The Blank Statement Template for Business Expenses serves as a practical tool for tracking and organizing company expenditures. It helps businesses maintain accurate records for accounting and tax purposes, ensuring every cost is accounted for. Utilizing this template streamlines financial management and supports budget planning.

Business Expense Statement Sample Template

A

Business Expense Statement Sample Template document is a structured form designed to record and itemize expenses incurred by employees or business entities during work-related activities. This template facilitates accurate bookkeeping, ensuring all reimbursable expenses such as travel, meals, and supplies are documented with dates, amounts, and descriptions. Utilizing a standardized expense statement enhances financial transparency and streamlines the reimbursement process while supporting compliance with company policies and tax regulations.

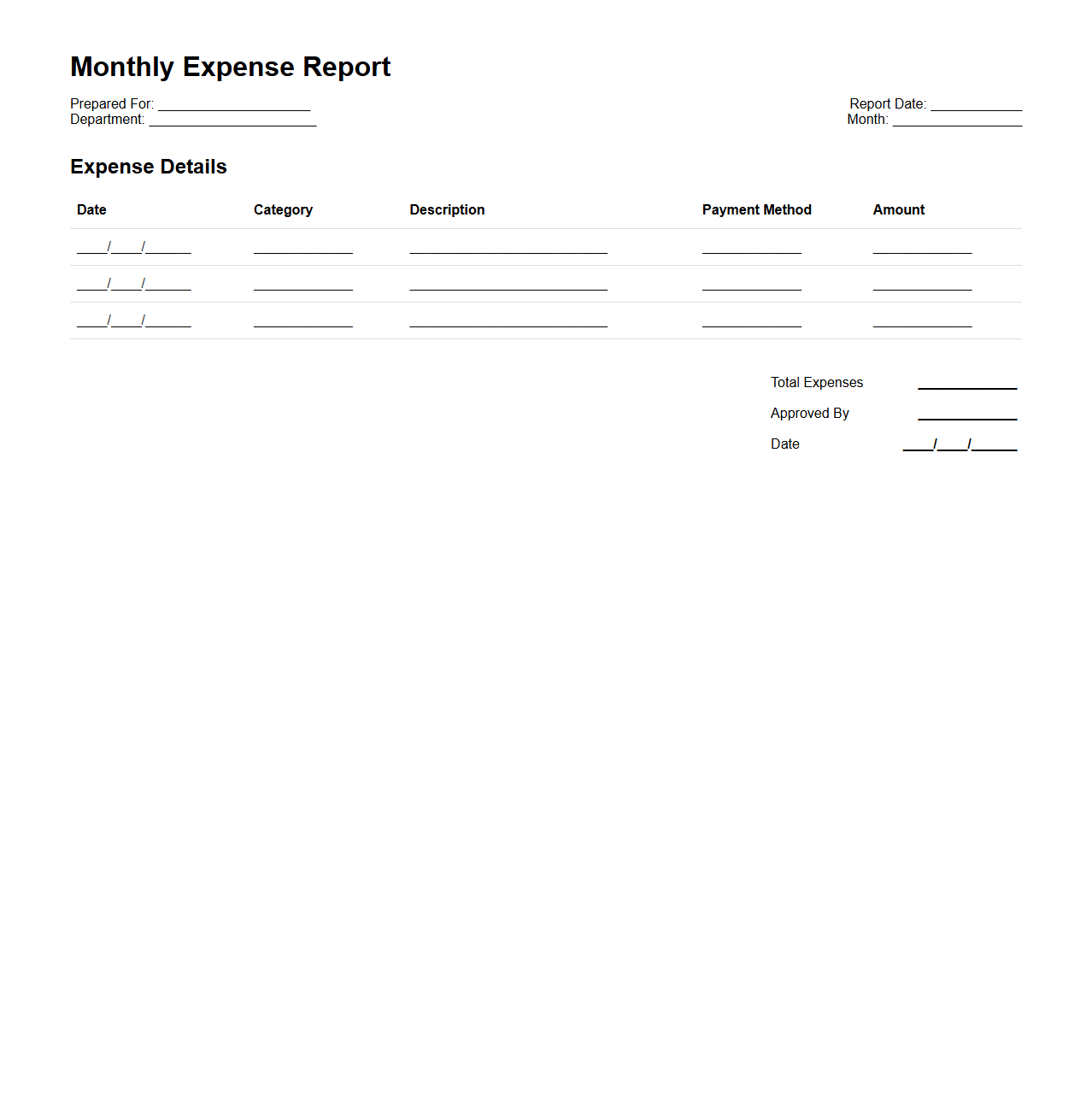

Monthly Expense Report Statement Format

A Monthly Expense Report Statement Format document is a standardized template used to record and summarize all expenses incurred within a specific month for a business or individual. This format typically includes categories such as travel, office supplies, meals, and utilities, ensuring clear tracking and accountability of financial outflows. Using a

Monthly Expense Report helps streamline budgeting processes and supports accurate financial analysis and reimbursement claims.

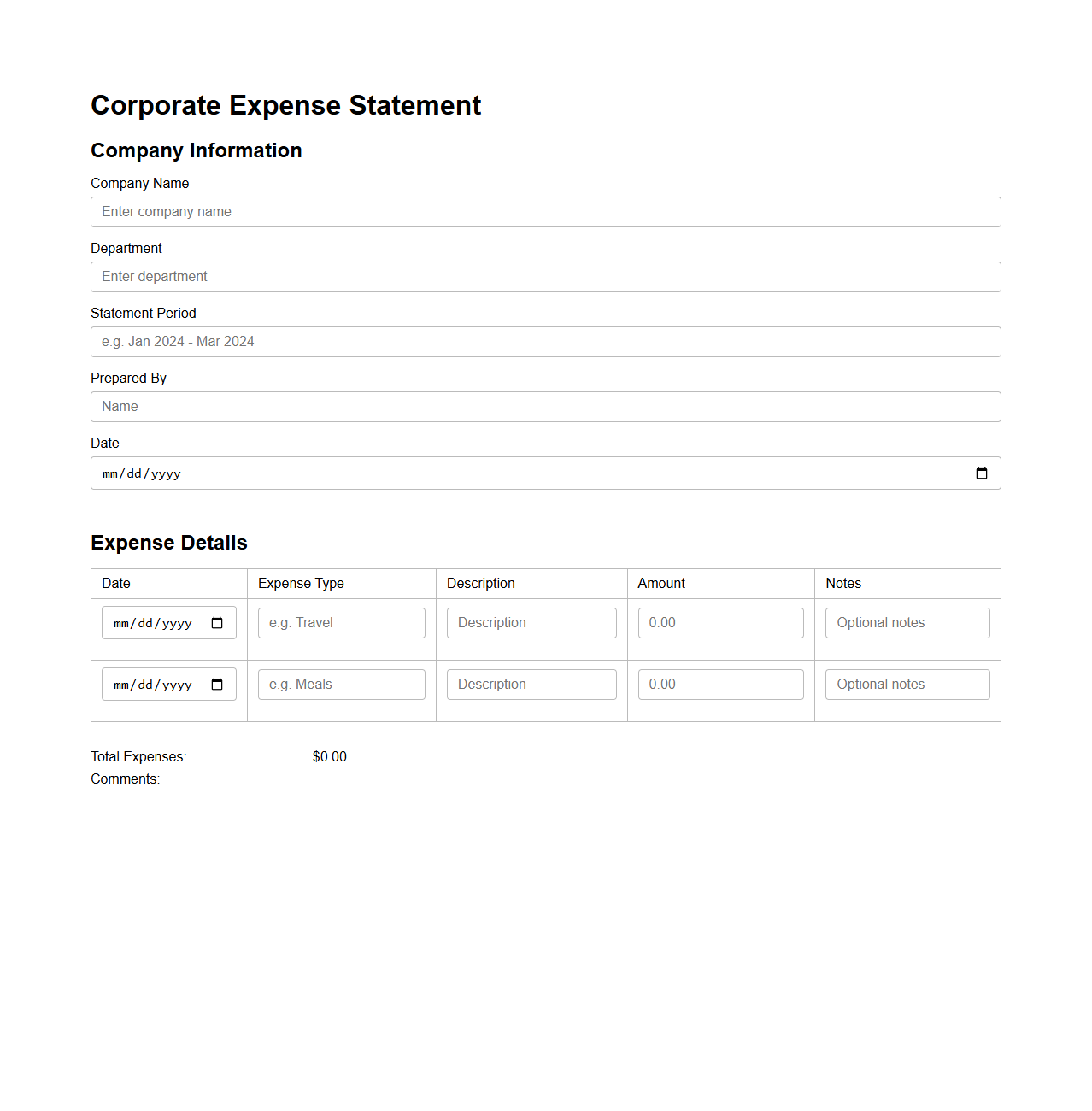

Simple Corporate Expense Statement Outline

A

Simple Corporate Expense Statement Outline document provides a clear and structured format to record and track business-related expenditures. It typically includes essential sections such as date, expense category, description, amount, and approval status, ensuring accurate financial reporting and budget management. This streamlined outline helps organizations maintain transparency, control costs, and simplify reimbursement processes.

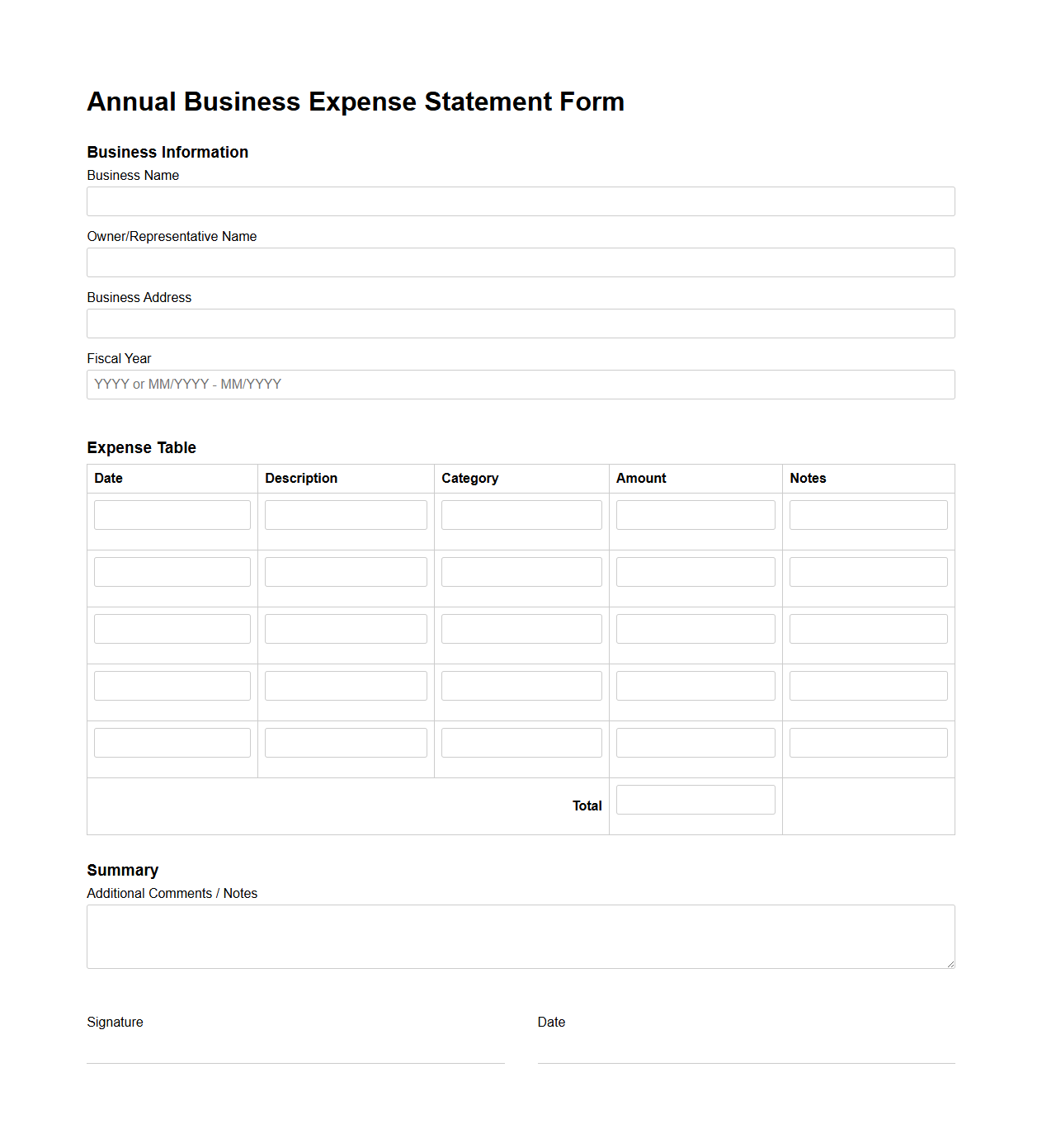

Annual Business Expense Statement Form

The

Annual Business Expense Statement Form is a crucial document used by companies to report and track all expenses incurred throughout the fiscal year for accounting and tax purposes. It provides a detailed summary of operating costs, including salaries, utilities, supplies, and travel expenses, ensuring accurate financial records and compliance with regulatory requirements. Proper completion of this form supports effective budget management and aids in identifying potential areas for cost savings.

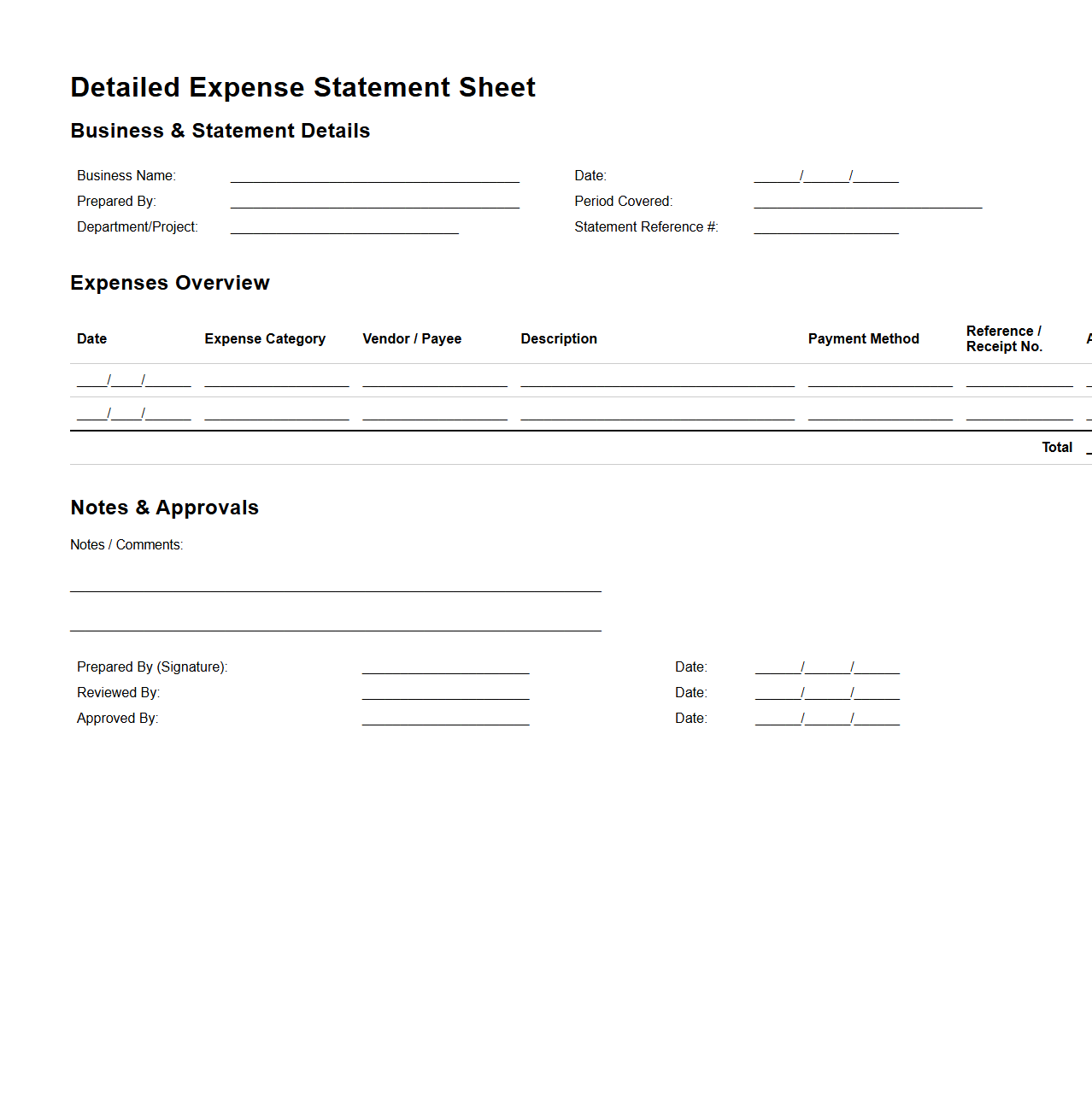

Detailed Expense Statement Sheet for Businesses

A

Detailed Expense Statement Sheet for businesses is a comprehensive document that itemizes all incurred costs related to company operations, including dates, descriptions, amounts, and payment methods. It helps track financial transactions accurately, ensuring transparent budget management and compliance with accounting standards. This sheet is essential for auditing purposes and financial analysis, enabling informed decision-making and cost control.

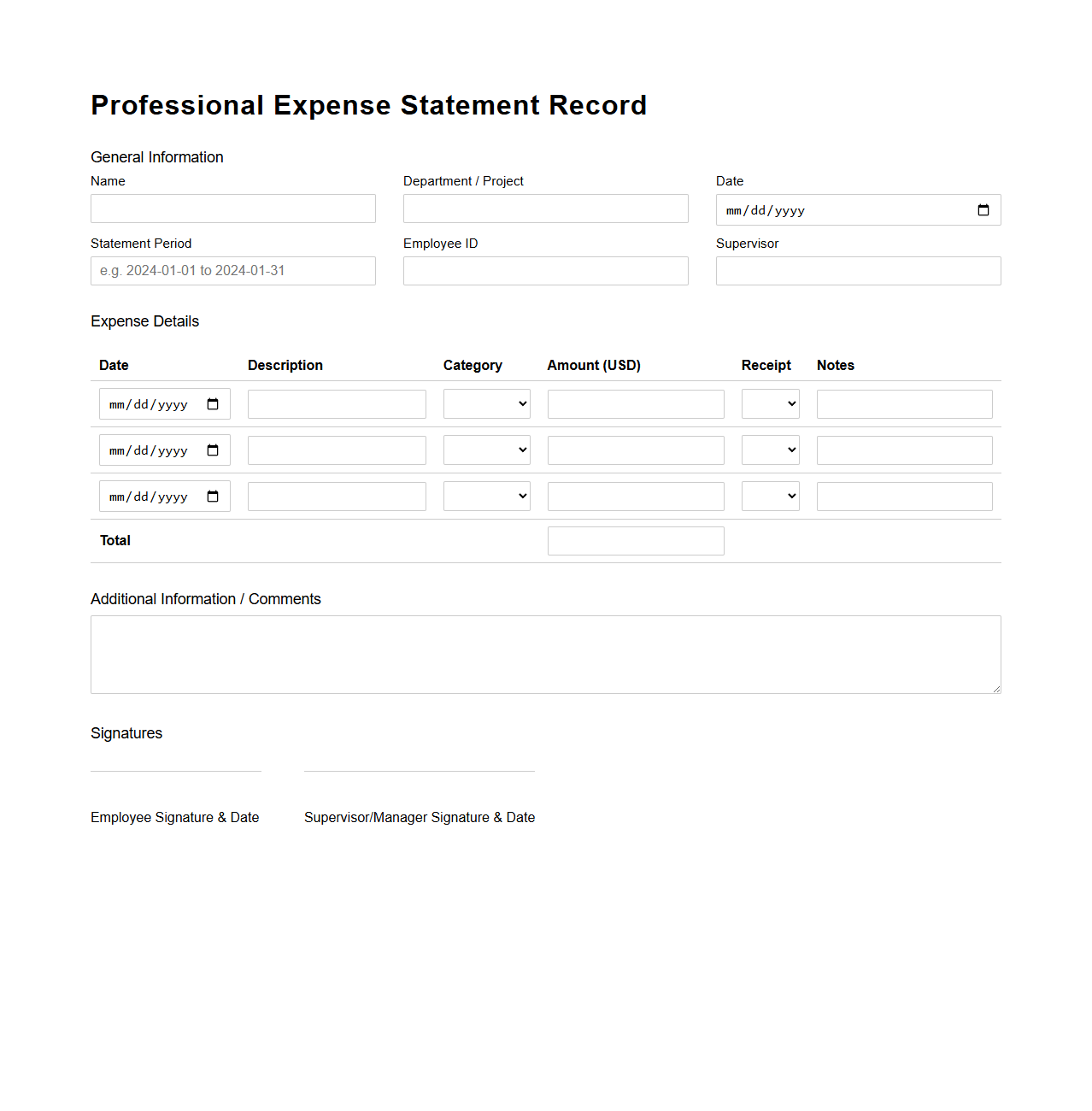

Professional Expense Statement Record

A

Professional Expense Statement Record document is a detailed report used to track and itemize expenses incurred by professionals during their work activities. It typically includes information such as dates, descriptions, amounts, and categories of expenses, ensuring accurate financial management and reimbursement. This document serves as a vital tool for budgeting, auditing, and tax reporting purposes.

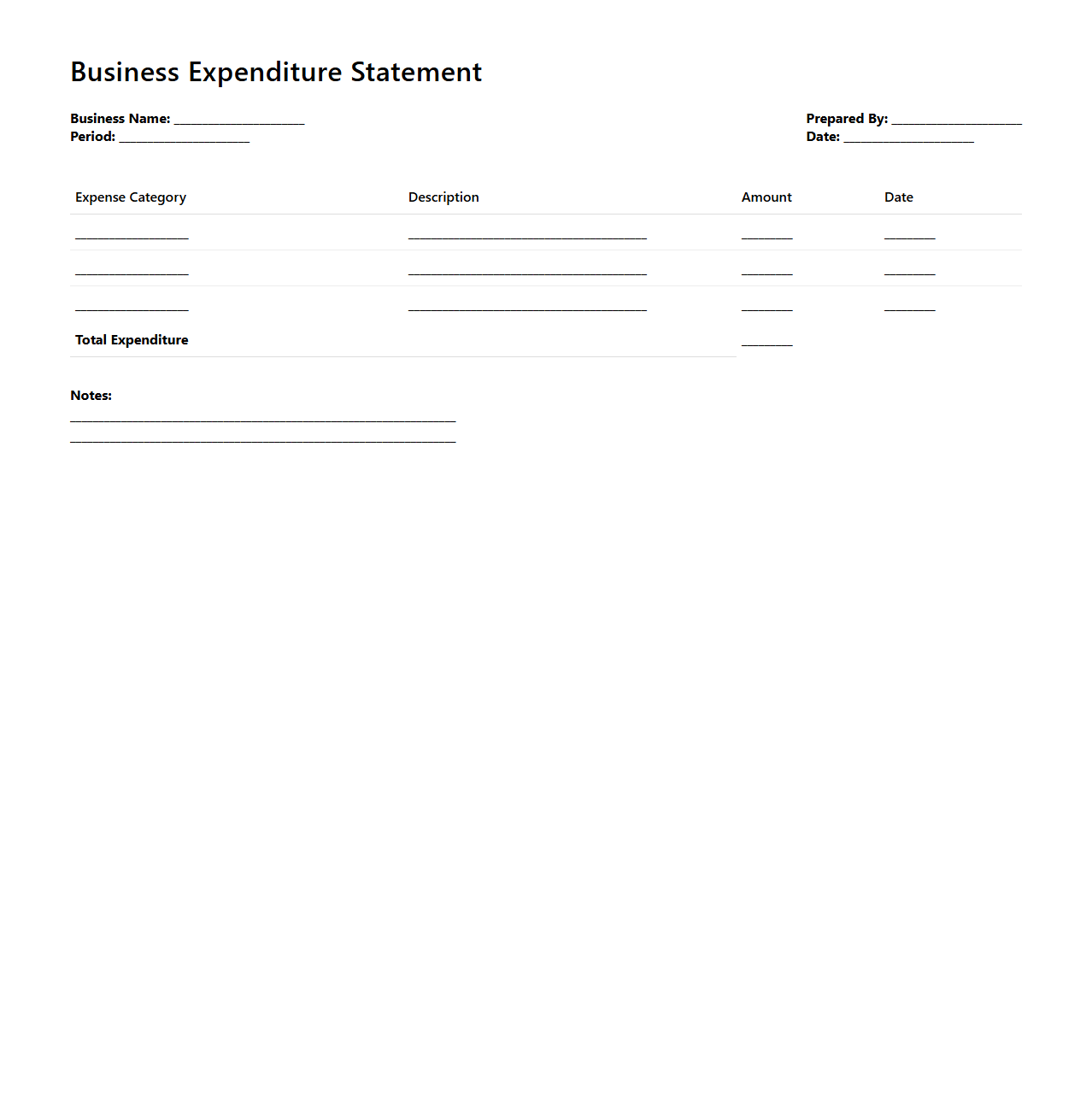

Minimalist Business Expenditure Statement Layout

A

Minimalist Business Expenditure Statement Layout document is designed to clearly present business expenses with simplicity and precision, focusing on essential financial data without unnecessary details. This layout streamlines the reporting process by using clean lines, concise categories, and straightforward formatting, making it easier for stakeholders to analyze spending patterns and budget management. Its efficiency supports quick decision-making and enhances financial transparency within an organization.

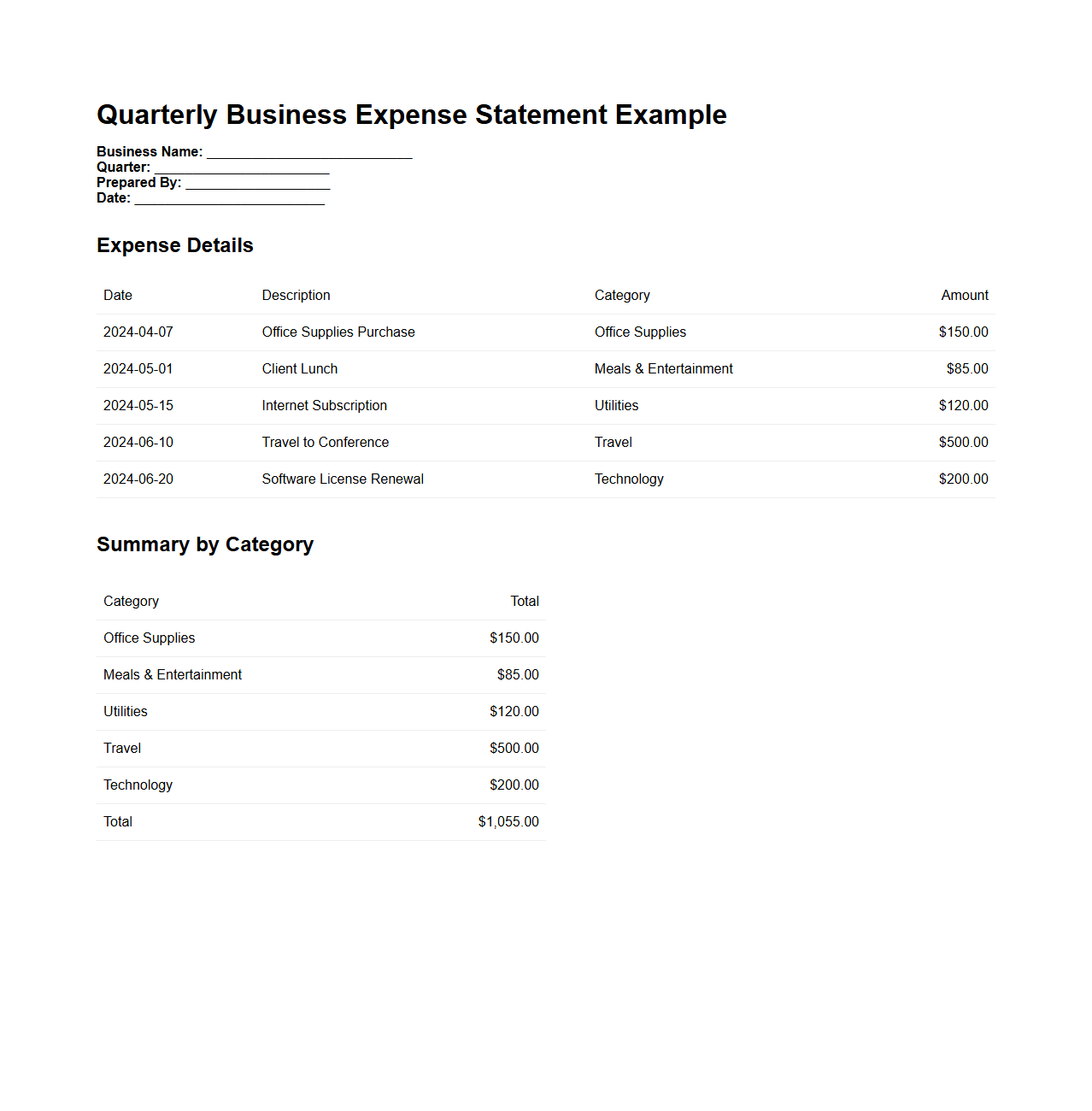

Quarterly Business Expense Statement Example

A

Quarterly Business Expense Statement Example document outlines a company's total expenses incurred over a three-month period, categorizing costs such as travel, supplies, and operational fees. This document assists businesses in tracking expenditure trends, ensuring budget adherence, and preparing accurate financial reports for stakeholders. It serves as a critical tool for financial analysis, tax preparation, and strategic planning within the organization.

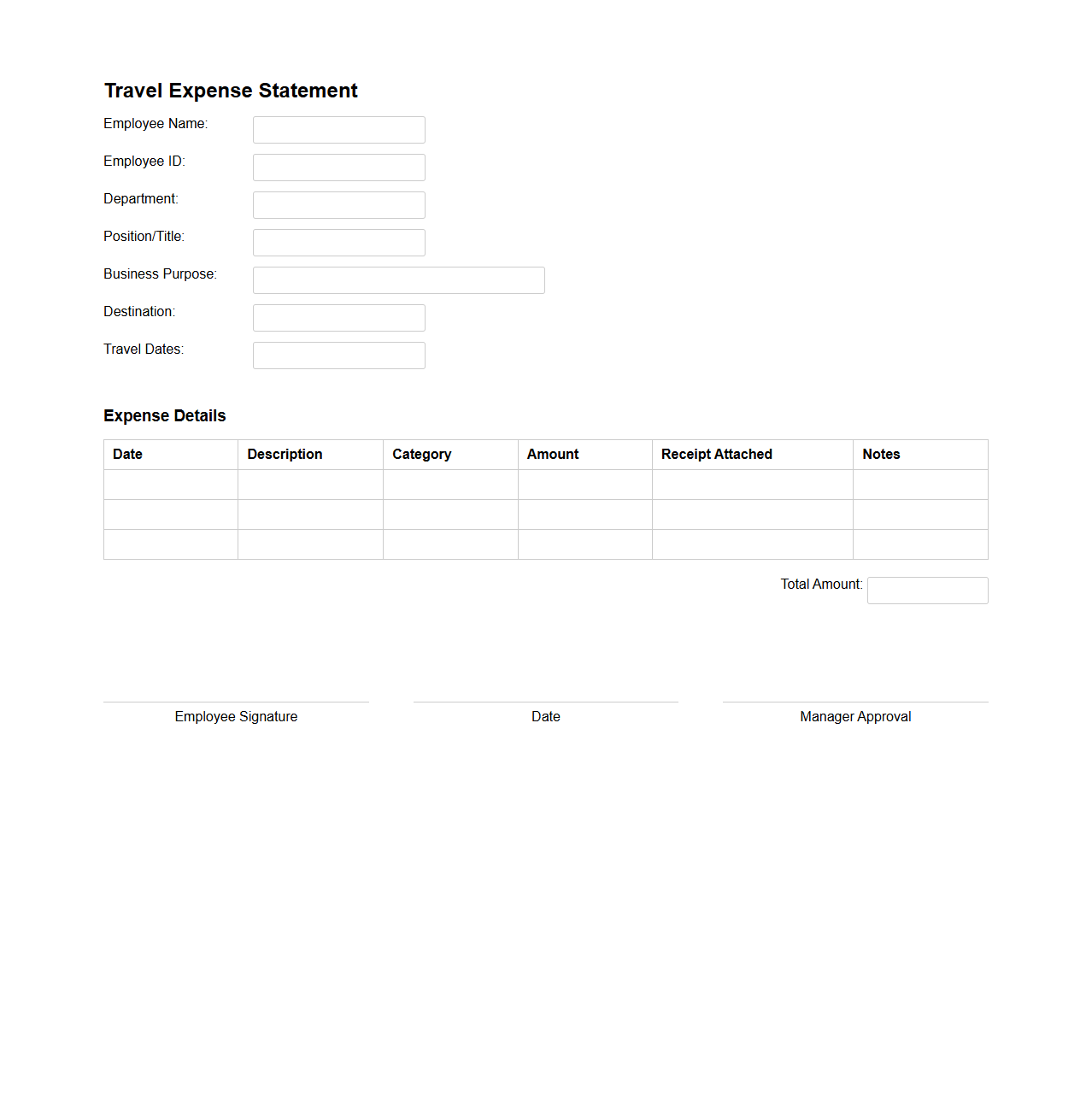

Travel Expense Statement for Corporate Use

A

Travel Expense Statement for corporate use is a detailed document that outlines all costs incurred by an employee during a business trip, including transportation, lodging, meals, and other reimbursable expenses. This statement helps companies track and verify travel-related spending, ensuring accurate accounting and compliance with corporate travel policies. It also facilitates timely reimbursement by providing clear expense categorization and supporting receipts.

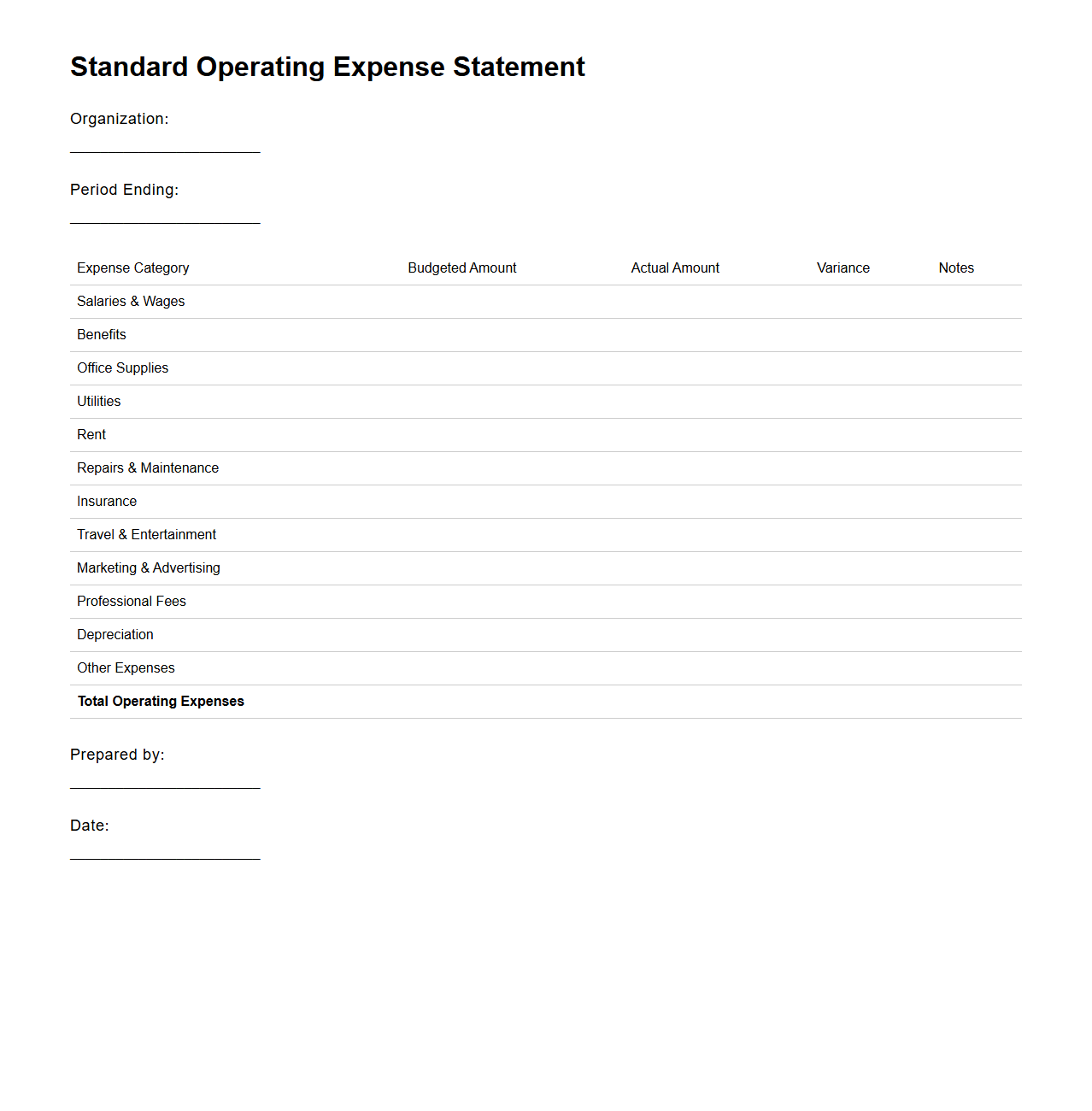

Standard Operating Expense Statement Framework

The

Standard Operating Expense Statement Framework document outlines a structured approach to categorizing and reporting operating expenses within an organization. It ensures consistency and transparency in financial reporting by defining expense categories, allocation methods, and reconciliation procedures. This framework facilitates accurate budgeting, cost control, and performance analysis across departments.

What details are required in a blank statement for itemizing business expenses?

A blank statement for itemizing business expenses must include fields for the date, description, and amount of each expense. It should also provide a category section to classify each expense accurately. Including spaces for the payee's name and purpose of the expense is essential for thorough documentation.

How should receipts be referenced in a blank business expense statement?

Receipts should be referenced by attaching a unique identifier or receipt number next to each corresponding expense entry. This helps in organizing and verifying the expenses during audit or review processes. Additionally, a note section can be useful for explaining discrepancies or special circumstances related to the receipts.

Are digital signatures acceptable on blank business expense statements?

Digital signatures are widely accepted as a valid form of approval for business expense statements, provided they comply with relevant legal standards. They offer a secure and efficient way to authenticate the document without requiring physical presence. Proper authorization through digital signatures also enhances the traceability of expense approvals.

What approval workflow is typically associated with blank statement submissions?

The typical approval workflow involves submission by the employee, initial review by a direct supervisor, and final authorization by the finance or accounting department. Each step should be tracked and documented to ensure accountability in the expense approval process. Automated systems often streamline this workflow, reducing errors and processing time.

How can blank business expense statements ensure compliance with IRS regulations?

Blank business expense statements can ensure IRS compliance by including all necessary information required for deduction justification, such as dates, amounts, and business purposes. Maintaining clear, organized records aligned with IRS guidelines helps prevent audit issues. Regular updates and reviews of the statement format also ensure ongoing adherence to evolving tax laws.