A Blank Income Statement Template for Personal Finance helps individuals track their monthly earnings and expenses with ease. This customizable tool allows users to organize income sources and categorize expenditures clearly for better financial management. Using this template improves budgeting accuracy and supports goal setting for personal financial growth.

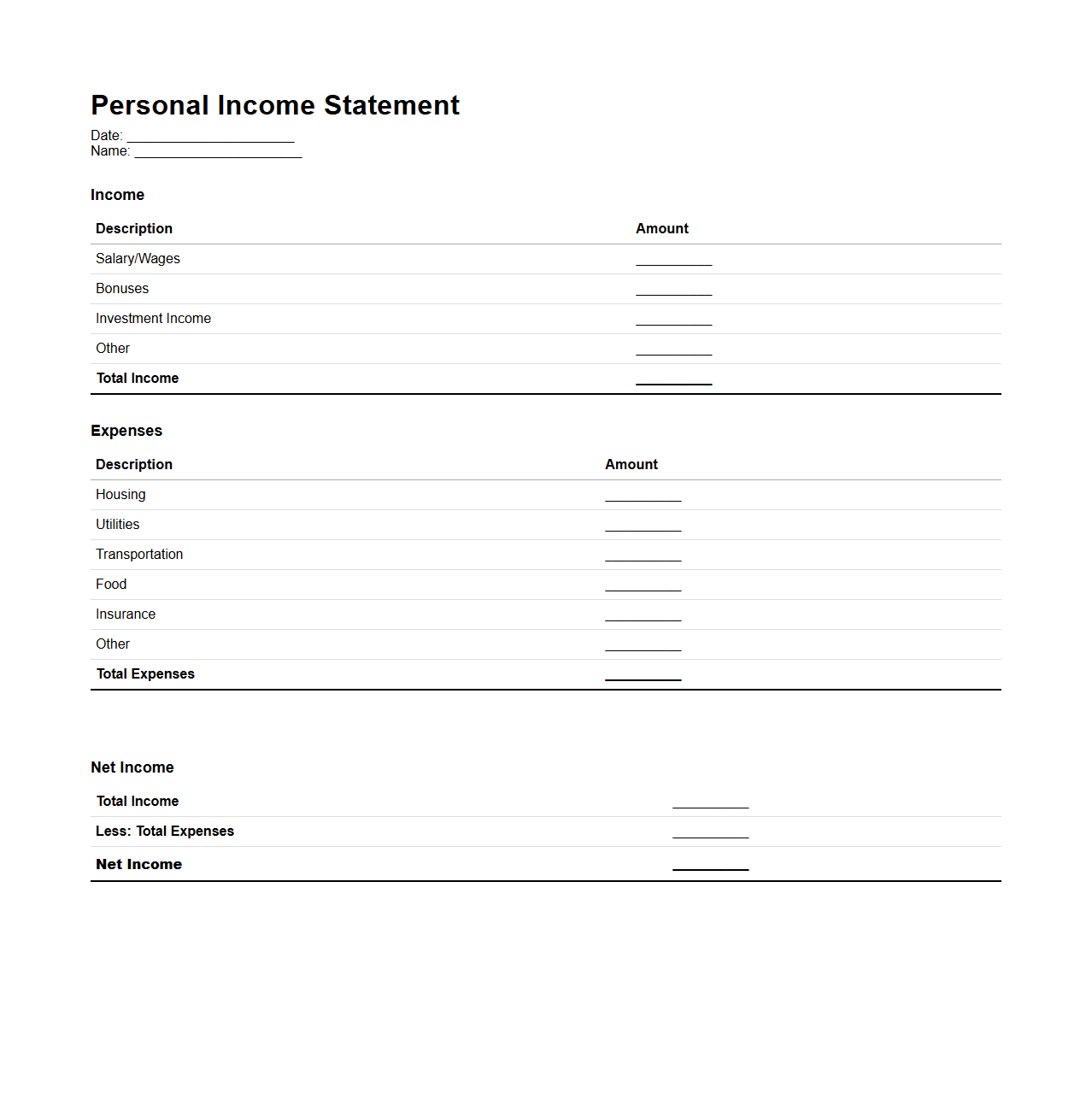

Simple Personal Income Statement Template

A

Simple Personal Income Statement Template document helps individuals track and organize their monthly or annual income and expenses in a structured format. It provides a clear overview of earnings from various sources, such as salaries, freelance work, and investments, alongside expenditures like bills, groceries, and entertainment. This template aids in budgeting, financial planning, and assessing one's net income for better money management.

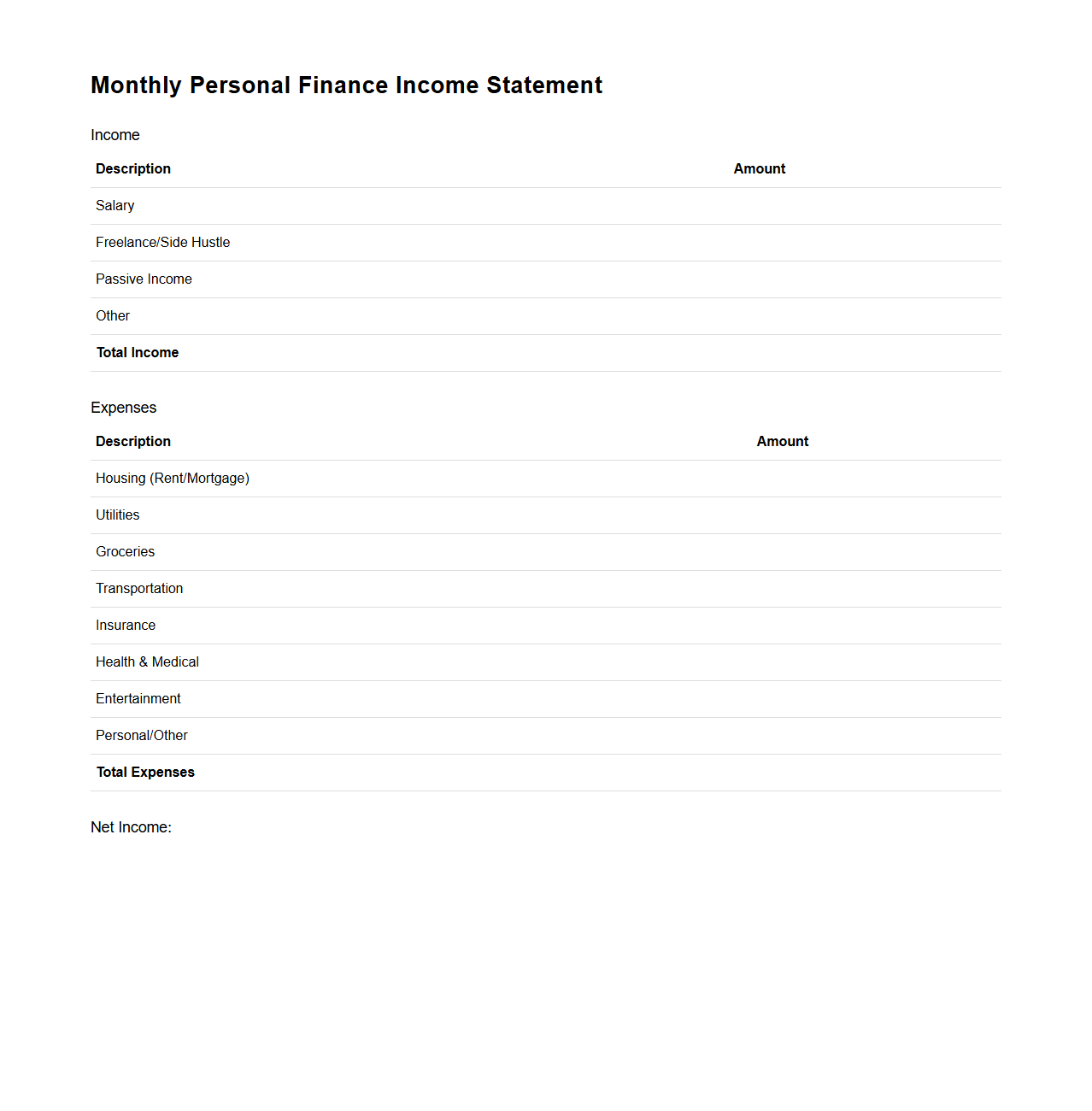

Monthly Personal Finance Income Statement

A

Monthly Personal Finance Income Statement is a financial document that summarizes an individual's income and expenses over a specific month, helping track cash flow and budgeting. It details all sources of income, including salary, investments, and other earnings, alongside categorized expenses such as housing, transportation, food, and discretionary spending. This statement enables effective financial planning by highlighting surplus or deficit, aiding in informed decision-making and long-term financial goals.

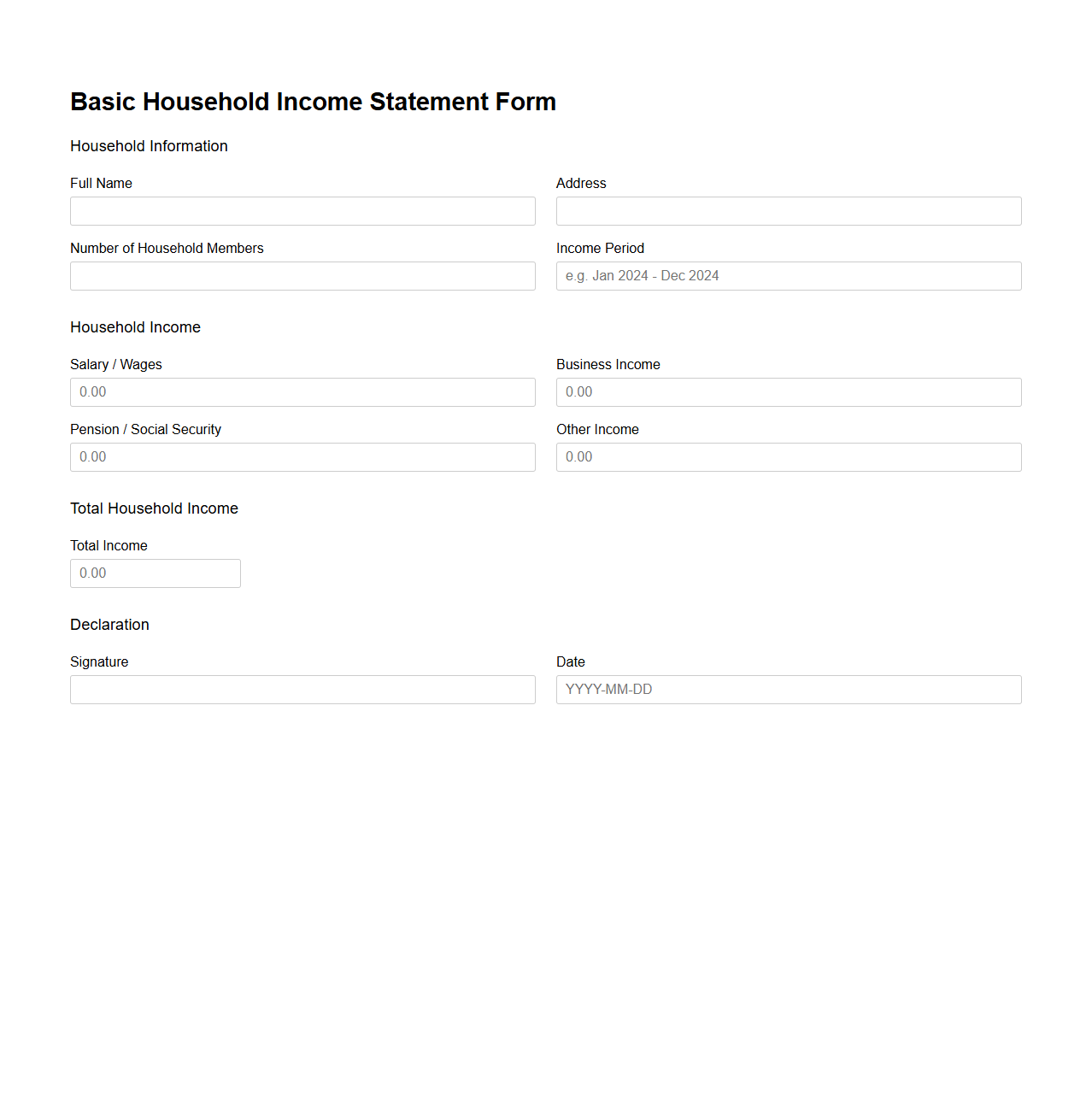

Basic Household Income Statement Form

The

Basic Household Income Statement Form is a financial document used to record and summarize all sources of income for a household over a specific period. It typically includes wages, salaries, investments, government benefits, and other income streams, helping individuals or families assess their total earnings accurately. This form is essential for budgeting, loan applications, and financial planning purposes.

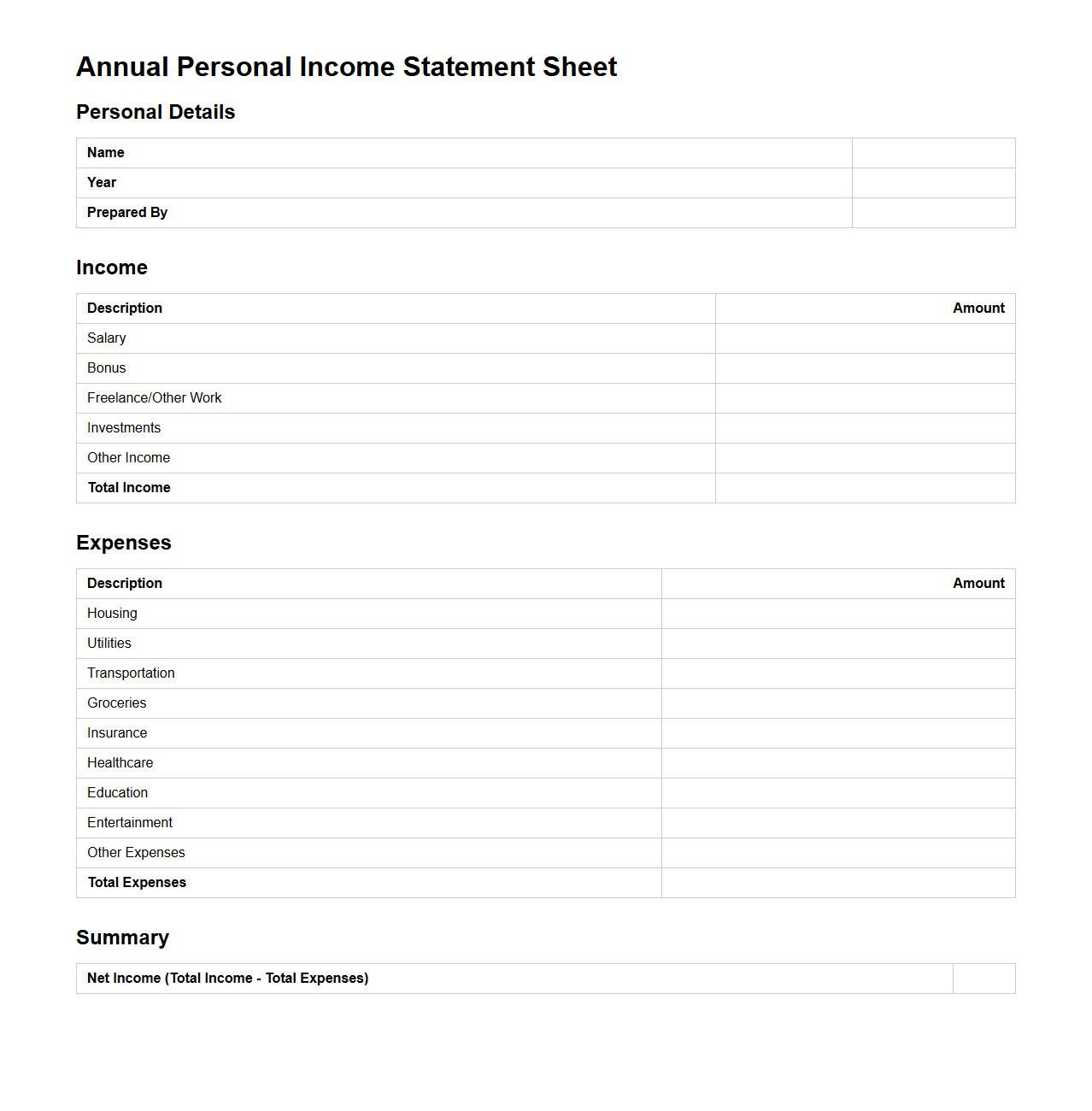

Annual Personal Income Statement Sheet

An

Annual Personal Income Statement Sheet is a financial document that summarizes an individual's total income and expenses over the course of a year. It helps track sources of revenue such as salary, investments, and other earnings, alongside detailed expenditures to assess net savings or deficits. This statement is essential for budgeting, tax preparation, and long-term financial planning.

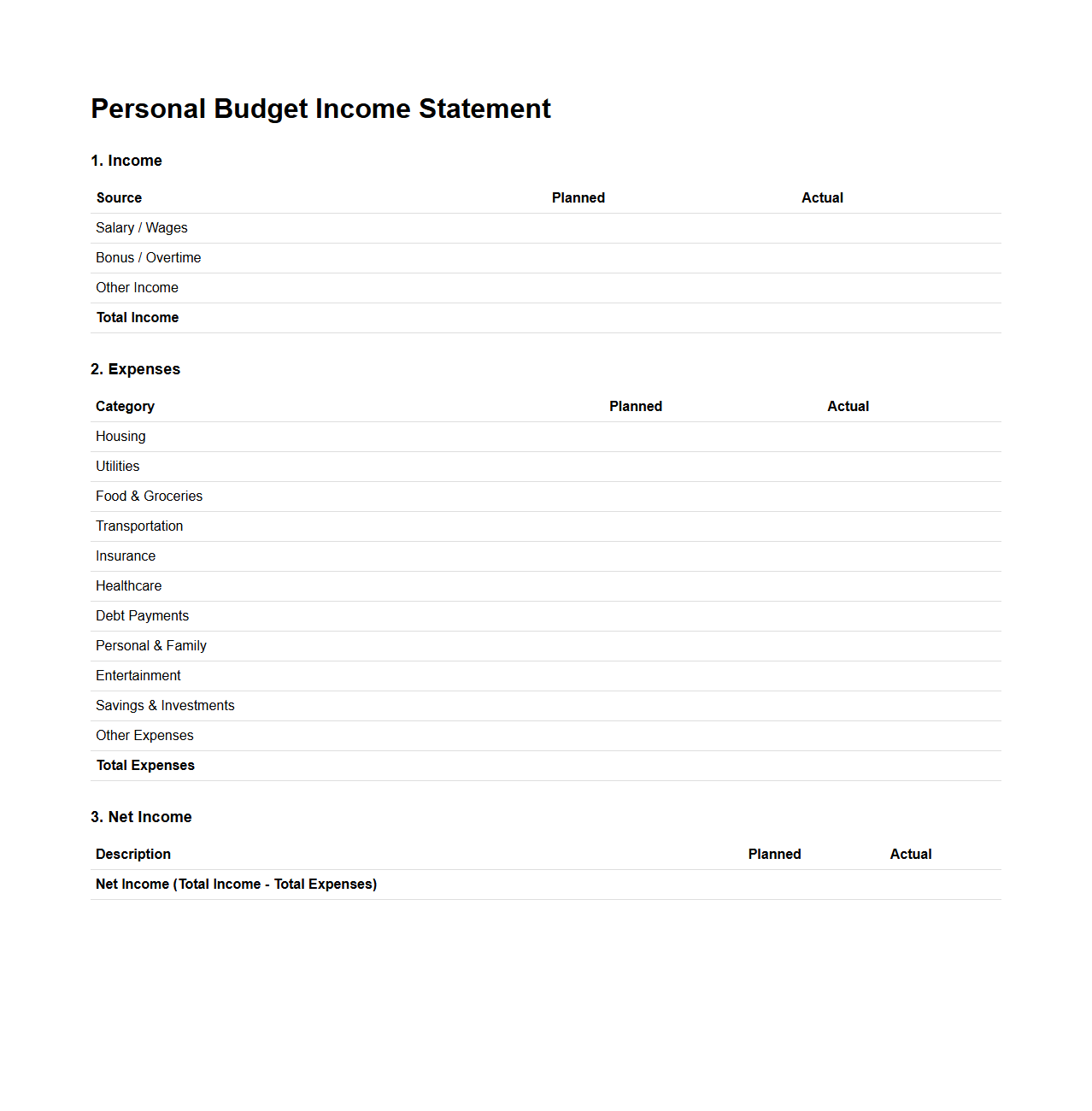

Personal Budget Income Statement Outline

A

Personal Budget Income Statement Outline document serves as a structured financial tool that details individual income sources and expenses over a specific period, helping to manage cash flow effectively. It typically includes sections for wages, bonuses, investment income, and categorized expenditures, allowing for clear tracking and planning. This document aids in identifying spending patterns and supports informed decisions for achieving financial goals.

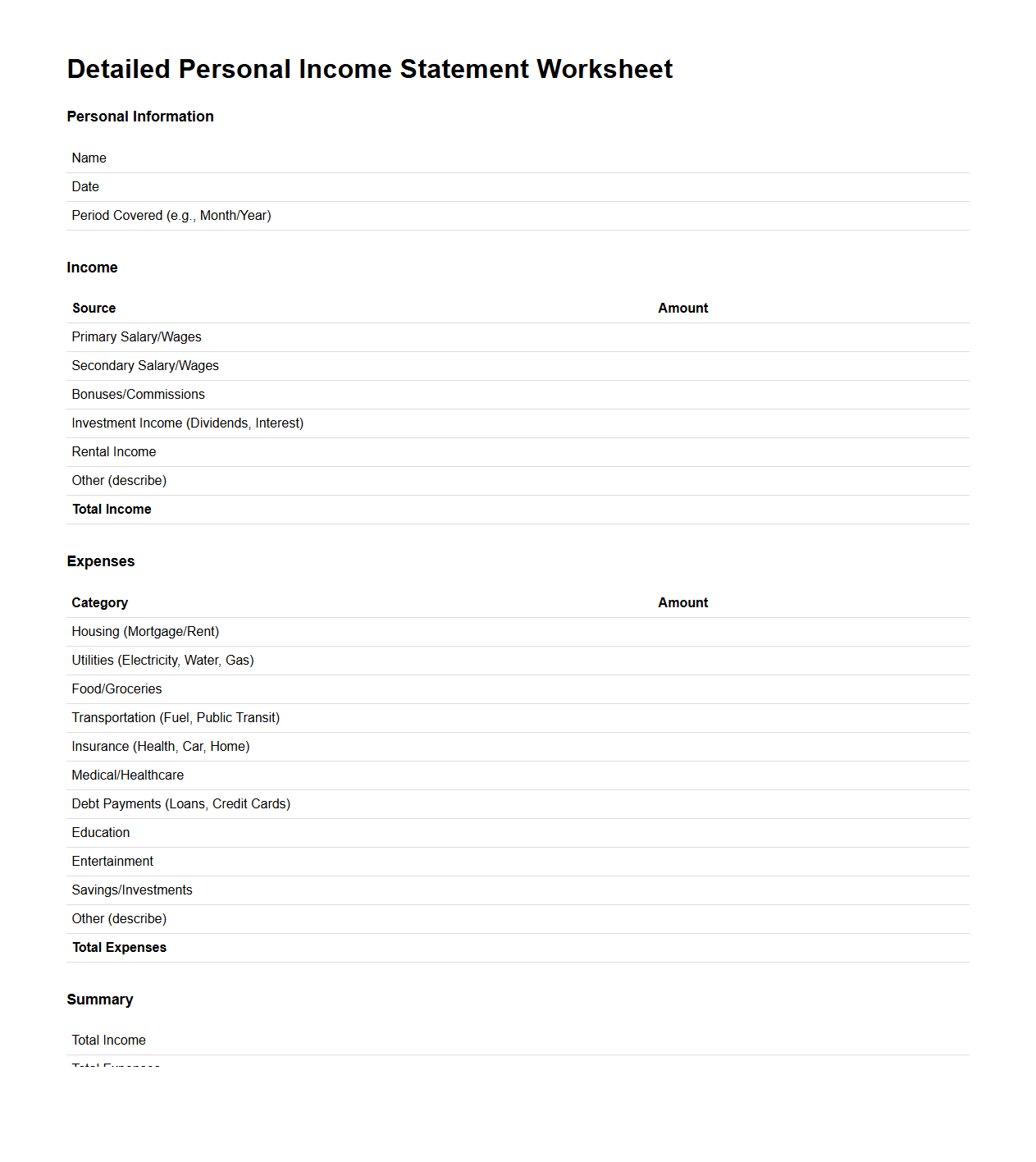

Detailed Personal Income Statement Worksheet

A

Detailed Personal Income Statement Worksheet is a financial document used to systematically record and analyze individual income sources and expenses over a specific period. It helps track earnings from salaries, investments, and other revenue streams while categorizing expenditures to provide a clear picture of net income. This worksheet is essential for budgeting, financial planning, and identifying areas for cost-saving or income optimization.

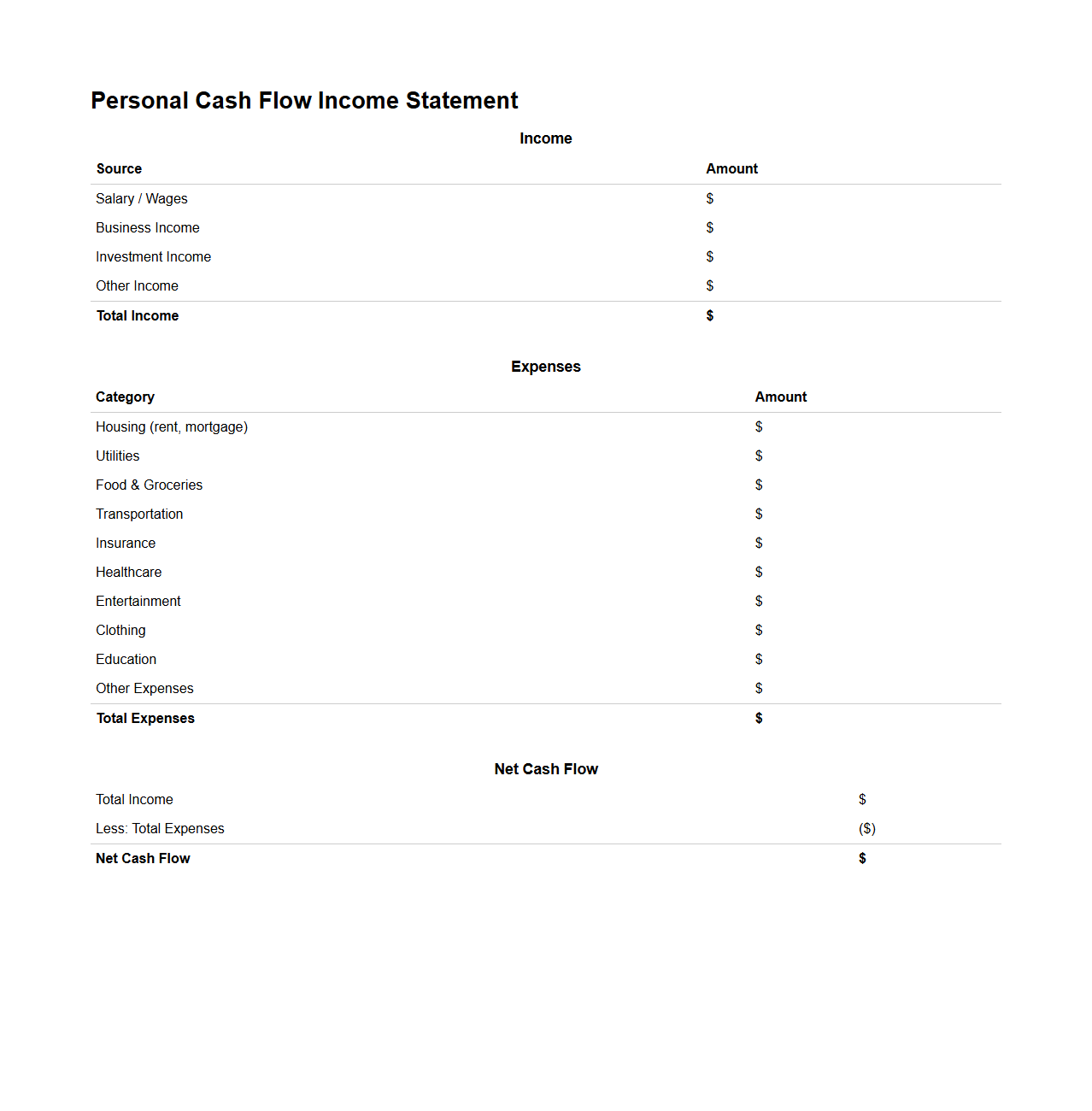

Personal Cash Flow Income Statement Example

A

Personal Cash Flow Income Statement Example document illustrates an individual's detailed record of income sources and expenses over a specific period. This financial tool helps in tracking net cash flow, identifying spending patterns, and improving budget planning. It is essential for managing personal finances effectively and achieving financial goals.

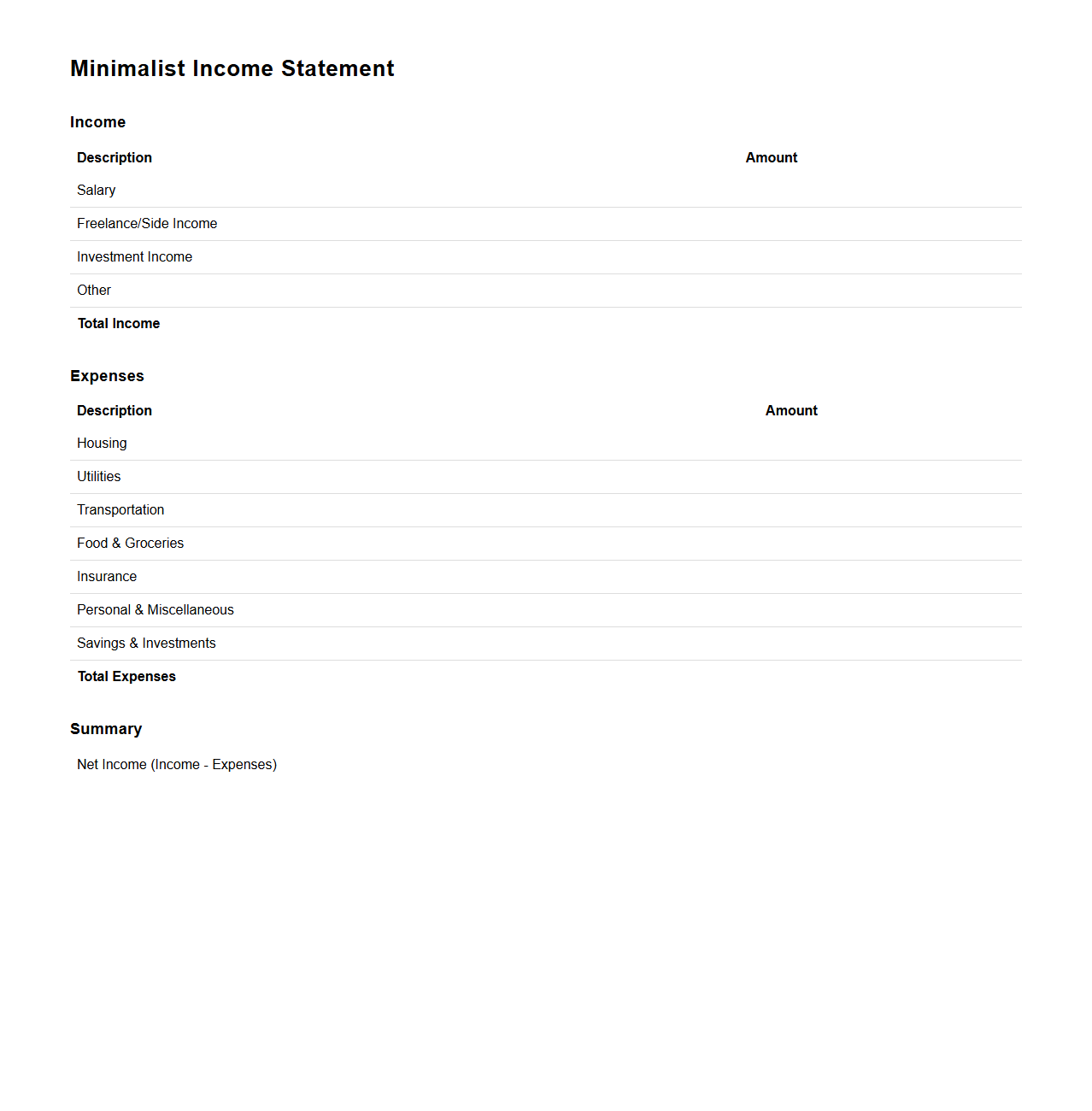

Minimalist Income Statement for Individuals

A

Minimalist Income Statement for Individuals is a simplified financial document that outlines personal income and expenses in a clear and concise manner. It helps individuals track their net earnings by focusing only on essential categories like salary, investments, and necessary expenditures. This streamlined approach aids in better budgeting and financial decision-making without overwhelming details.

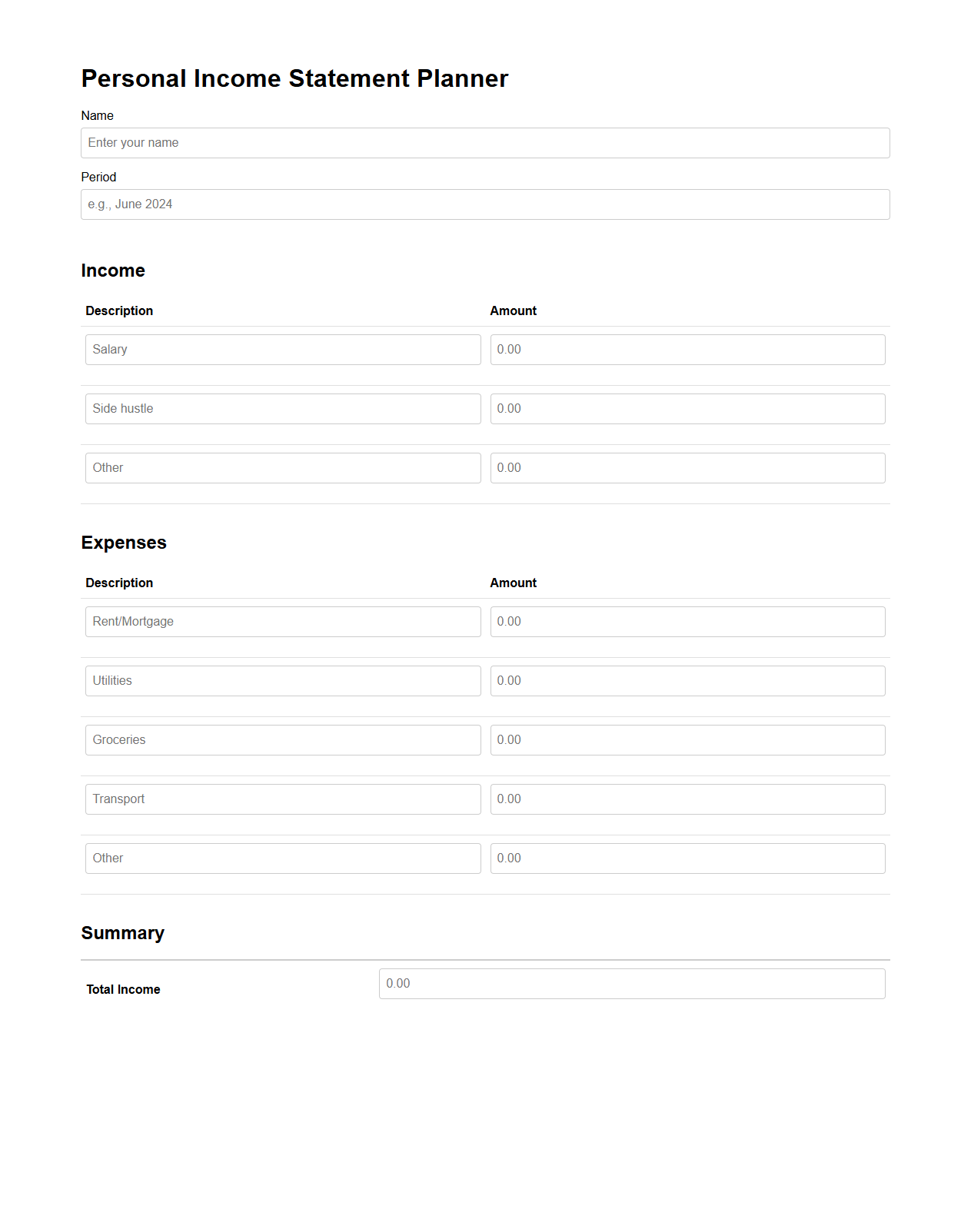

Customizable Personal Income Statement Planner

A

Customizable Personal Income Statement Planner document is a tailored financial tool designed to track and organize individual income and expenses systematically. It enables users to input varying sources of income, categorize expenditures, and adjust fields to match their unique financial situations for accurate budgeting and forecasting. This planner supports better money management by providing clear visibility into cash flow patterns and financial goals.

Personal Financial Statement Income Tracker

A

Personal Financial Statement Income Tracker document is a detailed record used to monitor and analyze individual income sources over time. It helps users categorize earnings from salaries, investments, and other revenue streams to provide a clear financial overview. Maintaining this tracker supports budgeting, tax preparation, and financial planning by ensuring accurate and organized income data.

How can I customize a blank income statement template for irregular freelance income?

To customize a blank income statement for irregular freelance income, start by adding separate income categories for each client or project. Include a section to note the dates and amounts of payments received to track income fluctuations accurately. Use a rolling monthly or quarterly format to better reflect the variability and smooth out inconsistencies in your earnings.

What categories should be included in a personal finance blank income statement?

A personal finance blank income statement should include income categories such as salary, freelance work, investments, and other sources like rental income. Expense categories should cover essentials like housing, food, transportation, utilities, and discretionary spending. Including a net income section at the end helps you easily calculate the difference between total income and expenses.

How do you track variable monthly expenses on a blank income statement?

Tracking variable monthly expenses involves creating detailed subcategories such as entertainment, dining out, or medical costs under the main expense headings. Record each variable expense monthly and compare them side-by-side to identify trends or unusually high spending periods. Using an expense tracker or spreadsheet function helps ensure accurate and consistent tracking over time.

Can a blank income statement be used for household budgeting and financial planning?

Yes, a blank income statement is an effective tool for household budgeting and financial planning by providing a clear overview of income and expenses. It allows families to monitor their cash flow, identify unnecessary costs, and plan savings goals more strategically. Regular updates to the statement ensure ongoing awareness of the household's financial health.

What is the best format for a blank income statement to visualize net income trends over time?

The best format for visualizing net income trends includes a chronological layout with monthly or quarterly columns and clear rows for income, expenses, and net income. Adding charts or graphs alongside the table enhances the ability to quickly interpret fluctuations and growth patterns. A digital spreadsheet format with automated calculations offers the most flexibility and clarity for ongoing analysis.