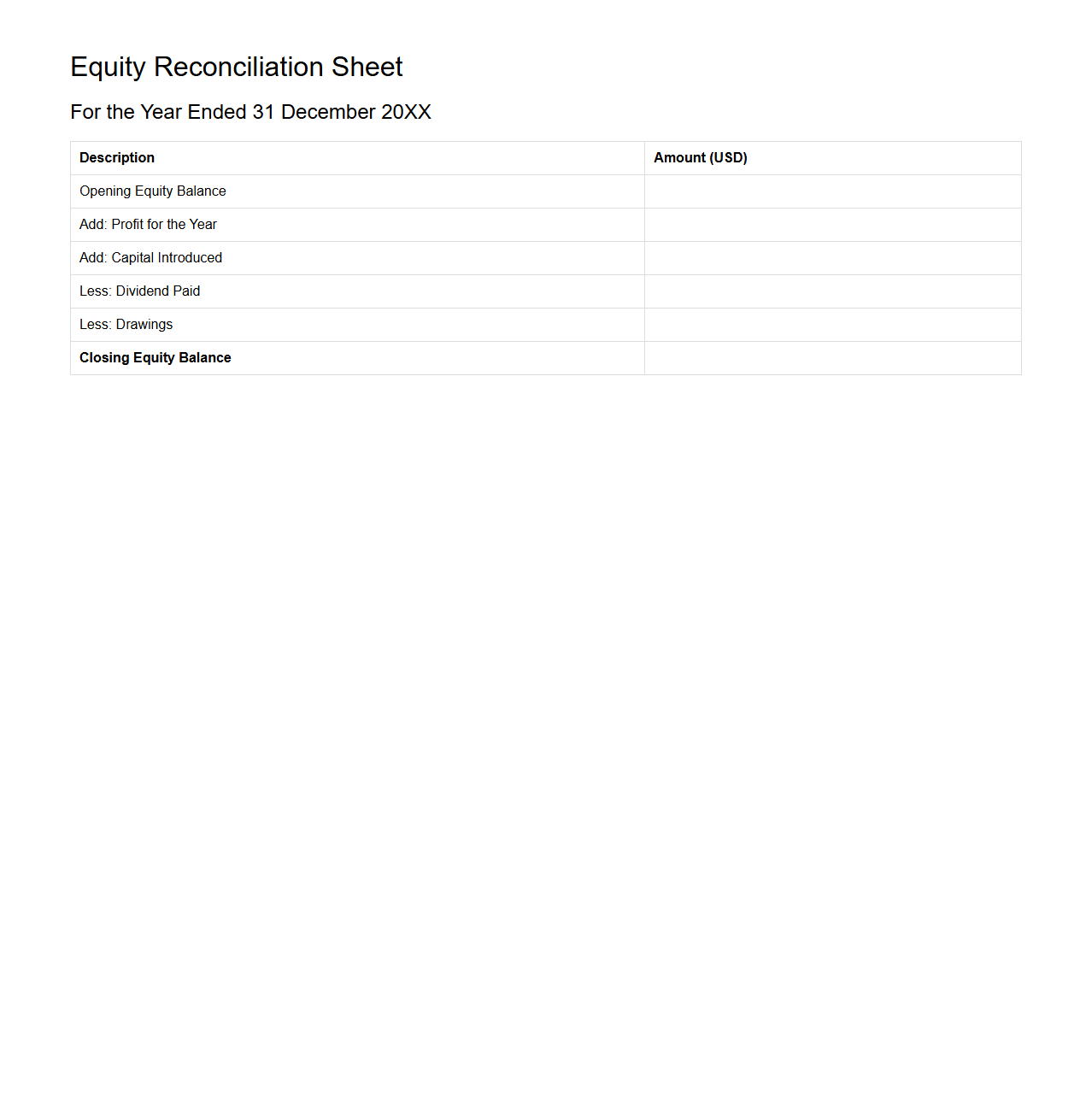

Opening and Closing Equity Reconciliation Sheet

The

Opening and Closing Equity Reconciliation Sheet is a financial document that tracks changes in shareholders' equity over a specific accounting period. It outlines the beginning equity balance, adjustments, net income or loss, dividends paid, and ending equity, providing transparency on equity fluctuations. This reconciliation is essential for maintaining accurate financial statements and ensuring compliance with accounting standards.

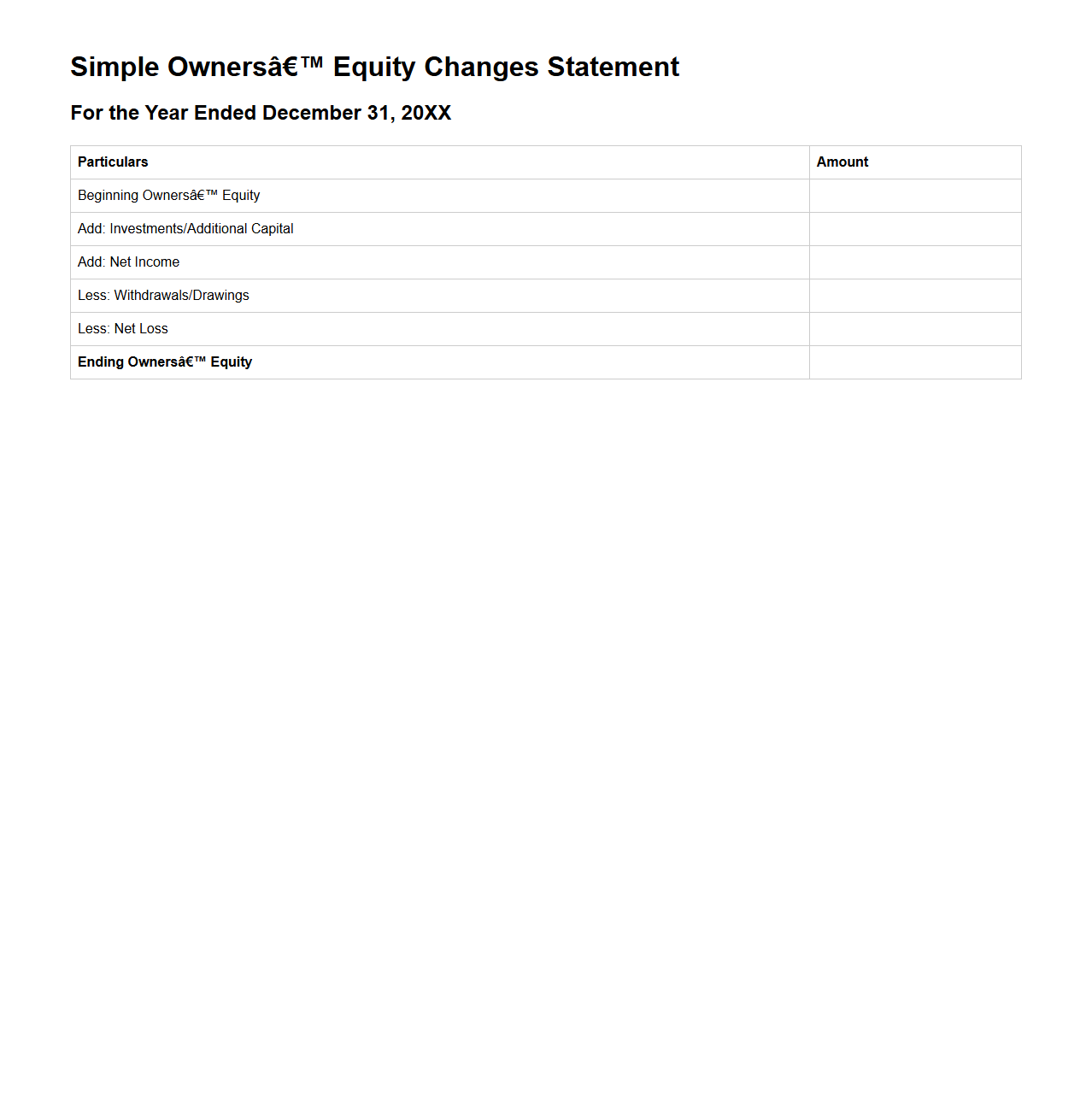

Simple Owners’ Equity Changes Statement

The

Simple Owners' Equity Changes Statement document summarizes the fluctuations in an owner's equity over a specific accounting period, detailing contributions, withdrawals, and net income or loss. It provides a clear insight into how these factors impact the overall equity balance, helping stakeholders understand the financial position of a business. This statement is crucial for tracking ownership interests and ensuring accurate financial reporting.

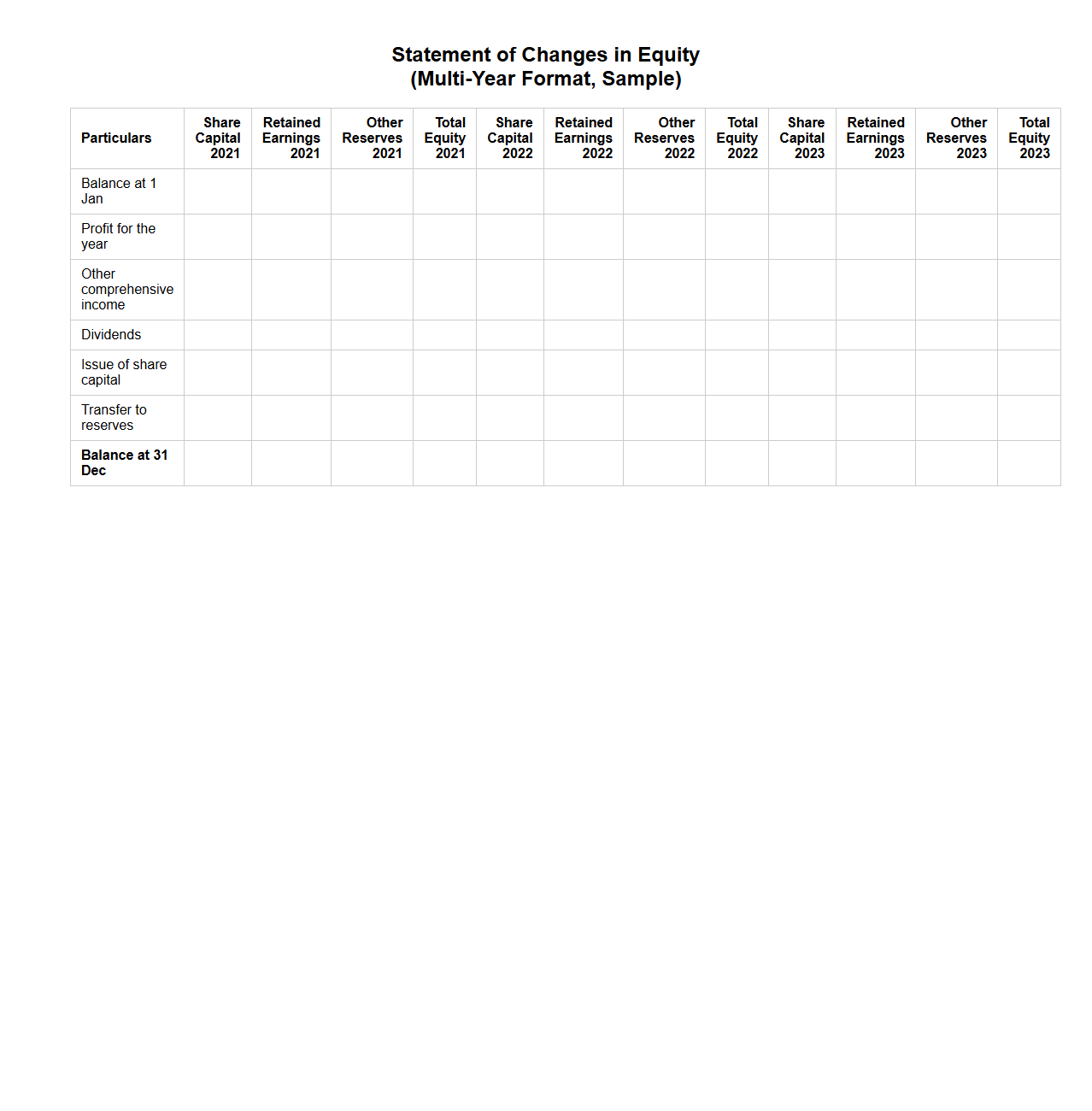

Multi-Year Changes in Equity Format

The

Multi-Year Changes in Equity Format document provides a comprehensive overview of shareholders' equity movements over multiple fiscal periods. It details components such as share capital, retained earnings, reserves, and other comprehensive income changes, allowing stakeholders to analyze trends and assess financial stability. This format facilitates transparency and consistency in reporting equity fluctuations for investors, auditors, and regulatory bodies.

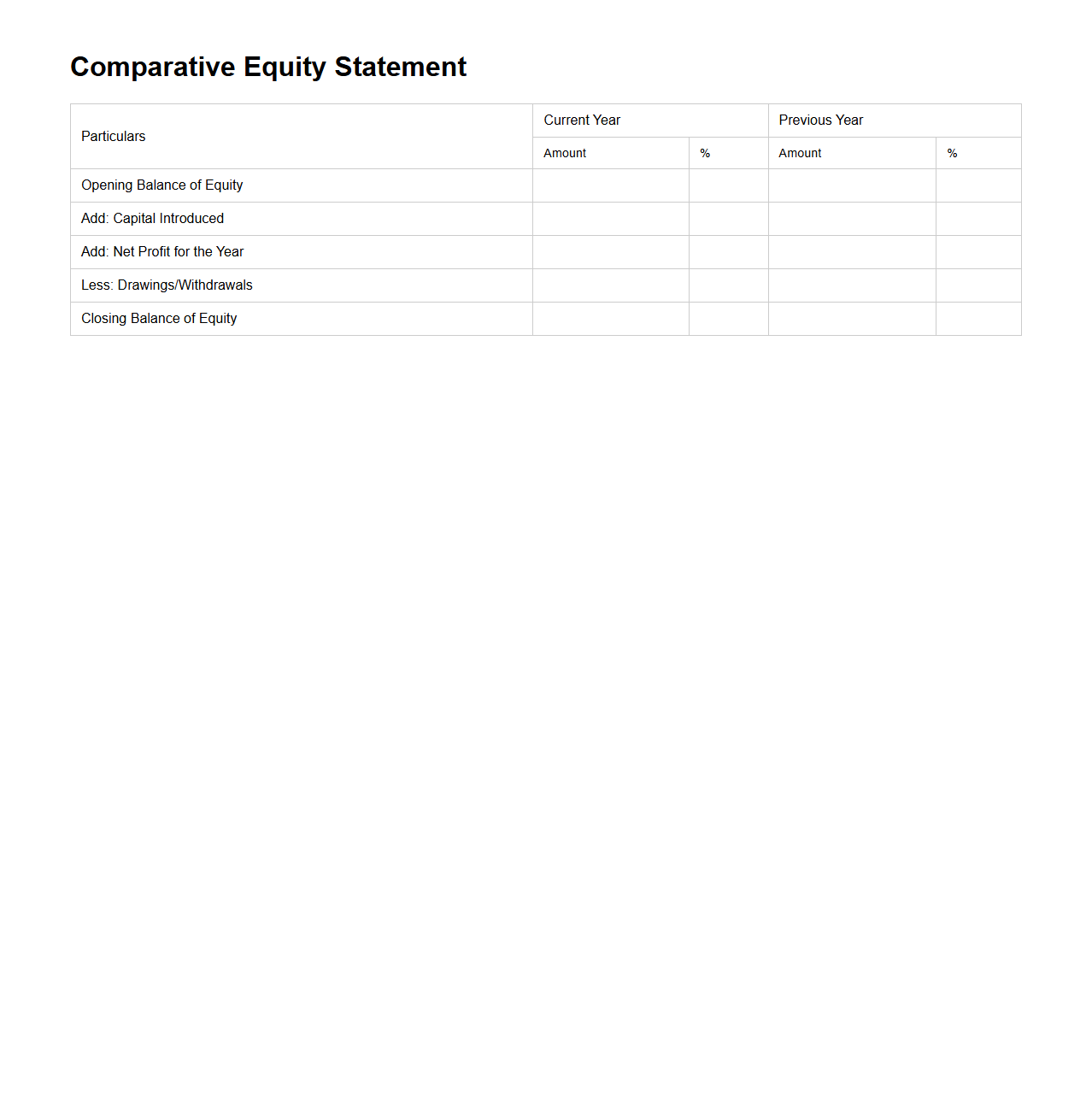

Comparative Equity Statement Spreadsheet

A

Comparative Equity Statement Spreadsheet document systematically tracks changes in owners' equity over specific accounting periods by organizing data such as retained earnings, common stock, and dividends. This spreadsheet facilitates clear, side-by-side comparisons of equity components across multiple periods, improving accuracy in financial analysis and reporting. Businesses utilize it to assess growth trends and inform strategic decisions based on equity fluctuations.

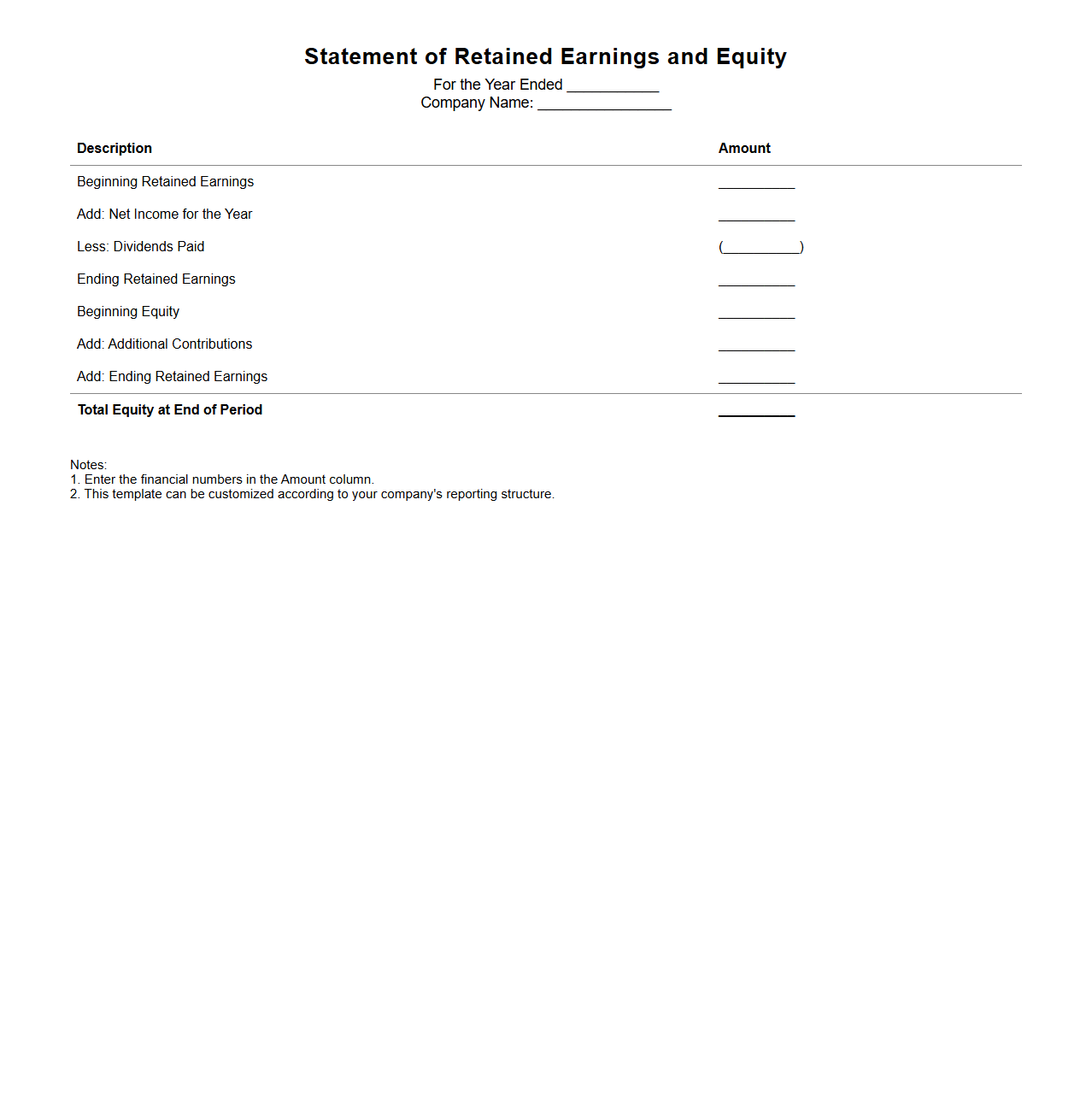

Statement of Retained Earnings and Equity Template

The

Statement of Retained Earnings and Equity Template document provides a structured format to summarize changes in a company's equity over a specific period, highlighting retained earnings, contributed capital, and other equity components. It tracks how net income, dividends, and owner investments impact the overall equity balance, offering crucial insights for financial analysis and reporting. This template ensures consistency and accuracy in presenting shareholder equity information for internal management and external stakeholders.

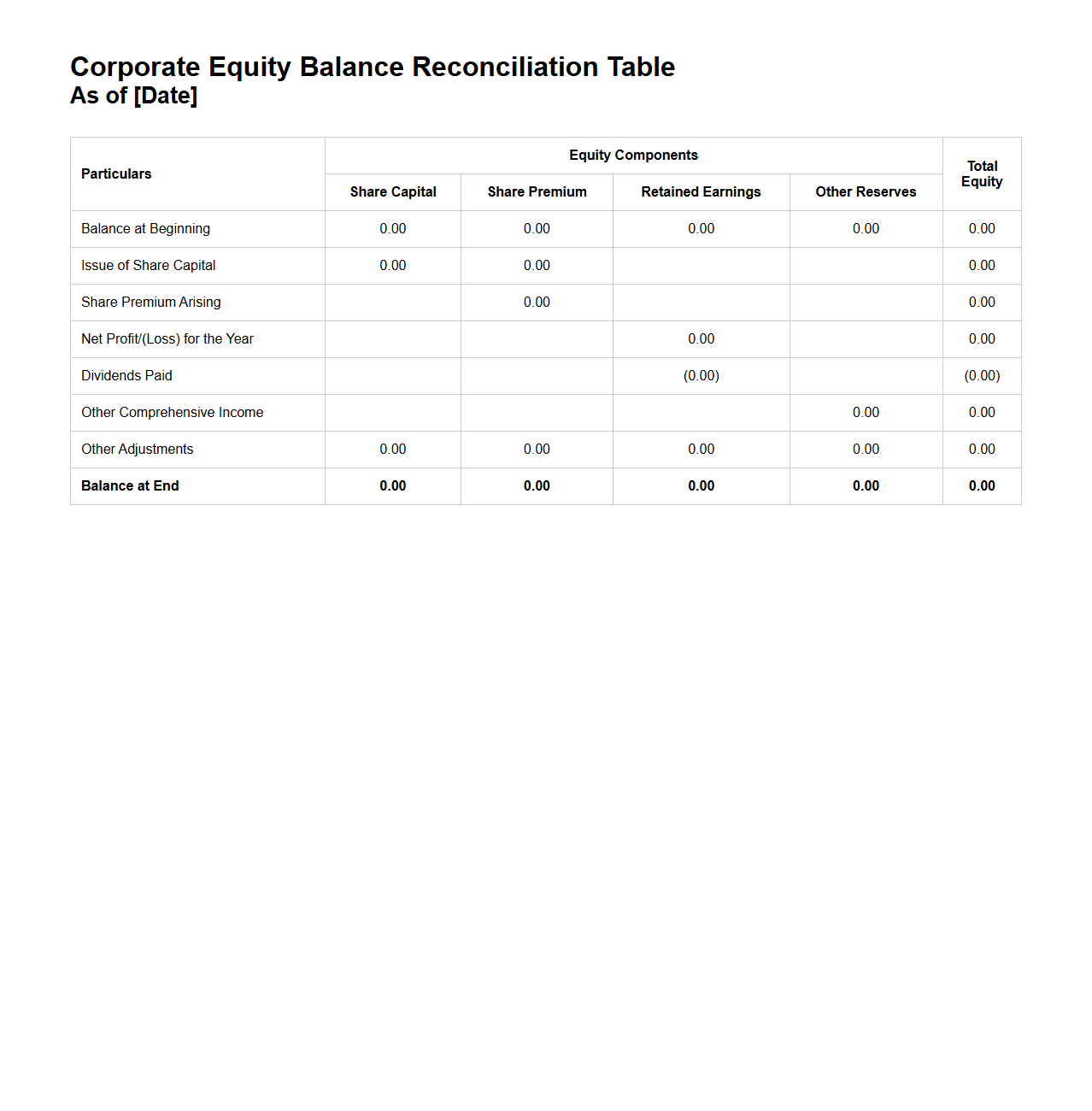

Corporate Equity Balance Reconciliation Table

The

Corporate Equity Balance Reconciliation Table document systematically tracks changes in a company's equity accounts over a specific period, detailing transactions such as retained earnings, stock issuances, and dividends. It serves as a crucial financial tool for reconciling beginning and ending equity balances, ensuring accuracy in shareholders' equity reporting. This document supports transparent financial analysis and enhances the reliability of corporate financial statements.

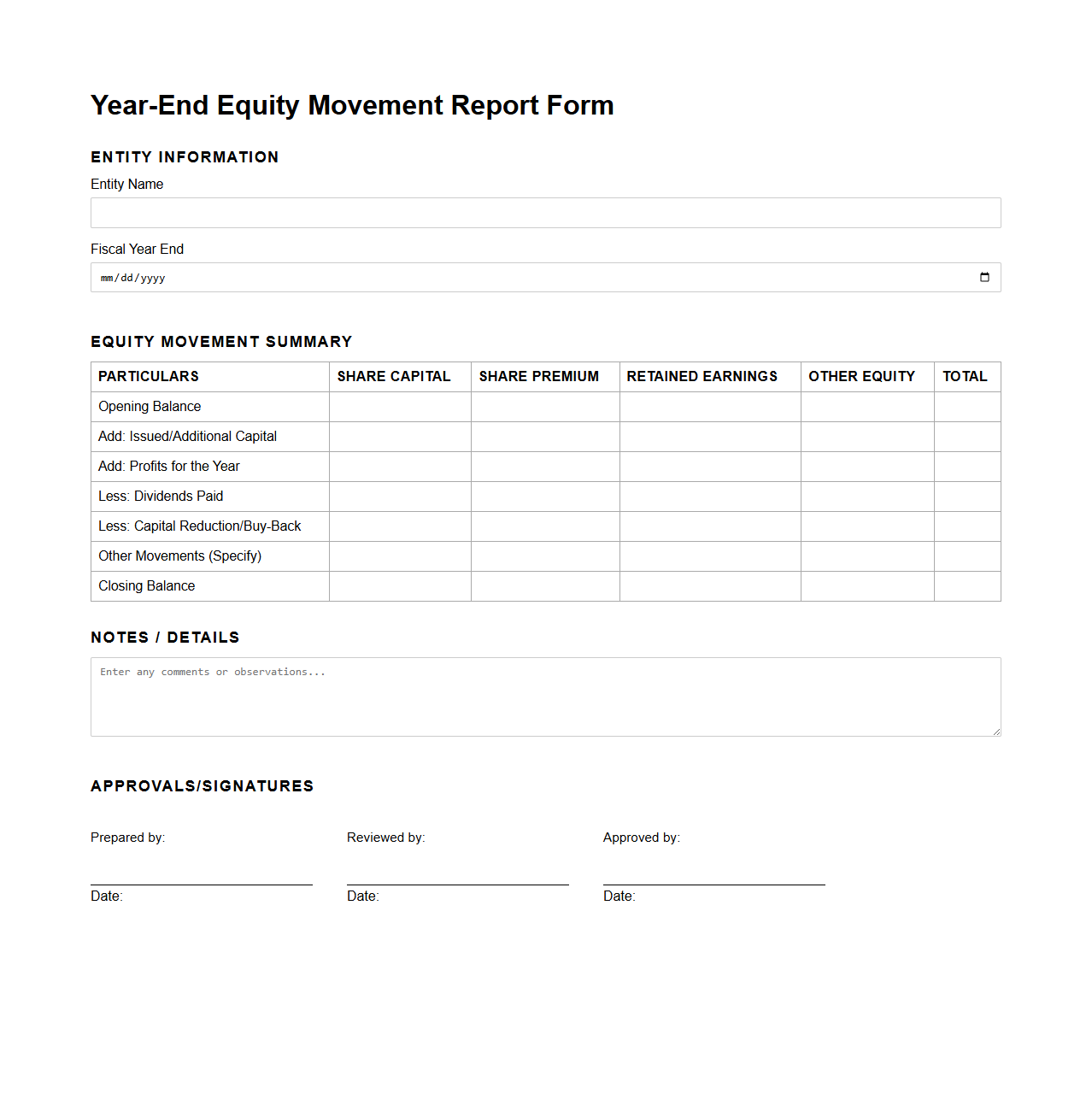

Year-End Equity Movement Report Form

The

Year-End Equity Movement Report Form is a financial document used to track changes in equity accounts over the fiscal year, including stock issuance, buybacks, dividends, and other equity-related transactions. This report provides a detailed summary that supports accurate financial statement preparation and compliance with accounting standards. Companies use this form to ensure transparency and consistency in reporting shareholders' equity fluctuations.

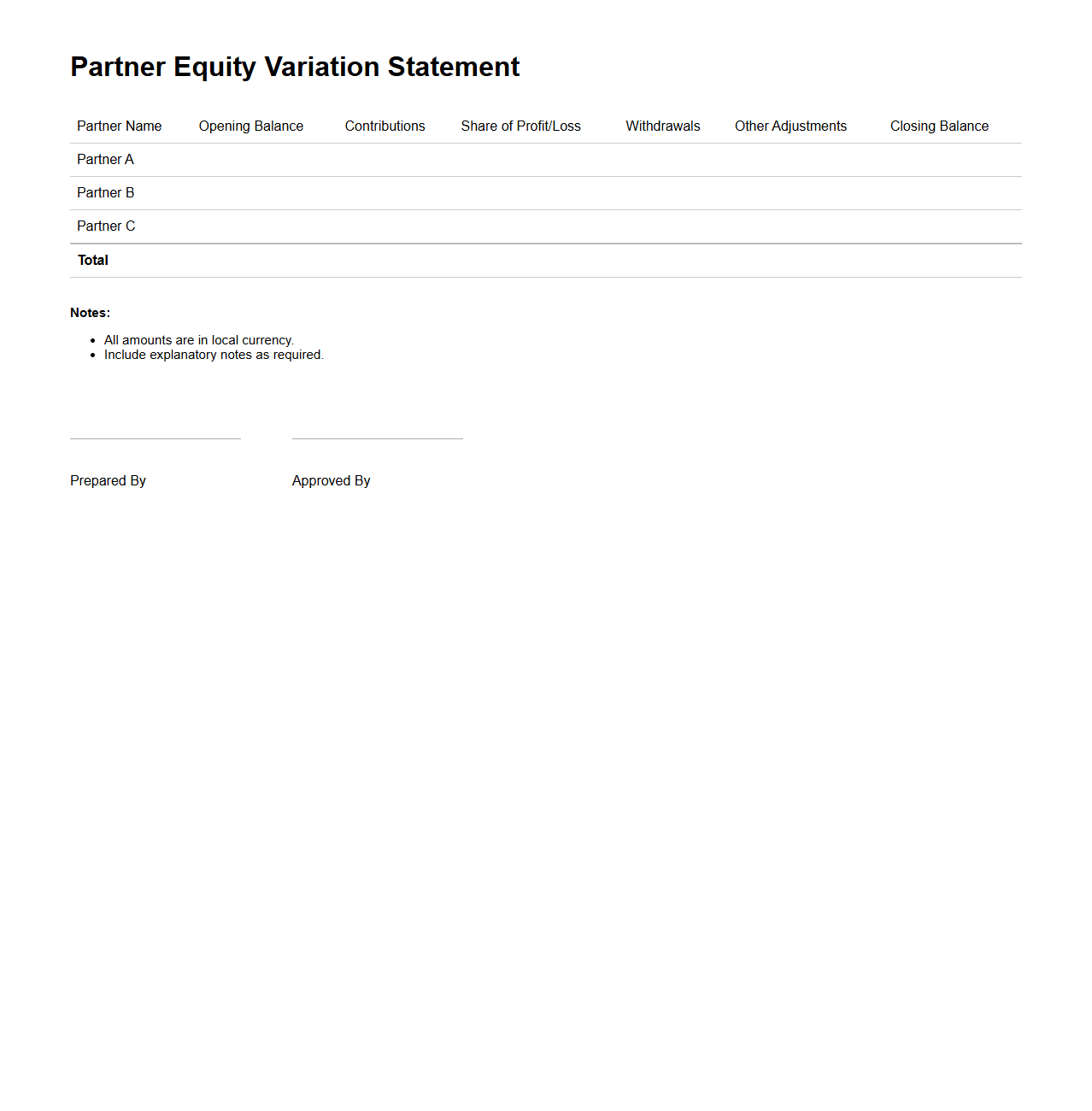

Partner Equity Variation Statement Layout

The

Partner Equity Variation Statement Layout document outlines the format and structure used to report changes in partner equity within a business partnership. It details how variations such as capital contributions, profit distributions, and withdrawals should be presented to ensure clarity and consistency in financial reporting. This layout helps stakeholders accurately track and analyze shifts in partner ownership over time.

What key disclosures are required in a blank Statement of Changes in Equity template for compliance?

The key disclosures in a blank Statement of Changes in Equity template must include components such as share capital, retained earnings, and reserves. It should also disclose any transactions with owners, including dividends and issuance or repurchase of shares. Transparency in changes due to comprehensive income is essential for compliance.

How should prior period adjustments be presented on a blank Statement of Changes in Equity?

Prior period adjustments must be clearly disclosed as separate line items on the Statement of Changes in Equity to avoid confusion. These adjustments typically appear as a distinct reconciliation from the opening balance of equity. Proper presentation ensures that users can understand impacts on retained earnings and other equity components.

What column headings are typically included in a standardized blank equity statement form?

Standardized column headings in a blank Statement of Changes in Equity include Share Capital, Retained Earnings, Other Reserves, and Total Equity. Additional columns may capture components such as non-controlling interests for consolidated statements. Clear labeling enhances the statement's readability and comparability.

Which financial reporting standards govern the minimum content of a Statement of Changes in Equity?

The minimum content requirements for a Statement of Changes in Equity are governed by IAS 1 (International Accounting Standard 1) under IFRS and ASC Topic 220 for US GAAP. These standards define the presentation, required disclosures, and reconciliation of equity components. Adhering to these standards ensures global compliance and consistency.

How is the blank Statement of Changes in Equity formatted for group versus individual entity reporting?

For group reporting, the Statement of Changes in Equity includes columns for non-controlling interests alongside parent equity components. Individual entity statements focus on the entity's own equity without consolidation effects. Formatting differences must reflect these reporting scopes for accurate financial representation.