A Blank Financial Plan Template for Budget Management provides a structured format to organize income, expenses, and savings goals efficiently. This customizable template helps track spending habits and allocate resources effectively, ensuring better control over personal or business finances. Using such a template simplifies financial decision-making and promotes disciplined budgeting practices.

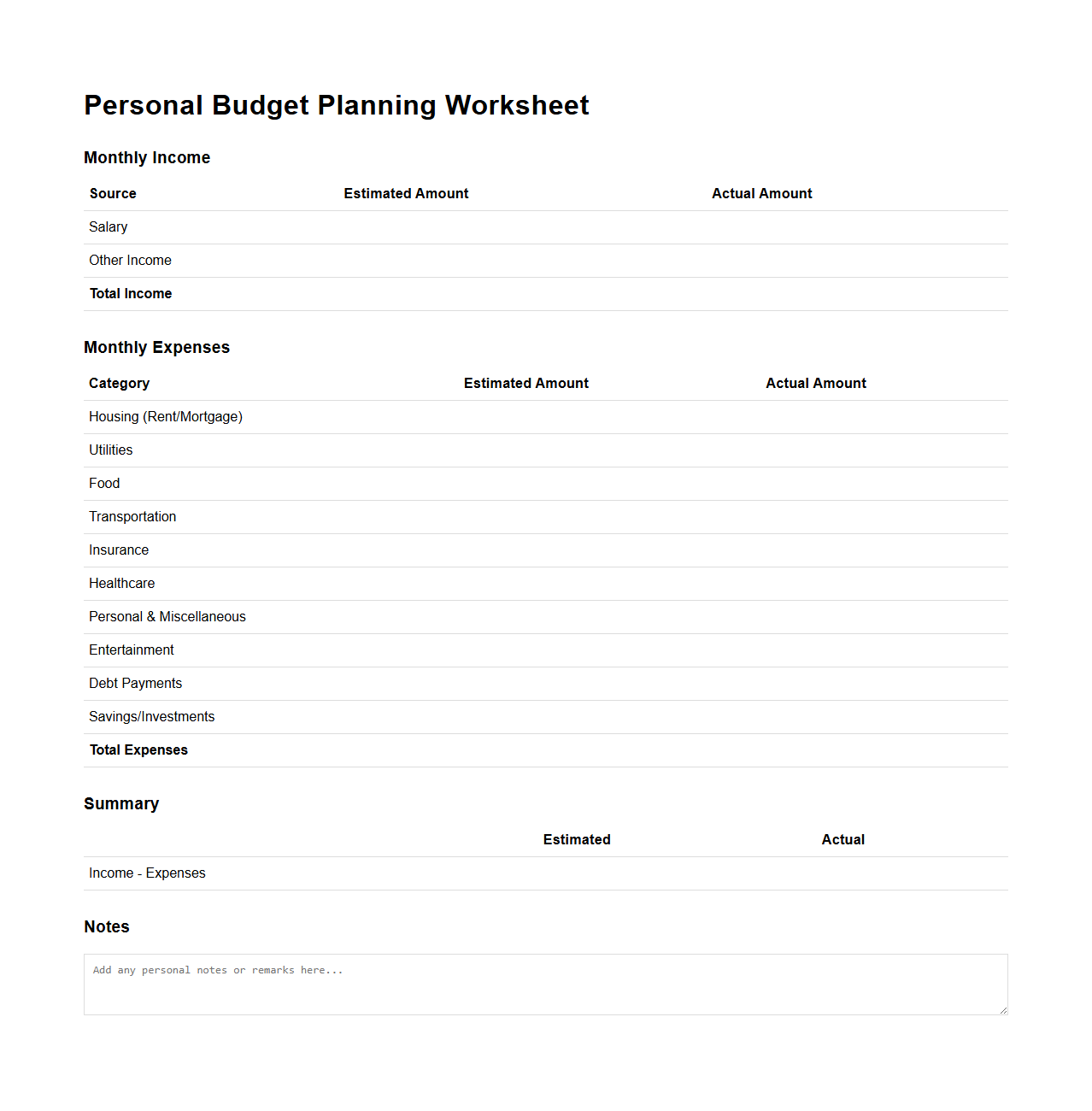

Personal Budget Planning Worksheet

A

Personal Budget Planning Worksheet is a structured document that helps individuals track and manage their income, expenses, and savings goals. It provides a clear overview of monthly finances, enabling better decision-making for spending and financial planning. Utilizing this worksheet can lead to improved money management and achievement of financial objectives.

Monthly Expense Tracking Template

A

Monthly Expense Tracking Template is a structured document designed to record and categorize personal or business expenditures over a 30-day period. It helps users monitor spending habits, identify cost-saving opportunities, and maintain financial discipline by providing clear visibility into monthly cash flow. This template typically includes sections for fixed expenses, variable costs, and total monthly outflows, enhancing budget management and financial planning.

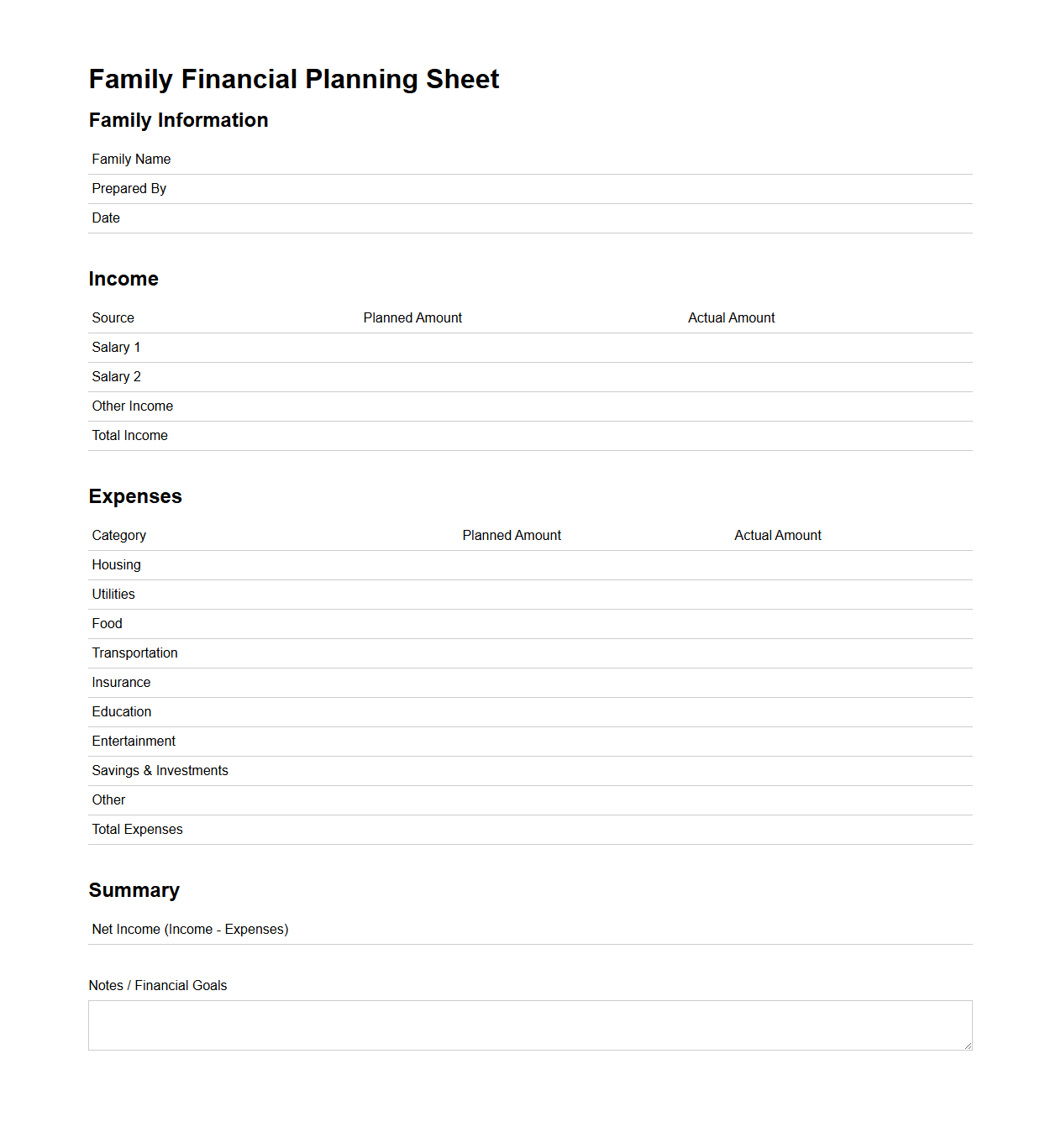

Family Financial Planning Sheet

A

Family Financial Planning Sheet is a comprehensive document designed to track and organize a household's income, expenses, savings, and financial goals. It provides a clear overview of the family's budget, helping to allocate resources effectively and plan for future needs such as education, emergencies, and retirement. By regularly updating this sheet, families can make informed decisions to improve their financial stability and achieve long-term financial success.

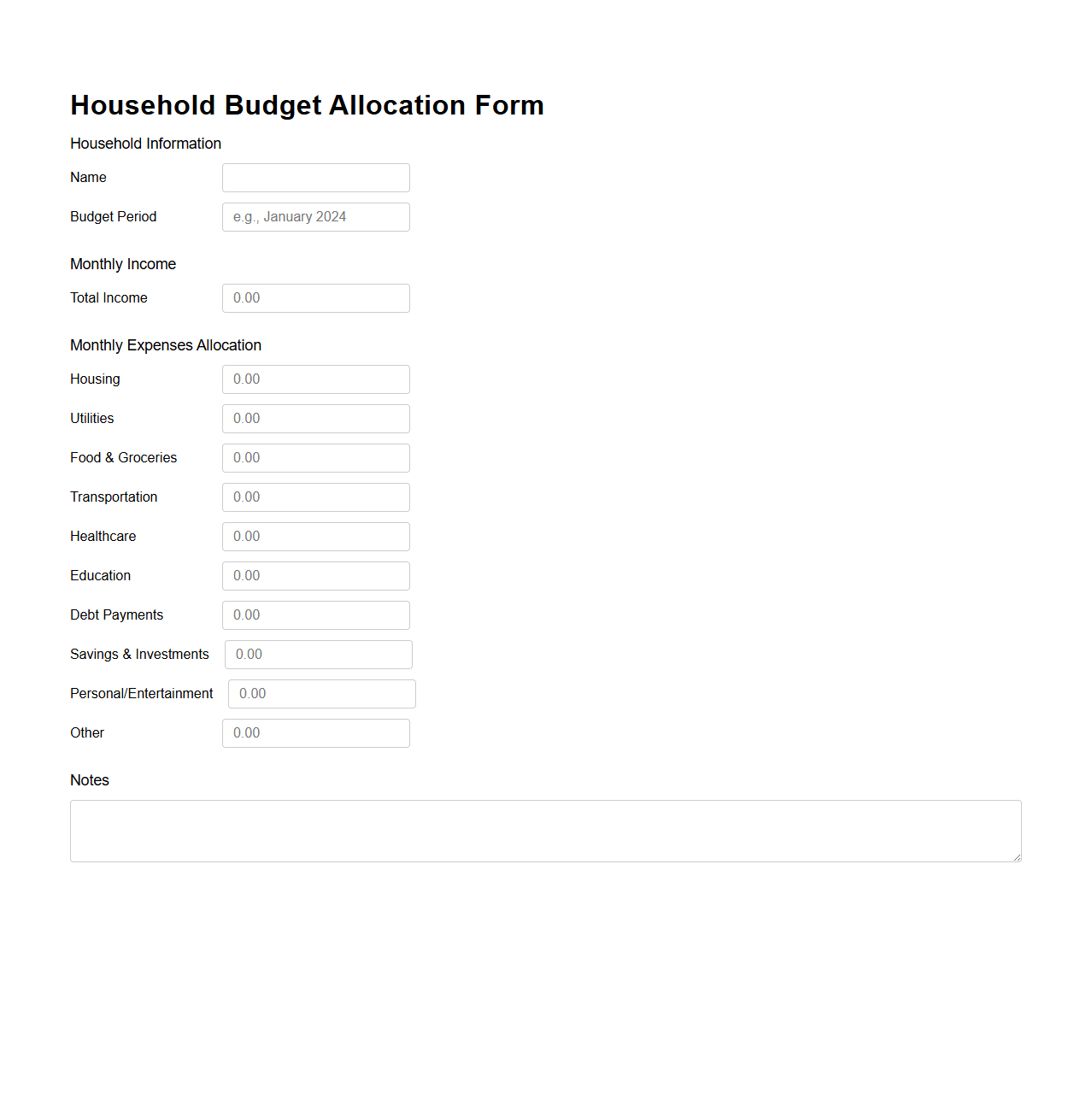

Household Budget Allocation Form

The

Household Budget Allocation Form is a financial planning document used to distribute income across various expense categories such as housing, utilities, groceries, transportation, and savings. This form helps individuals or families manage their finances efficiently by tracking spending habits and ensuring funds are allocated according to priorities. By providing a clear overview of expenditures, the document aids in maintaining financial stability and achieving budgeting goals.

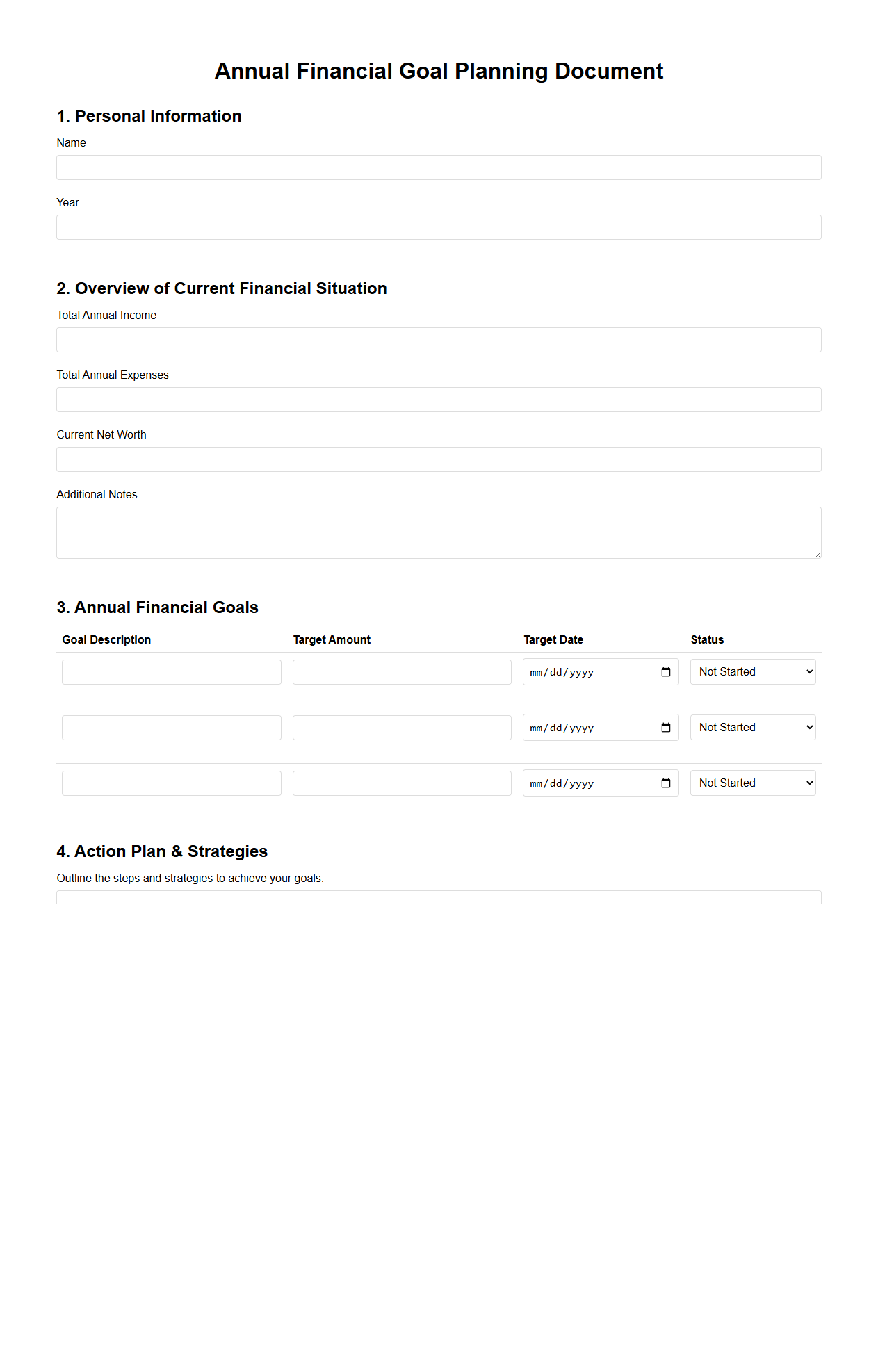

Annual Financial Goal Planning Document

An

Annual Financial Goal Planning Document outlines specific monetary objectives and strategies for a business or individual to achieve within a fiscal year. This document serves as a roadmap for budgeting, forecasting, and resource allocation, ensuring alignment with long-term financial targets. It typically includes measurable goals, timelines, and performance metrics to track progress effectively.

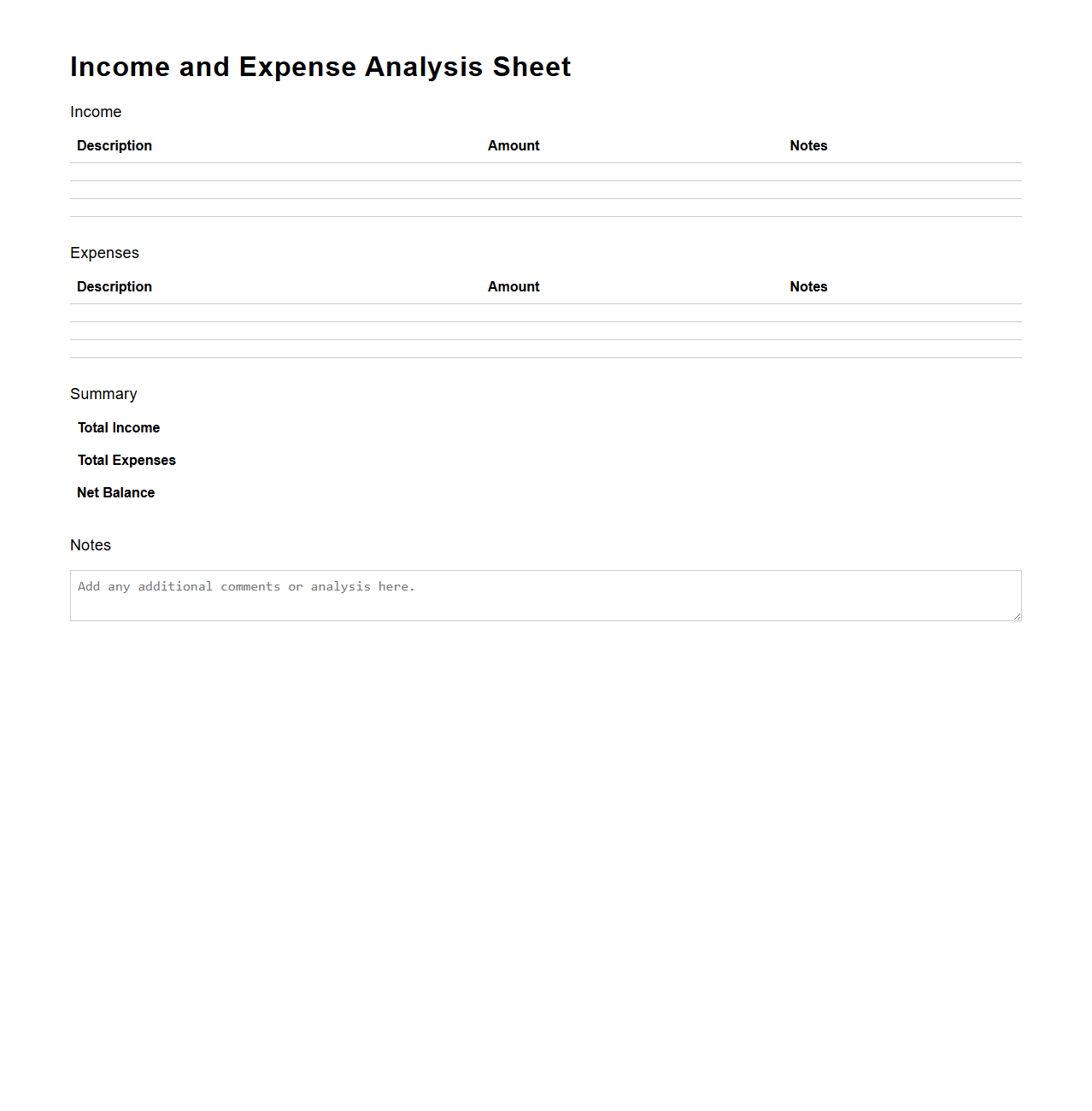

Income and Expense Analysis Sheet

An

Income and Expense Analysis Sheet is a financial document used to track and evaluate all sources of income alongside various expenses over a specific period. This sheet helps businesses and individuals identify spending patterns, monitor cash flow, and make informed budgeting decisions. Effective analysis of this document supports financial planning and enhances the ability to optimize profitability.

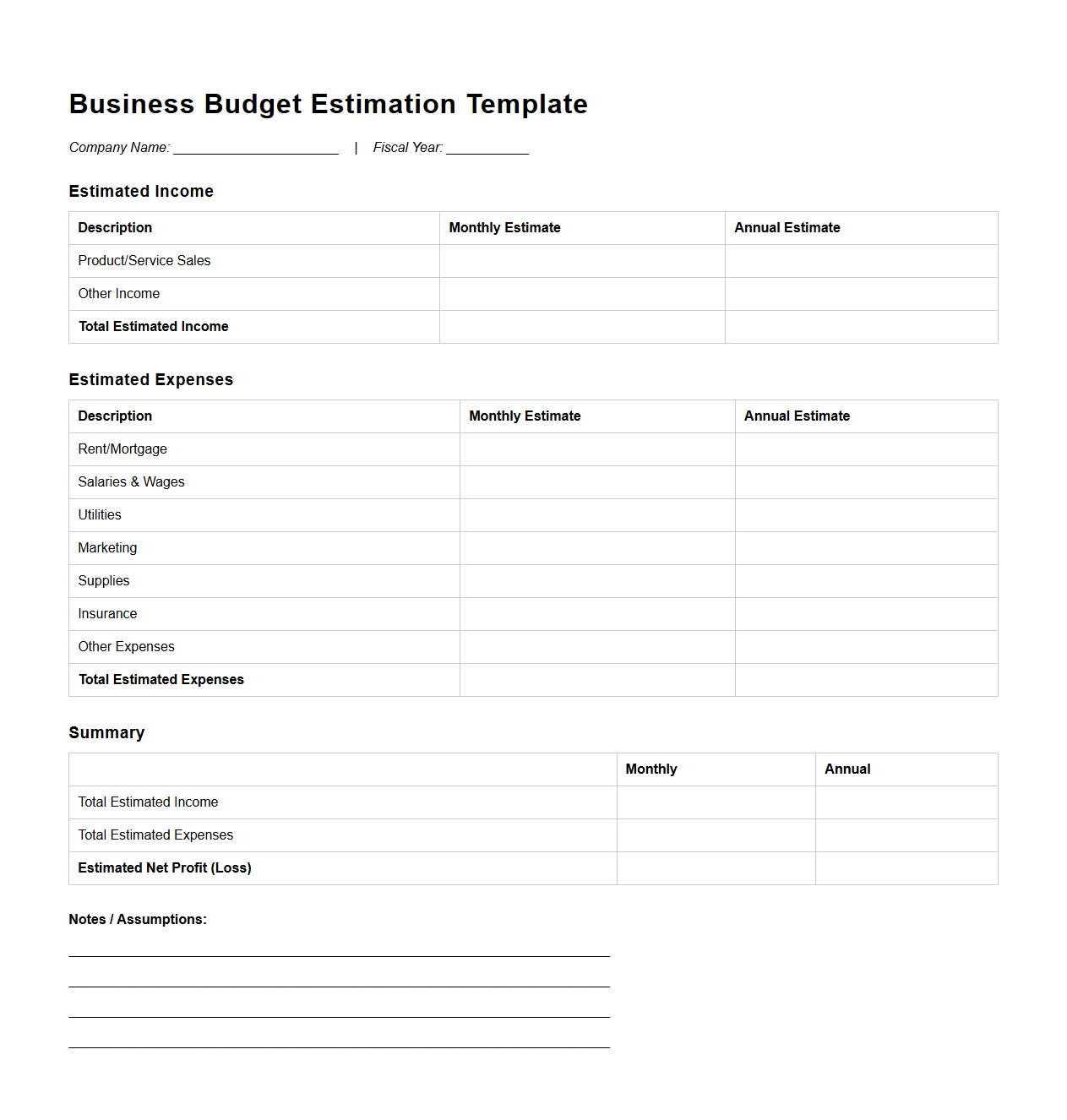

Business Budget Estimation Template

A

Business Budget Estimation Template is a structured document designed to forecast and allocate financial resources for various business activities. It helps organizations project expenses, revenues, and cash flow, enabling effective financial planning and decision-making. By providing a clear overview of anticipated costs and income, this template supports budget control and optimizes resource management.

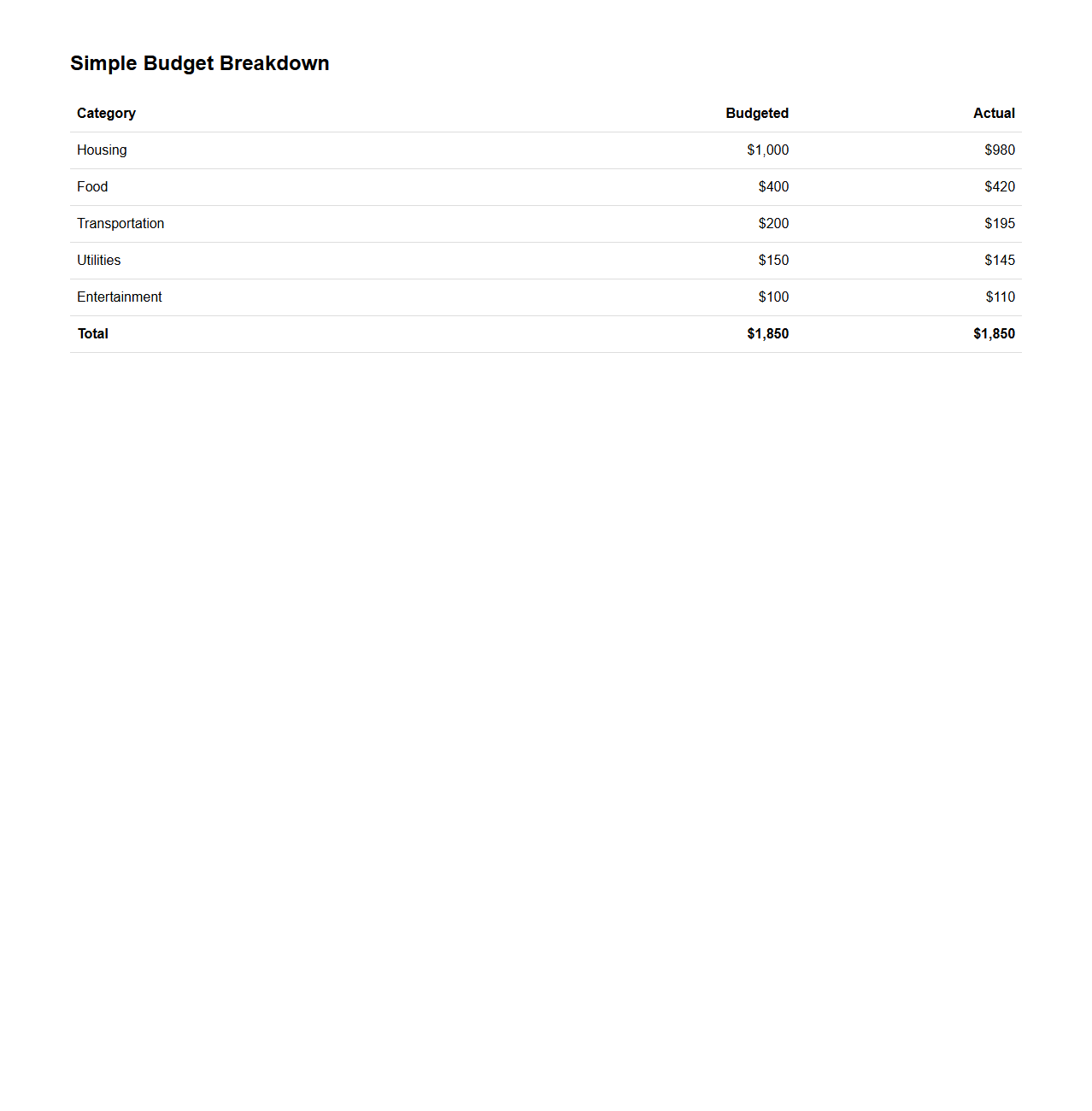

Simple Budget Breakdown Chart

A

Simple Budget Breakdown Chart document visually represents the allocation of a budget into distinct categories, allowing clear understanding of spending distribution. It typically includes labeled sections with percentages or amounts assigned to each expense area, aiding in financial planning and tracking. This tool enhances transparency and supports better decision-making by summarizing complex budget data into an easy-to-read format.

Savings and Expense Log Tracker

A

Savings and Expense Log Tracker document is a financial tool designed to help individuals monitor and manage their income, savings, and daily expenditures systematically. It provides a structured format to record transaction dates, amounts, categories, and balances, enabling better budgeting and financial planning. Using this tracker promotes accountability and supports achieving financial goals by offering clear insights into spending habits and saving progress.

Home Finance Organization Template

A

Home Finance Organization Template is a structured document designed to help individuals systematically manage their household budgets, track expenses, and plan savings. It typically includes sections for income, fixed and variable expenses, debt management, and financial goals, providing a clear overview of personal finances. Using this template enhances financial discipline and aids in making informed decisions to achieve long-term monetary stability.

What key financial assumptions should be included in a blank financial plan template?

A blank financial plan template should include assumptions about income growth, expense inflation, and investment returns to create realistic projections. These assumptions help in setting achievable financial goals and preparing for future uncertainties. Including such assumptions ensures the plan remains adaptable to changing economic conditions.

How does a blank financial plan address emergency fund allocations in budget management?

A blank financial plan typically incorporates a dedicated section for emergency fund allocations to safeguard against unexpected expenses. This helps individuals prioritize saving a specific amount or percentage of income to cover unforeseen financial needs. It encourages disciplined budgeting and financial resilience.

Which expense categories should be pre-listed in a basic financial plan document?

Common expense categories pre-listed in a basic financial plan include housing, utilities, transportation, groceries, insurance, and entertainment. These categories cover the core areas of monthly spending, providing a structured approach to budgeting. Having these categories detailed upfront streamlines expense tracking and financial analysis.

How can a blank financial plan template improve forecasting accuracy for monthly budgets?

A blank financial plan template enhances forecasting accuracy by enabling detailed input of income and expenses, allowing for precise budget predictions. It facilitates comparison between projected and actual figures to identify discrepancies early. This structured approach supports better financial decision-making and goal alignment.

What essential income tracking fields must appear on a budget-oriented financial plan letter?

Essential income tracking fields include primary income sources, secondary income, and irregular earnings to capture all revenue streams comprehensively. Documenting pay periods and anticipated bonuses helps in accurate monthly budget planning. These fields provide a clear view of total income for effective budget management.