A Blank Investment Proposal Template for Potential Investors provides a clear, structured format to present business ideas and financial projections. This customizable template highlights key details such as market analysis, funding requirements, and expected returns, helping to capture investor interest effectively. Using a well-organized proposal increases the chances of securing capital by demonstrating professionalism and thorough planning.

Sample Investment Proposal Outline for New Ventures

A

Sample Investment Proposal Outline for New Ventures is a structured document designed to present a clear and compelling case for funding a startup or new business initiative. It typically includes sections such as executive summary, market analysis, business model, financial projections, and funding requirements to help investors understand the potential return on investment. This outline ensures that entrepreneurs cover all critical aspects necessary for securing investment while demonstrating the viability and growth potential of their venture.

Simple Startup Investment Proposal Format

A

Simple Startup Investment Proposal Format document outlines a clear and concise plan for potential investors, detailing the business idea, market opportunities, financial projections, and funding requirements. It serves as a strategic tool to communicate the startup's value proposition and investment potential effectively. This format helps streamline investor evaluation by presenting essential information in an structured, easy-to-understand manner.

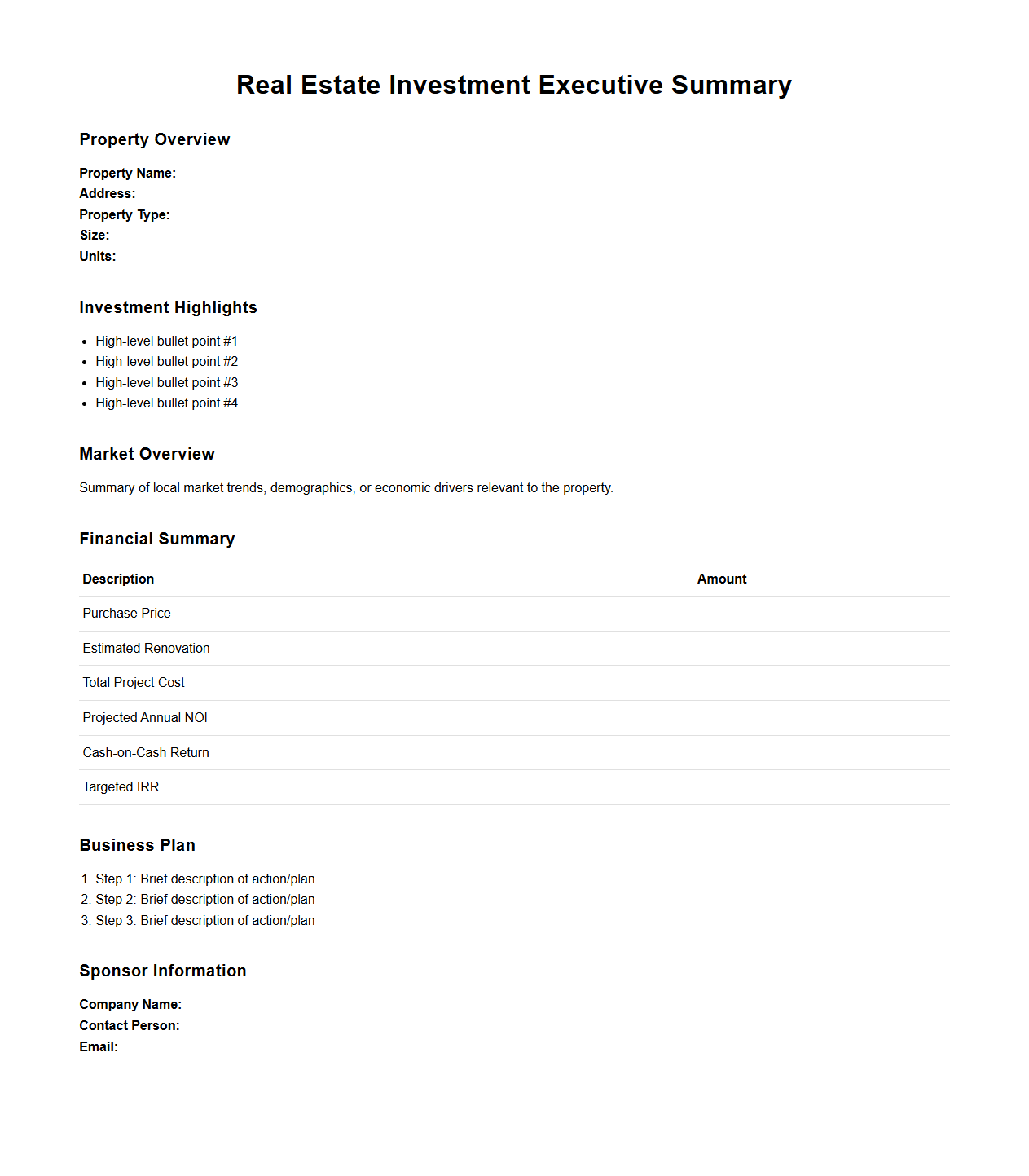

Real Estate Investment Executive Summary Template

A

Real Estate Investment Executive Summary Template document provides a concise overview of a property investment opportunity, highlighting critical financial metrics, market analysis, and project goals. It streamlines communication between investors and stakeholders by summarizing key information such as projected returns, funding requirements, and risk assessments. This template is essential for efficiently presenting a compelling case to secure investment or approval.

Preliminary Business Investment Proposal Sample

A

Preliminary Business Investment Proposal Sample document outlines the initial plan and financial requirements for a new business venture, providing a clear summary of the investment opportunity. It typically includes key elements such as the business concept, target market analysis, projected costs, and expected returns to help investors evaluate the potential risks and rewards. This document serves as a foundational tool for securing stakeholder interest and guiding further detailed planning.

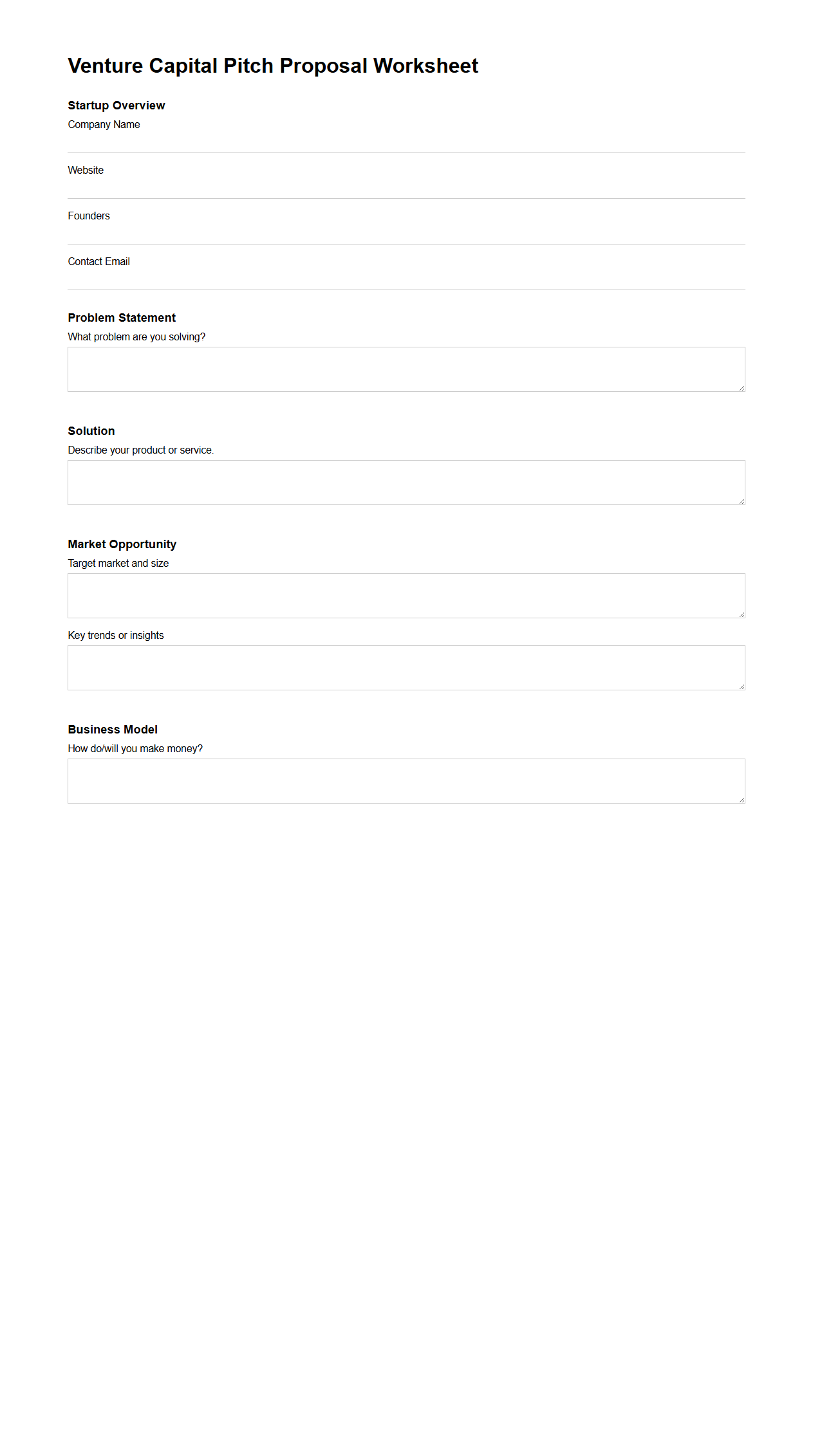

Venture Capital Pitch Proposal Worksheet

A

Venture Capital Pitch Proposal Worksheet document serves as a structured tool for entrepreneurs to clearly outline their business idea, market analysis, financial projections, and growth strategy. It helps in organizing critical information that investors seek, such as the value proposition, target audience, competitive landscape, funding requirements, and expected return on investment. This worksheet streamlines the preparation process, ensuring a compelling and coherent presentation to attract venture capital funding.

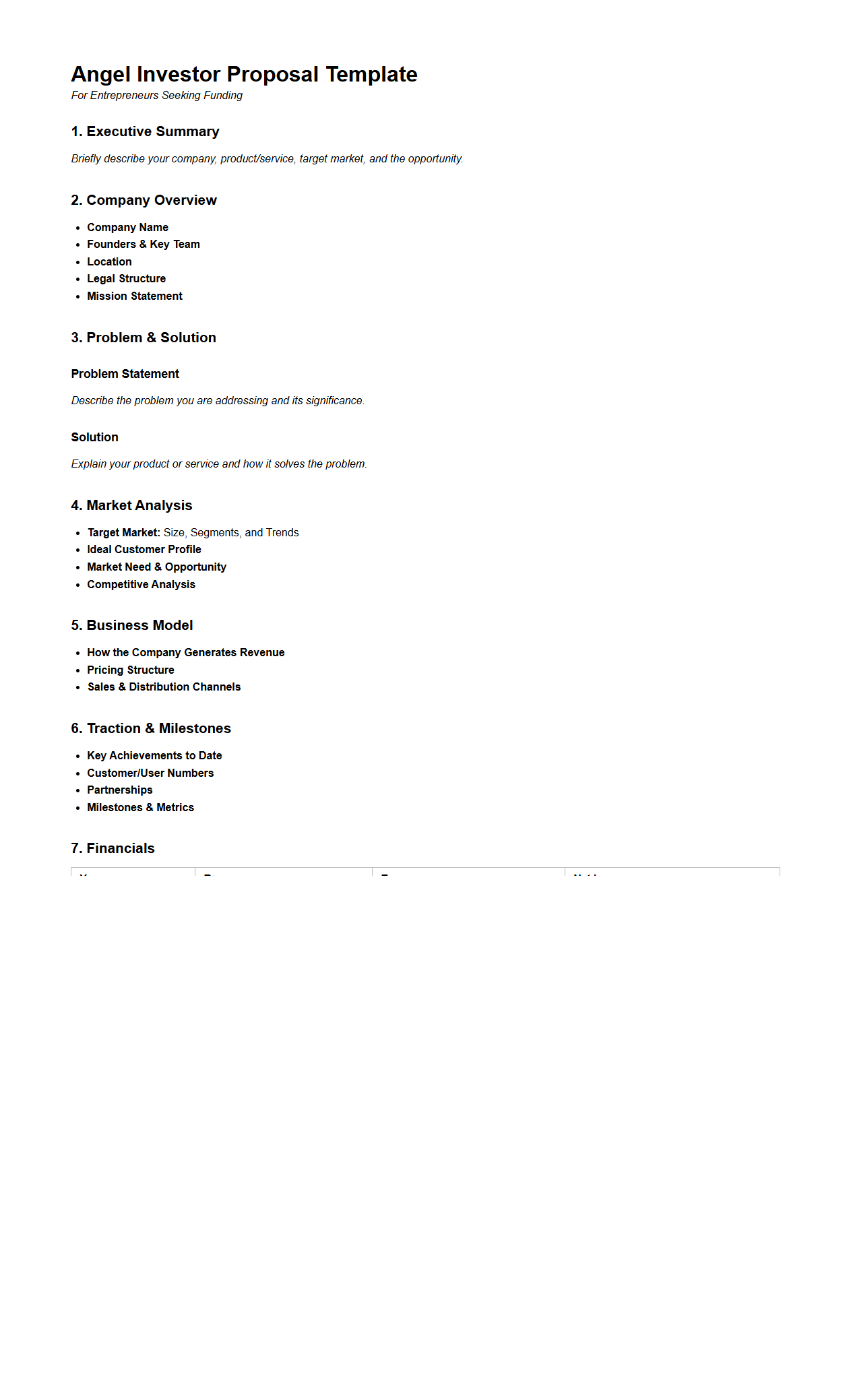

Angel Investor Proposal Template for Entrepreneurs

An

Angel Investor Proposal Template for entrepreneurs is a structured document designed to effectively present a startup idea, business plan, and funding requirements to potential angel investors. This template includes sections such as market analysis, financial projections, and the unique value proposition, helping entrepreneurs clearly communicate the investment opportunity. Using this template increases the chances of securing capital by ensuring all critical information is organized and professionally presented.

Clean Corporate Investment Proposal Layout

A

Clean Corporate Investment Proposal Layout document is a structured framework designed to present investment opportunities clearly and professionally. It organizes essential financial data, market analysis, risk assessments, and strategic objectives in a concise format to facilitate investor understanding and decision-making. This layout enhances communication effectiveness by prioritizing clarity, relevance, and streamlined content presentation.

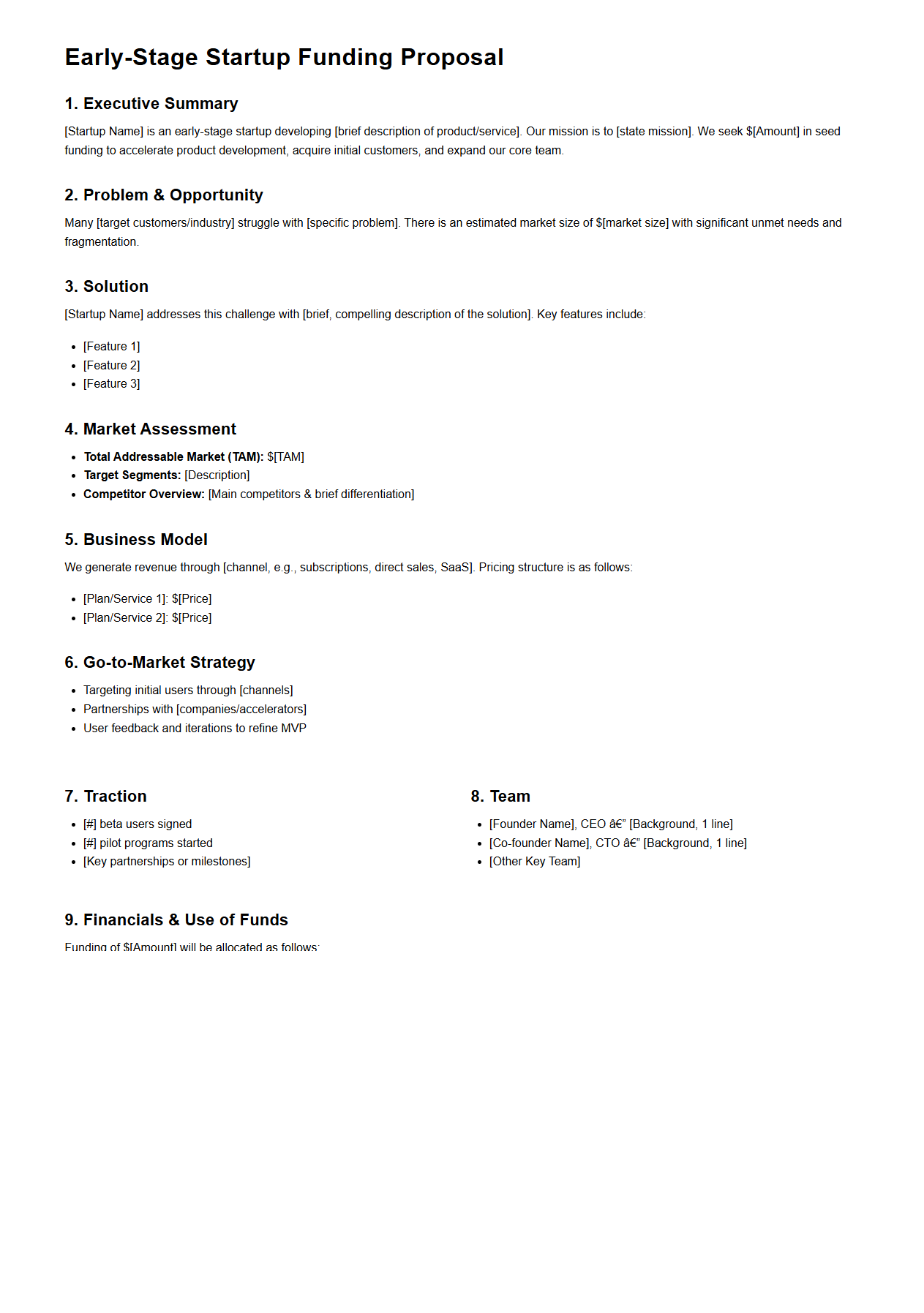

Early-Stage Startup Funding Proposal Example

An

Early-Stage Startup Funding Proposal Example document outlines a detailed plan for securing investment during the initial phase of a startup's development. It typically includes a clear description of the business idea, target market, competitive analysis, financial projections, and funding requirements. This document serves as a strategic tool to attract investors by demonstrating the startup's growth potential and planned use of funds.

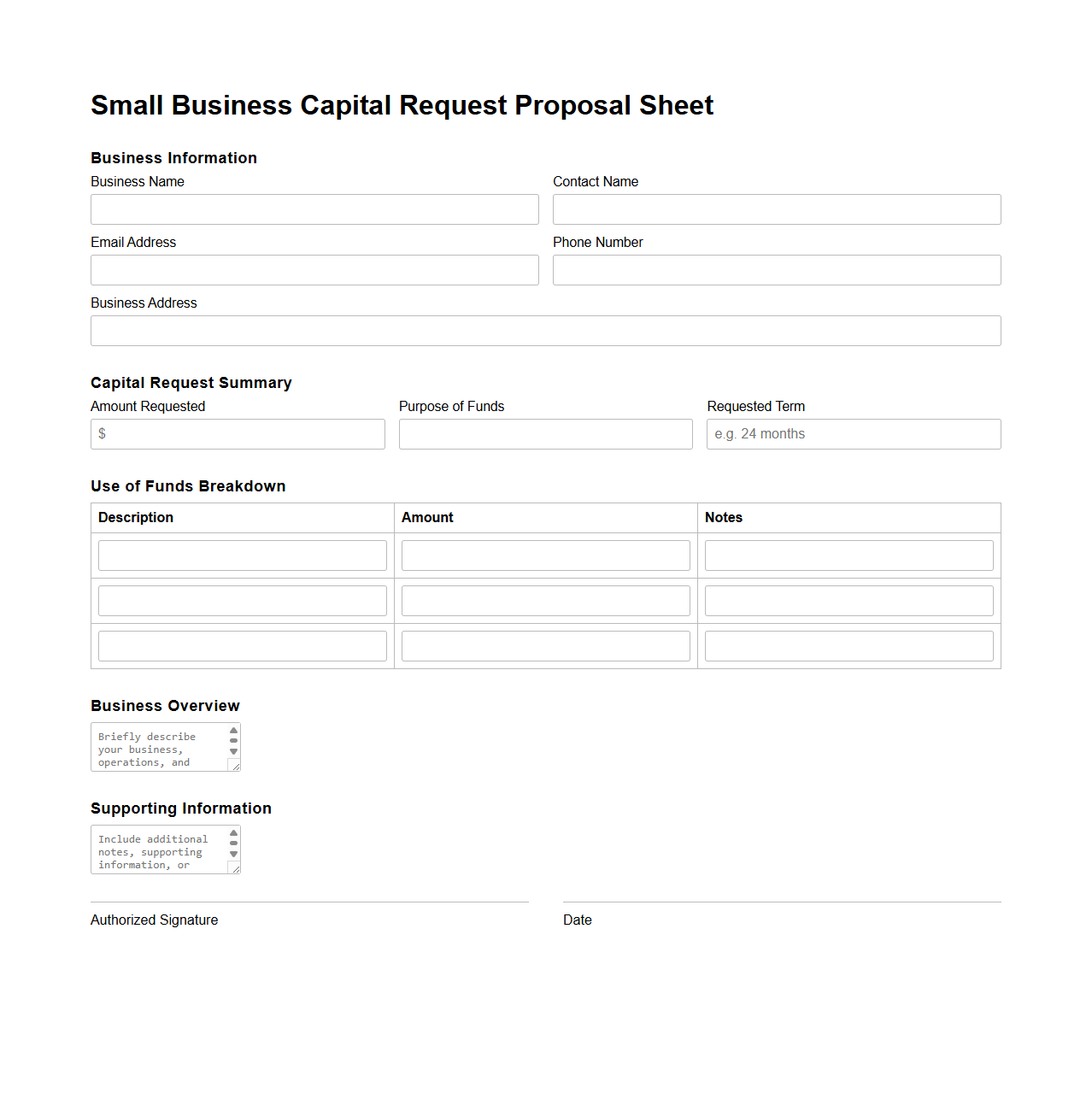

Small Business Capital Request Proposal Sheet

A

Small Business Capital Request Proposal Sheet is a formal document used by entrepreneurs to outline their funding needs and business objectives when seeking investment or loans. It typically includes detailed financial projections, the amount of capital required, intended use of funds, and plans for business growth. This document serves as a critical tool to communicate the viability and financial strategy of the small business to potential investors or lenders.

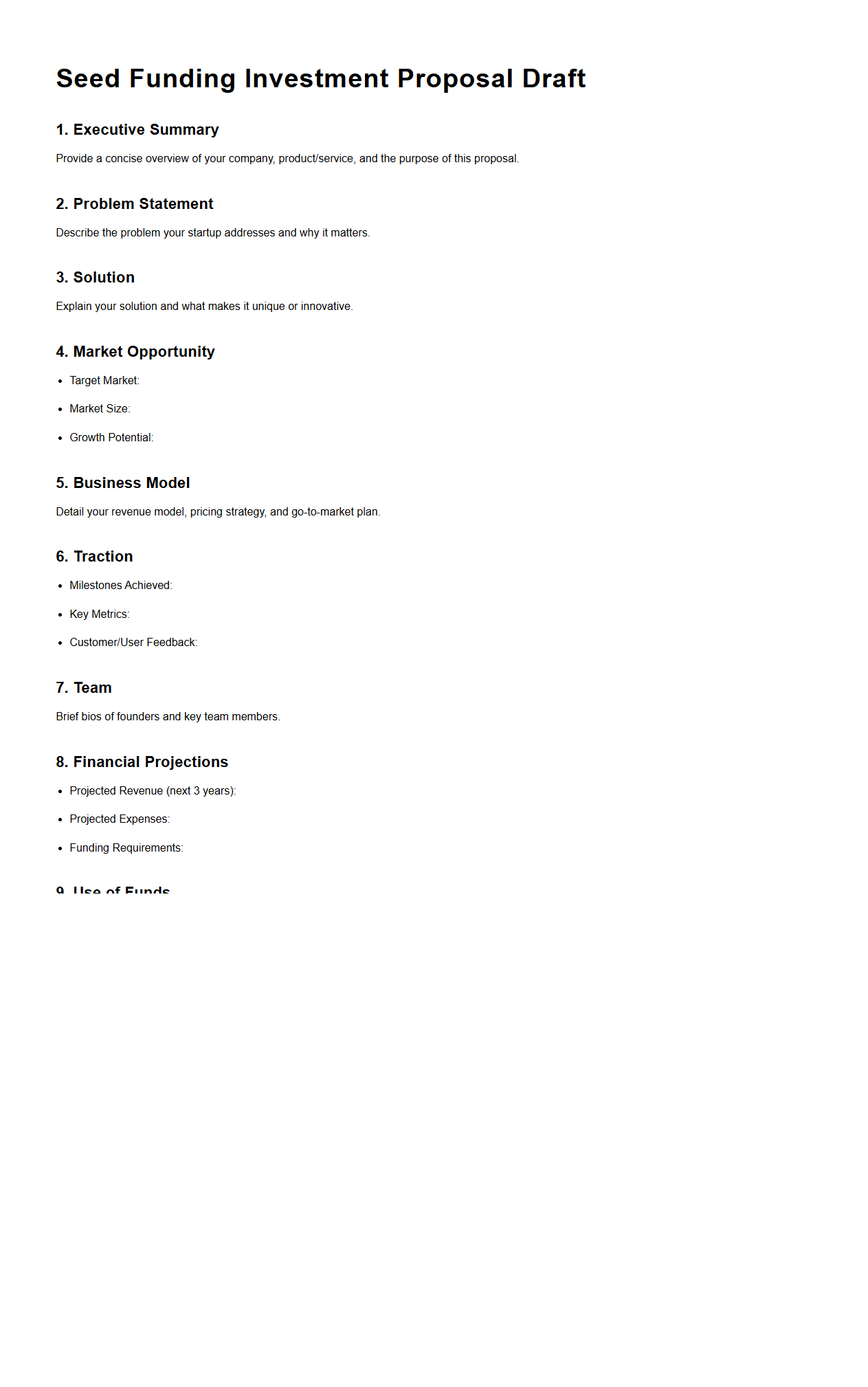

Seed Funding Investment Proposal Draft

A

Seed Funding Investment Proposal Draft document outlines the initial plan and financial requirements of a startup seeking early-stage capital to develop its product or service. It includes detailed information on the business model, market analysis, funding amount requested, planned use of funds, and projected financial returns to attract potential investors. This draft serves as a critical tool for communicating the startup's vision and growth potential to secure seed funding.

What key metrics should the Blank Investment Proposal highlight to attract niche investors?

The Blank Investment Proposal should emphasize unique performance indicators that resonate with niche investors, such as market penetration rates within specialized sectors. Highlighting return on investment (ROI) specifically tailored to the niche market ensures relevance and appeal. Additionally, showcasing growth potential supported by data-driven insights can significantly attract niche investor interest.

How does the document outline risk mitigation strategies specific to uncommon investment sectors?

The proposal includes customized risk mitigation strategies designed to address the distinctive challenges of uncommon sectors, such as regulatory changes and market volatility. It details contingency plans and insurance options tailored to these risks. Emphasizing proactive risk identification ensures investors feel secure despite sector-specific uncertainties.

Are there sections for customizable financial projections tailored to unique investment interests?

The document features flexible financial projections that can be adjusted to suit various niche interests and investment timelines. It provides interactive models to reflect different scenarios and outcomes for unique markets. This level of customization allows investors to align projections with their individual risk tolerance and goals.

What compliance or due diligence checkpoints are included for specialized investors?

Compliance sections incorporate industry-specific regulations and highlight steps for thorough due diligence tailored to niche sectors. The proposal outlines required documentation and verification processes to satisfy specialized investor criteria. This approach ensures transparency and trust are maintained throughout the investment process.

How does the letter differentiate the opportunity from typical mainstream investment proposals?

The letter emphasizes unique value propositions that set the opportunity apart, focusing on specialized market advantages and untapped potential. It contrasts these features with common offerings by highlighting exclusivity and innovation. By targeting niche investor priorities, the letter establishes a compelling narrative not found in mainstream proposals.