A Blank Promissory Note Template for Debt Acknowledgment provides a customizable and legally binding document for recording loan agreements between parties. It clearly outlines the terms of repayment, including the principal amount, interest rate, and due date, ensuring both lender and borrower have a mutual understanding. This template helps prevent disputes by formally acknowledging the debt and the obligation to repay under agreed conditions.

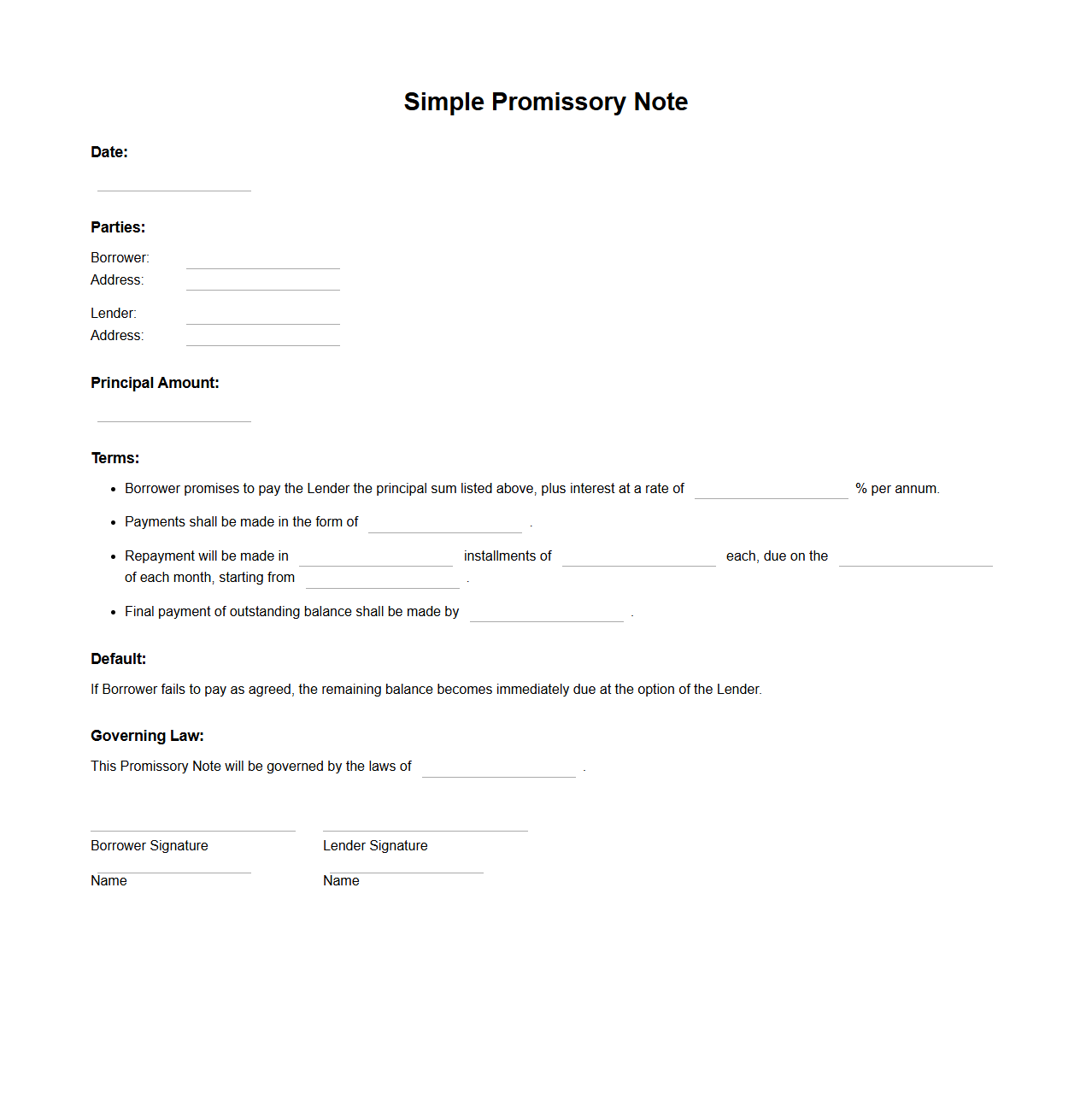

Simple Promissory Note Template for Loan Agreements

A

Simple Promissory Note Template for Loan Agreements is a legally binding document that outlines the terms of a loan between a lender and borrower in a straightforward format. It includes essential details such as the loan amount, interest rate, repayment schedule, and signatures of both parties to ensure clarity and enforceability. This template serves as a crucial tool for formalizing personal or business loans, protecting the interests of both lender and borrower.

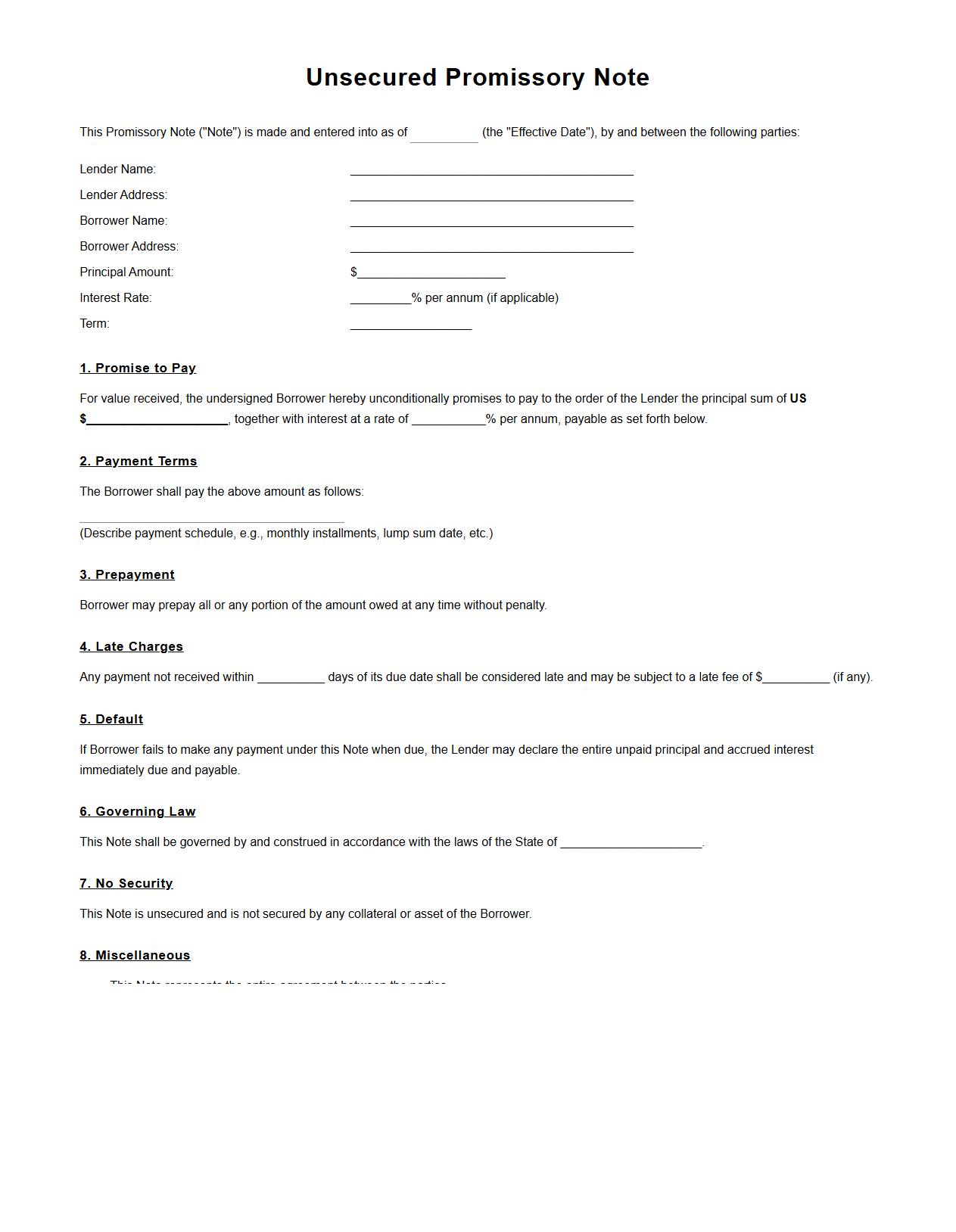

Unsecured Promissory Note Document for Personal Loans

An

Unsecured Promissory Note Document for personal loans is a legal agreement between a borrower and lender that outlines the loan terms without requiring collateral. It specifies the loan amount, interest rate, repayment schedule, and consequences of default. This document serves as a formal promise to repay the debt, providing legal protection for both parties.

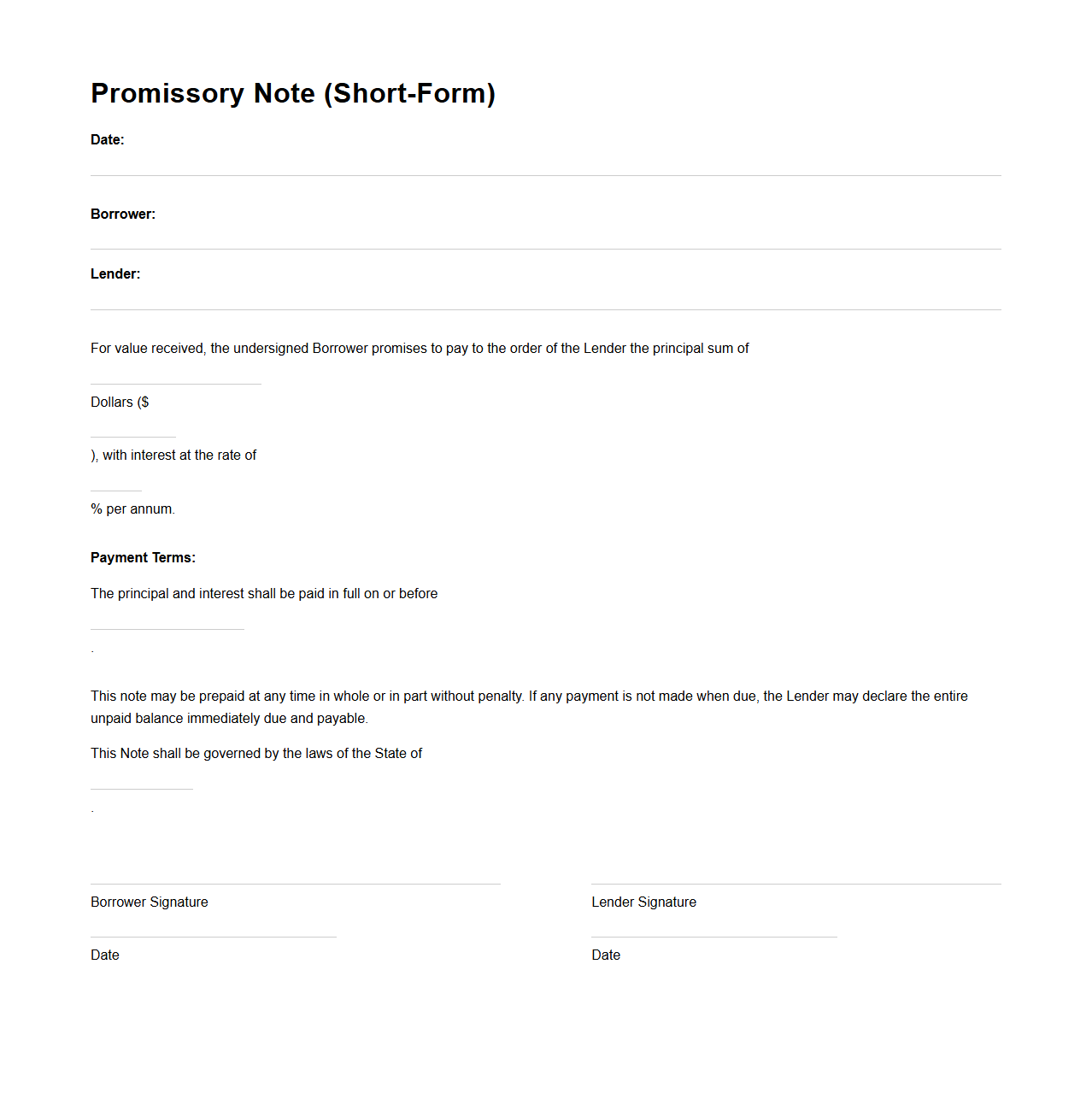

Short-Form Promissory Note for Borrowed Money

A

Short-Form Promissory Note for borrowed money is a concise legal document that outlines the borrower's promise to repay a specified amount to the lender under agreed terms. It typically includes essential details such as the loan amount, interest rate, repayment schedule, and maturity date, providing clear evidence of the debt. This streamlined note ensures enforceability while minimizing complexity for straightforward lending transactions.

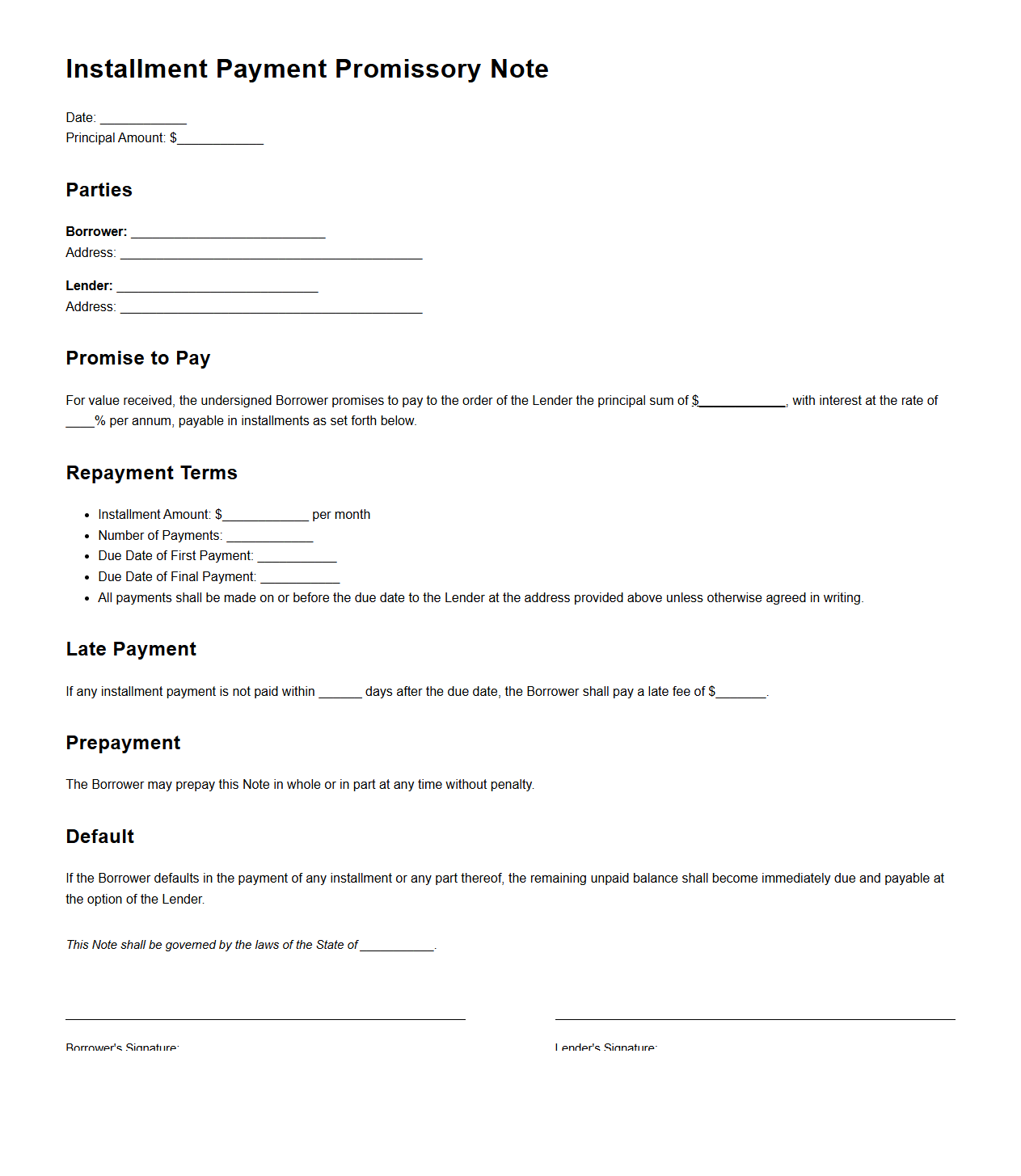

Installment Payment Promissory Note for Debt Repayment

An

Installment Payment Promissory Note for Debt Repayment is a legal document outlining the borrower's commitment to repay a specified debt through scheduled, periodic payments. It clearly details the total amount owed, installment amounts, payment due dates, interest rates, and consequences for missed or late payments. This document serves as a formal agreement protecting both lender and borrower by establishing clear repayment terms and obligations.

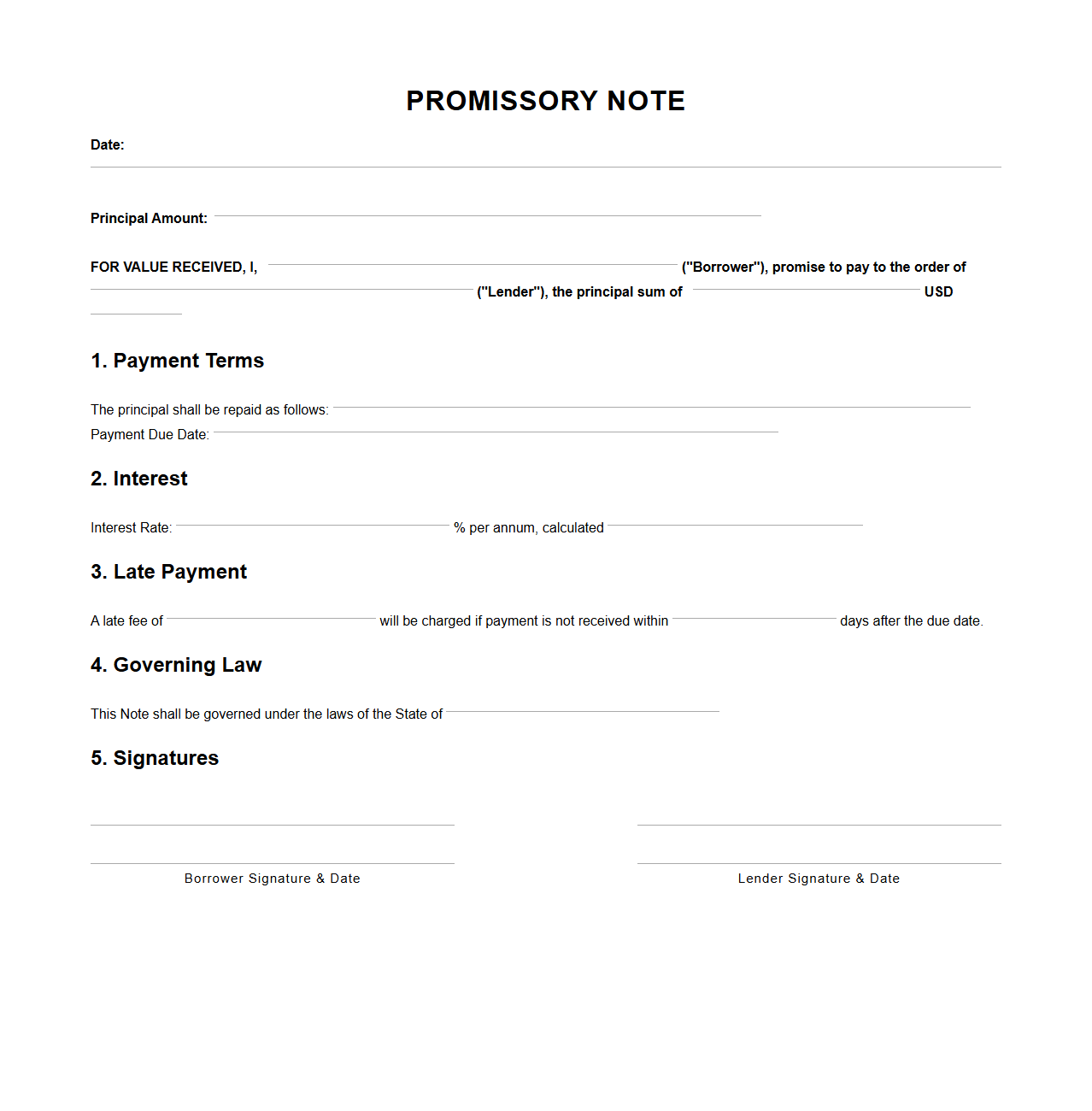

One-Page Promissory Note for Financial Obligations

A

One-Page Promissory Note for Financial Obligations is a concise, legally binding document outlining the terms under which one party promises to repay a debt to another. It typically includes essential details such as the principal amount, interest rate, repayment schedule, and maturity date. This streamlined format ensures clarity and efficiency in documenting loan agreements or financial commitments.

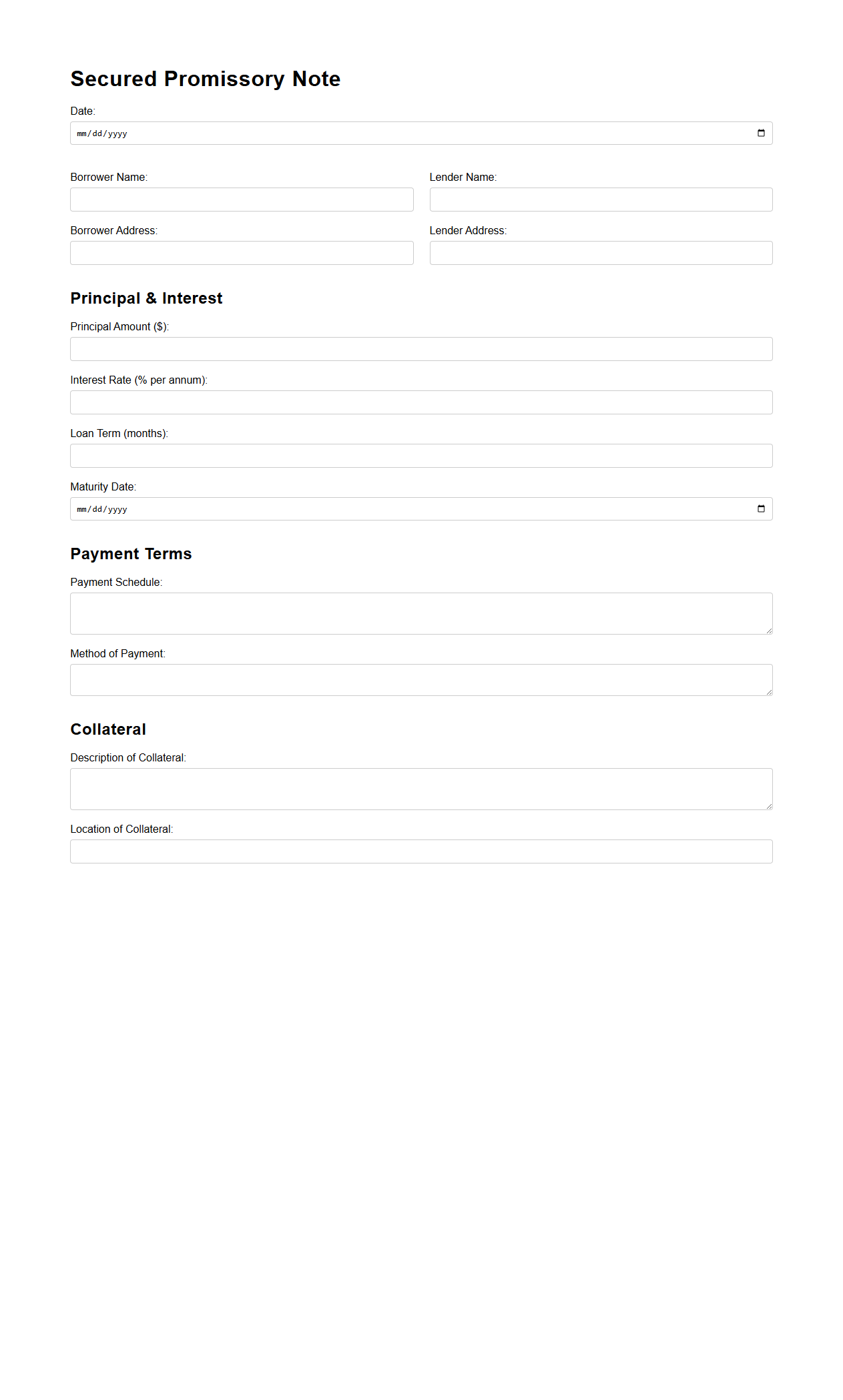

Secured Promissory Note Form for Collateralized Loans

A

Secured Promissory Note Form for Collateralized Loans is a legal document that outlines the terms and conditions under which a borrower agrees to repay a loan secured by specific collateral. This form specifies the loan amount, interest rate, repayment schedule, and consequences of default, ensuring both parties understand their rights and obligations. It serves as a binding agreement that protects the lender's interest by using the collateral as security for the loan.

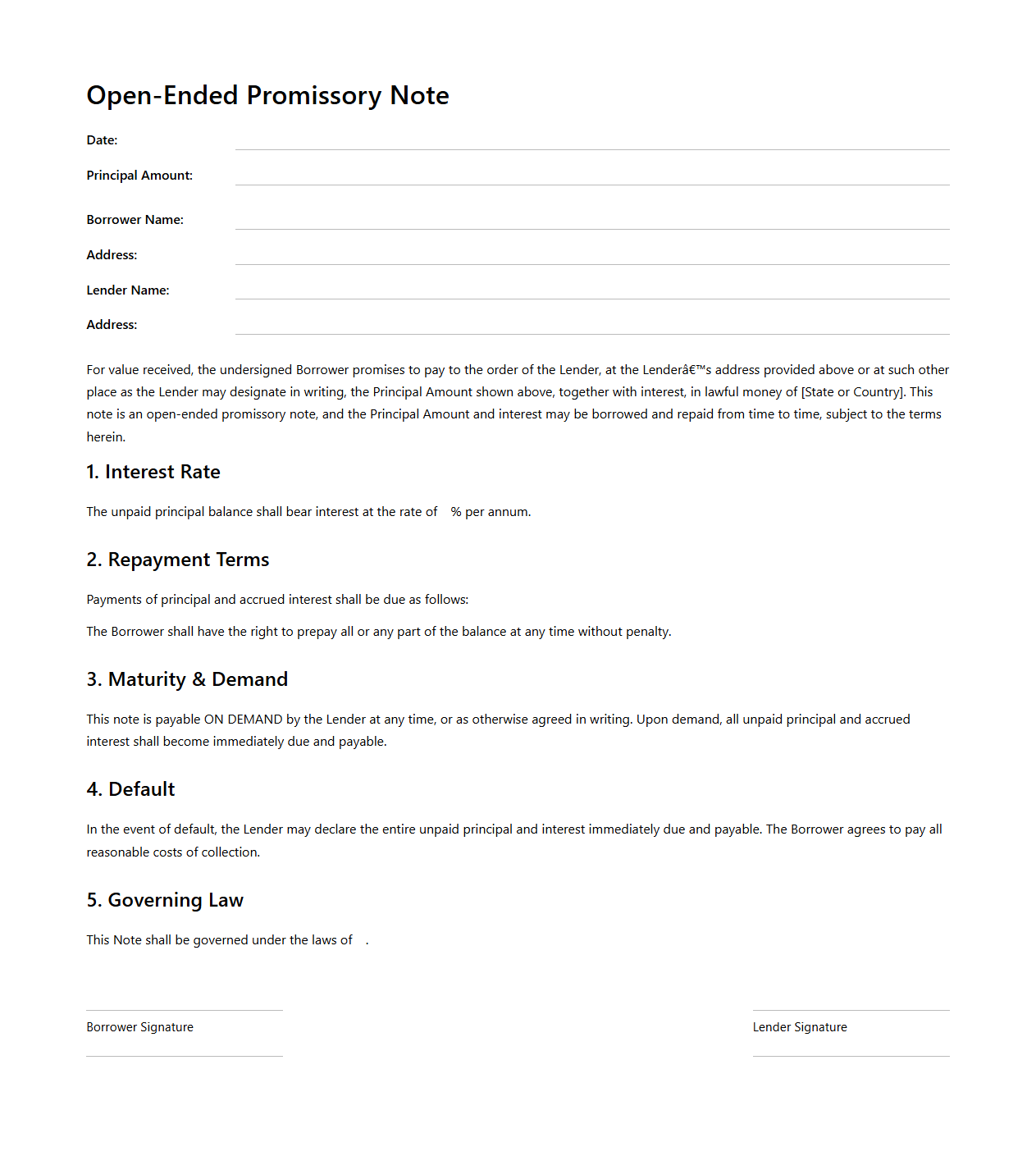

Open-Ended Promissory Note for Flexible Repayment

An

Open-Ended Promissory Note for Flexible Repayment is a financial instrument that allows borrowers to repay the loan amount without a fixed end date, accommodating varying payment schedules. This document outlines the borrower's obligation to pay the lender while providing flexibility in repayment amounts and timing, often used in personal or business loans requiring adaptable terms. It ensures clear terms of debt acknowledgement and repayment conditions, enhancing trust between parties.

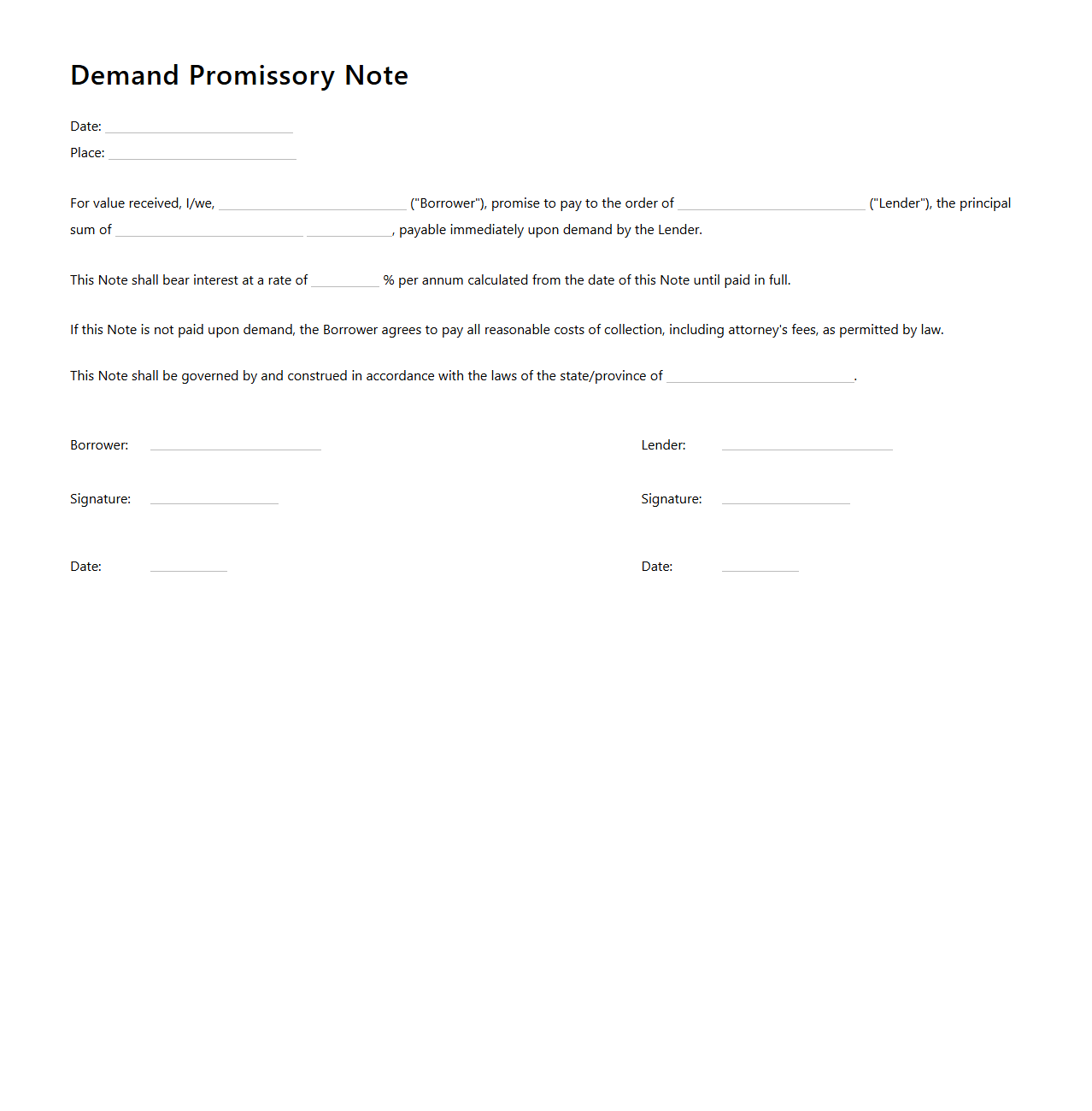

Demand Promissory Note Template for Immediate Payment

A

Demand Promissory Note Template for Immediate Payment is a legal document used to formally request repayment of a debt without delay. It outlines the borrower's promise to pay a specific amount immediately upon the lender's demand, providing clear terms to enforce payment. This template ensures clarity and protects the rights of both parties in financial agreements requiring prompt settlement.

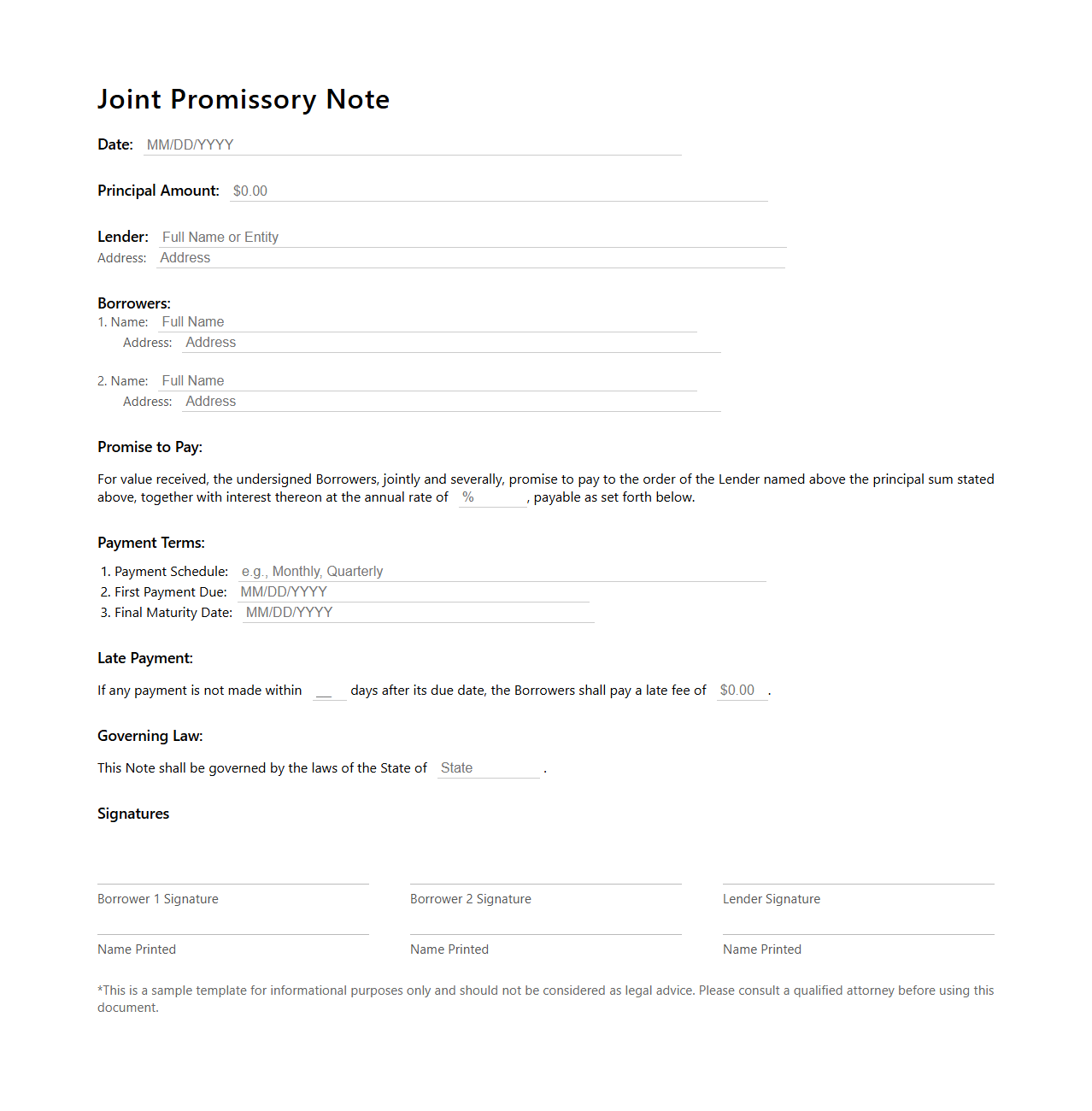

Joint Promissory Note Document for Multiple Borrowers

A

Joint Promissory Note Document for Multiple Borrowers is a legally binding agreement where two or more borrowers commit to repay a loan together under shared terms. This document specifies the total loan amount, interest rate, repayment schedule, and the responsibilities of each borrower to ensure clarity and enforceability. It protects lenders by holding all borrowers collectively responsible for the debt, reducing the risk of default.

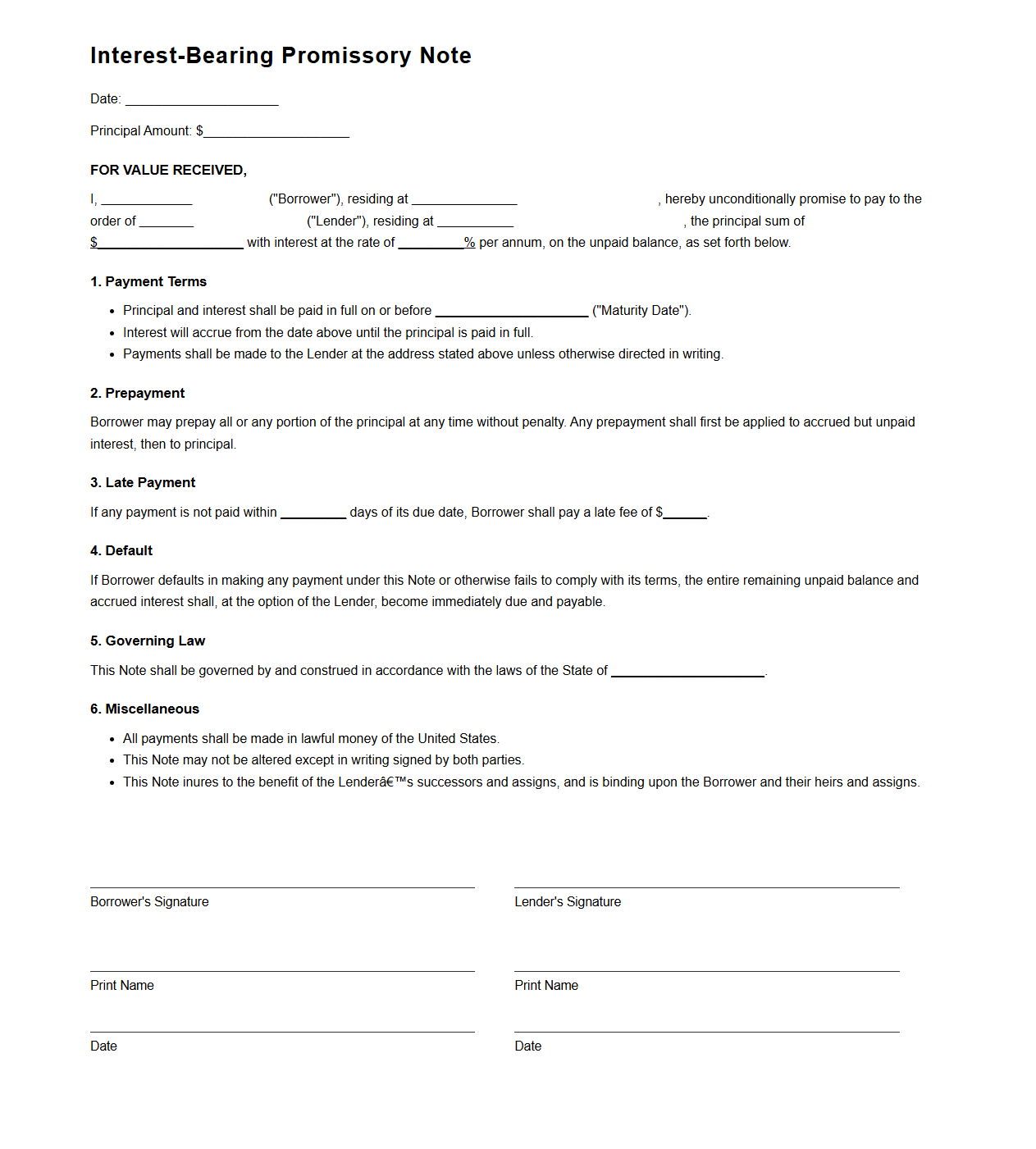

Interest-Bearing Promissory Note for Formal Lending

An

Interest-Bearing Promissory Note is a formal lending document that records a borrower's promise to repay a specified principal amount along with interest over a set period. This legal instrument outlines critical terms such as the interest rate, payment schedule, maturity date, and consequences of default, providing clear evidence of the debt obligation. It serves as a binding contract, protecting both lender and borrower by detailing the financial responsibilities and repayment conditions.

What legal elements must a blank promissory note include for valid debt acknowledgment?

A valid blank promissory note must clearly state the intention to acknowledge a debt and promise repayment. It should include essential elements such as the principal amount, interest rate (if any), and payment terms. Without these legal elements, the note may not be enforceable in a court of law.

How does a borrower's signature on a blank promissory note impact enforceability?

The borrower's signature on a blank promissory note indicates consent to the terms once filled out. This signature binds the borrower to repay the debt according to the note's terms, even if the specifics are completed later. Courts often view a signed blank note as evidence of intent to create a legal obligation.

What risks arise from using an undated blank promissory note in debt agreements?

An undated blank promissory note creates ambiguity around when the debt was incurred, complicating enforcement and statute of limitations issues. It increases the risk of fraudulent backdating or unauthorized completion. The lack of a date weakens the lender's position in legal disputes regarding the loan's timeline.

Can a blank promissory note be completed by the lender without borrower consent?

Typically, a lender should not complete a blank promissory note without the borrower's consent. Unauthorized completion may render the note invalid or subject it to claims of fraud. Legal standards generally require mutual agreement on the loan terms before enforceability.

How does jurisdiction affect the validity of a blank promissory note for debt acknowledgment?

Jurisdiction significantly influences the enforceability and legal requirements of blank promissory notes. Different states or countries have varied rules about what constitutes a valid note and acceptable completion practices. Understanding local laws is essential to ensure the note's validity and protect both parties' rights.