A Blank Profit and Loss Statement Template for Entrepreneurs provides a structured format to track income, expenses, and net profit over a specific period. This easy-to-use template helps entrepreneurs analyze financial performance, identify cost-saving opportunities, and make informed business decisions. Maintaining accurate records with this template supports effective budgeting and financial planning for sustainable growth.

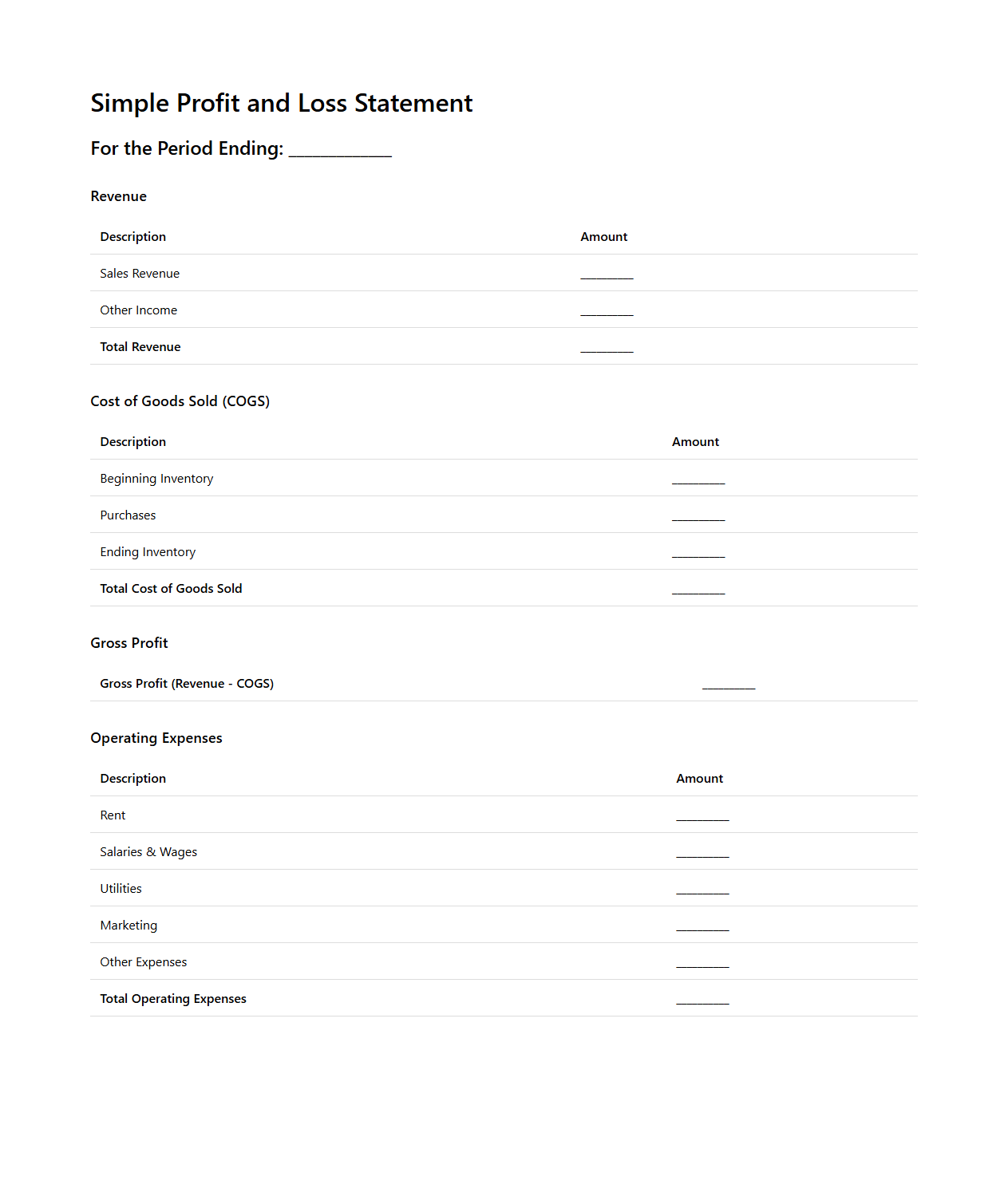

Simple Profit and Loss Statement Template for Small Business Owners

A

Simple Profit and Loss Statement Template for Small Business Owners is a streamlined financial document designed to track revenue, expenses, and net profit over a specific period. This template helps small businesses monitor financial performance, identify cost-saving opportunities, and make informed decisions without the complexity of detailed accounting software. It typically includes categorized income and expense fields, providing a clear snapshot of profitability crucial for budgeting and tax preparation.

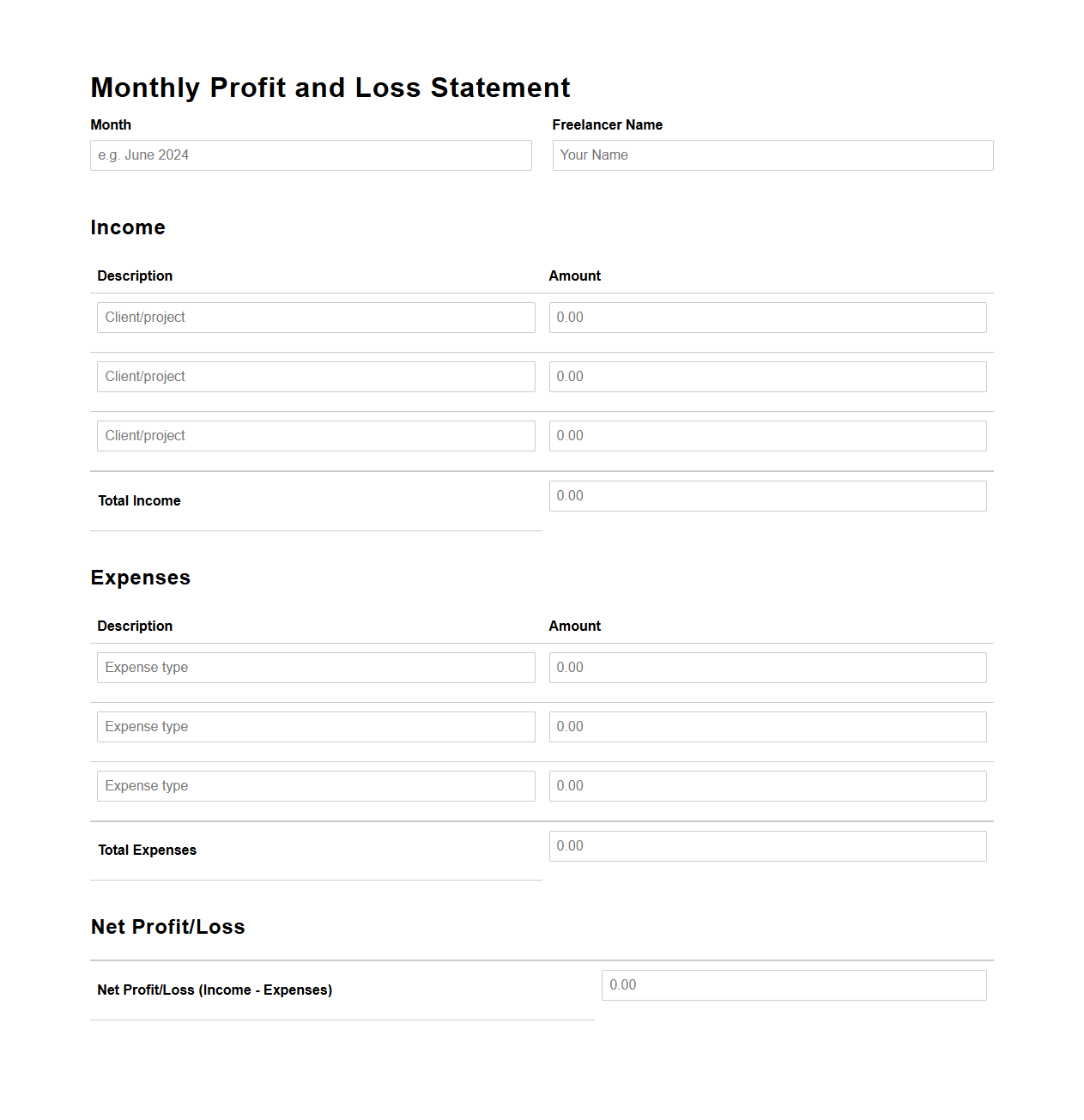

Monthly Profit and Loss Statement Template for Freelancers

A

Monthly Profit and Loss Statement Template for Freelancers is a financial document designed to help independent professionals track their income and expenses over a specific month. It provides a clear overview of revenue sources, operational costs, and net profit, enabling freelancers to monitor their financial health effectively. Utilizing this template supports accurate bookkeeping, simplifies tax preparation, and facilitates informed business decisions.

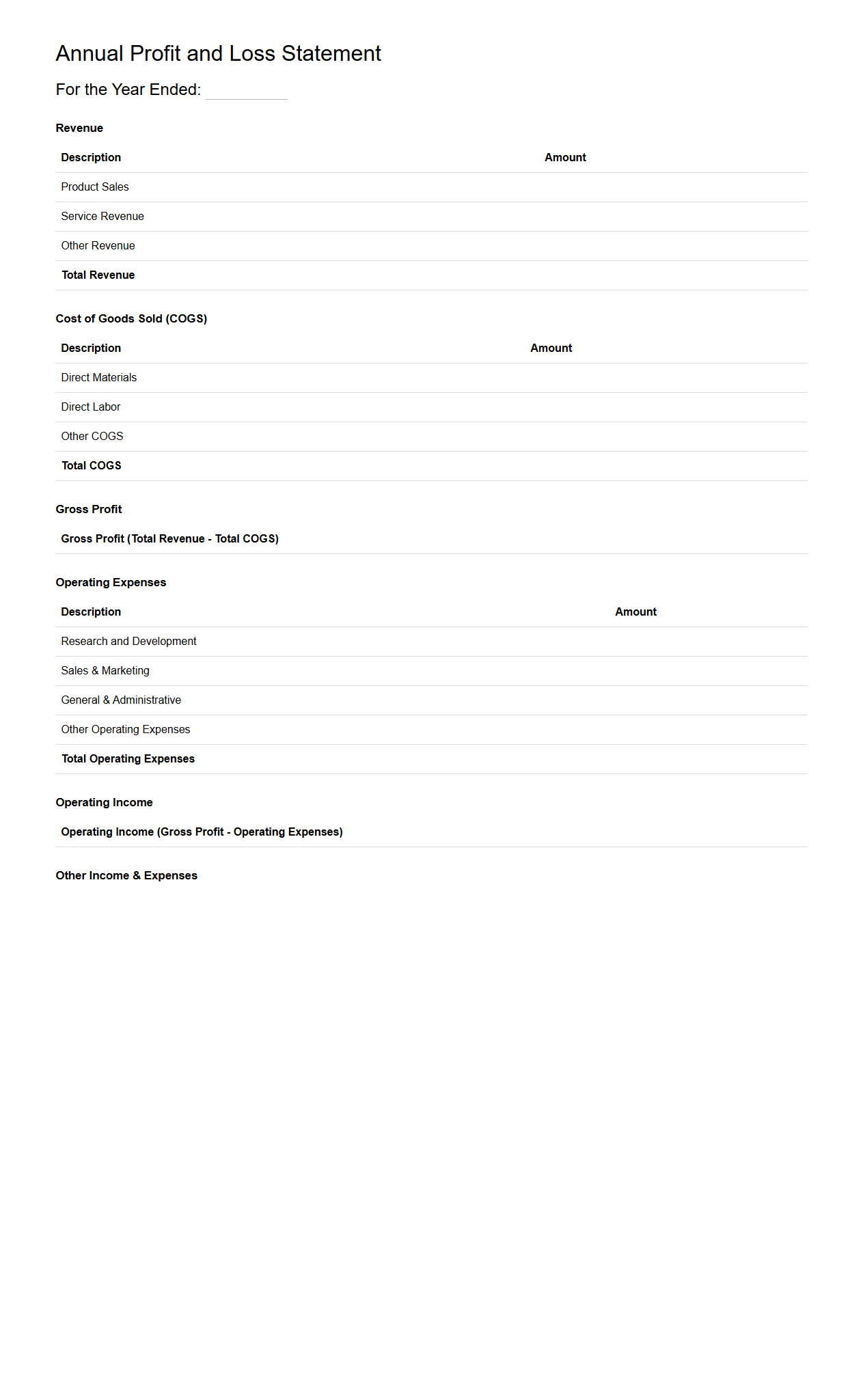

Annual Profit and Loss Statement Template for Startups

An

Annual Profit and Loss Statement Template for Startups is a financial document designed to help new businesses track their revenues, expenses, and net income over a fiscal year. This template provides a structured format for startups to analyze profitability, manage cash flow, and make informed decisions based on detailed income and expense categories. By using this template, entrepreneurs can easily monitor financial performance, identify cost-saving opportunities, and present clear financial reports to investors or stakeholders.

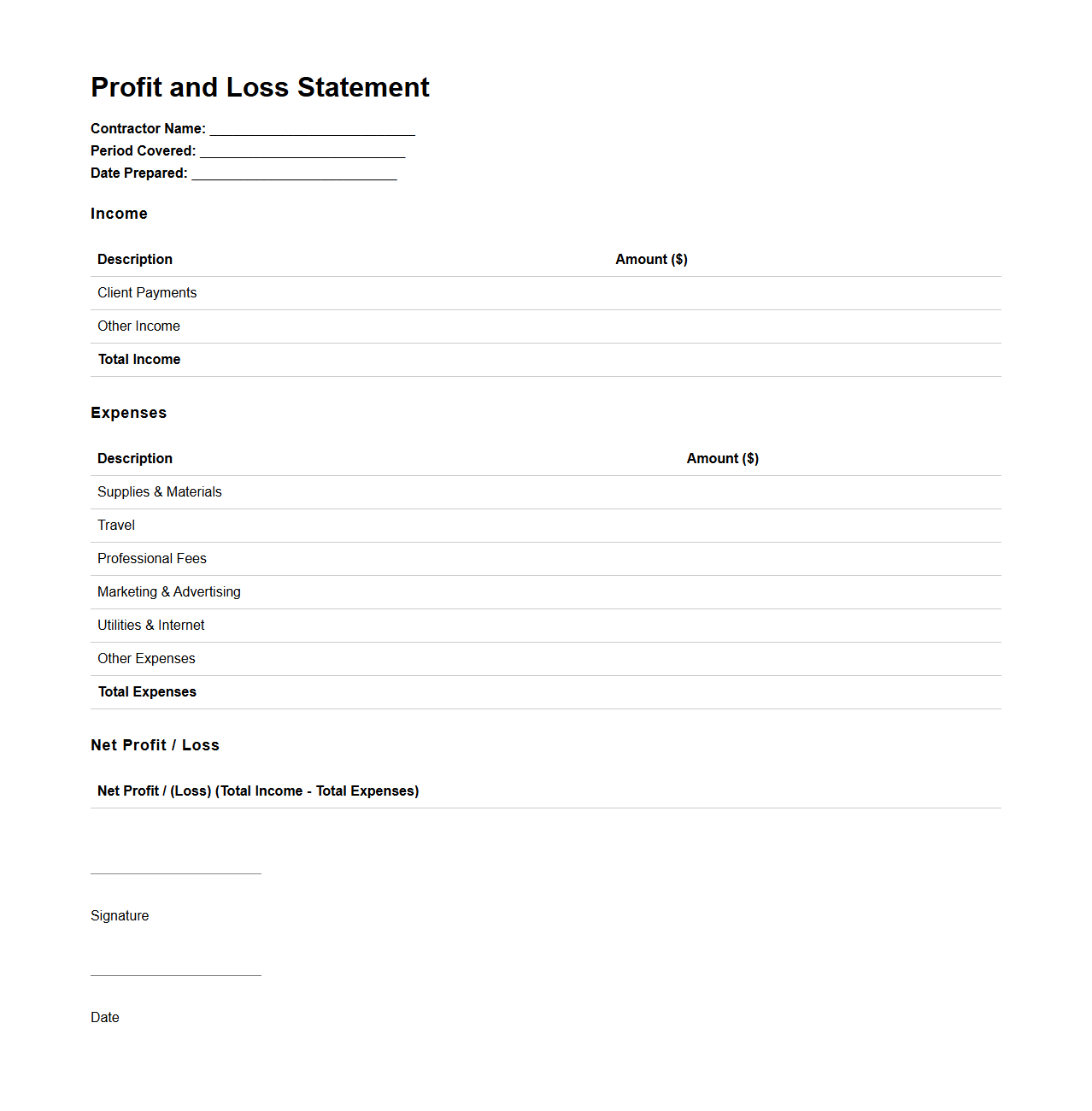

Basic Profit and Loss Statement Template for Independent Contractors

A

Basic Profit and Loss Statement Template for Independent Contractors is a financial document designed to track income and expenses related to self-employment activities. It helps contractors organize revenue streams, deductible costs, and net profit over specific periods, facilitating accurate tax reporting and financial planning. This template streamlines bookkeeping by providing a clear structure for monitoring business performance and managing cash flow effectively.

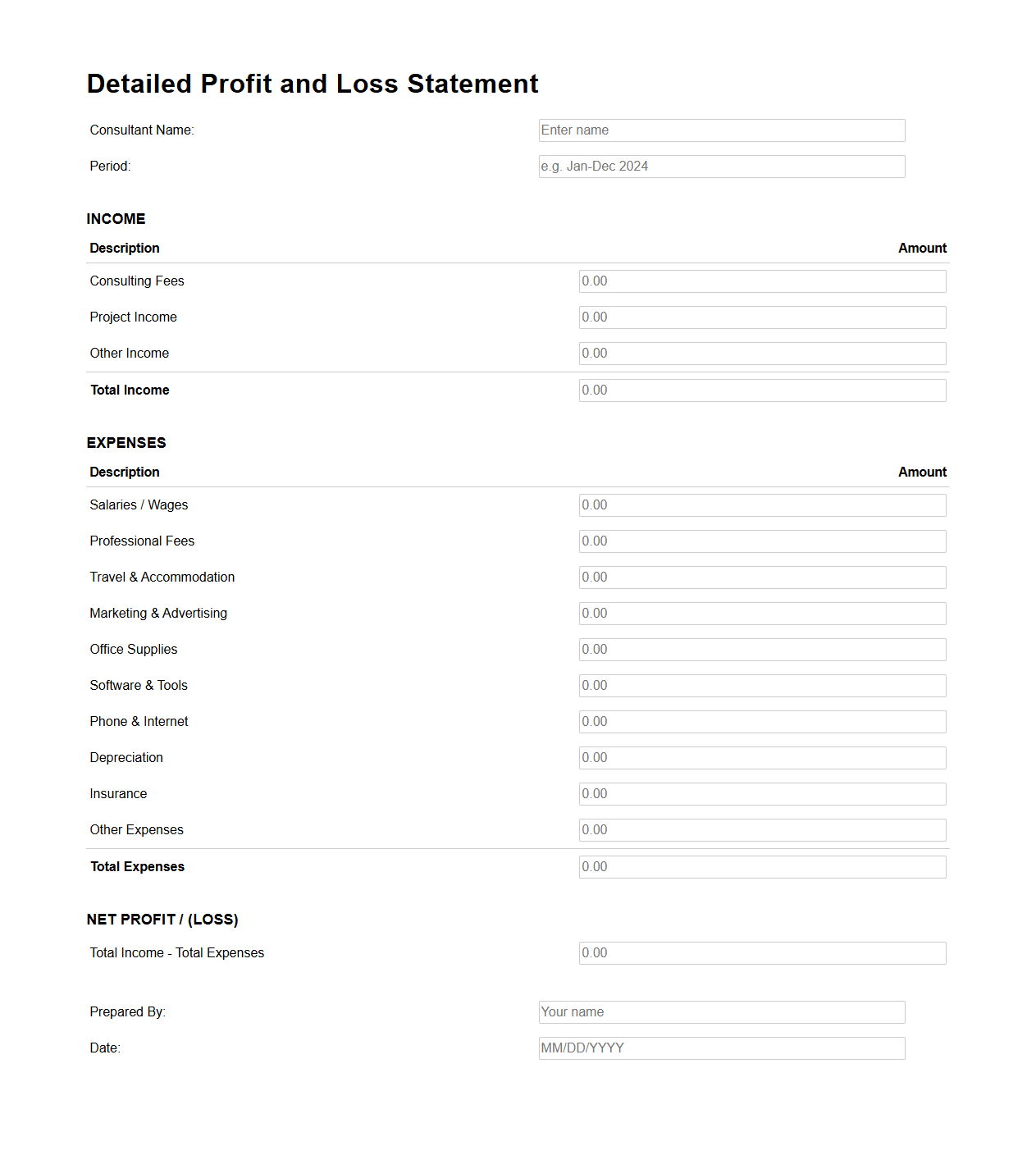

Detailed Profit and Loss Statement Template for Consultants

A

Detailed Profit and Loss Statement Template for Consultants is a comprehensive financial tool designed to track and analyze revenue and expenses specific to consulting businesses. It provides clear categories for income streams, operational costs, and project-related expenditures, enabling precise profit calculation. This template helps consultants maintain organized financial records, identify growth opportunities, and make informed decisions to enhance profitability.

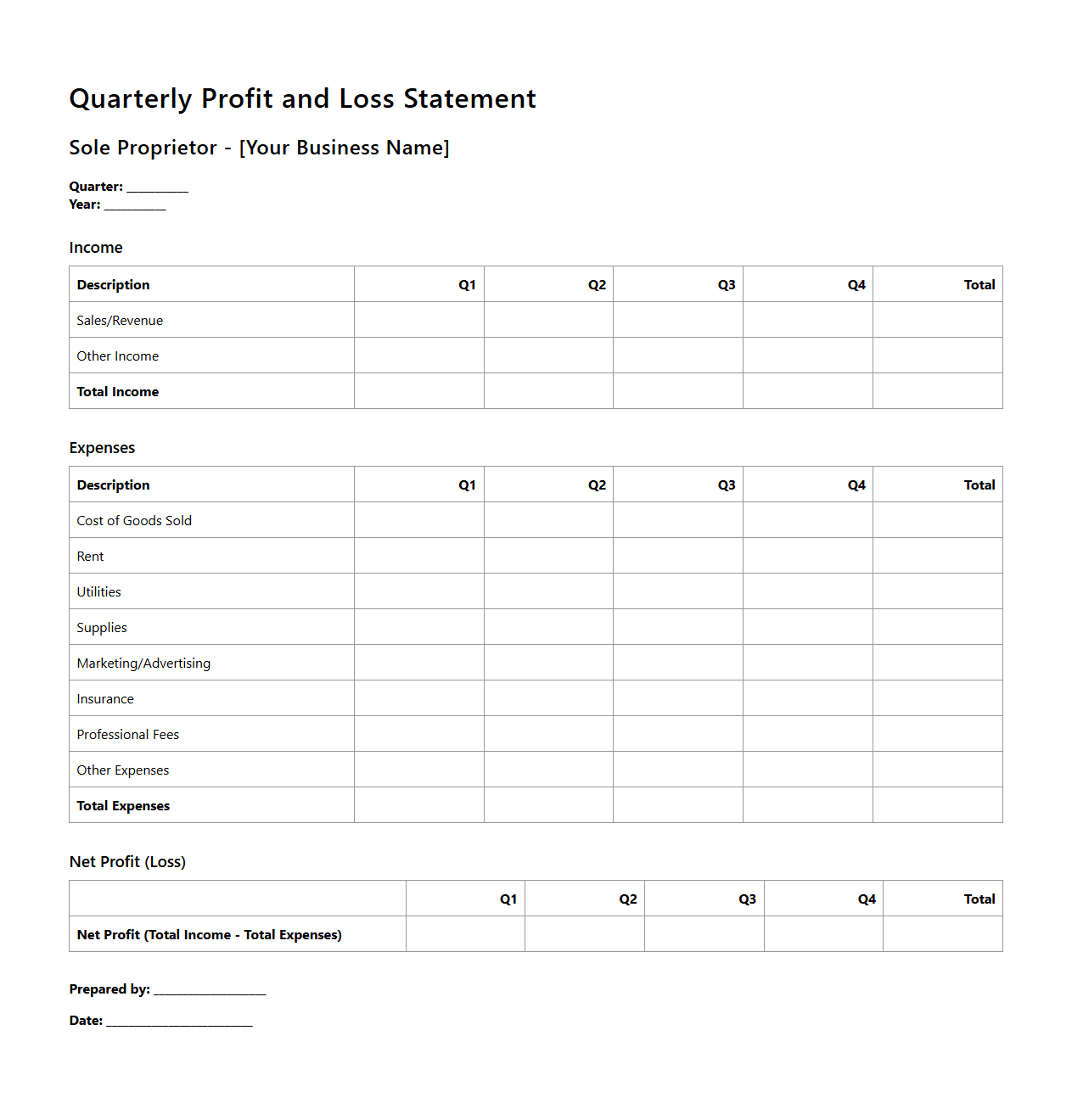

Quarterly Profit and Loss Statement Template for Sole Proprietors

A

Quarterly Profit and Loss Statement Template for Sole Proprietors is a financial document designed to help sole proprietors track their business income, expenses, and net profit over a three-month period. This template facilitates clear organization of revenue sources and cost categories, enabling accurate performance analysis and informed decision-making. It is essential for tax preparation, budgeting, and evaluating the financial health of a sole proprietorship.

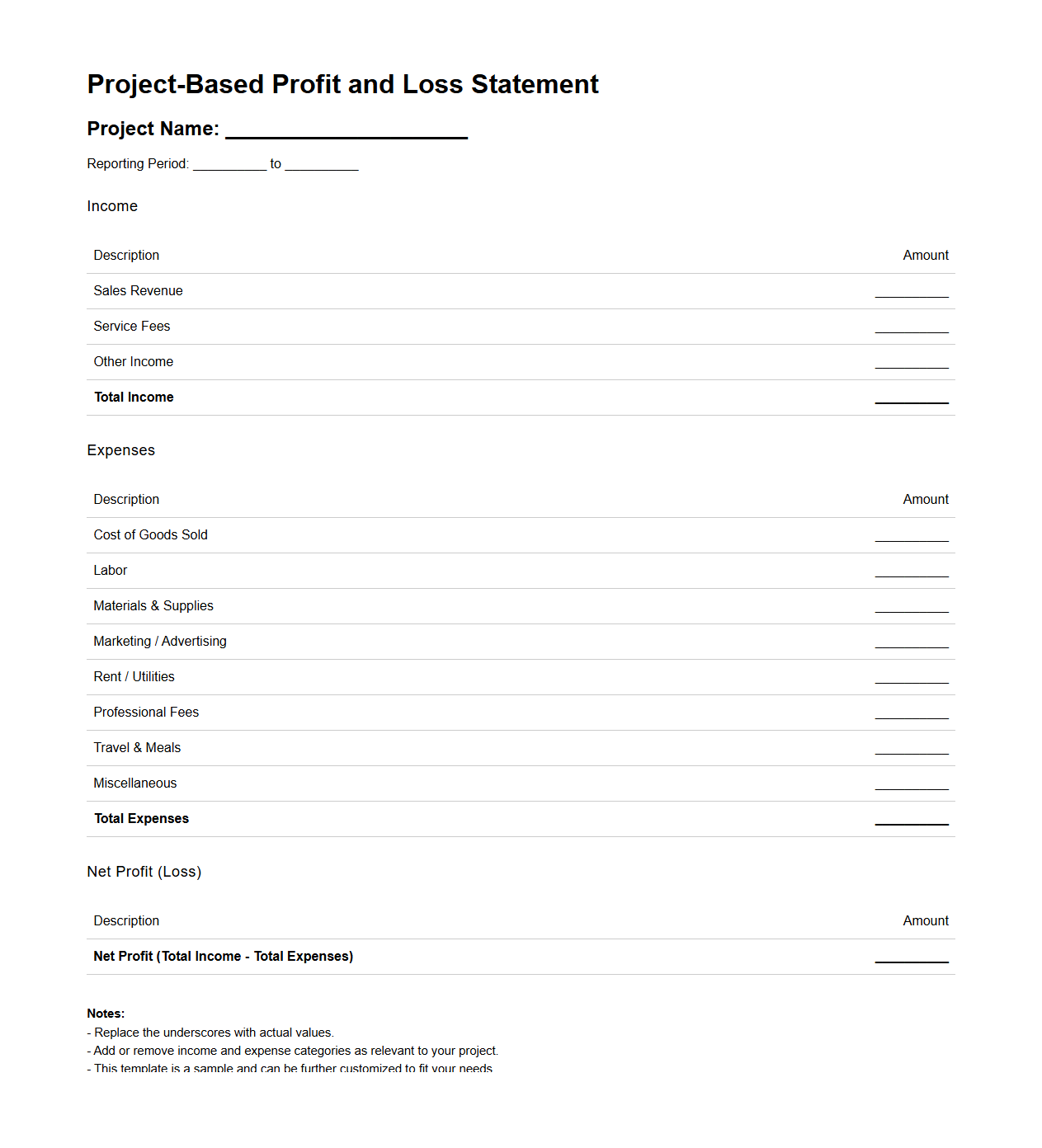

Project-Based Profit and Loss Statement Template for Entrepreneurs

A

Project-Based Profit and Loss Statement Template for entrepreneurs is a financial tool designed to track income and expenses specific to individual projects. It enables business owners to analyze profitability on a per-project basis, facilitating more accurate budgeting and financial planning. This template helps entrepreneurs identify cost overruns, monitor revenue streams, and make informed decisions to enhance project performance.

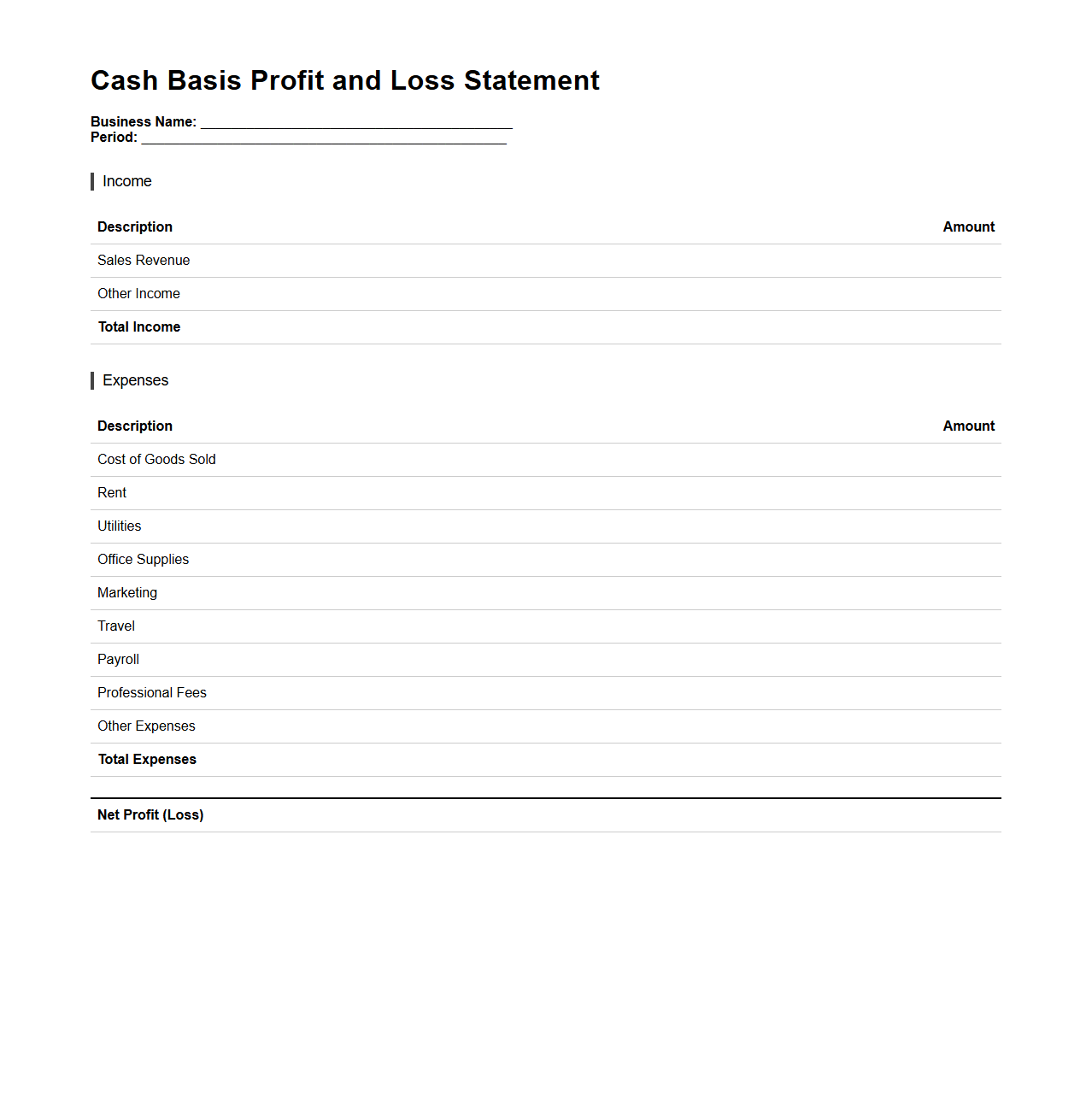

Cash Basis Profit and Loss Statement Template for Microbusinesses

A

Cash Basis Profit and Loss Statement Template for microbusinesses is a financial document designed to track income and expenses when cash is actually received or paid, rather than when they are incurred. This template helps small business owners manage their cash flow effectively by providing a clear picture of their revenue and expenditures during a specific period. It is an essential tool for ensuring accurate profit calculation and making informed financial decisions in cash-based accounting systems.

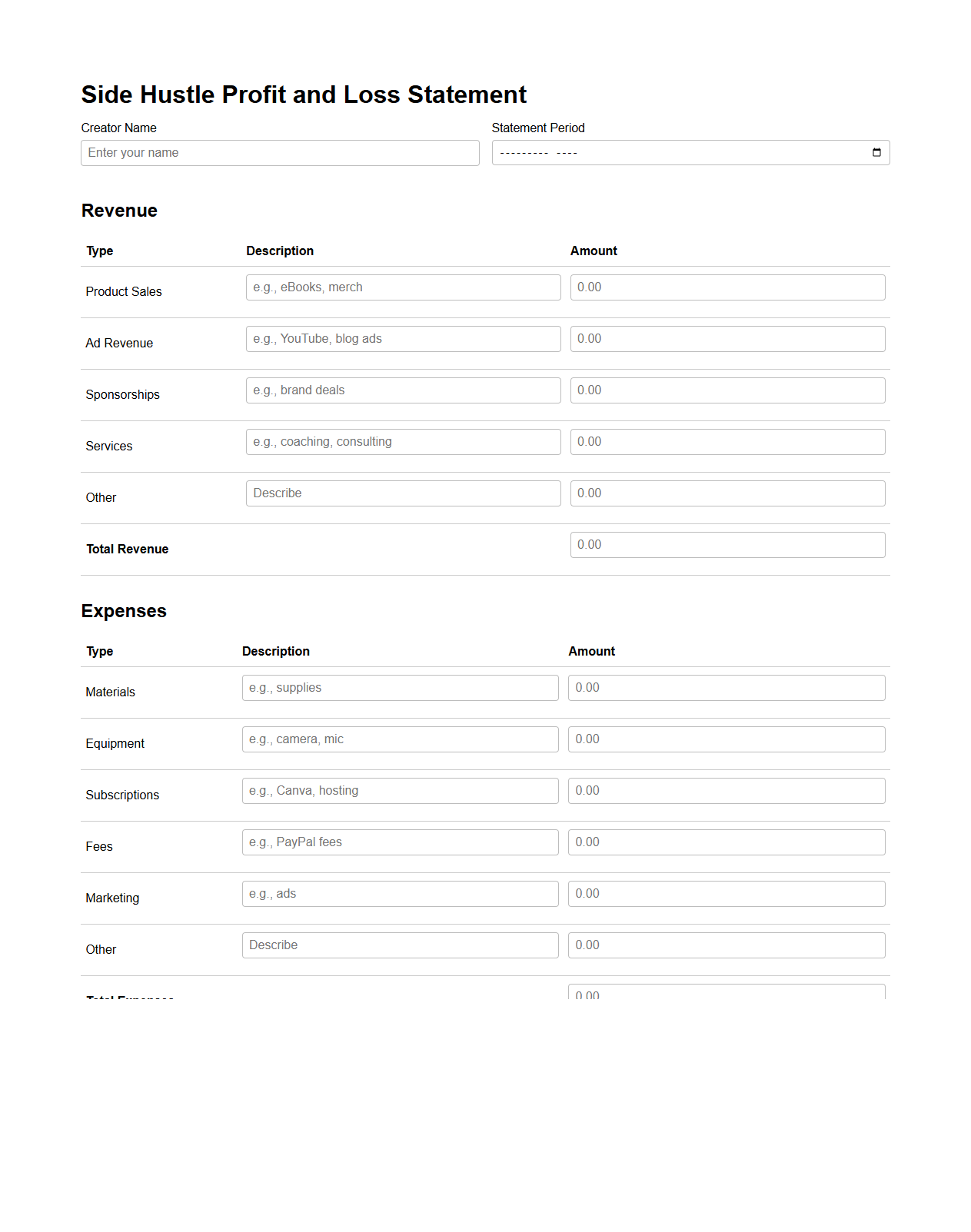

Side Hustle Profit and Loss Statement Template for Creators

The

Side Hustle Profit and Loss Statement Template for Creators is a financial tool designed to help content creators track their income and expenses from various side projects. It organizes revenue streams such as sponsorships, merchandise, and freelance work, alongside costs like equipment, software, and marketing, enabling accurate profit calculation. This template facilitates informed decision-making and financial planning by providing a clear overview of profitability and cash flow specific to creative side hustles.

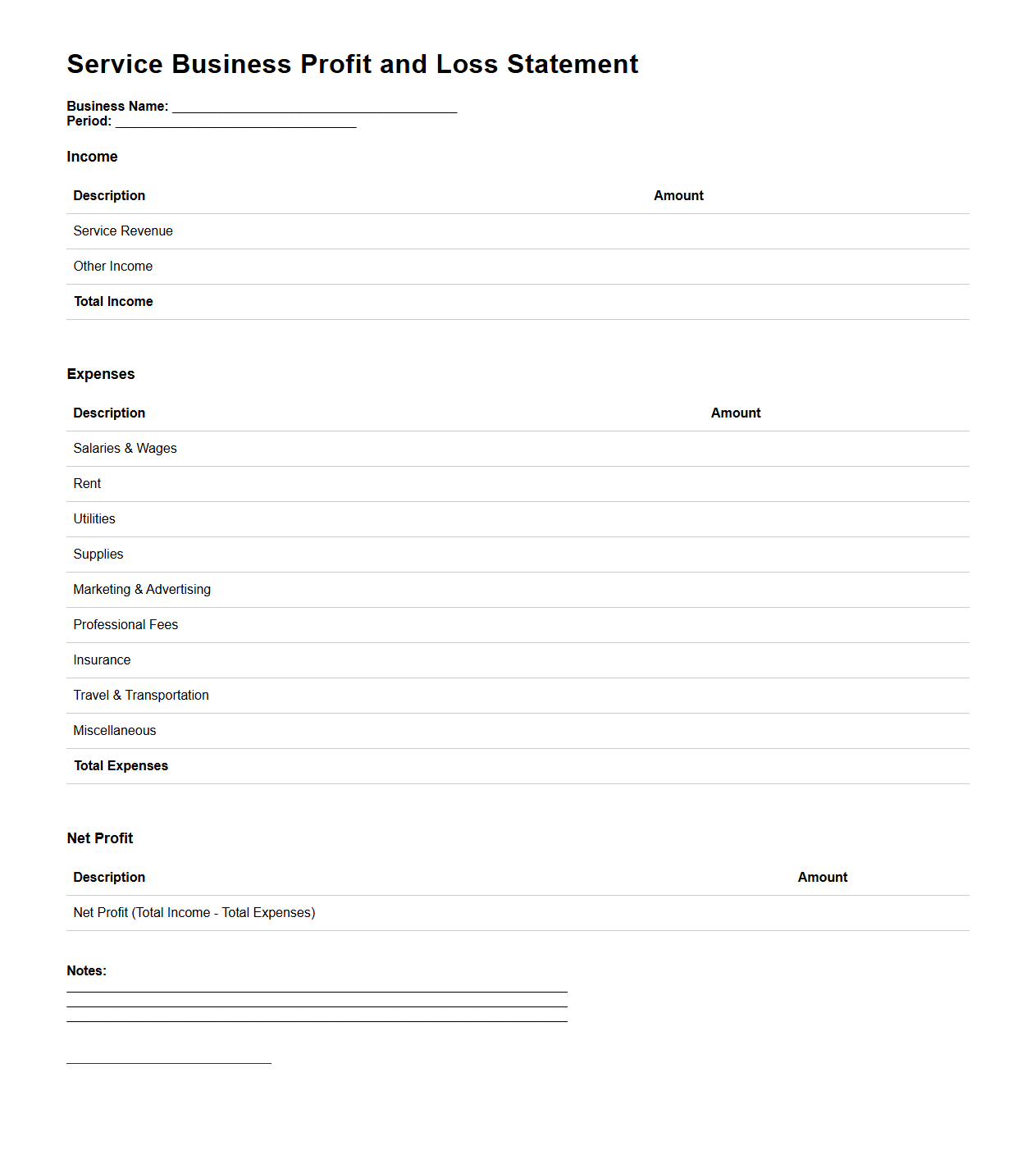

Service Business Profit and Loss Statement Template for Entrepreneurs

A

Service Business Profit and Loss Statement Template for entrepreneurs is a financial document designed to track revenue, costs, and expenses specific to service-based businesses. This template helps entrepreneurs analyze profitability by detailing income from services rendered against operational costs, including labor, materials, and overhead. It provides a clear overview to support informed decision-making and effective financial management.

What essential sections should a blank profit and loss statement for entrepreneurs include?

A blank profit and loss statement should include essential sections such as Revenue, which lists all income generated from sales or services. It must also have a section for Cost of Goods Sold (COGS) to account for direct costs related to the production of goods sold. Lastly, including Operating Expenses like marketing, salaries, and utilities helps in calculating accurate net profit or loss.

How can a customizable profit and loss template support early-stage startups?

A customizable profit and loss template allows early-stage startups to tailor the statement to their specific business activities, improving financial tracking and forecasting. It helps entrepreneurs quickly adapt to changing business models by easily adding or removing sections. This flexibility supports better decision-making and resource allocation during critical growth phases.

What common mistakes do entrepreneurs make when filling out a blank profit and loss statement?

Entrepreneurs often make the mistake of not categorizing expenses accurately, which can distort the true financial position. Another common error is failing to update the statement regularly, leading to outdated and unreliable data. Additionally, overlooking non-operating expenses or income results in incomplete profit and loss assessments.

Which key performance indicators (KPIs) should entrepreneurs track with their profit and loss statement?

Entrepreneurs should focus on KPIs such as Gross Profit Margin to understand profitability before operating expenses. Tracking Net Profit Margin provides insight into overall business efficiency after all costs are deducted. Additionally, monitoring Operating Expenses Ratio helps control overhead and improve financial health.

How often should entrepreneurs update and review their blank profit and loss statement?

Entrepreneurs should update their profit and loss statement at least on a monthly basis to maintain accurate financial visibility. Regular reviews, ideally quarterly, enable timely identification of trends and necessary adjustments. Frequent updates support effective budgeting and long-term financial planning.