A Blank Statement Template for Tax Purposes serves as a customizable document to report financial information accurately to tax authorities. This template helps individuals and businesses organize income, expenses, and deductions in a clear format to ensure compliance with tax regulations. Using a structured blank statement improves record-keeping efficiency and minimizes errors during tax filing.

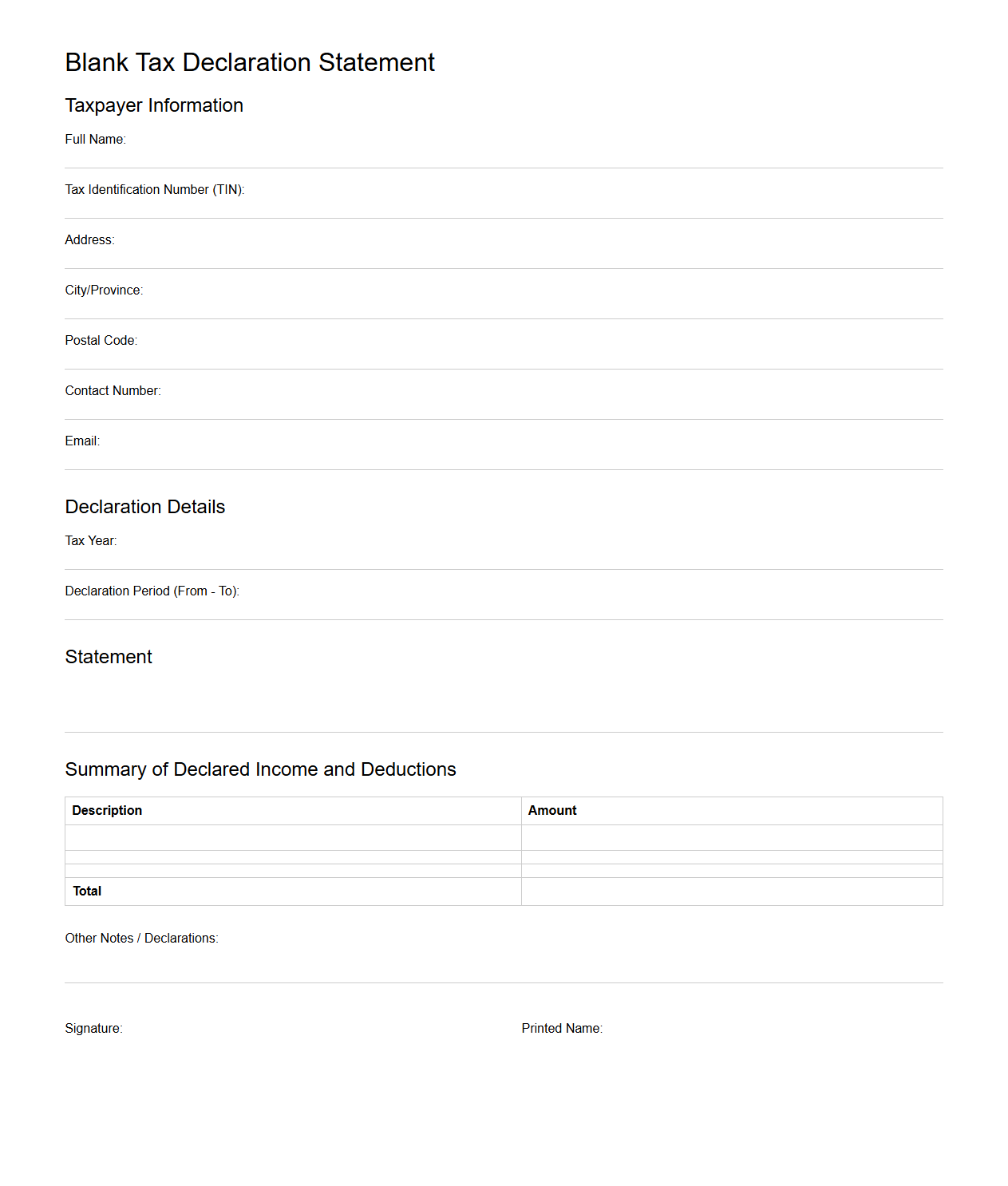

Blank Tax Declaration Statement Template

A

Blank Tax Declaration Statement Template document is a pre-formatted form designed for individuals or businesses to declare their income, assets, and liabilities for tax assessment purposes. It ensures accurate and consistent reporting by providing standardized fields for essential financial information required by tax authorities. This template facilitates compliance with tax regulations, making the declaration process more efficient and transparent.

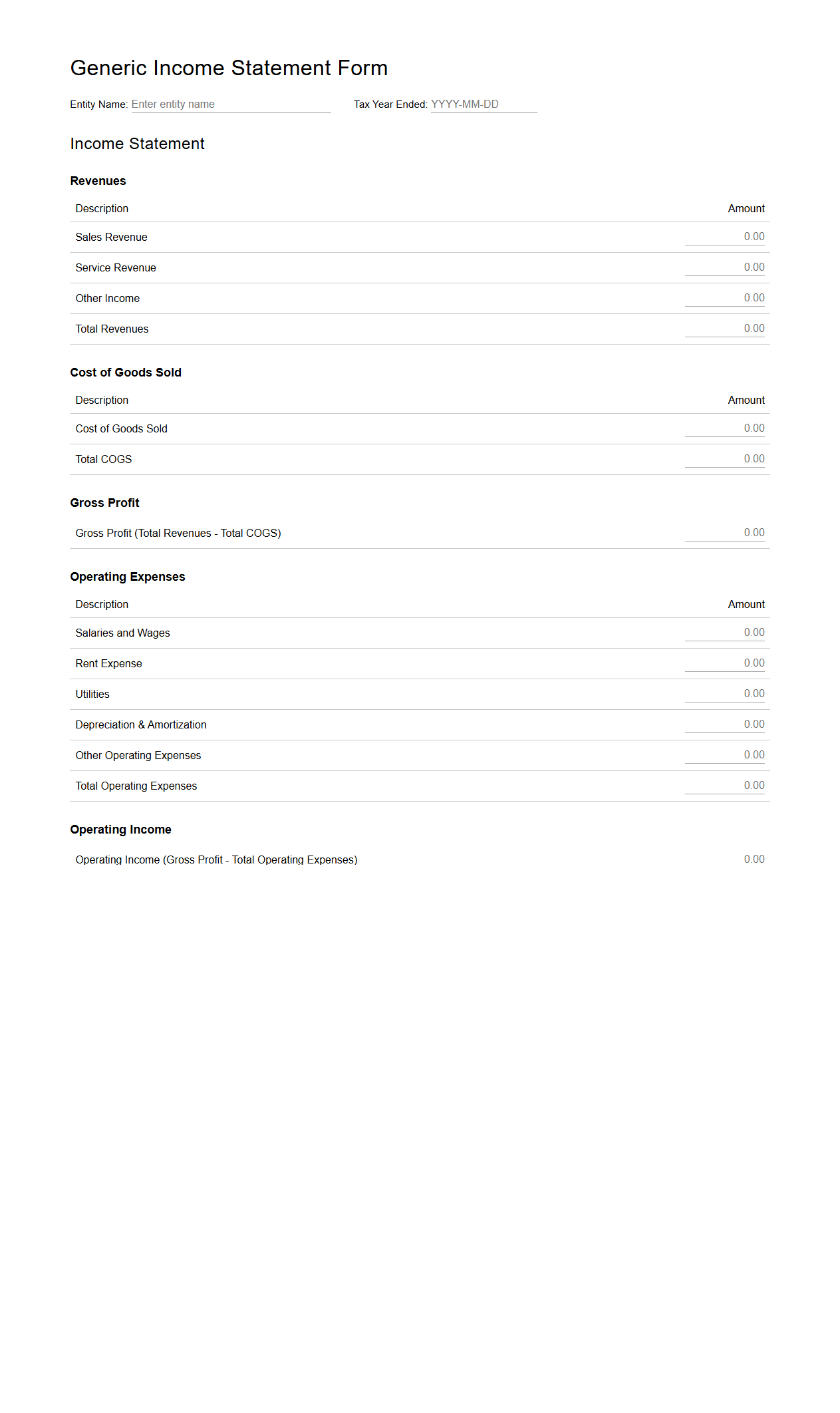

Generic Income Statement Form for Tax Reporting

The Generic Income Statement Form for Tax Reporting is a standardized financial document used to summarize a company's revenues, expenses, and net income during a specific tax period. This form ensures compliance with tax regulations by providing clear, accurate financial data required for tax return preparation and filing. Accurate completion of the

Generic Income Statement facilitates efficient tax reporting and helps avoid penalties or audits.

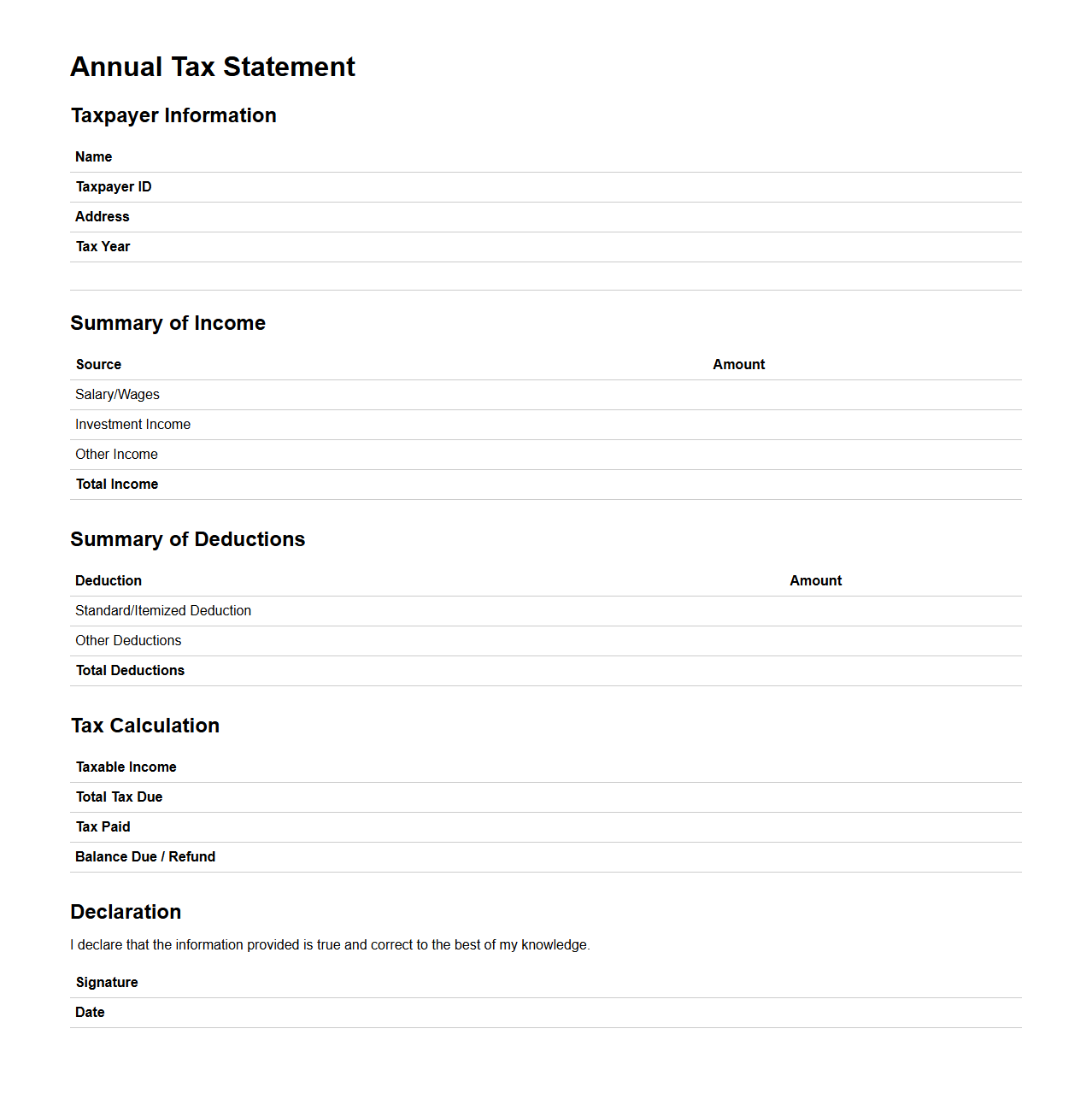

Basic Annual Tax Statement Outline

The

Basic Annual Tax Statement Outline document provides a structured summary of an individual's or entity's taxable income, deductions, and credits for the fiscal year. It serves as a reference for preparing detailed tax returns, ensuring compliance with tax regulations and accurate reporting to authorities. This outline typically includes key financial figures, tax liabilities, and relevant documentation to streamline the tax filing process.

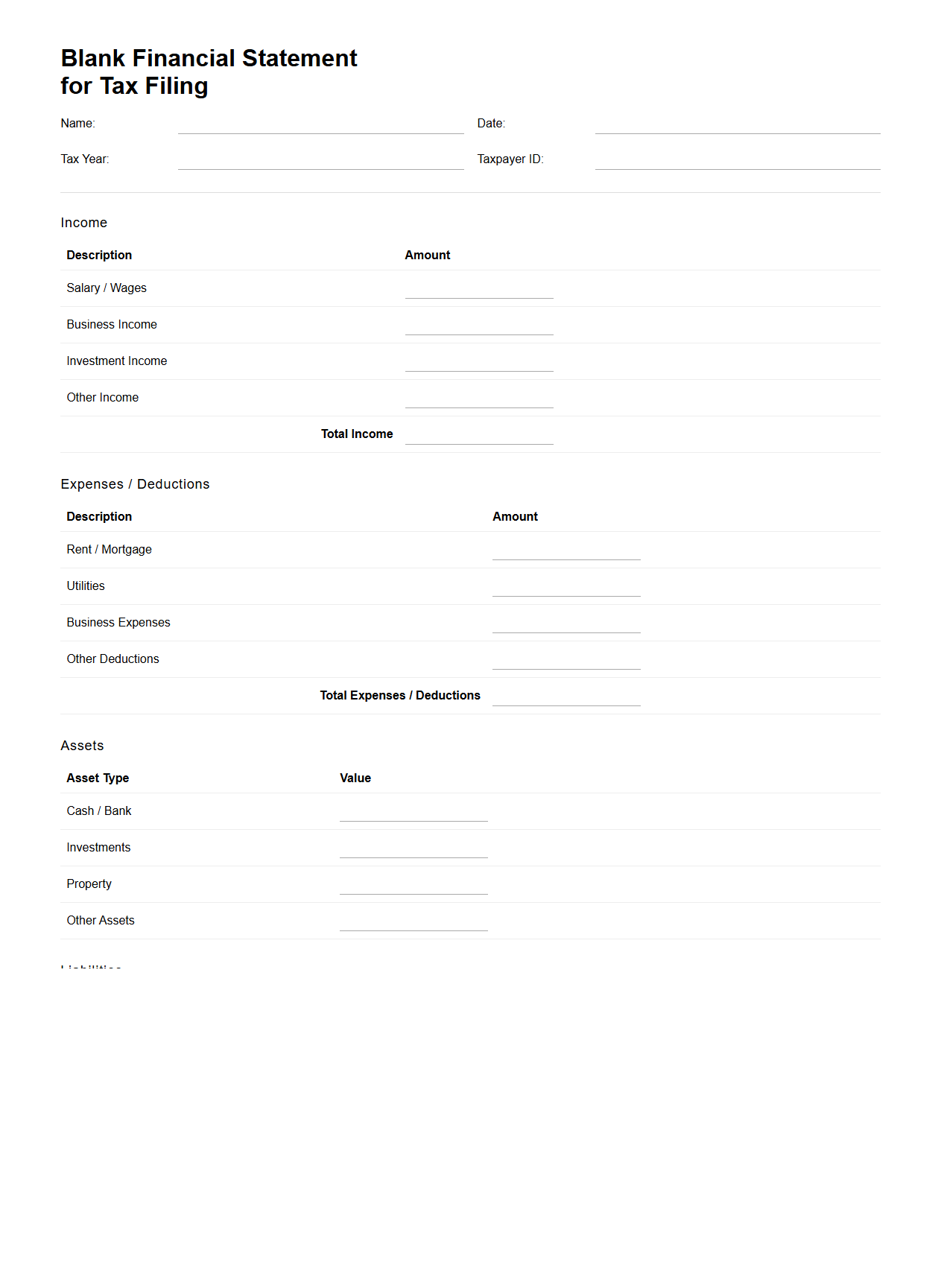

Blank Financial Statement for Tax Filing

A

Blank Financial Statement for Tax Filing is a standardized form used to report an individual's or business's financial details to tax authorities, ensuring accurate assessment of tax liabilities. This document typically includes sections for income, expenses, assets, and liabilities, allowing taxpayers to provide comprehensive financial information. By using a blank template, users can customize the statement according to their specific financial situation while complying with tax regulations.

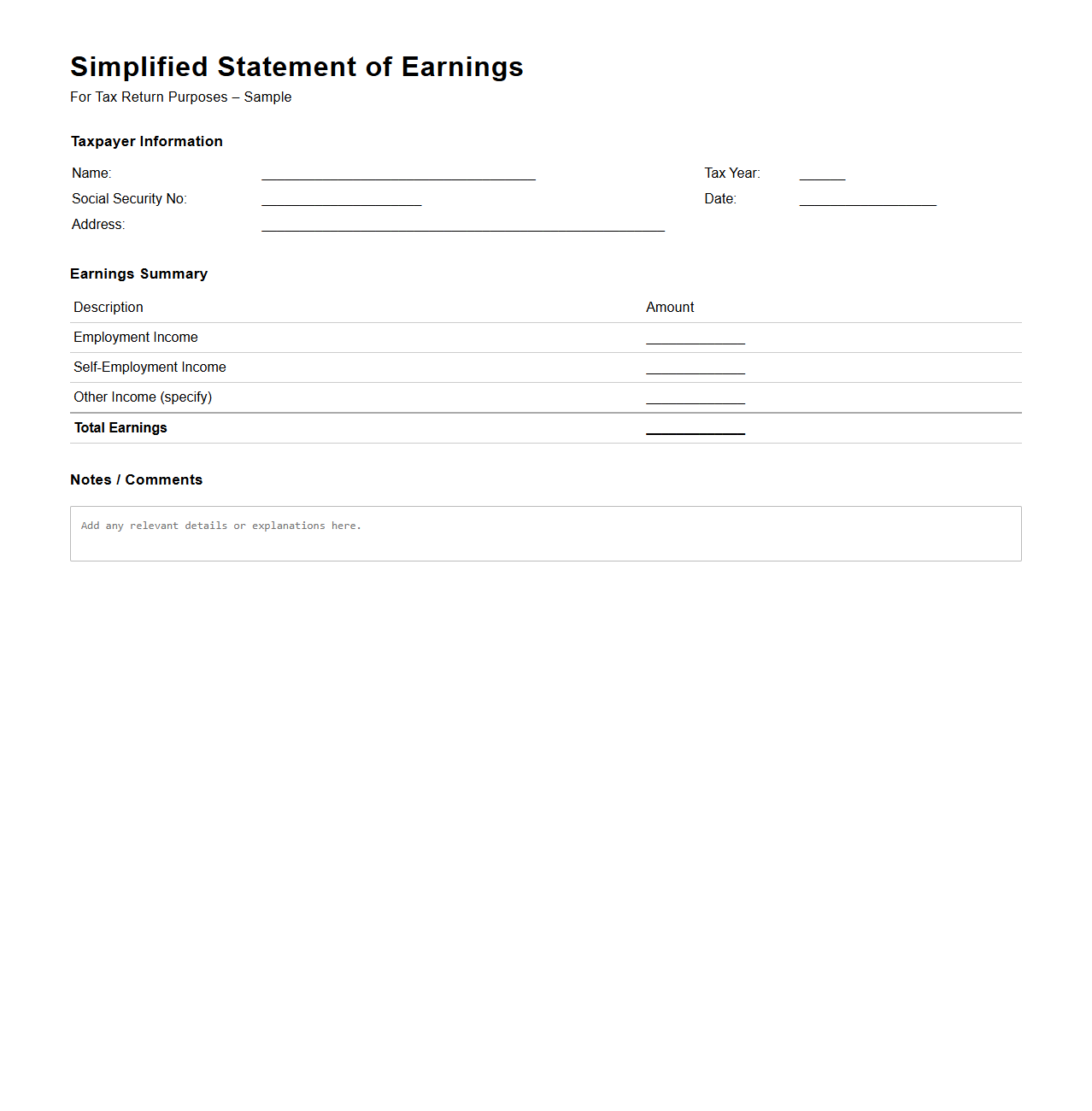

Simplified Statement of Earnings for Tax Returns

A

Simplified Statement of Earnings for Tax Returns is a concise financial document summarizing an individual's or business's income over a specific period, usually for tax filing purposes. It highlights key earnings, deductions, and taxes withheld, providing a clear overview to assist tax authorities in assessing taxable income accurately. This document streamlines the tax return process by offering essential income data without complex financial details.

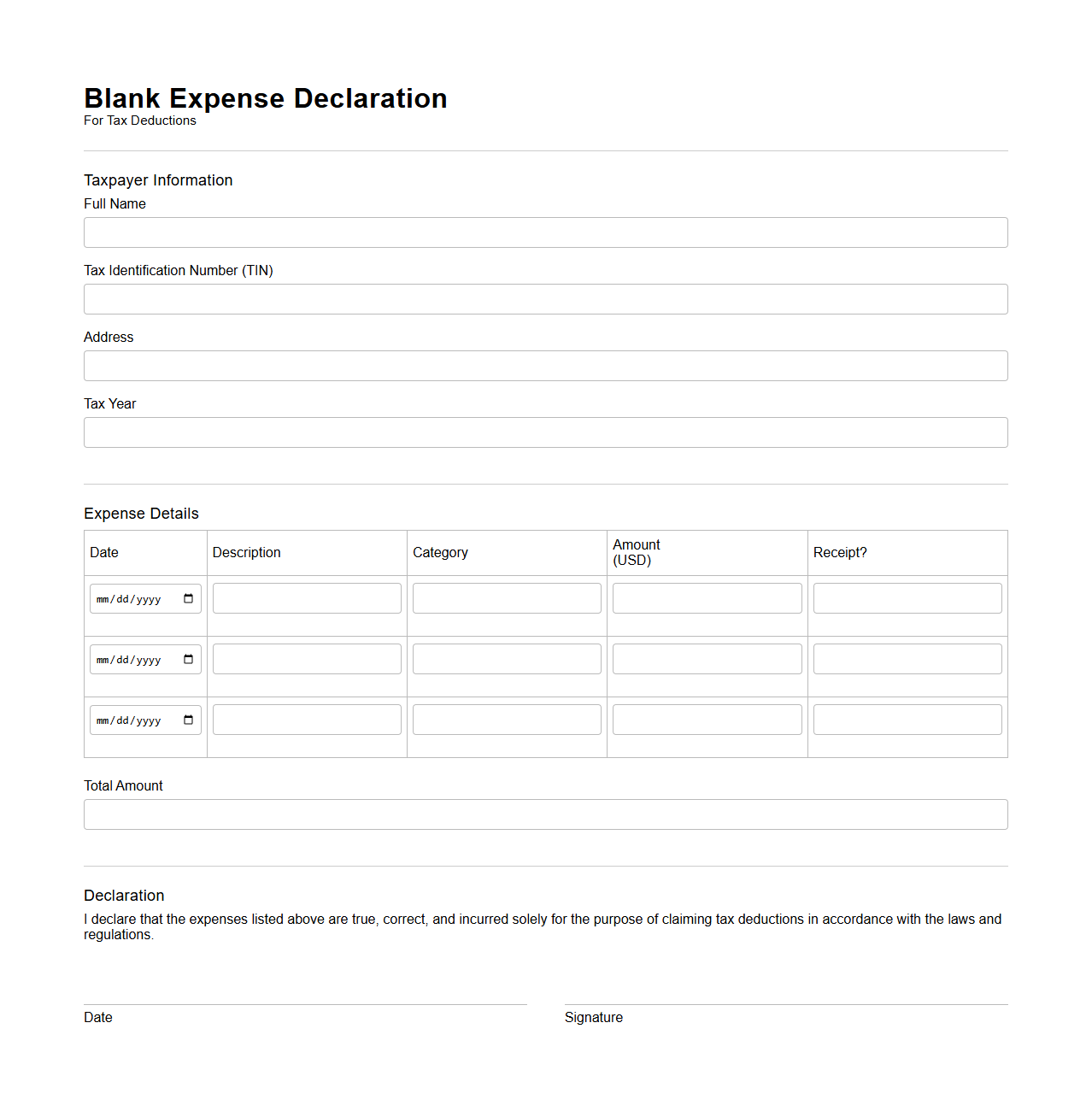

Blank Expense Declaration Template for Tax Deductions

A

Blank Expense Declaration Template for Tax Deductions is a standardized form used to itemize and report expenses eligible for tax deductions. This document helps individuals and businesses organize their deductible expenses, ensuring accurate and compliant tax filing. Proper use of the template can streamline the documentation process and maximize potential tax savings.

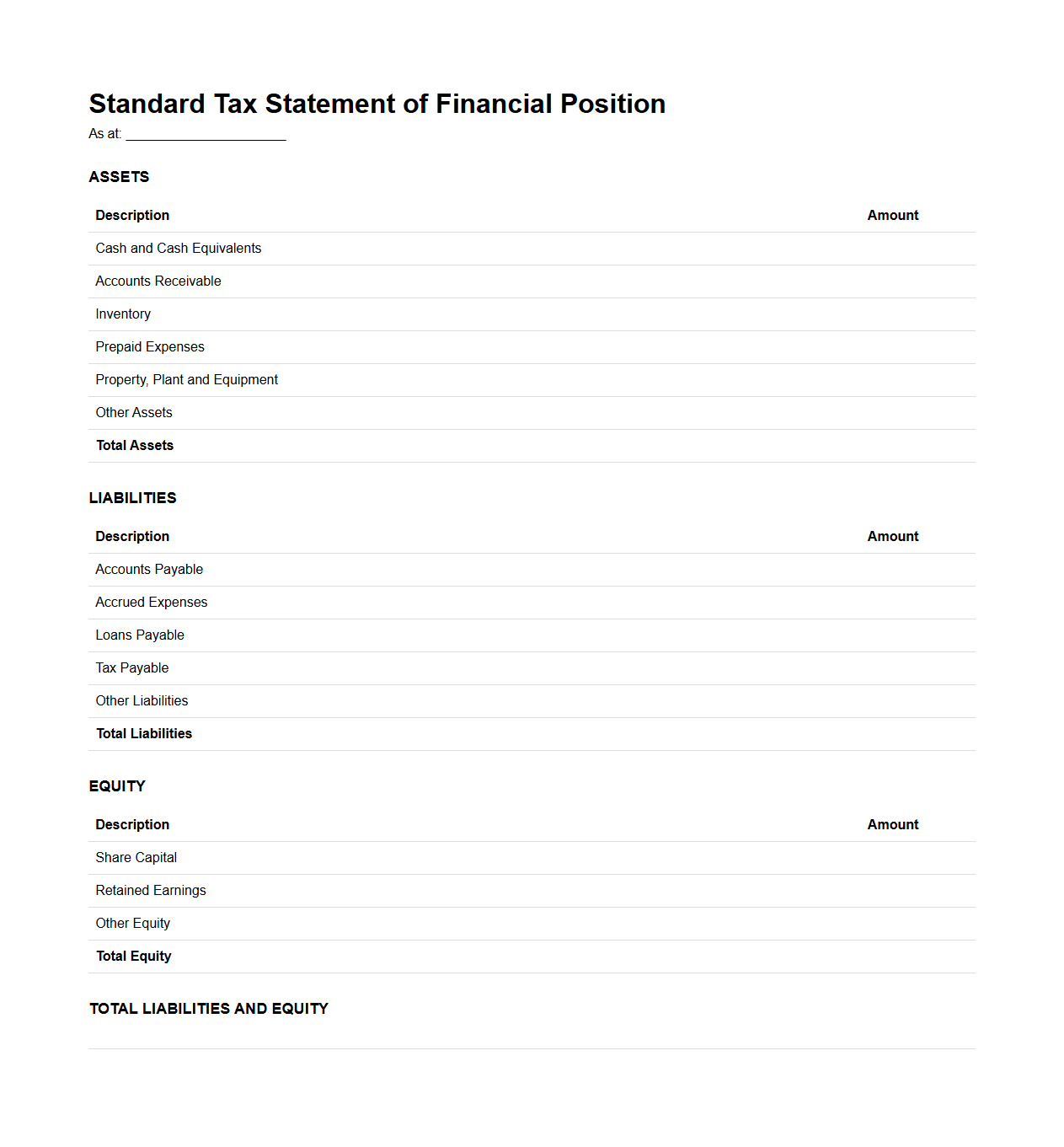

Standard Tax Statement of Financial Position

The

Standard Tax Statement of Financial Position is a formal financial document that outlines an entity's assets, liabilities, and equity at a specific point in time, primarily for tax reporting purposes. It provides detailed information necessary for tax authorities to assess the financial health and tax obligations of a business or individual. This statement ensures compliance with tax regulations by accurately reflecting the financial position relevant to taxable events.

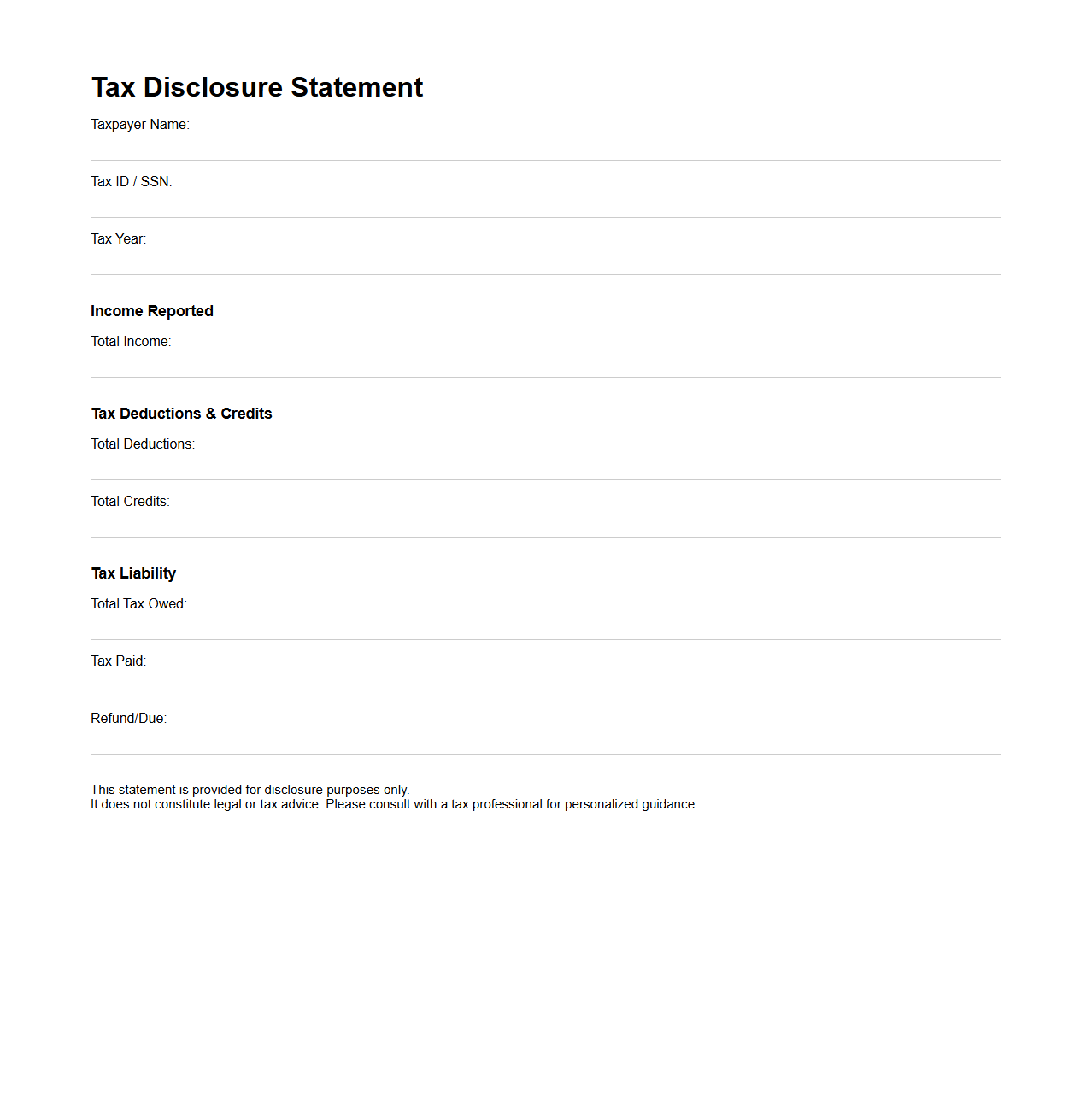

Minimal Tax Disclosure Statement Template

A

Minimal Tax Disclosure Statement Template document serves as a streamlined format for reporting essential tax information with clarity and precision. It helps individuals or businesses provide only the necessary tax-related details required by authorities, reducing complexity and ensuring compliance. This template typically includes fields for income, deductions, credits, and other critical tax elements to facilitate accurate and efficient disclosure.

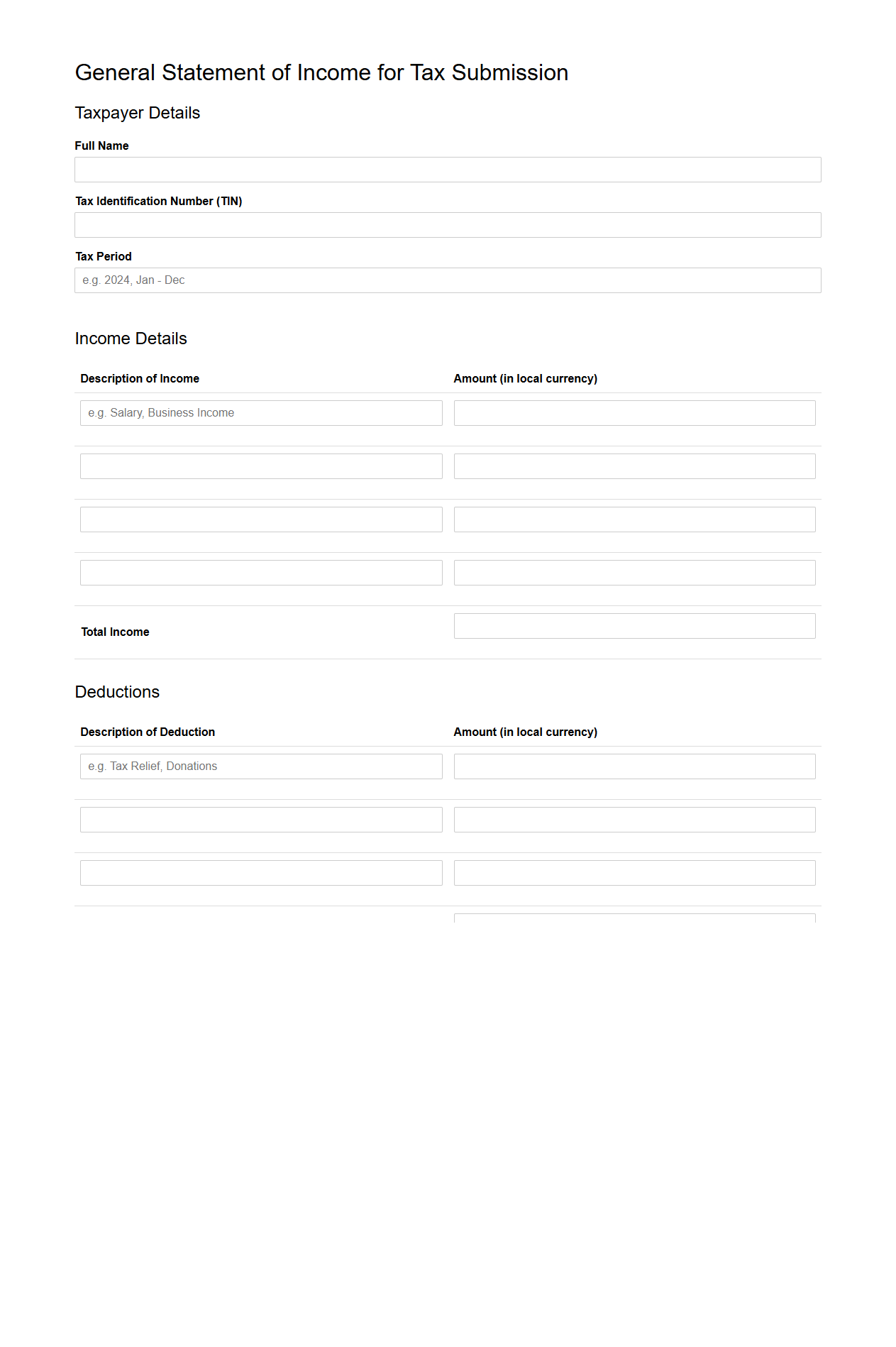

General Statement of Income for Tax Submission

The

General Statement of Income for Tax Submission is a comprehensive financial document that summarizes an individual's or business's total earnings during a specific fiscal period. It includes income from various sources such as salary, business profits, investments, and other taxable revenues, providing the necessary data for accurate tax calculation. This statement serves as a critical foundation for filing tax returns and ensuring compliance with tax authorities.

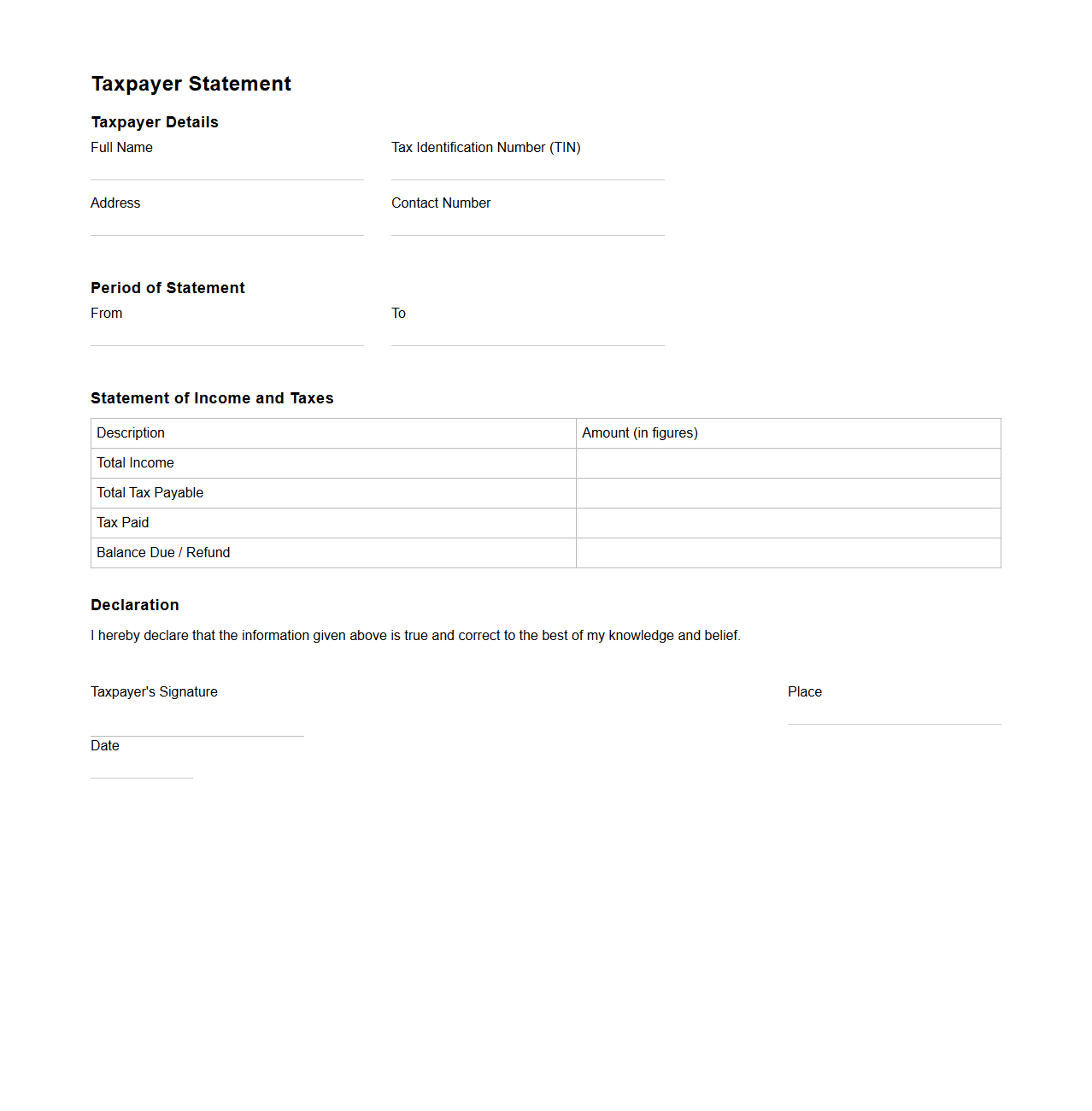

Unfilled Taxpayer Statement Format

The

Unfilled Taxpayer Statement Format document is a standardized form used by tax authorities to notify taxpayers who have not submitted their required tax declarations or reports. It outlines the necessary information taxpayers must provide to comply with tax regulations and serves as a formal request for submission. This document helps ensure accurate tax records and enforces timely compliance with filing obligations.

What specific details must a blank statement for tax purposes include to meet IRS requirements?

A blank statement for tax purposes must clearly state the taxpayer's full name and Social Security Number or Taxpayer Identification Number. It should explicitly declare that the individual had zero income for the reporting tax year. The document must also be signed and dated by the taxpayer to satisfy IRS authenticity standards.

How can a blank statement letter be formatted to verify zero income for tax filing?

The letter should begin with a header including the taxpayer's name and contact information. A concise declaration such as "I hereby certify that I had no income during the tax year [Year]" serves as the core of the zero income verification. Ending with the taxpayer's signature and date finalizes the formal structure required for tax filing.

Are there legal implications in submitting a blank statement for tax purposes to financial institutions?

Submitting a blank statement inaccurately may lead to legal scrutiny, as financial institutions require truthful and complete information. Providing false or misleading information can be considered tax evasion or fraud, carrying serious penalties. Therefore, it is critical that any submitted statement reflects the taxpayer's actual financial status.

In which scenarios is a "blank statement" accepted by tax authorities as valid supporting documentation?

Tax authorities may accept a blank statement as valid when an individual has genuinely earned no income within the fiscal year. This is common for students, dependents, or individuals temporarily not earning wages. However, such acceptance often requires additional proof, like bank statements or affidavits, corroborating the zero income claim.

What digital tools are recommended for securely generating and storing blank tax statement letters?

Secure document creation tools like Adobe Acrobat and Microsoft Word with encryption options are recommended for generating blank tax statement letters. Cloud storage services with strong security protocols, such as Google Drive or Dropbox with two-factor authentication, are ideal for safe storage. Utilizing password protection and regular backups further ensures the document's integrity and accessibility.